This version of the form is not currently in use and is provided for reference only. Download this version of

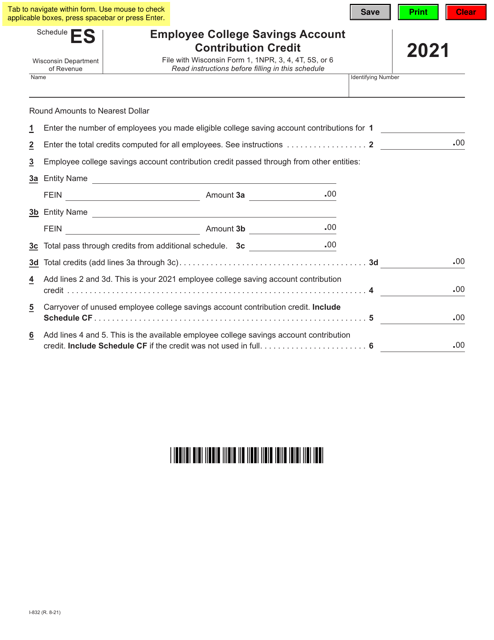

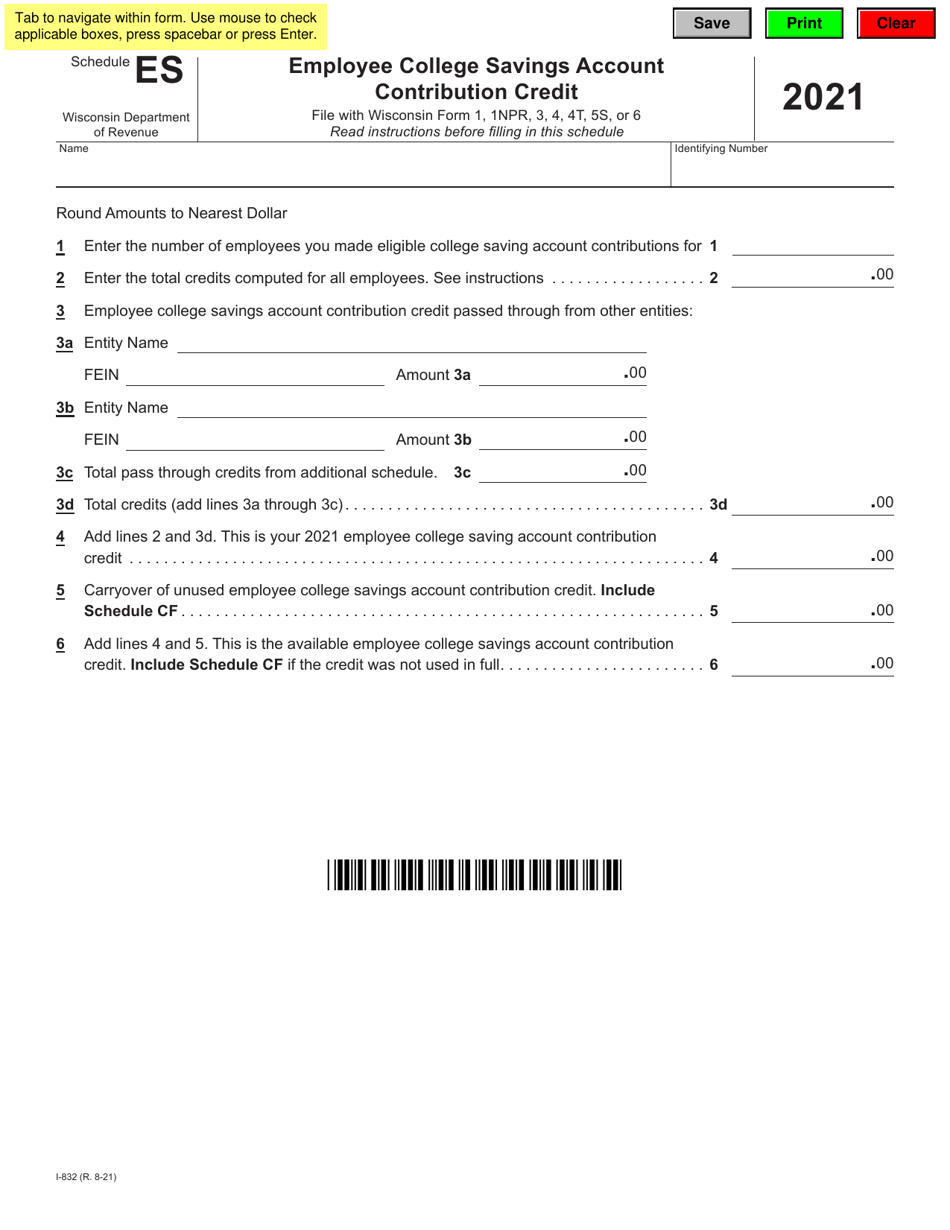

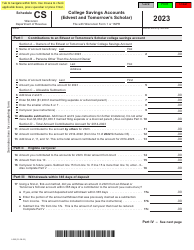

Form I-832 Schedule ES

for the current year.

Form I-832 Schedule ES Employee College Savings Account Contribution Credit - Wisconsin

What Is Form I-832 Schedule ES?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-832 Schedule ES?

A: Form I-832 Schedule ES is a form used to claim the Employee College Savings Account Contribution Credit in Wisconsin.

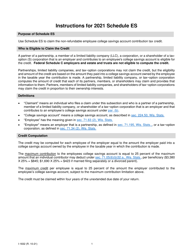

Q: What is the Employee College Savings Account Contribution Credit?

A: The Employee College Savings Account Contribution Credit is a tax credit in Wisconsin that allows eligible employees to claim a credit for contributing to a college savings account.

Q: Who is eligible to claim the Employee College Savings Account Contribution Credit?

A: Employees in Wisconsin who make contributions to a qualified college savings account are eligible to claim this credit.

Q: What is the purpose of the Employee College Savings Account Contribution Credit?

A: The purpose of this credit is to incentivize employees to save for higher education expenses by providing a tax benefit for contributing to a college savings account.

Q: How do I claim the Employee College Savings Account Contribution Credit?

A: To claim this credit, you need to complete and file Form I-832 Schedule ES with your Wisconsin tax return, providing the necessary information about your contributions to a college savings account.

Q: Are there any limitations or requirements for claiming the Employee College Savings Account Contribution Credit?

A: Yes, there are certain income limitations and other requirements that must be met in order to claim this credit. It is recommended to review the instructions for Form I-832 Schedule ES or consult with a tax professional for more specific information.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-832 Schedule ES by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.