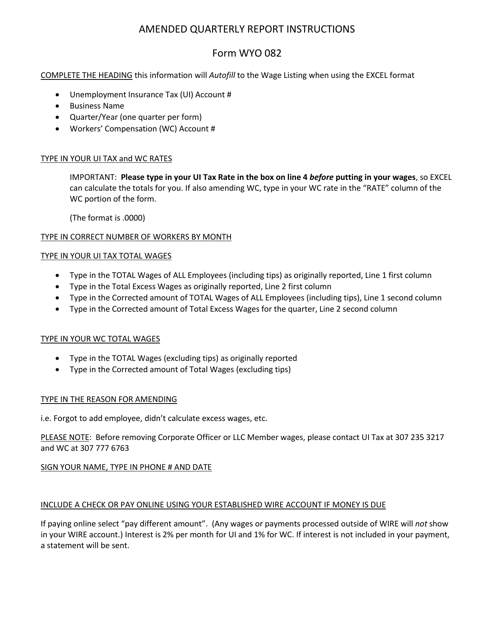

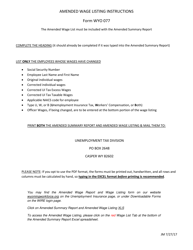

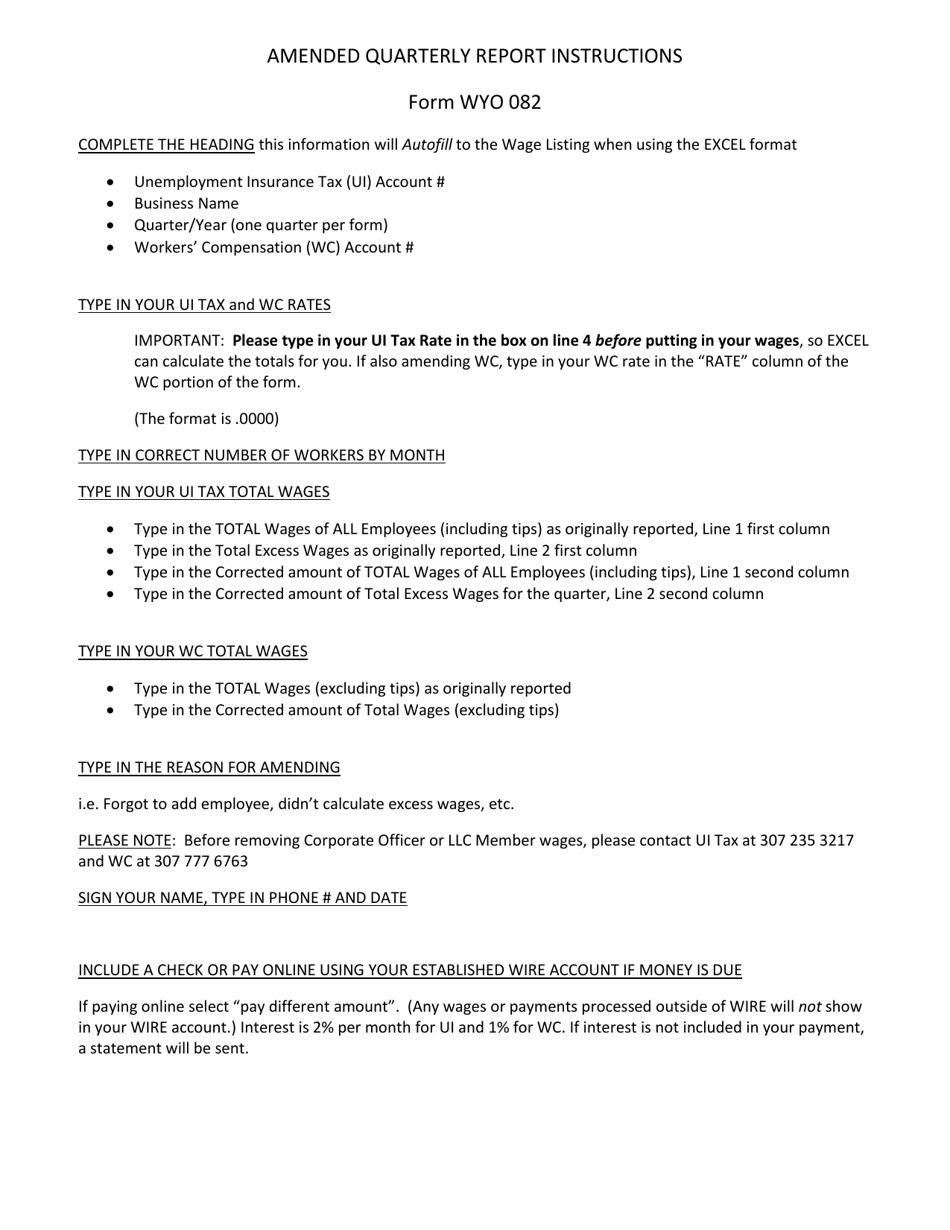

Instructions for Form WYO-082 Amended Summary Report - Wyoming

This document contains official instructions for Form WYO-082 , Amended Summary Report - a form released and collected by the Wyoming Department of Workforce Services.

FAQ

Q: What is Form WYO-082?

A: Form WYO-082 is an Amended Summary Report for Wyoming.

Q: When do I need to file Form WYO-082?

A: You need to file Form WYO-082 when you want to submit an amended summary report for Wyoming.

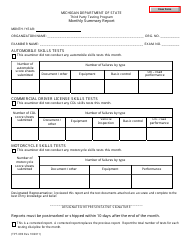

Q: What information is required on Form WYO-082?

A: Form WYO-082 requires you to provide your taxpayer identification number, the tax period being amended, and the amended amounts for each category reported on the original summary report.

Q: Do I need to include any supporting documents with Form WYO-082?

A: No, you do not need to include any supporting documents with Form WYO-082 unless specifically requested by the Wyoming Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wyoming Department of Workforce Services.