This version of the form is not currently in use and is provided for reference only. Download this version of

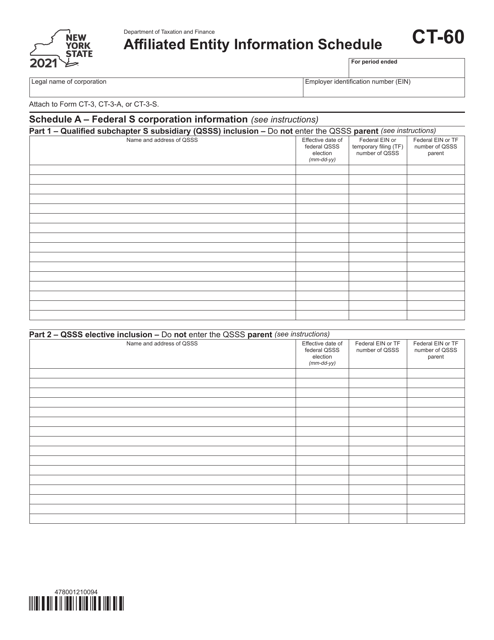

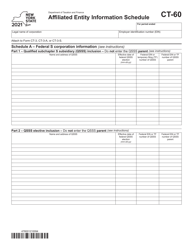

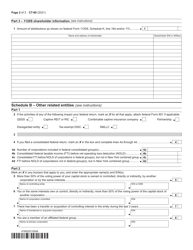

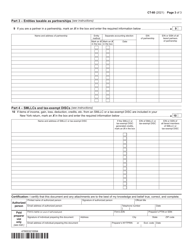

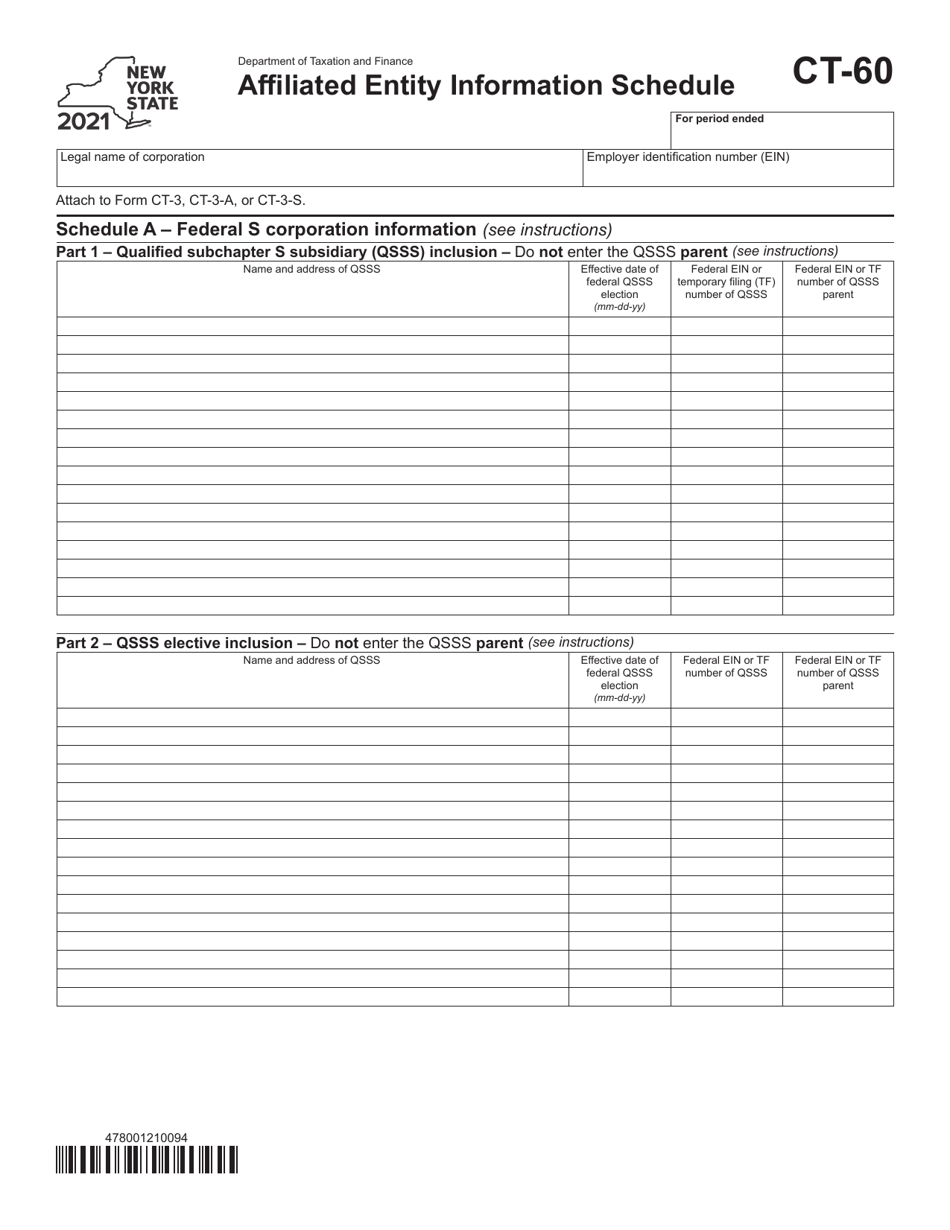

Form CT-60

for the current year.

