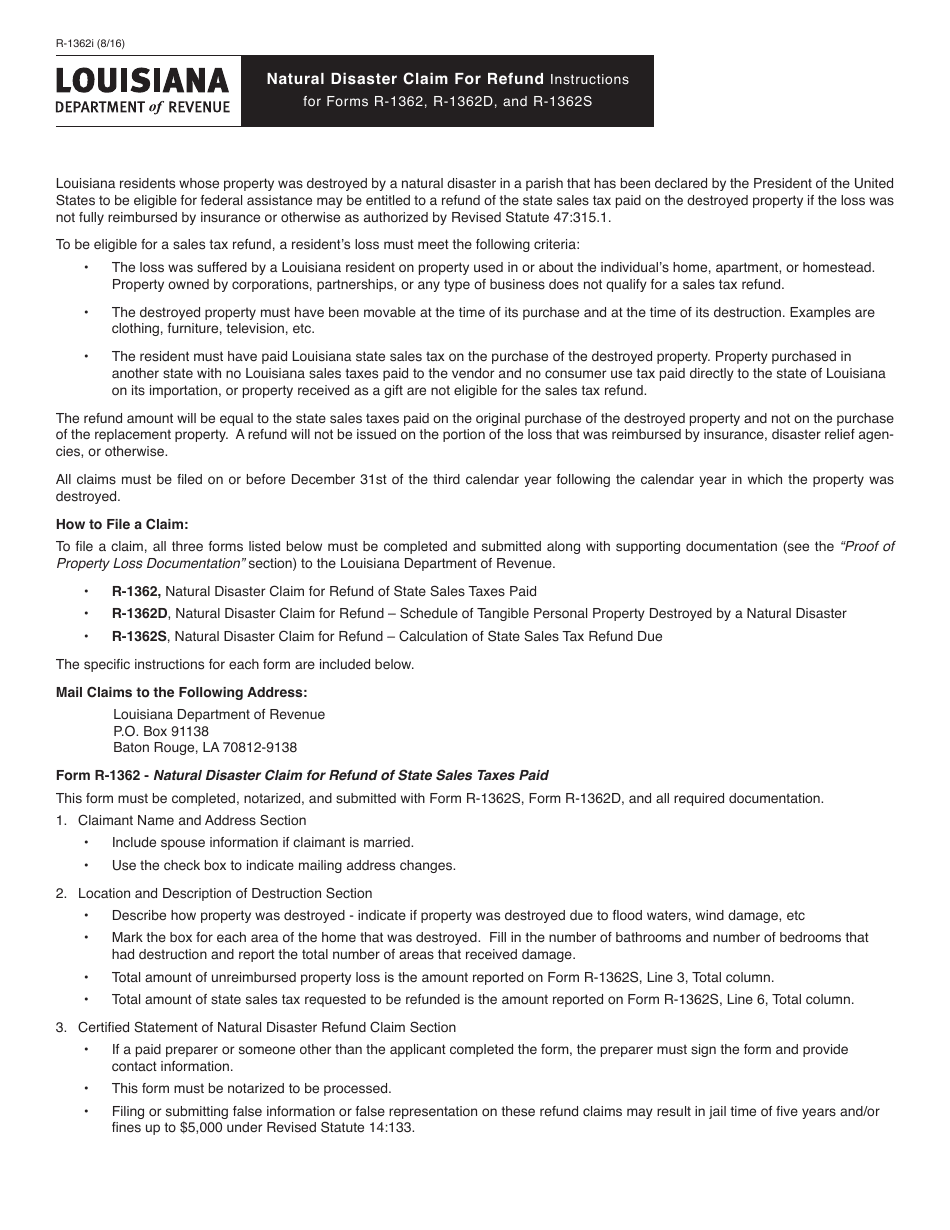

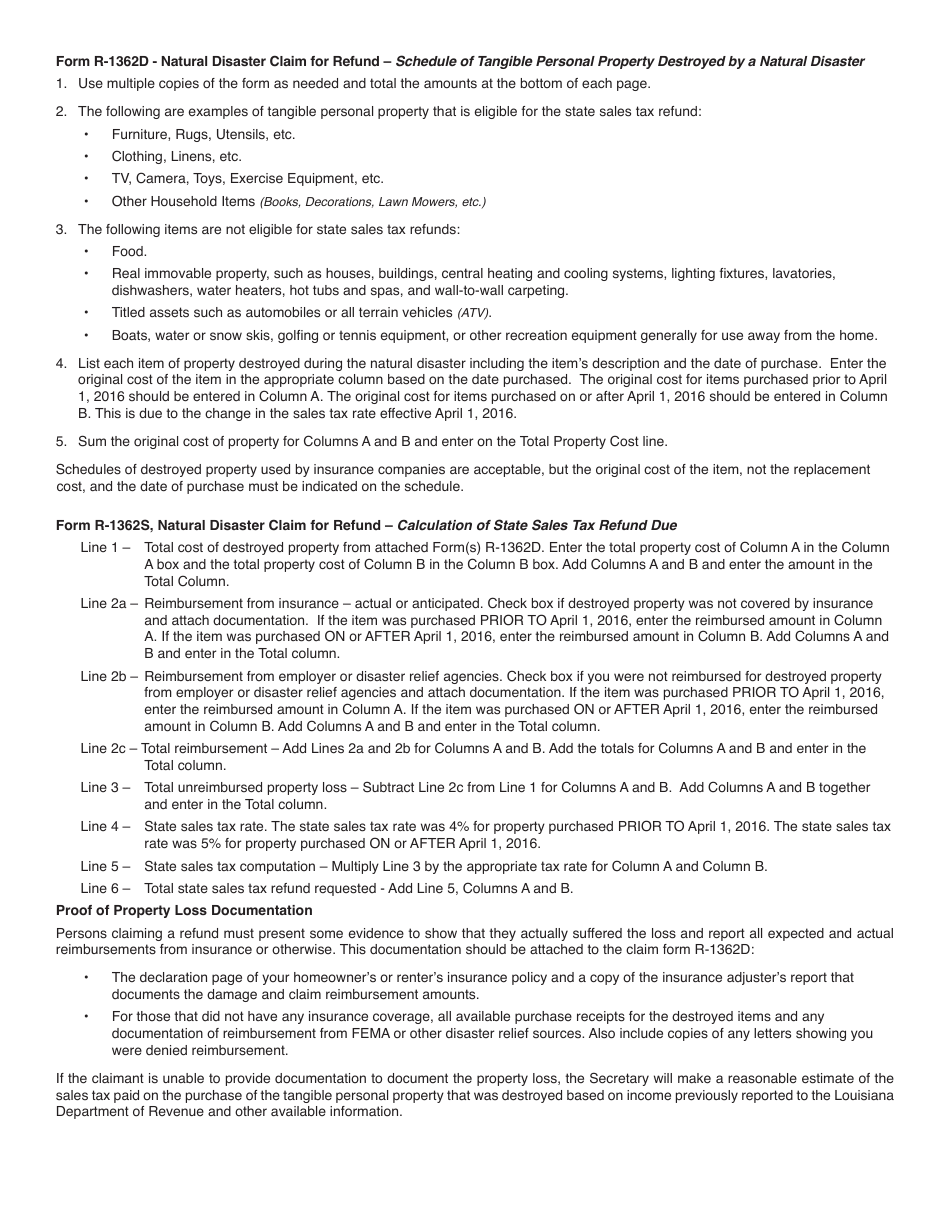

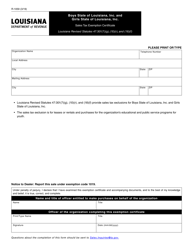

Instructions for Form R-1362, R-1362D, R-1362S Natural Disaster Claim for Refund - Louisiana

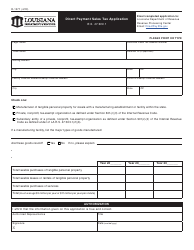

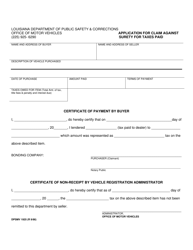

This document contains official instructions for Form R-1362 , Form R-1362D , and Form R-1362S . All forms are released and collected by the Louisiana Department of Revenue. An up-to-date fillable Form R-1362 is available for download through this link.

FAQ

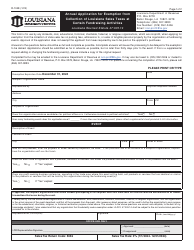

Q: What is Form R-1362?

A: Form R-1362 is a form used in Louisiana for natural disaster claim refunds.

Q: What is the purpose of Form R-1362?

A: The purpose of Form R-1362 is to claim a refund for taxes paid on property damaged or destroyed by a natural disaster.

Q: What other versions of the form are available?

A: There are two other versions of the form: R-1362D for individual taxpayers and R-1362S for businesses.

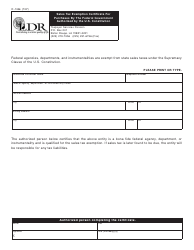

Q: Who can use Form R-1362?

A: Any taxpayer in Louisiana whose property was damaged or destroyed by a natural disaster can use Form R-1362 to claim a refund.

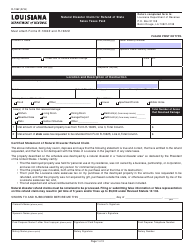

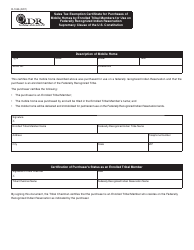

Q: What information is required on Form R-1362?

A: The form requires information such as the taxpayer's name, address, social security number (or taxpayer identification number), the type of disaster, and the amount of refund being claimed.

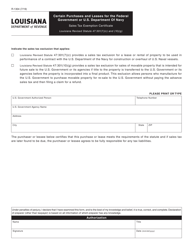

Q: When should I file Form R-1362?

A: Form R-1362 should be filed within one year from the date the property was damaged or destroyed by the natural disaster.

Q: Is there a deadline to submit Form R-1362?

A: Yes, the form must be submitted within one year from the date the property was damaged or destroyed by the natural disaster.

Q: What documents should be attached to Form R-1362?

A: Supporting documents such as photos, repair estimates, and insurance claims should be attached to the form to substantiate the claim.

Q: How long does it take to receive a refund after filing Form R-1362?

A: The processing time for refunds may vary, but taxpayers can generally expect to receive a refund within a few months of filing the form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.