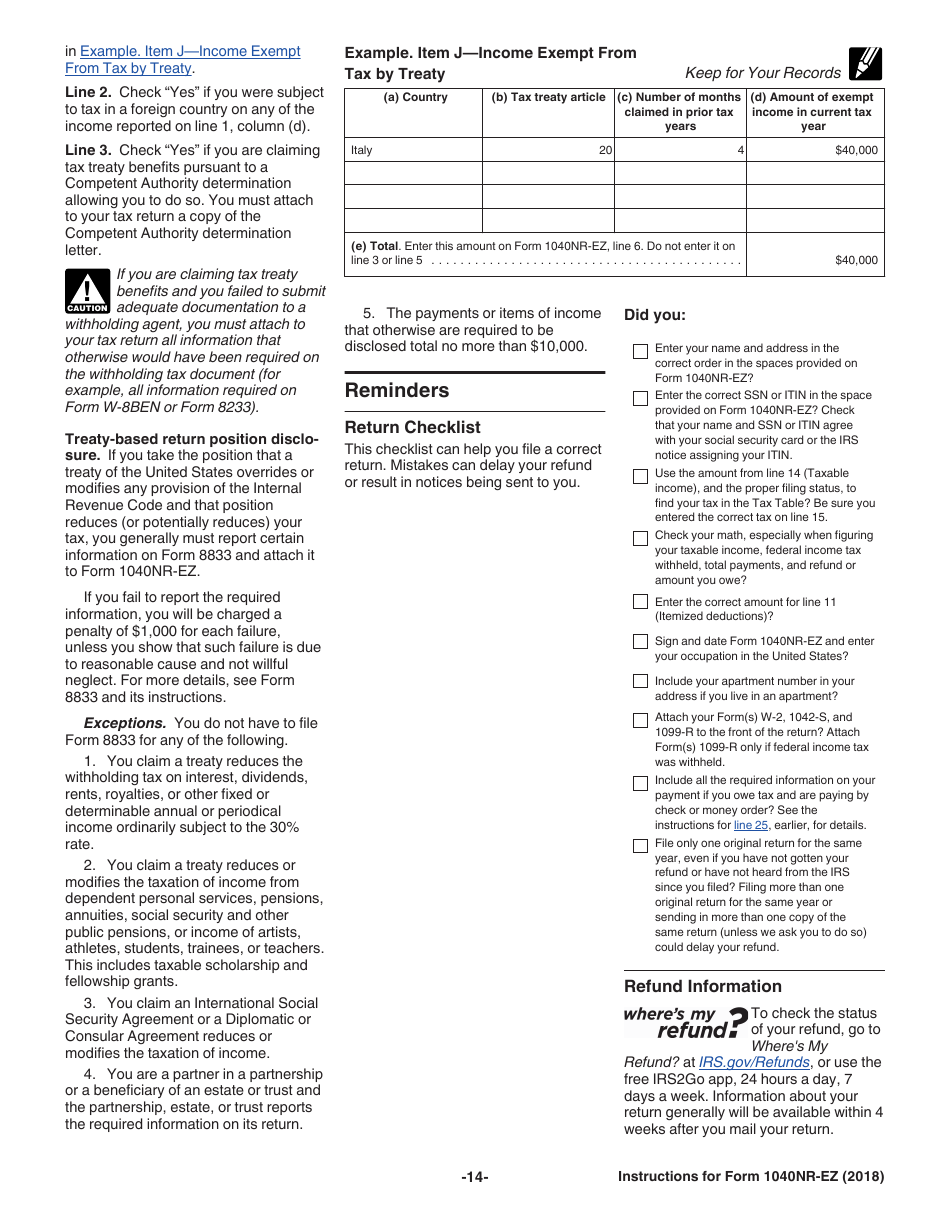

Instructions for IRS Form 1040NR-EZ U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents

This document contains official instructions for IRS Form 1040NR-EZ , U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1040NR-EZ?

A: IRS Form 1040NR-EZ is the U.S. income tax return specifically designed for certain nonresident aliens with no dependents.

Q: Who is eligible to use Form 1040NR-EZ?

A: Nonresident aliens who have no dependents and meet certain criteria can use Form 1040NR-EZ.

Q: What is the purpose of Form 1040NR-EZ?

A: The purpose of Form 1040NR-EZ is to report income earned in the U.S. by nonresident aliens who are not eligible for Social Security numbers.

Q: What types of income should be reported on Form 1040NR-EZ?

A: Form 1040NR-EZ is used to report wages, salaries, tips, and other compensation earned in the U.S. It should also be used to report scholarship and fellowship grants.

Q: Do nonresident aliens need to file Form 1040NR-EZ?

A: Nonresident aliens must file Form 1040NR-EZ if they have earned income in the U.S. that is subject to federal income tax.

Q: When is the deadline to file Form 1040NR-EZ?

A: The deadline to file Form 1040NR-EZ is generally April 15th of the following year. However, it may be extended if the nonresident alien is granted an extension.

Instruction Details:

- This 34-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.