This version of the form is not currently in use and is provided for reference only. Download this version of

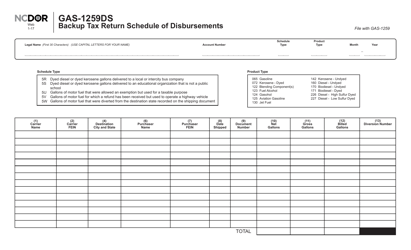

Form GAS-1259

for the current year.

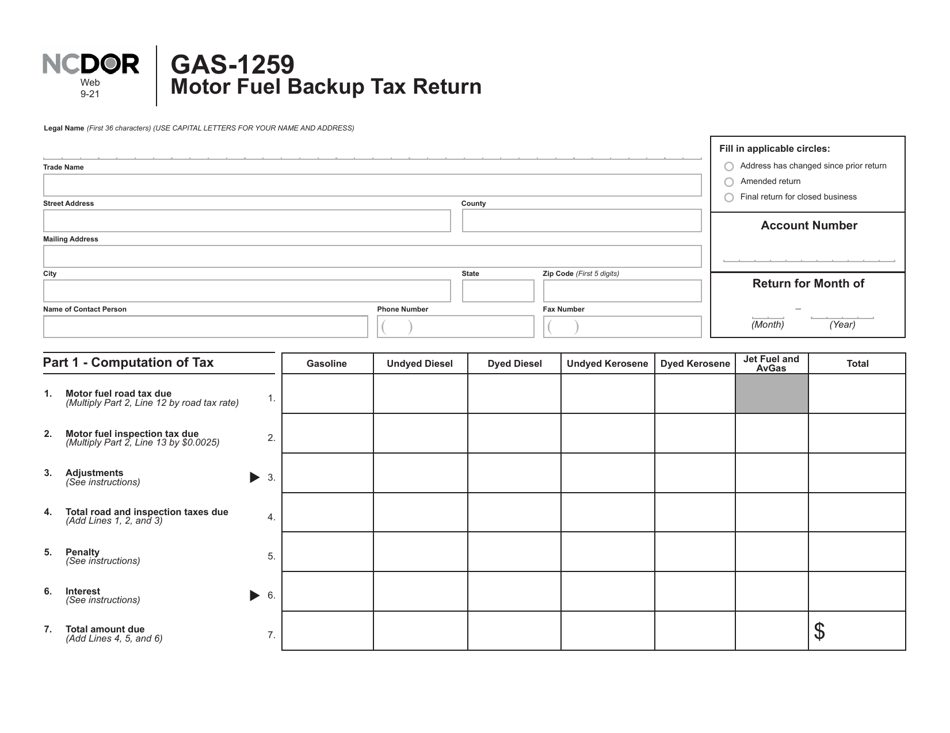

Form GAS-1259 Motor Fuel Backup Tax Return - North Carolina

What Is Form GAS-1259?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GAS-1259?

A: Form GAS-1259 is the Motor Fuel Backup Tax Return for the state of North Carolina.

Q: Who needs to file Form GAS-1259?

A: Any person or entity who sells or uses backup motor fuel in North Carolina needs to file Form GAS-1259.

Q: What is backup motor fuel?

A: Backup motor fuel is fuel used in an emergency or during periods of interrupted supply.

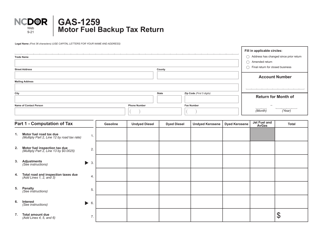

Q: What information is required on Form GAS-1259?

A: Form GAS-1259 requires information such as the gallons of backup motor fuel purchased or used, the tax rate, and the total amount of tax due.

