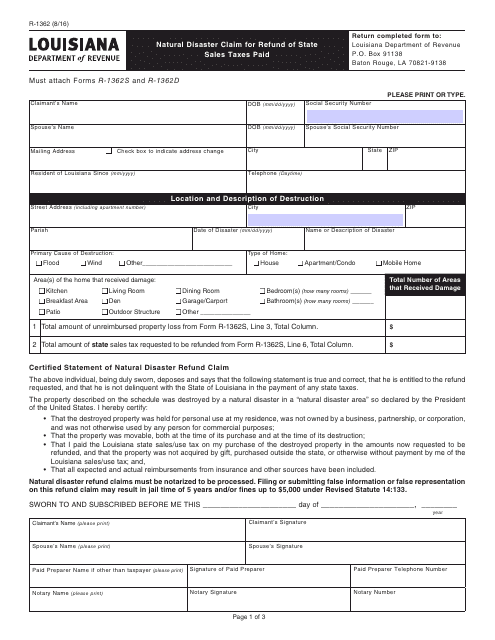

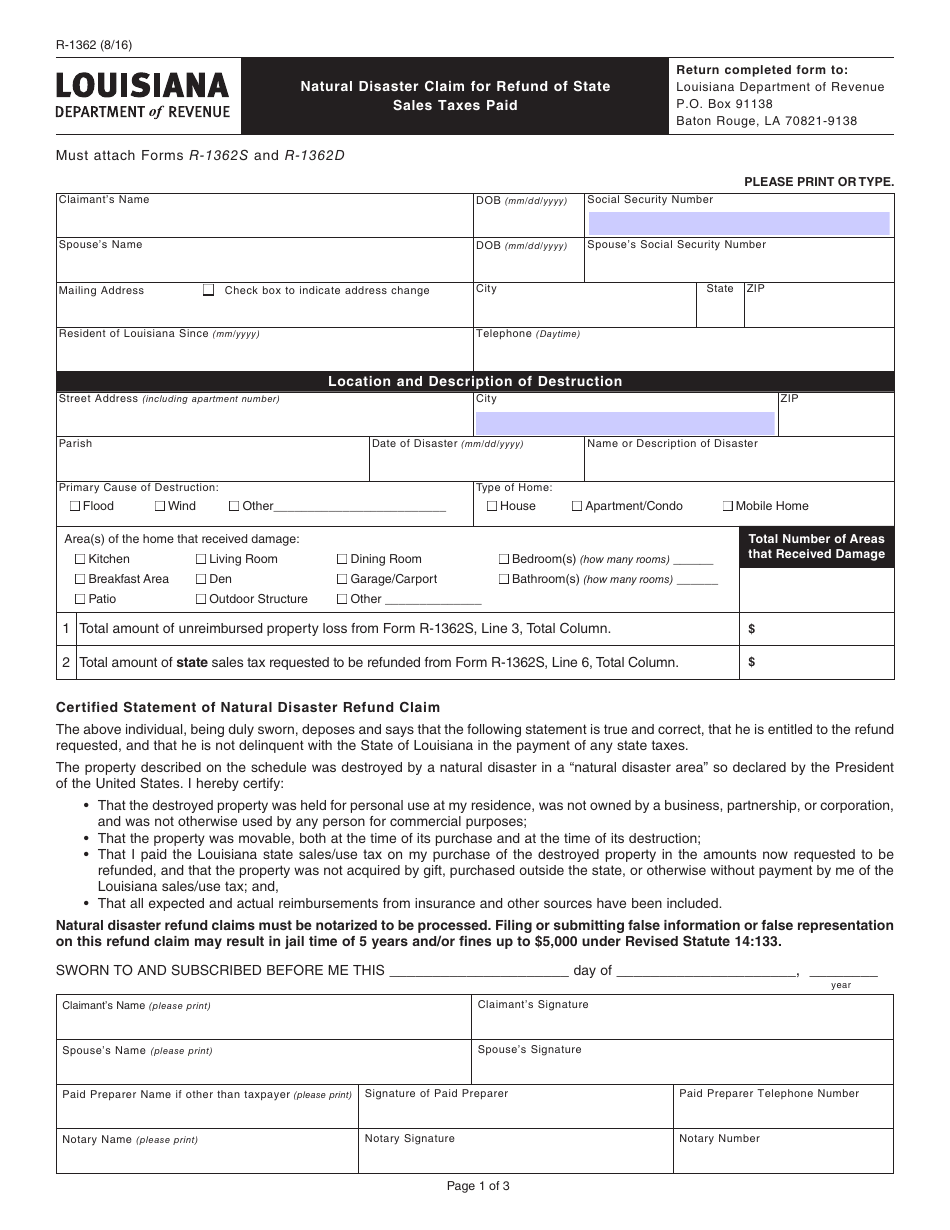

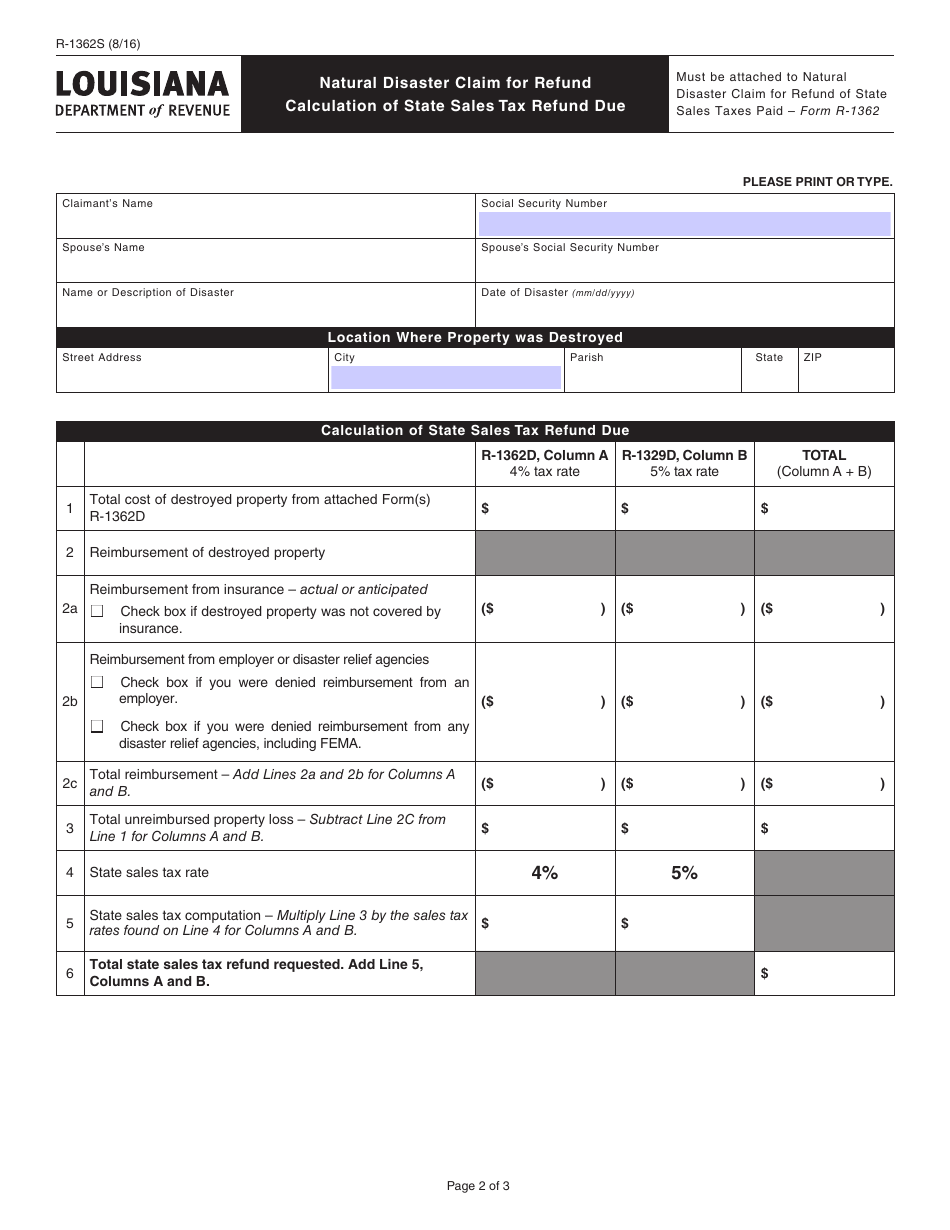

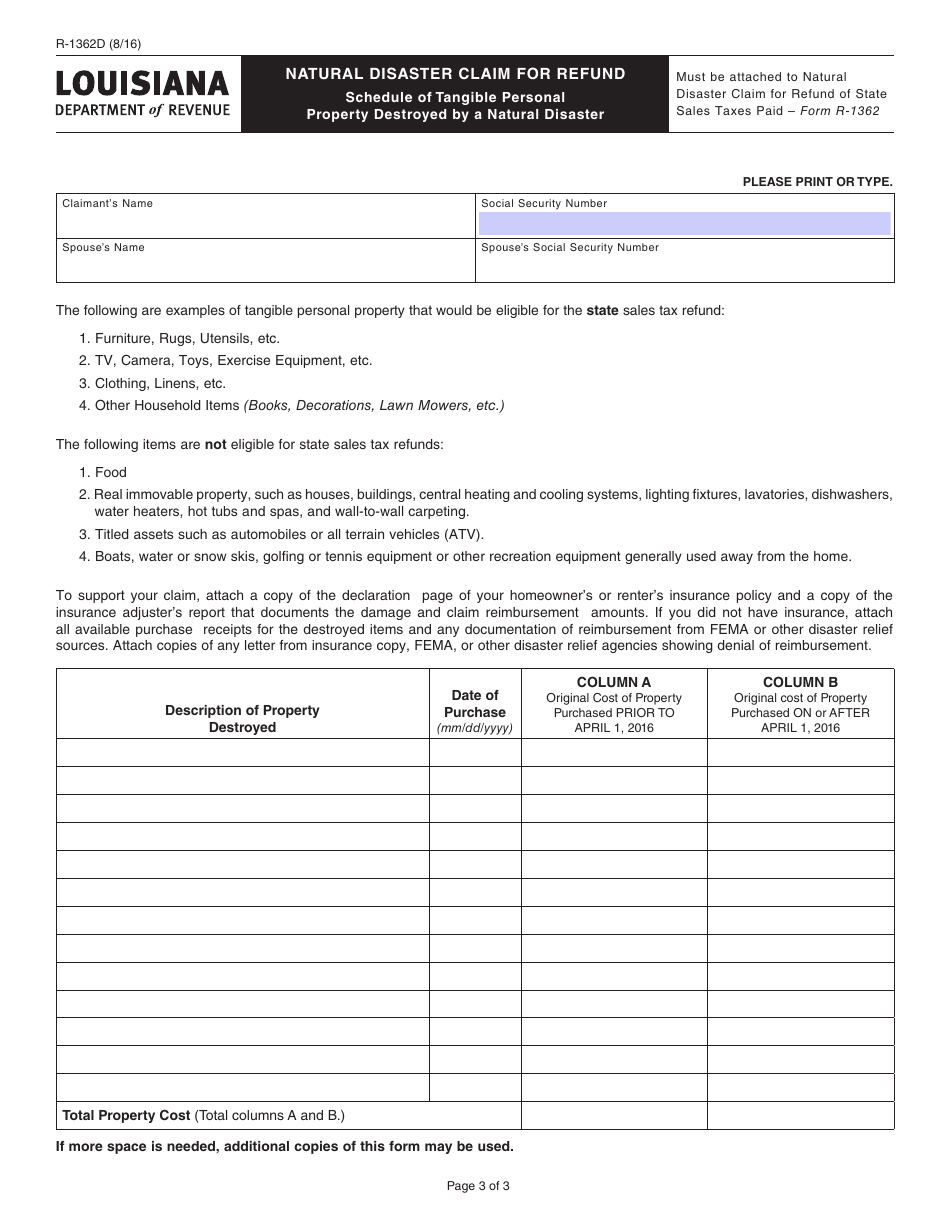

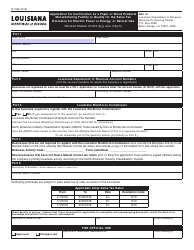

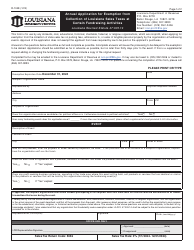

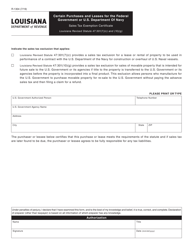

Form R-1362 Natural Disaster Claim for Refund of State Sales Taxes Paid - Louisiana

What Is Form R-1362?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-1362?

A: Form R-1362 is a document used in Louisiana to claim a refund of state sales taxes paid due to a natural disaster.

Q: Who can use Form R-1362?

A: Louisiana residents who have paid state sales taxes and have been affected by a natural disaster can use Form R-1362.

