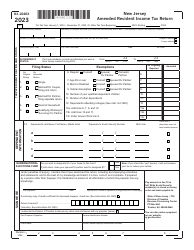

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form NJ-1040NR

for the current year.

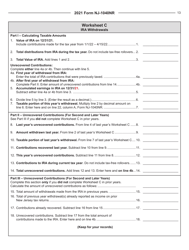

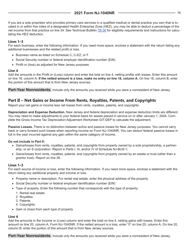

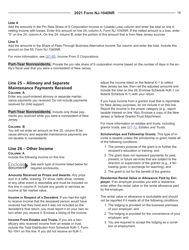

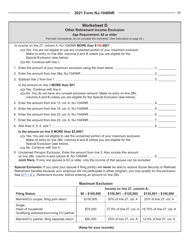

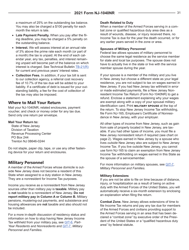

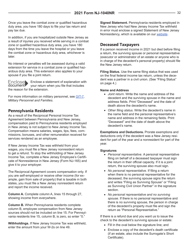

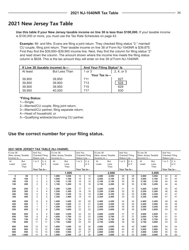

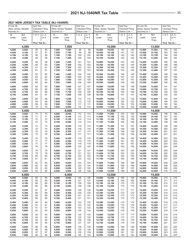

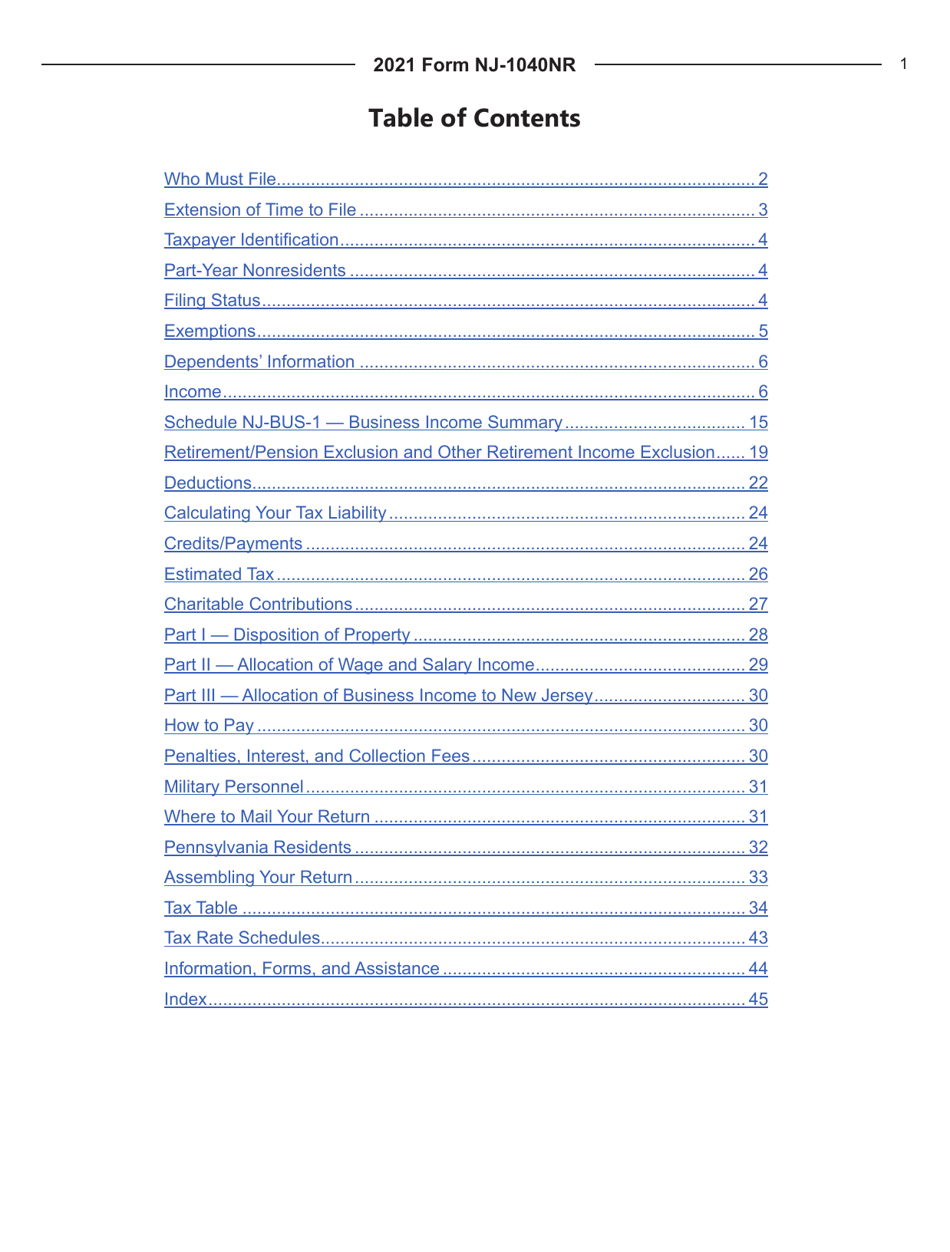

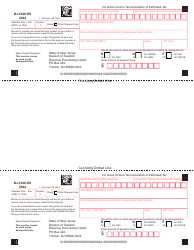

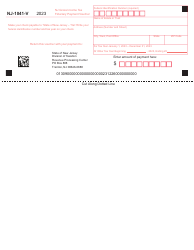

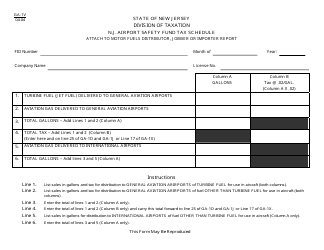

