This version of the form is not currently in use and is provided for reference only. Download this version of

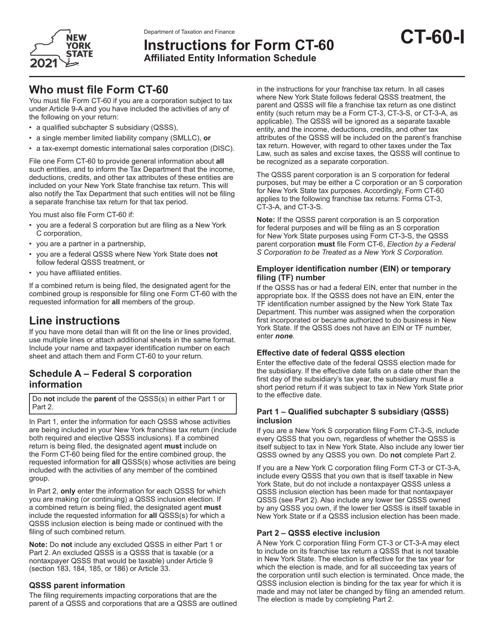

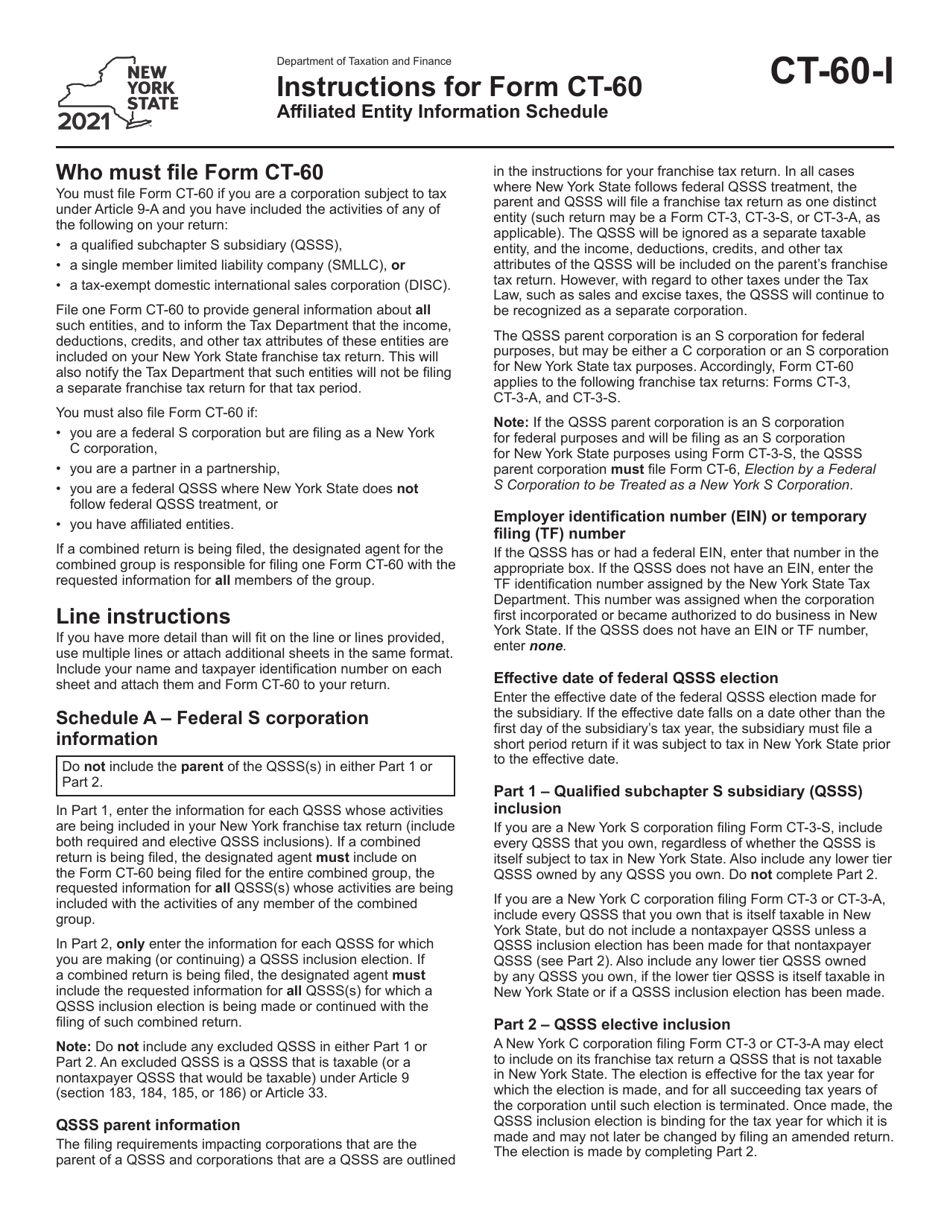

Instructions for Form CT-60

for the current year.

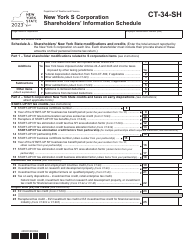

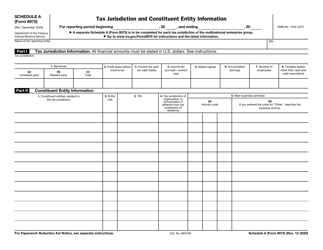

Instructions for Form CT-60 Affiliated Entity Information Schedule - New York

This document contains official instructions for Form CT-60 , Affiliated Entity Information Schedule - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-60 is available for download through this link.

FAQ

Q: What is Form CT-60?

A: Form CT-60 is the Affiliated Entity Information Schedule for New York.

Q: Who needs to file Form CT-60?

A: Affiliated entities that are part of a combined return in New York must file Form CT-60.

Q: What is the purpose of Form CT-60?

A: Form CT-60 is used to provide detailed information about affiliated entities that are part of a combined return in New York.

Q: When is Form CT-60 due?

A: Form CT-60 is due on the same date as the combined return for the affiliated group.

Q: Are there any penalties for not filing Form CT-60?

A: Yes, there are penalties for not filing Form CT-60 or for filing it late.

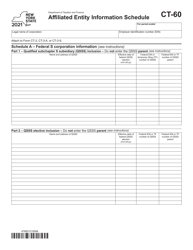

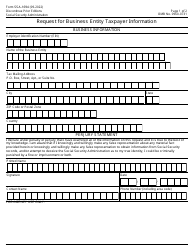

Q: What information is required on Form CT-60?

A: Form CT-60 requires information about each affiliated entity, including its name, address, federal employer identification number (FEIN), and ownership percentage.

Q: Can Form CT-60 be filed electronically?

A: Yes, Form CT-60 can be filed electronically using the New York State Department of Taxation and Finance's e-file system.

Q: Can I claim a credit for taxes paid by an affiliated entity on Form CT-60?

A: No, Form CT-60 is used only for informational purposes and does not allow you to claim a credit for taxes paid by an affiliated entity.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.