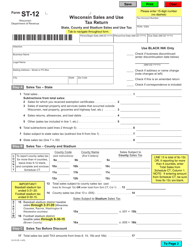

This version of the form is not currently in use and is provided for reference only. Download this version of

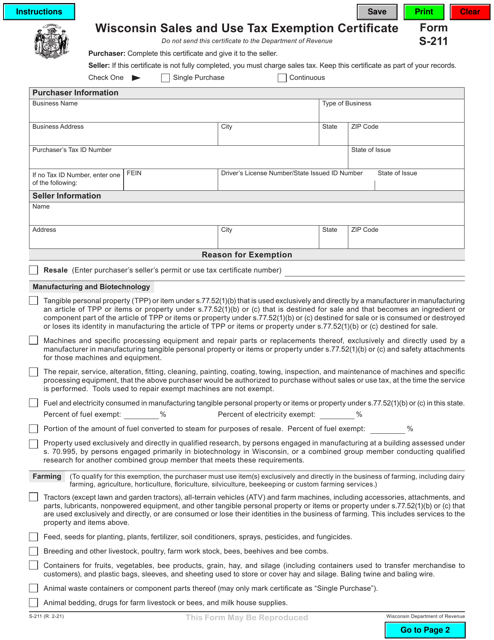

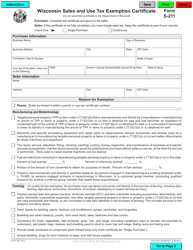

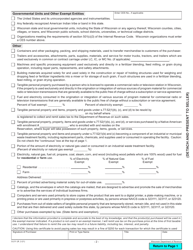

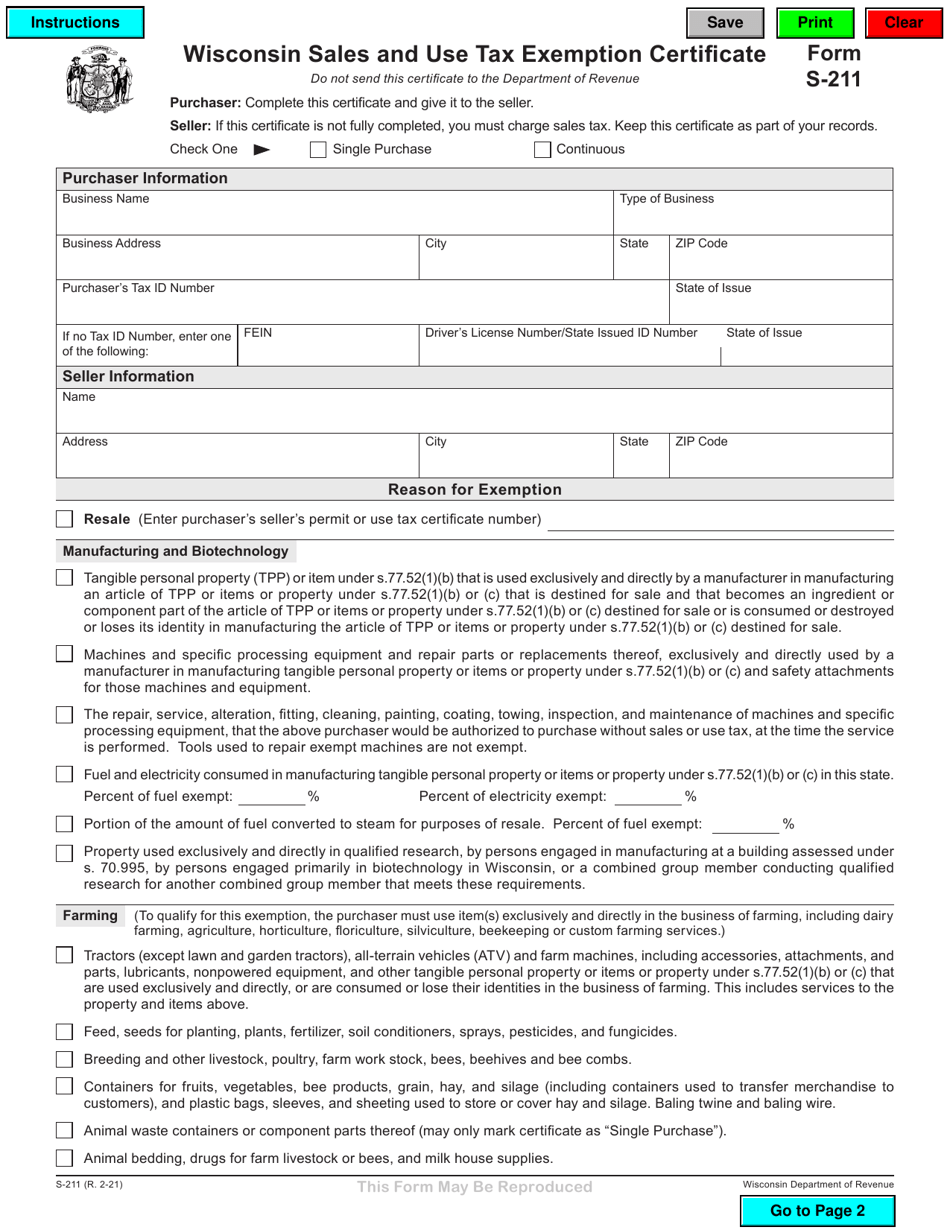

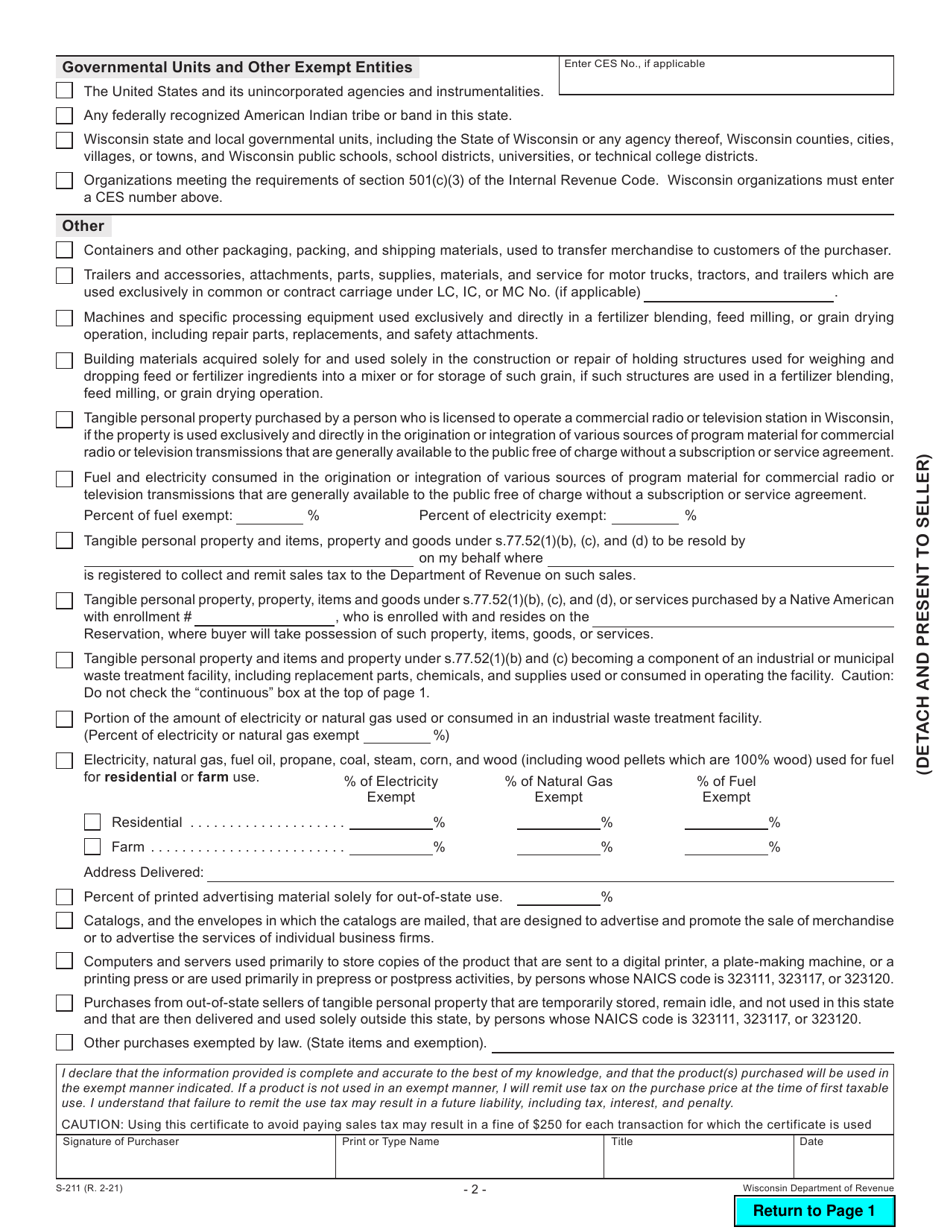

Form S-211

for the current year.

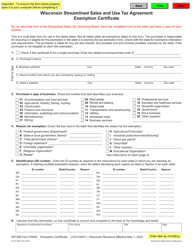

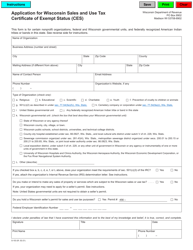

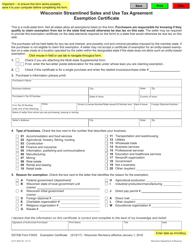

Form S-211 Sales and Use Tax Exemption Certificate - Wisconsin

What Is Form S-211?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form S-211?

A: Form S-211 is a Sales and Use Tax Exemption Certificate.

Q: What is the purpose of Form S-211?

A: The purpose of Form S-211 is to claim an exemption from sales and use tax in Wisconsin.

Q: Who can use Form S-211?

A: Form S-211 can be used by individuals, businesses, and organizations that qualify for a sales and use tax exemption in Wisconsin.

Q: What types of exemptions can be claimed using Form S-211?

A: Form S-211 can be used to claim exemptions for agricultural, manufacturing, and other specified activities.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S-211 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.