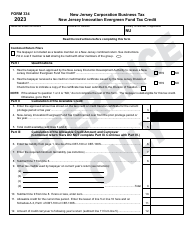

Instructions for Form NJ-1040NR Nonresident Income Tax Return - New Jersey

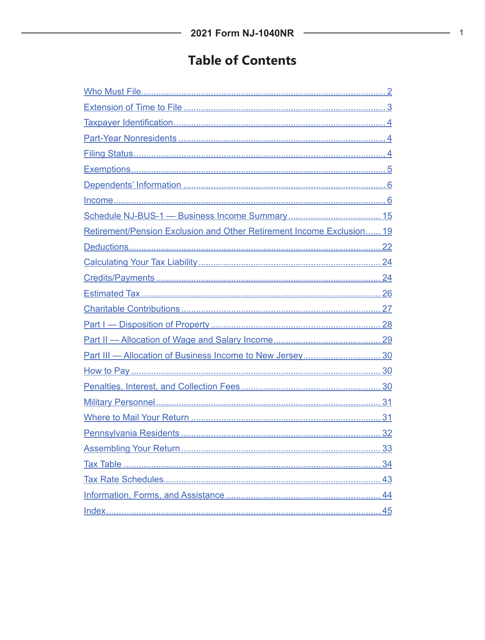

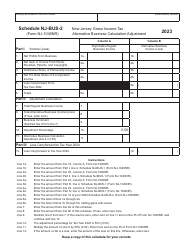

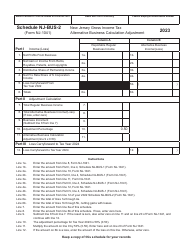

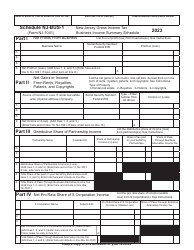

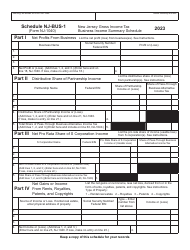

This document contains official instructions for Form NJ-1040NR , Nonresident Income Tax Return - a form released and collected by the New Jersey Department of the Treasury. An up-to-date fillable Form NJ-1040NR Schedule NJ-BUS-1 is available for download through this link.

FAQ

Q: What is Form NJ-1040NR?