Q: What is the purpose of Form R-1362?

A: The purpose of Form R-1362 is to request a refund of state sales taxes paid by individuals who have experienced losses due to a natural disaster in Louisiana.

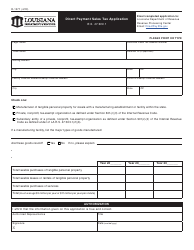

Q: What information do I need to provide on Form R-1362?

A: You will need to provide your personal information, details about the natural disaster, and information about the sales taxes paid.

Q: Is there a deadline for submitting Form R-1362?

A: Yes, Form R-1362 must be submitted within one year from the date of the natural disaster or the date the sales taxes were paid, whichever is later.

Q: How long does it take to receive a refund using Form R-1362?

A: The processing time for refunds can vary, but it typically takes several weeks to receive a refund.

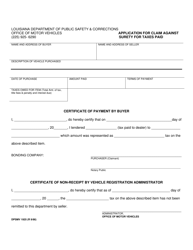

Q: Are there any additional documents required to submit with Form R-1362?

A: Yes, you may need to provide supporting documentation such as receipts or invoices for the sales taxes paid and proof of the natural disaster.

Q: Can I submit Form R-1362 electronically?

A: Currently, Form R-1362 cannot be submitted electronically. It must be mailed or submitted in person.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1362 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.