This version of the form is not currently in use and is provided for reference only. Download this version of

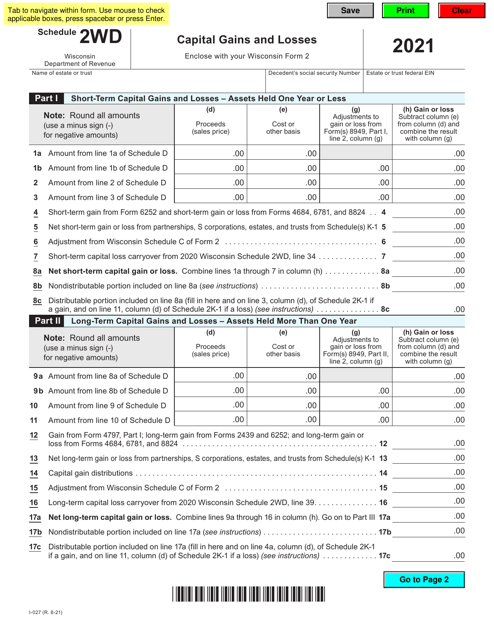

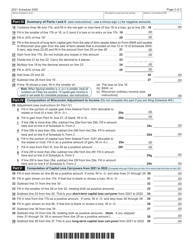

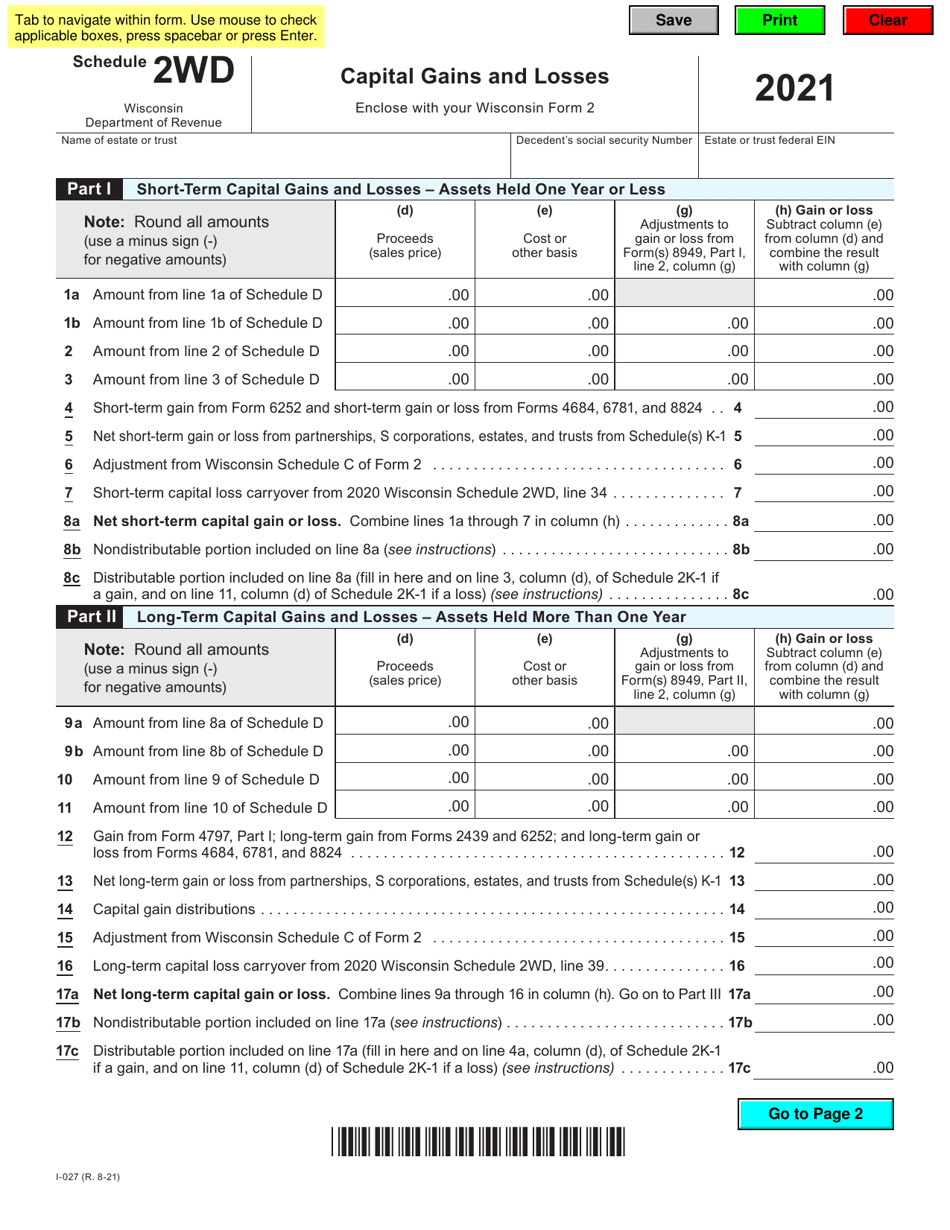

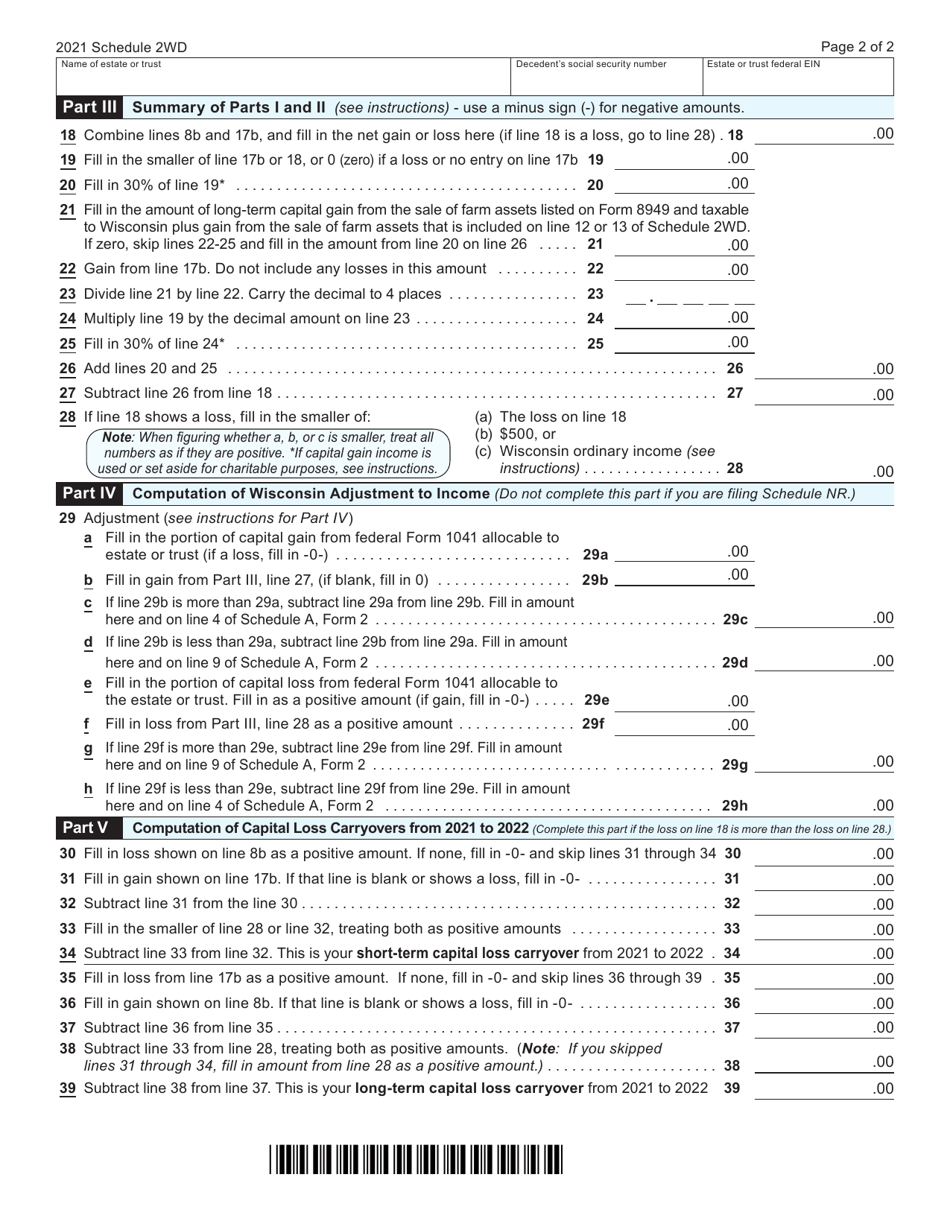

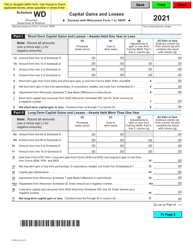

Form I-027 Schedule 2WD

for the current year.

Form I-027 Schedule 2WD Capital Gains and Losses - Wisconsin

What Is Form I-027 Schedule 2WD?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-027 Schedule 2WD?

A: Form I-027 Schedule 2WD is a tax form used to report capital gains and losses specifically for residents of Wisconsin.

Q: Who needs to file Form I-027 Schedule 2WD?

A: Residents of Wisconsin who have incurred capital gains or losses during the tax year are required to file Form I-027 Schedule 2WD.

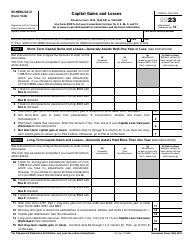

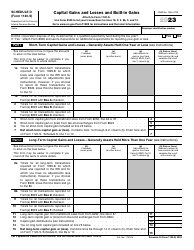

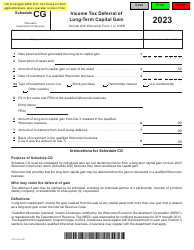

Q: What are capital gains and losses?

A: Capital gains are the profits made from the sale of certain assets, such as stocks or real estate. Capital losses occur when these assets are sold at a loss.

Q: Why do I need to report my capital gains and losses?

A: Reporting capital gains and losses is required by the tax laws of Wisconsin, and it helps determine your overall tax liability.

Q: How do I fill out Form I-027 Schedule 2WD?

A: You will need to provide information about your capital gains and losses, including details of the transactions and the corresponding amounts.

Q: When is the deadline to file Form I-027 Schedule 2WD?

A: The deadline to file Form I-027 Schedule 2WD is usually in line with the federal tax filing deadline, which is April 15th of each year.

Q: Are there any penalties for not filing Form I-027 Schedule 2WD?

A: Failure to file Form I-027 Schedule 2WD or reporting incorrect information may result in penalties or interest charges imposed by the state of Wisconsin.

Q: Do I need to file Form I-027 Schedule 2WD if I had no capital gains or losses?

A: If you did not have any capital gains or losses during the tax year, you may not be required to file Form I-027 Schedule 2WD. However, it is always a good idea to consult with a tax professional to ensure compliance with the tax laws of Wisconsin.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-027 Schedule 2WD by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.