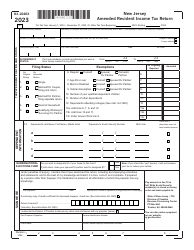

This version of the form is not currently in use and is provided for reference only. Download this version of

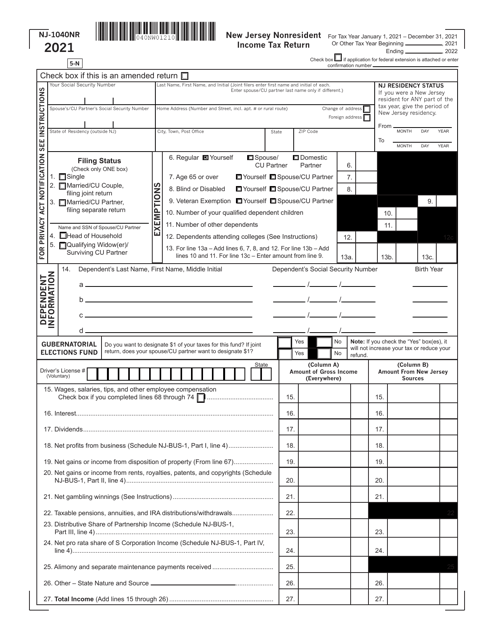

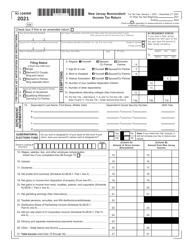

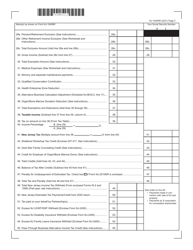

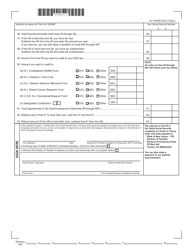

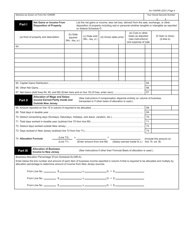