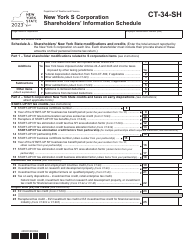

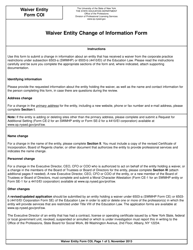

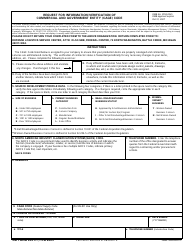

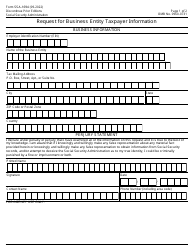

Form CT-60 Affiliated Entity Information Schedule - New York

What Is Form CT-60?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-60?

A: Form CT-60 is the Affiliated Entity Information Schedule for New York.

Q: Who needs to file Form CT-60?

A: Anyone who has an affiliated entity subject to New York State tax may need to file Form CT-60.

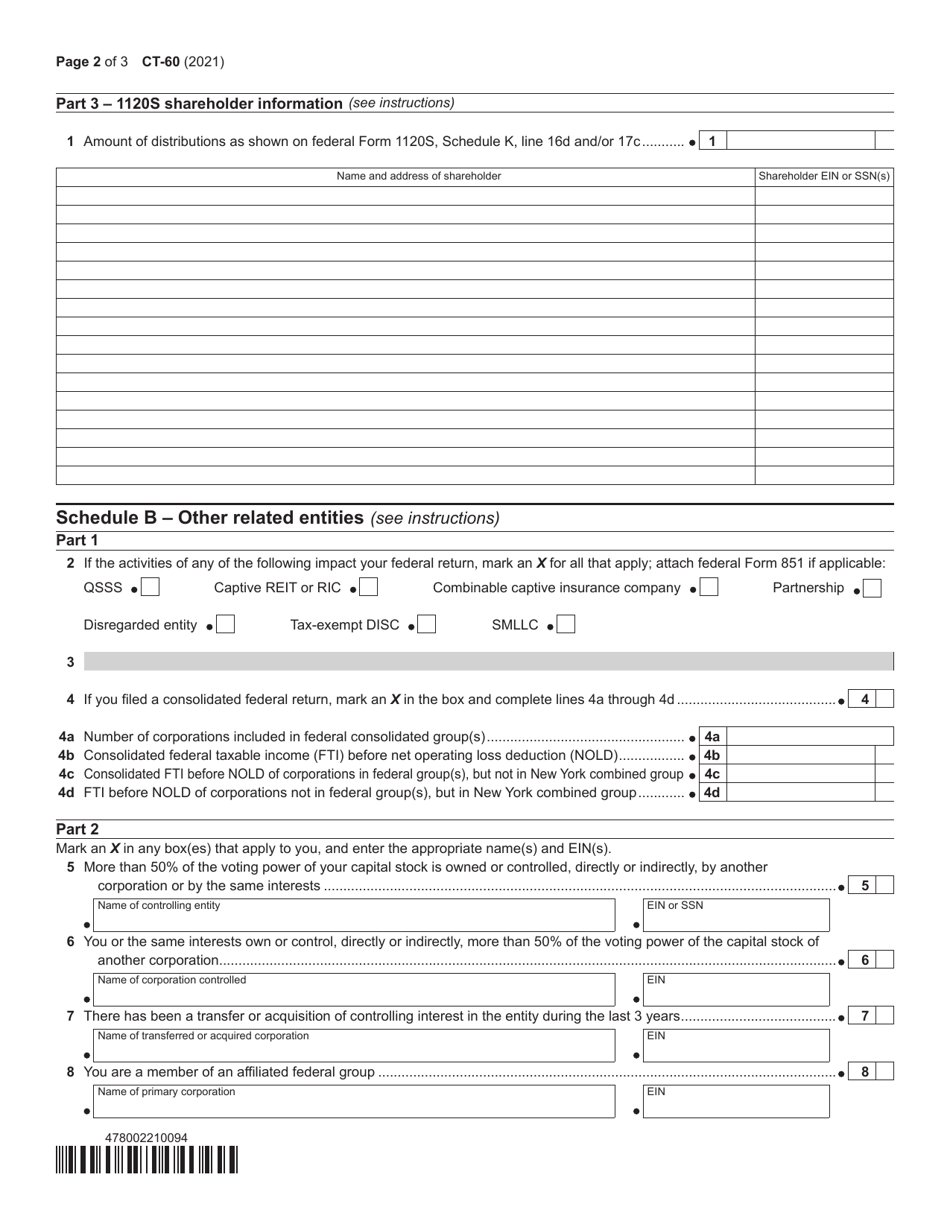

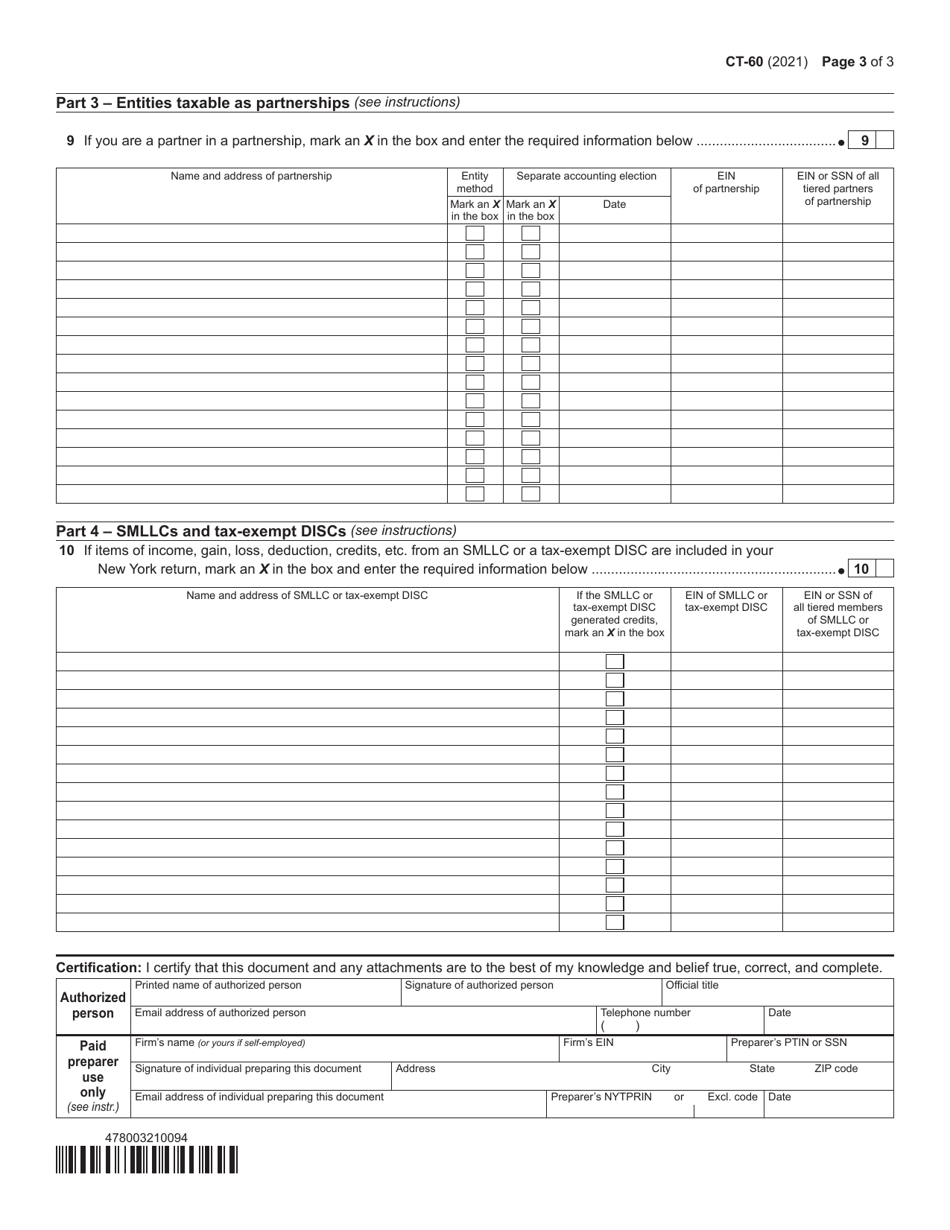

Q: What information is required on Form CT-60?

A: Form CT-60 requires information about the affiliated entity, including its name, address, federal EIN, and its relationship to the filer.

Q: When is the deadline to file Form CT-60?

A: The deadline to file Form CT-60 is generally the same as the deadline for filing the taxpayer's New York State tax return.

Q: Are there any filing fees for Form CT-60?

A: There are no filing fees required for Form CT-60.

Q: What happens if I don't file Form CT-60?

A: Failure to file Form CT-60 may result in penalties or interest charges imposed by the New York State Tax Department.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-60 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.