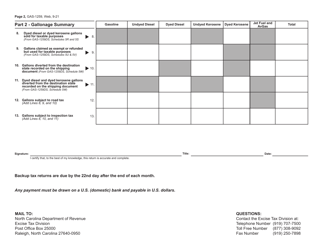

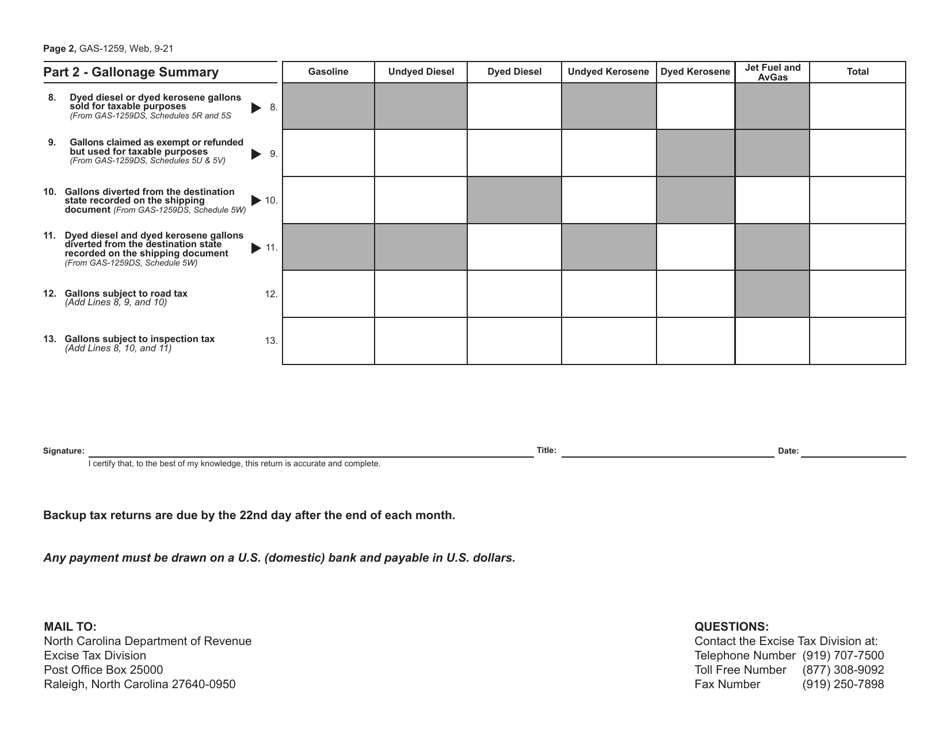

Q: When is Form GAS-1259 due?

A: Form GAS-1259 is due on the 25th day of the month following the end of the reporting period.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

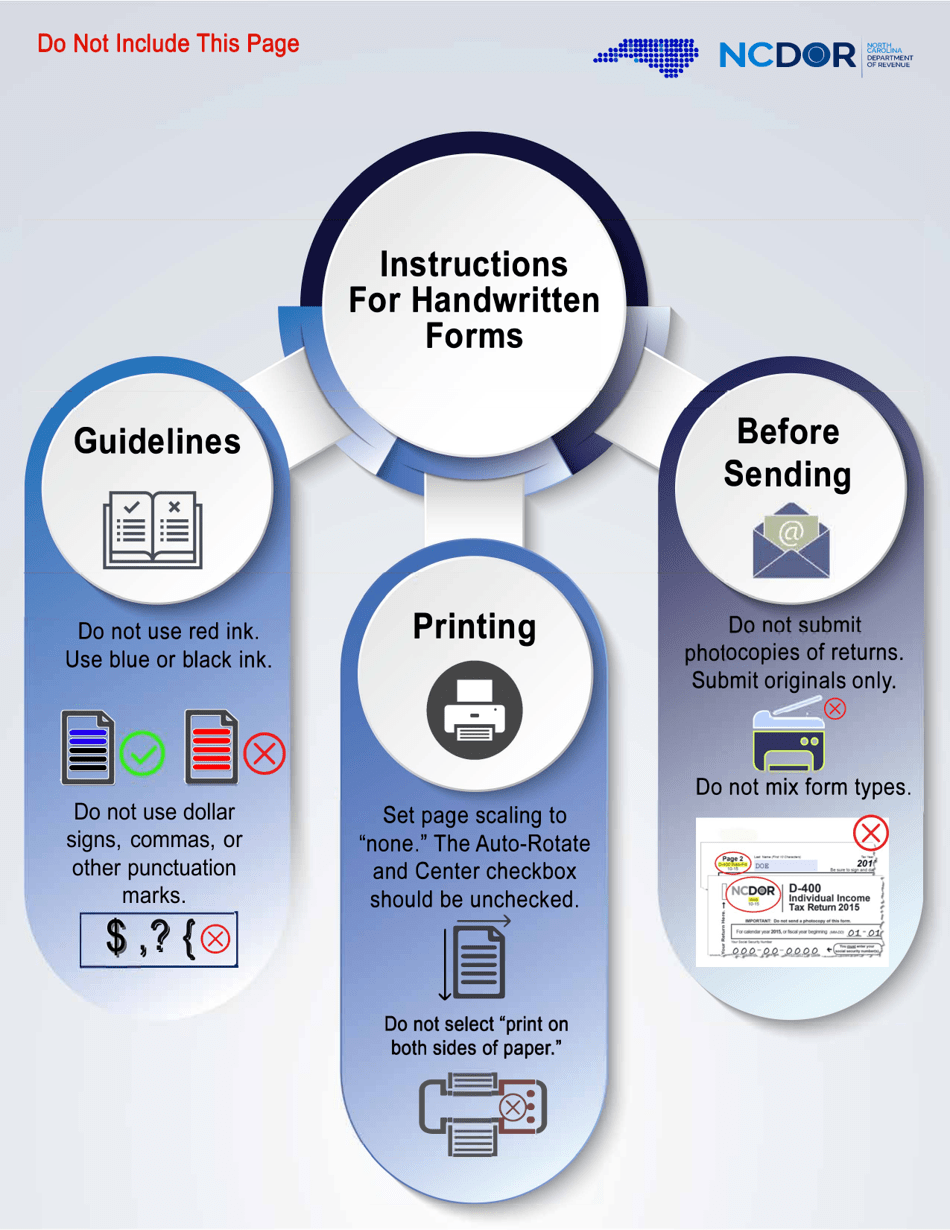

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1259 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.