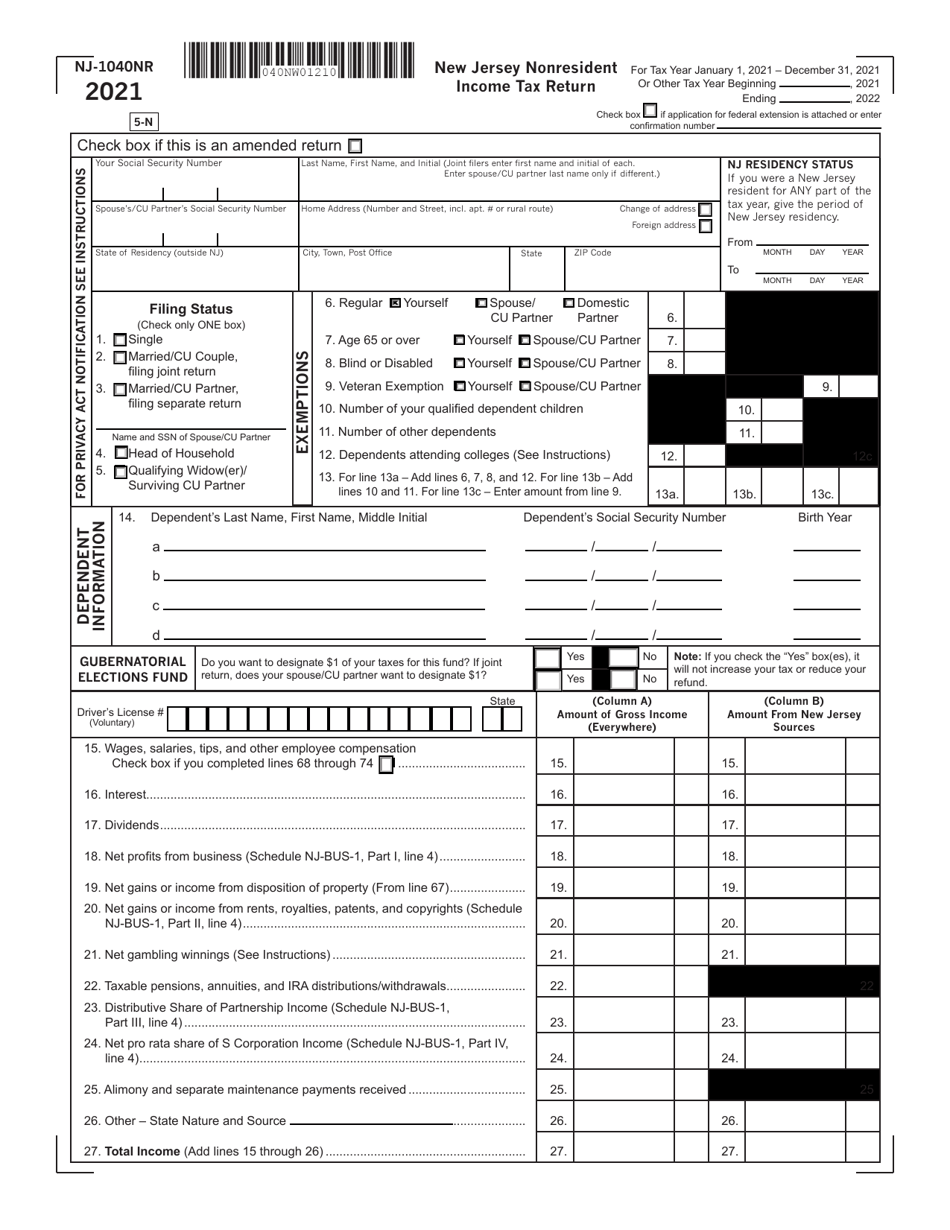

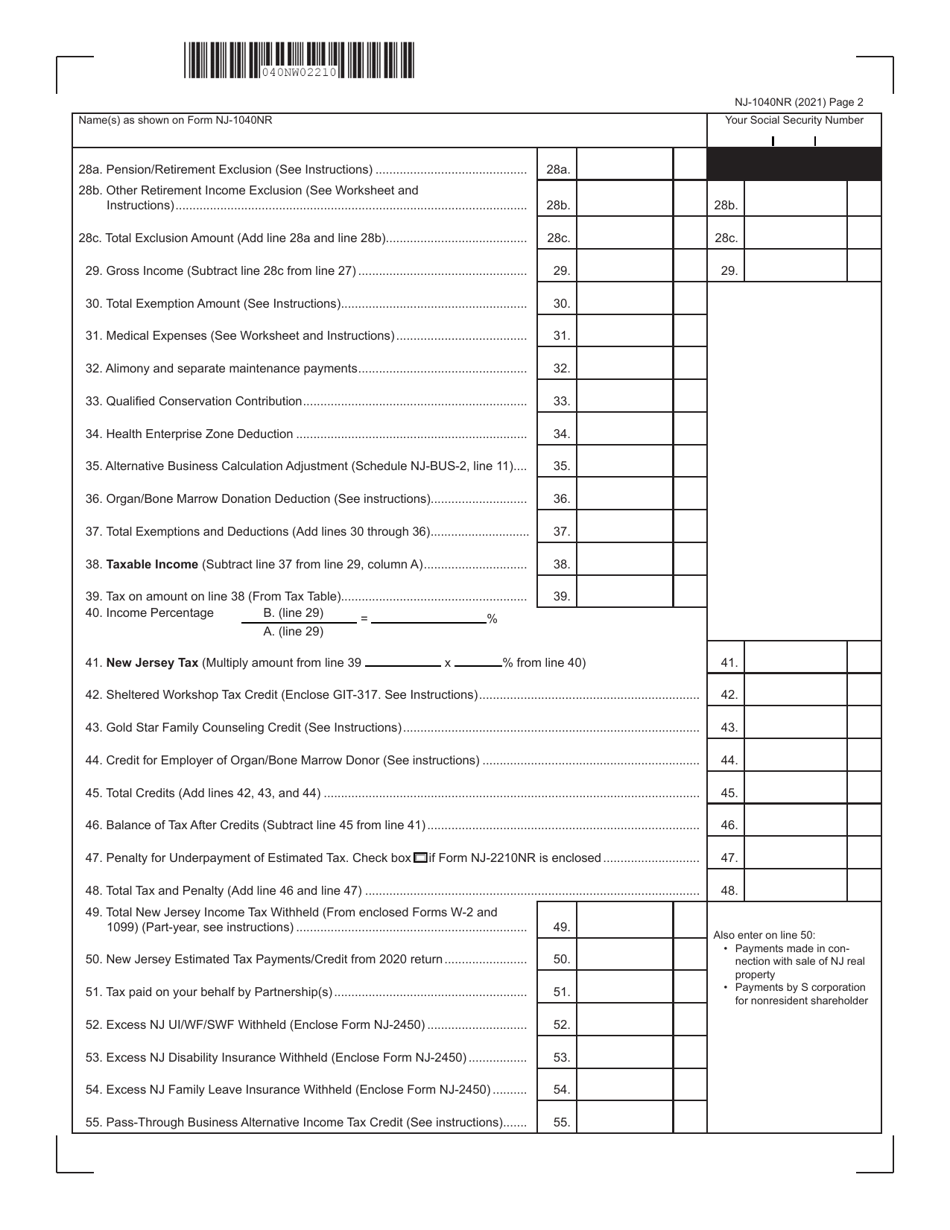

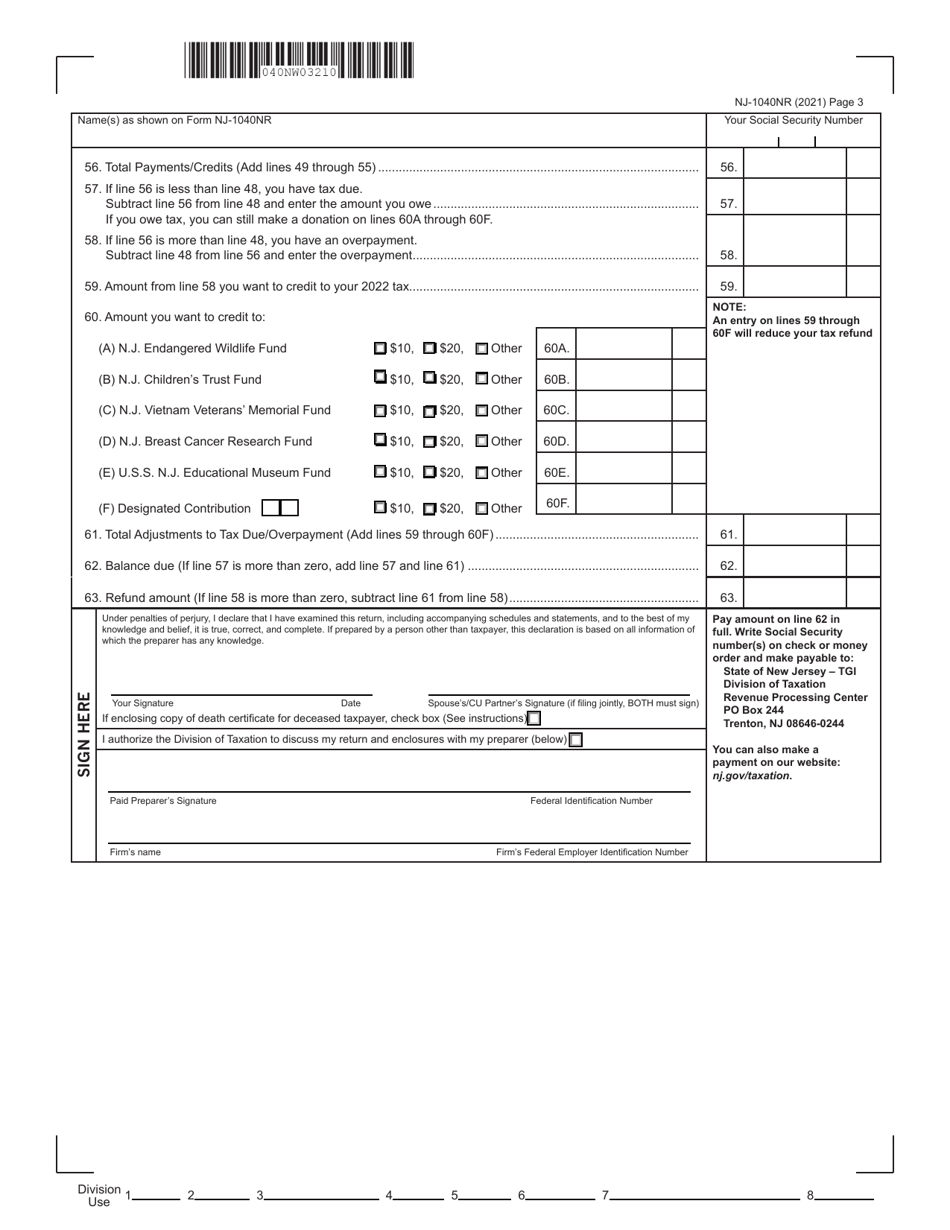

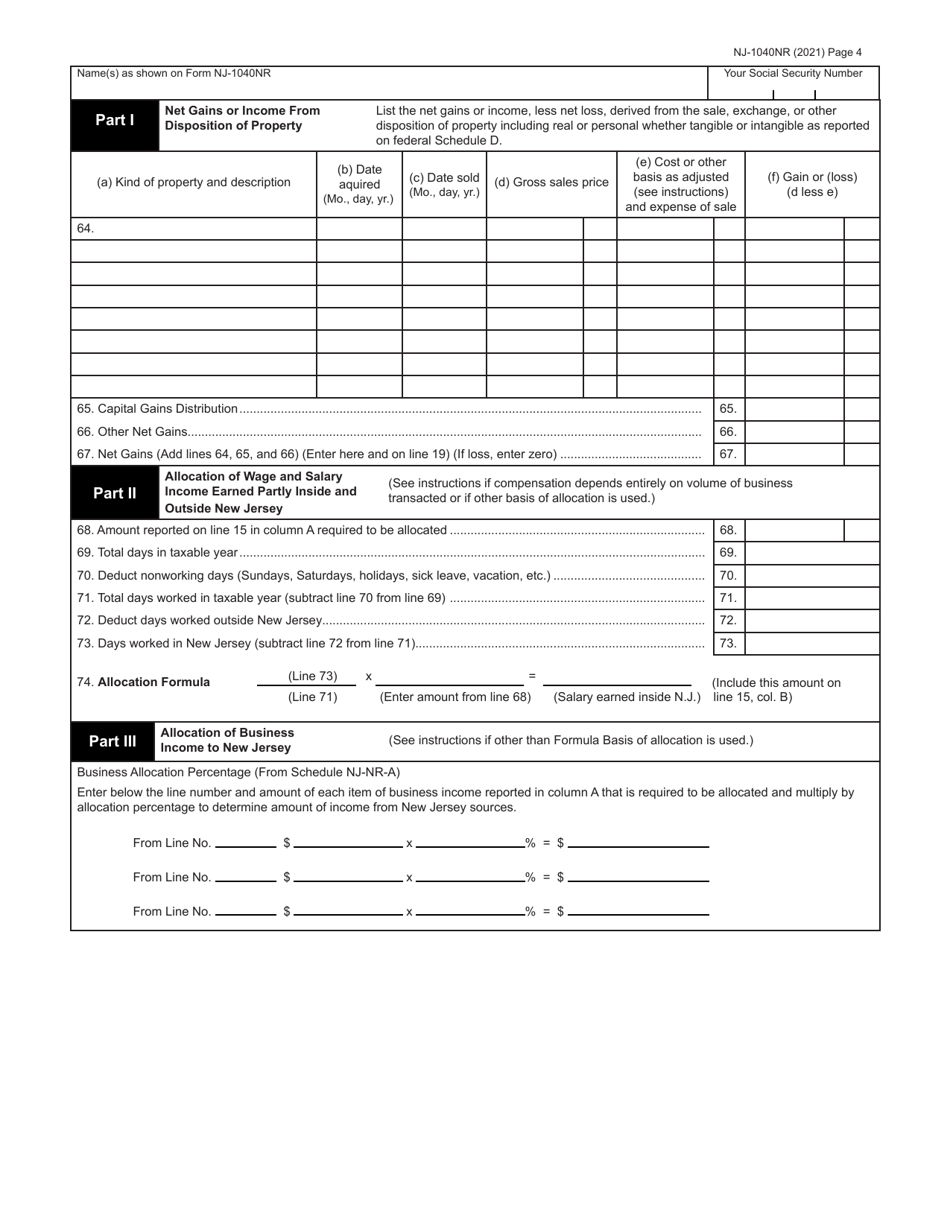

Form NJ-1040NR

for the current year.

Form NJ-1040NR Nonresident Income Tax Return - New Jersey

What Is Form NJ-1040NR?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: Who needs to file Form NJ-1040NR?

A: Nonresidents who have earned income in New Jersey need to file Form NJ-1040NR.

Q: What is the purpose of Form NJ-1040NR?

A: Form NJ-1040NR is used to report and pay income tax for nonresidents who earned income in New Jersey.

Q: When is the deadline to file Form NJ-1040NR?

A: The deadline to file Form NJ-1040NR is the same as the federal tax deadline, which is usually April 15th.

Q: What if I am unable to file Form NJ-1040NR by the deadline?

A: If you are unable to file Form NJ-1040NR by the deadline, you may request an extension or pay any owed tax and interest to avoid penalties.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040NR by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.