This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form I-832 Schedule ES

for the current year.

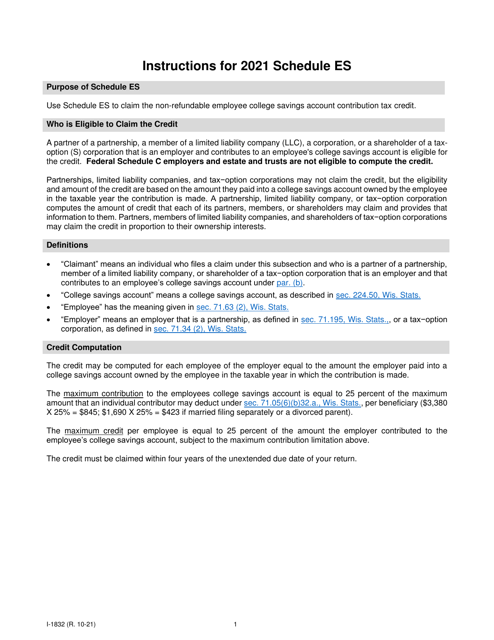

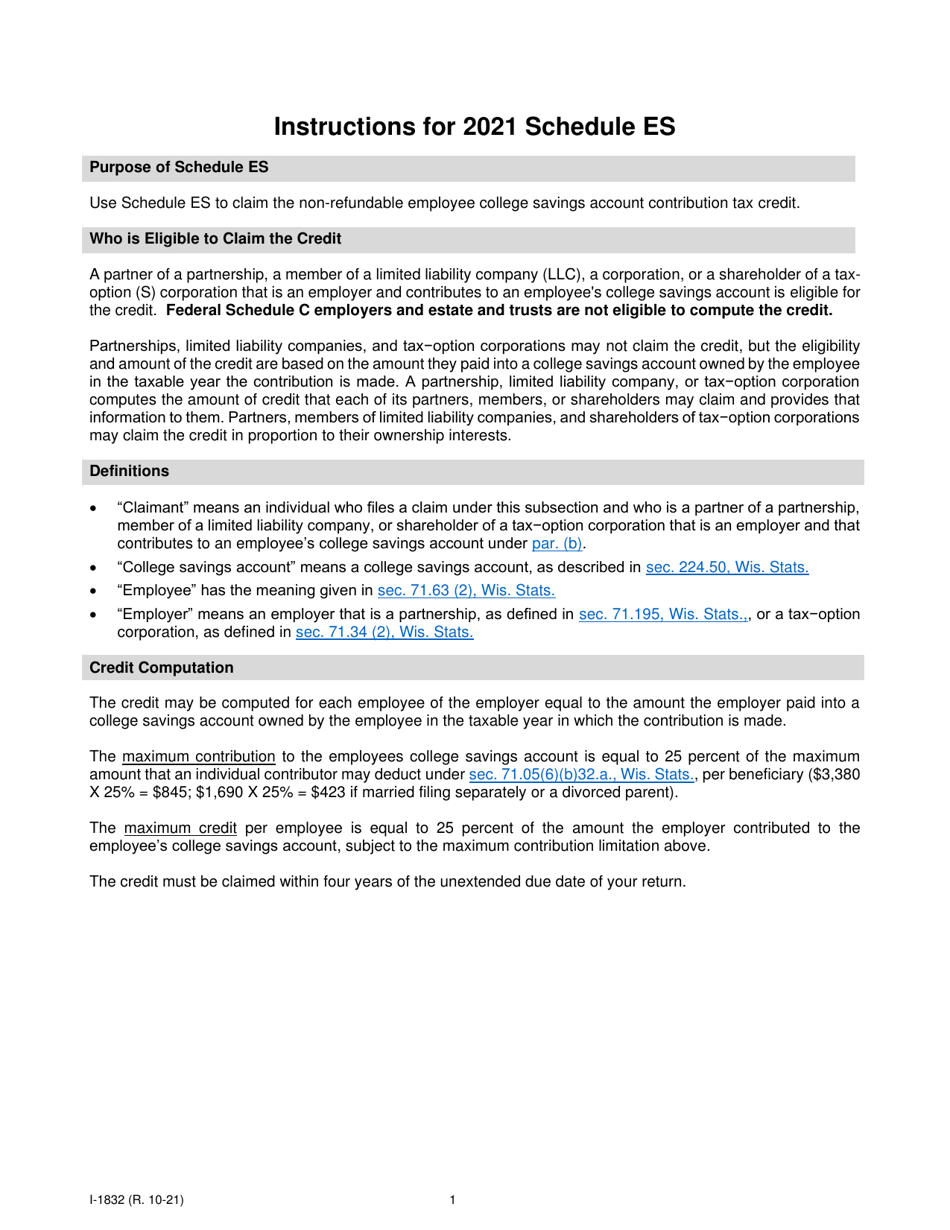

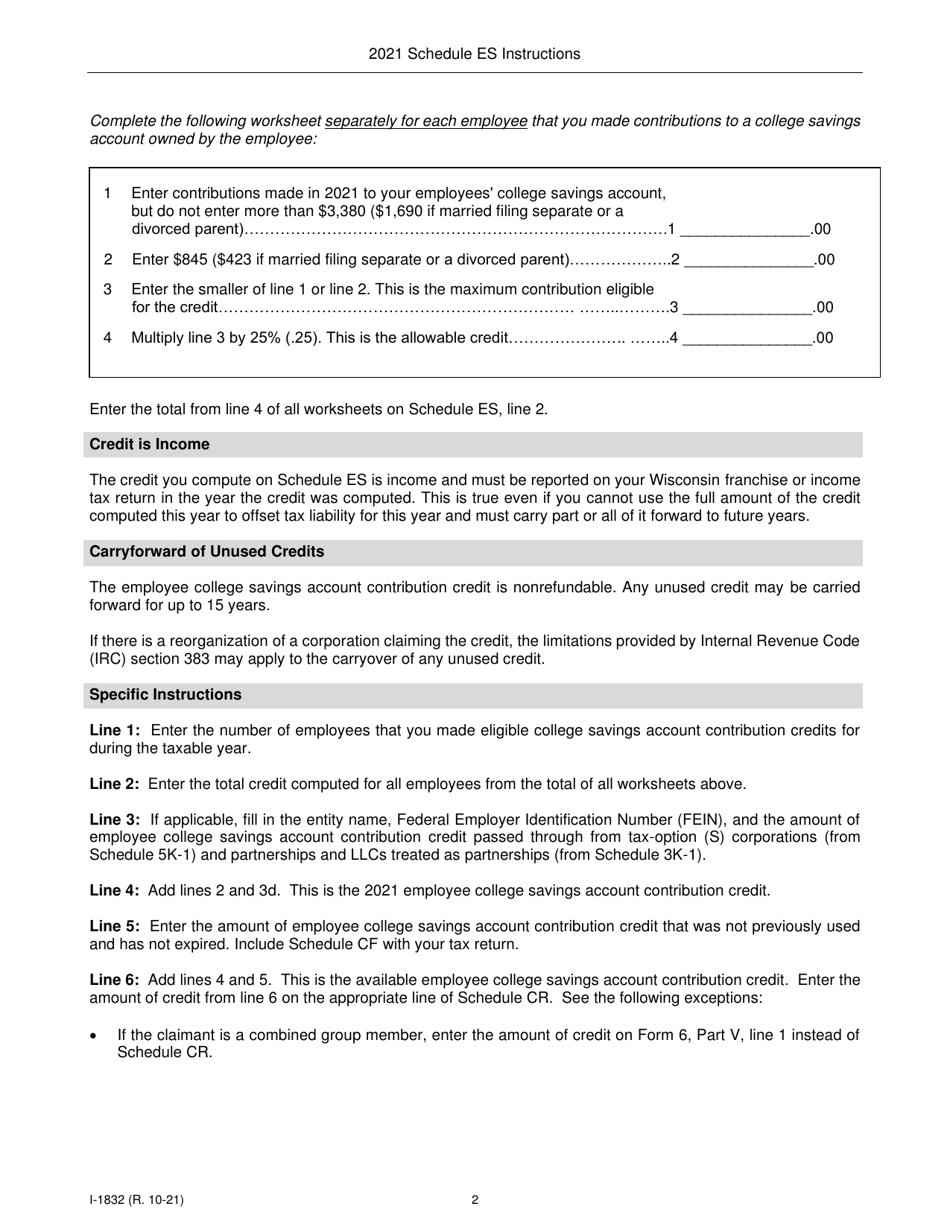

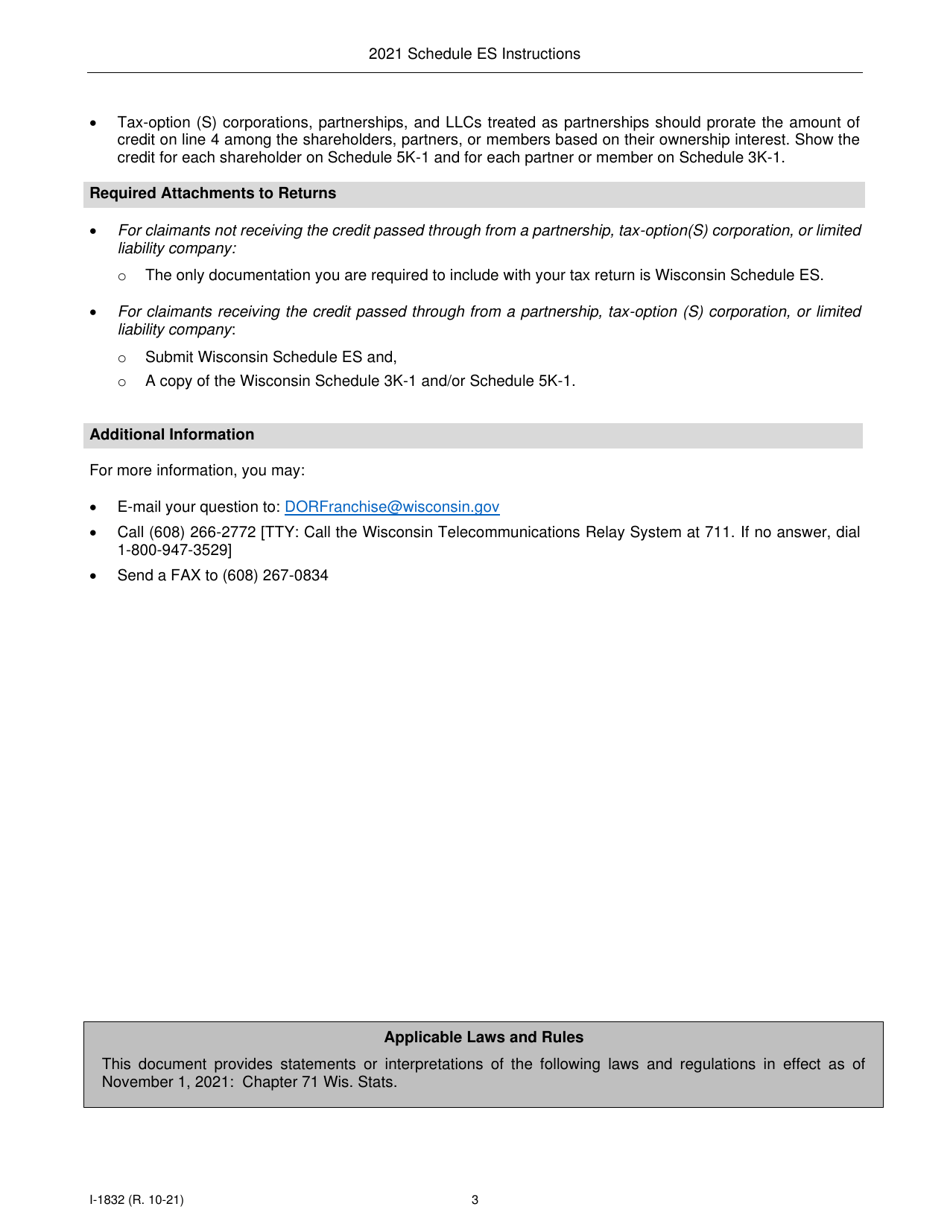

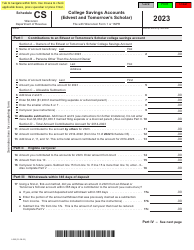

Instructions for Form I-832 Schedule ES Employee College Savings Account Contribution Credit - Wisconsin

This document contains official instructions for Form I-832 Schedule ES, Employee College Savings Account Contribution Credit - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form I-832 Schedule ES is available for download through this link.

FAQ

Q: What is Form I-832 Schedule ES?

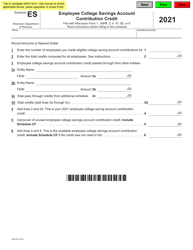

A: Form I-832 Schedule ES is a tax form used in Wisconsin to claim the Employee College Savings Account Contribution Credit.

Q: What is the Employee College Savings Account Contribution Credit?