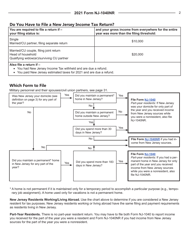

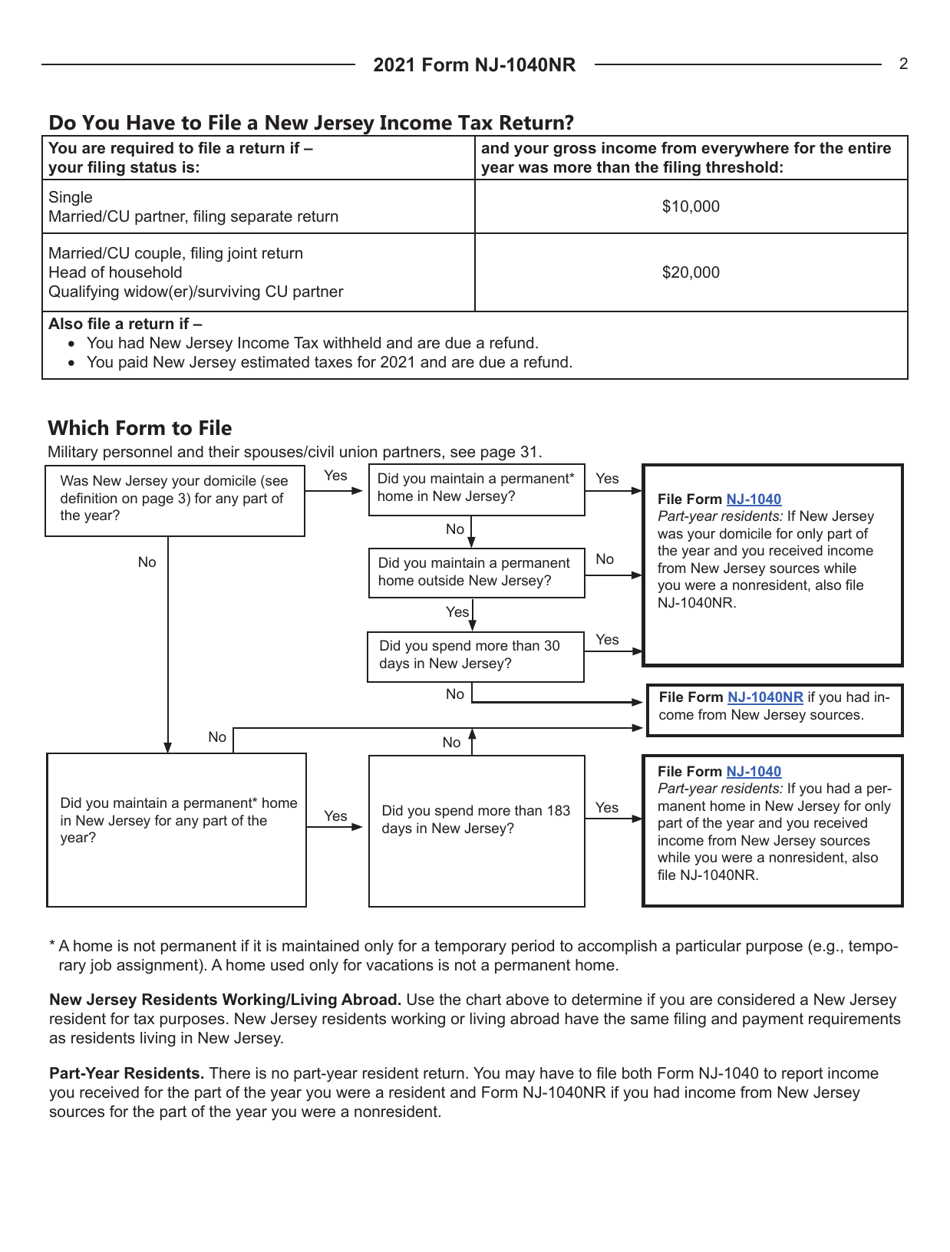

A: Form NJ-1040NR is the nonresident income tax return for individuals who earned income in New Jersey but are not residents of New Jersey.

Q: Who needs to file Form NJ-1040NR?

A: Nonresidents of New Jersey who earned income in New Jersey need to file Form NJ-1040NR.

Q: What information do I need to fill out Form NJ-1040NR?

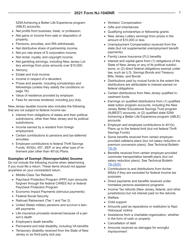

A: You will need to gather information about your income, deductions, and any tax credits or payments made.

Q: What is the filing deadline for Form NJ-1040NR?

A: The filing deadline for Form NJ-1040NR is the same as the federal income tax deadline, which is usually April 15th.

Q: Can I e-file Form NJ-1040NR?

A: Yes, you can e-file Form NJ-1040NR using approved commercial software or through a tax professional.

Q: Are there any special considerations for nonresident students?

A: Yes, nonresident students may have special considerations regarding their residency status and taxation. You should consult the instructions or a tax professional for guidance.

Q: What if I have additional questions?

A: If you have additional questions, you can contact the New Jersey Division of Taxation directly or consult a tax professional for assistance.

Instruction Details:

- This 45-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.