This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form I-027 Schedule 2WD

for the current year.

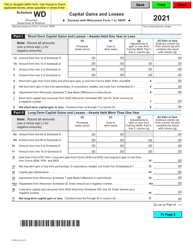

Instructions for Form I-027 Schedule 2WD Capital Gains and Losses - Wisconsin

This document contains official instructions for Form I-027 Schedule 2WD, Capital Gains and Losses - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form I-027 Schedule 2WD is available for download through this link.

FAQ

Q: What is Form I-027 Schedule 2WD?

A: Form I-027 Schedule 2WD is a tax form used by residents of Wisconsin to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are profits from the sale of assets such as stocks or real estate. Capital losses are losses from the sale of these assets.

Q: Why do I need to report capital gains and losses?

A: You need to report capital gains and losses for tax purposes. They may affect your overall tax liability.

Q: Who needs to file Form I-027 Schedule 2WD?

A: Residents of Wisconsin who have capital gains or losses during the tax year need to file Form I-027 Schedule 2WD.

Q: What kind of information do I need to fill out Form I-027 Schedule 2WD?

A: You will need to provide details about your capital gains and losses, including the dates of acquisition and sale, cost basis, and the amount of gain or loss.

Q: When is the deadline for filing Form I-027 Schedule 2WD?

A: The deadline for filing Form I-027 Schedule 2WD is typically the same as the deadline for filing your state income tax return, which is usually April 15th.

Q: What if I need help filling out Form I-027 Schedule 2WD?

A: If you need assistance in filling out Form I-027 Schedule 2WD, you can consult a tax professional or contact the Wisconsin Department of Revenue for guidance.

Q: Are there any penalties for not filing Form I-027 Schedule 2WD?

A: Failure to file Form I-027 Schedule 2WD or reporting inaccurate information may result in penalties or other enforcement actions by the Wisconsin Department of Revenue.

Q: Can I e-file Form I-027 Schedule 2WD?

A: Yes, you can e-file Form I-027 Schedule 2WD if you are using tax preparation software that supports Wisconsin state tax forms.

Q: Do I need to include Form I-027 Schedule 2WD with my federal tax return?

A: No, Form I-027 Schedule 2WD is specific to Wisconsin state taxes and should not be included with your federal tax return.

Q: Is there a fee for filing Form I-027 Schedule 2WD?

A: There is no fee for filing Form I-027 Schedule 2WD.

Q: What if I made a mistake on Form I-027 Schedule 2WD?

A: If you made a mistake on Form I-027 Schedule 2WD, you should file an amended return using Form I-029.

Q: Can I file Form I-027 Schedule 2WD electronically?

A: No, Form I-027 Schedule 2WD can only be filed by mail or in person.

Q: Is there a separate version of Form I-027 Schedule 2WD for non-residents?

A: No, Form I-027 Schedule 2WD is specific to Wisconsin residents.

Q: What other forms do I need to complete with Form I-027 Schedule 2WD?

A: You may need to complete other Wisconsin state tax forms, such as Form I-023, to report additional income or deductions.

Q: What if I didn't have any capital gains or losses during the tax year?

A: If you didn't have any capital gains or losses during the tax year, you may not need to file Form I-027 Schedule 2WD. However, it's always best to consult the Wisconsin Department of Revenue or a tax professional to confirm.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.