A: The Employee College Savings Account Contribution Credit is a tax credit that allows eligible individuals to claim a credit for making contributions to a college savings account.

Q: Who is eligible to claim the Employee College Savings Account Contribution Credit?

A: Residents of Wisconsin who made contributions to a college savings account are eligible to claim this credit, subject to certain income limitations.

Q: What is the purpose of the Employee College Savings Account Contribution Credit?

A: The purpose of this credit is to encourage individuals to save for higher education expenses by providing a tax incentive.

Q: How do I claim the Employee College Savings Account Contribution Credit?

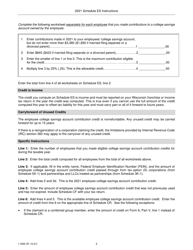

A: To claim this credit, you need to complete Form I-832 Schedule ES and attach it to your Wisconsin income tax return.

Q: Is there an income limit for claiming this credit?

A: Yes, there are income limitations for claiming the Employee College Savings Account Contribution Credit. You should refer to the instructions for Form I-832 Schedule ES to determine if you are eligible based on your income.

Q: Are there any other requirements to claim this credit?

A: In addition to the income limitations, you must also meet certain eligibility requirements, such as being a Wisconsin resident and making eligible contributions to a college savings account.

Q: Can I claim this credit if I made contributions to a 529 plan?

A: Yes, contributions to a 529 plan are generally eligible for the Employee College Savings Account Contribution Credit.

Q: What documentation do I need to keep to support the credit claim?

A: You should keep records of your contributions to a college savings account, as well as any other supporting documentation that may be required by the Wisconsin Department of Revenue.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.