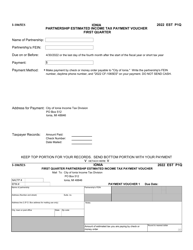

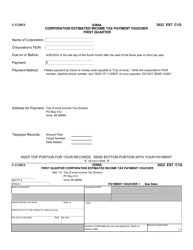

Instructions for Form 5489 City of Detroit Income Tax Withholding Guide - City of Detroit, Michigan

This document contains official instructions for Form 5489 , City of Detroit Income Tax Withholding Guide - a form released and collected by the Michigan Department of Treasury.

FAQ

Q: What is Form 5489?

A: Form 5489 is the City of Detroit Income Tax Withholding Guide.

Q: Who uses Form 5489?

A: Employers in the City of Detroit, Michigan use Form 5489.

Q: What is the purpose of Form 5489?

A: Form 5489 is used to determine the amount of income tax to be withheld from employees' wages in the City of Detroit.

Q: When is Form 5489 due?

A: Form 5489 is due on a quarterly basis. The due dates are April 30th, July 31st, October 31st, and January 31st.

Q: What information is required on Form 5489?

A: Form 5489 requires employer information, employee information, and details of wages and tax withholding.

Q: Are there any penalties for not filing Form 5489?

A: Yes, there are penalties for not filing or late filing of Form 5489. It is important to meet the deadlines to avoid penalties.

Q: Can Form 5489 be filed electronically?

A: Yes, employers have the option to file Form 5489 electronically if they meet certain criteria.

Q: What should I do if I have questions about Form 5489?

A: If you have questions about Form 5489, you should contact the City of Detroit's Income Tax Division for assistance.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Michigan Department of Treasury.