This version of the form is not currently in use and is provided for reference only. Download this version of

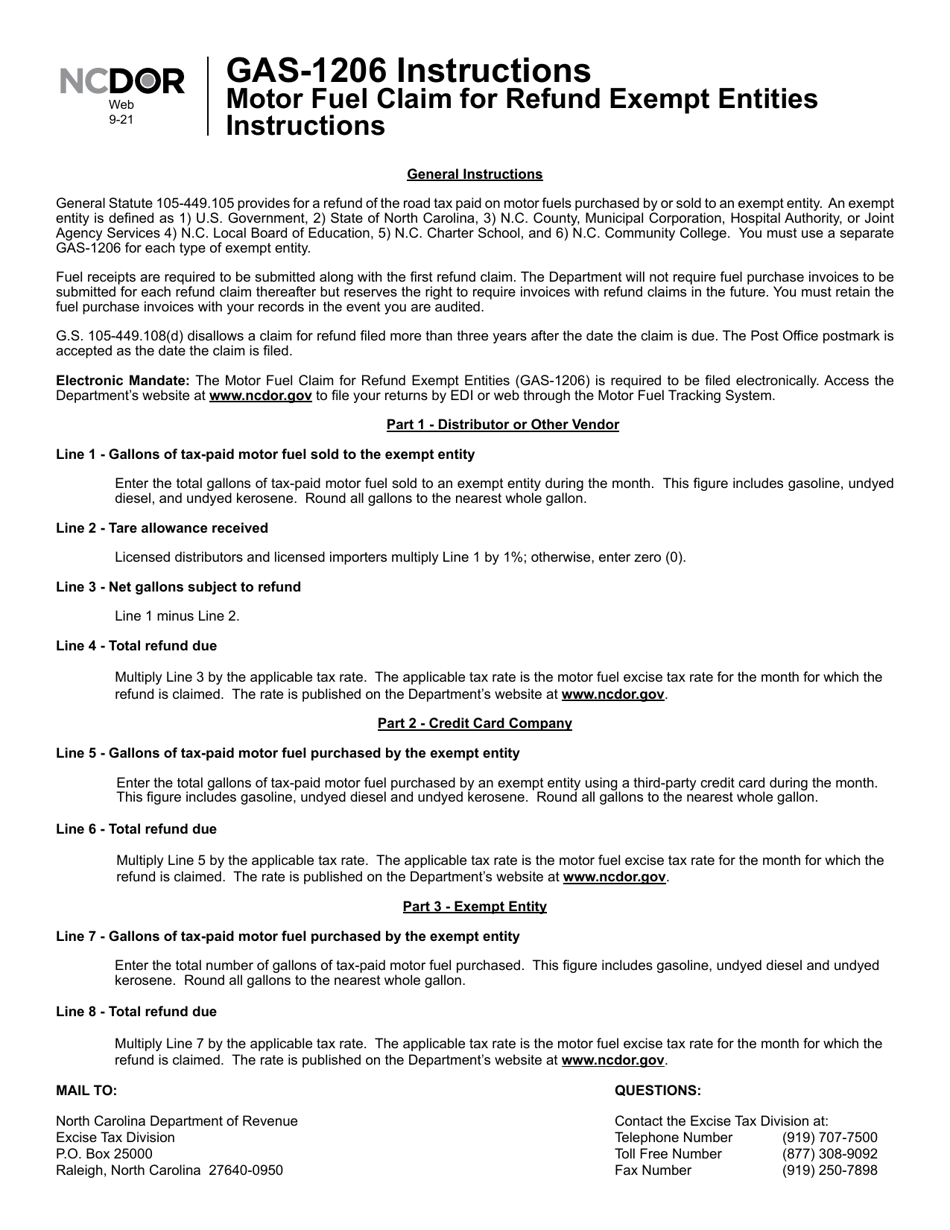

Instructions for Form GAS-1206

for the current year.

Instructions for Form GAS-1206 Motor Fuel Claim for Refund Exempt Entities - North Carolina

This document contains official instructions for Form GAS-1206 , Motor Fuel Claim for Refund Exempt Entities - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form GAS-1206 is available for download through this link.

FAQ

Q: What is Form GAS-1206?

A: Form GAS-1206 is the Motor Fuel Claim for Refund Exempt Entities form for North Carolina.

Q: Who can use Form GAS-1206?

A: Exempt entities in North Carolina can use Form GAS-1206 to claim a refund of motor fuel tax.

Q: What is the purpose of Form GAS-1206?

A: The purpose of Form GAS-1206 is to allow exempt entities to claim a refund of motor fuel tax paid in North Carolina.

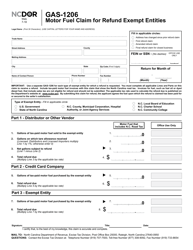

Q: What information is required on Form GAS-1206?

A: Form GAS-1206 requires information such as the entity's name and address, the type of exemption claimed, and details of the fuel purchases and tax paid.

Q: When is the deadline to file Form GAS-1206?

A: Form GAS-1206 must be filed on a quarterly basis, with the deadline falling on the 20th day of the month following the end of each quarter.

Q: How long does it take to process a refund claim with Form GAS-1206?

A: It typically takes the North Carolina Department of Revenue 6-8 weeks to process a refund claim submitted with Form GAS-1206.

Q: Are there any supporting documents required with Form GAS-1206?

A: Yes, you may be required to submit supporting documents such as invoices and receipts with your Form GAS-1206.

Q: Can I e-file Form GAS-1206?

A: No, Form GAS-1206 cannot be e-filed. It must be mailed to the North Carolina Department of Revenue.

Q: Can I claim a refund for motor fuel tax paid in a previous year?

A: No, Form GAS-1206 can only be used to claim a refund for motor fuel tax paid in the current year.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.