This version of the form is not currently in use and is provided for reference only. Download this version of

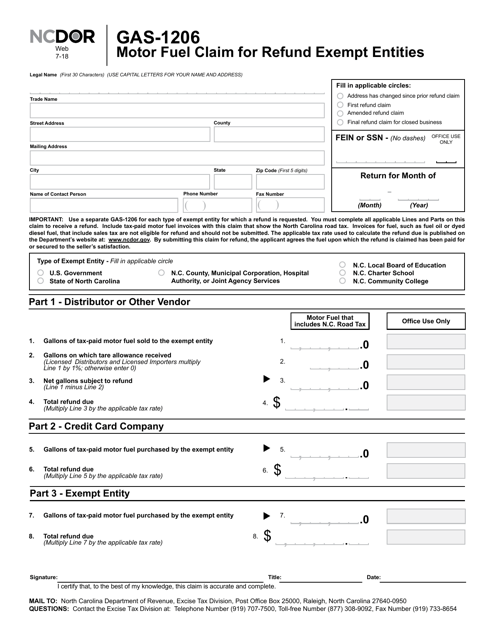

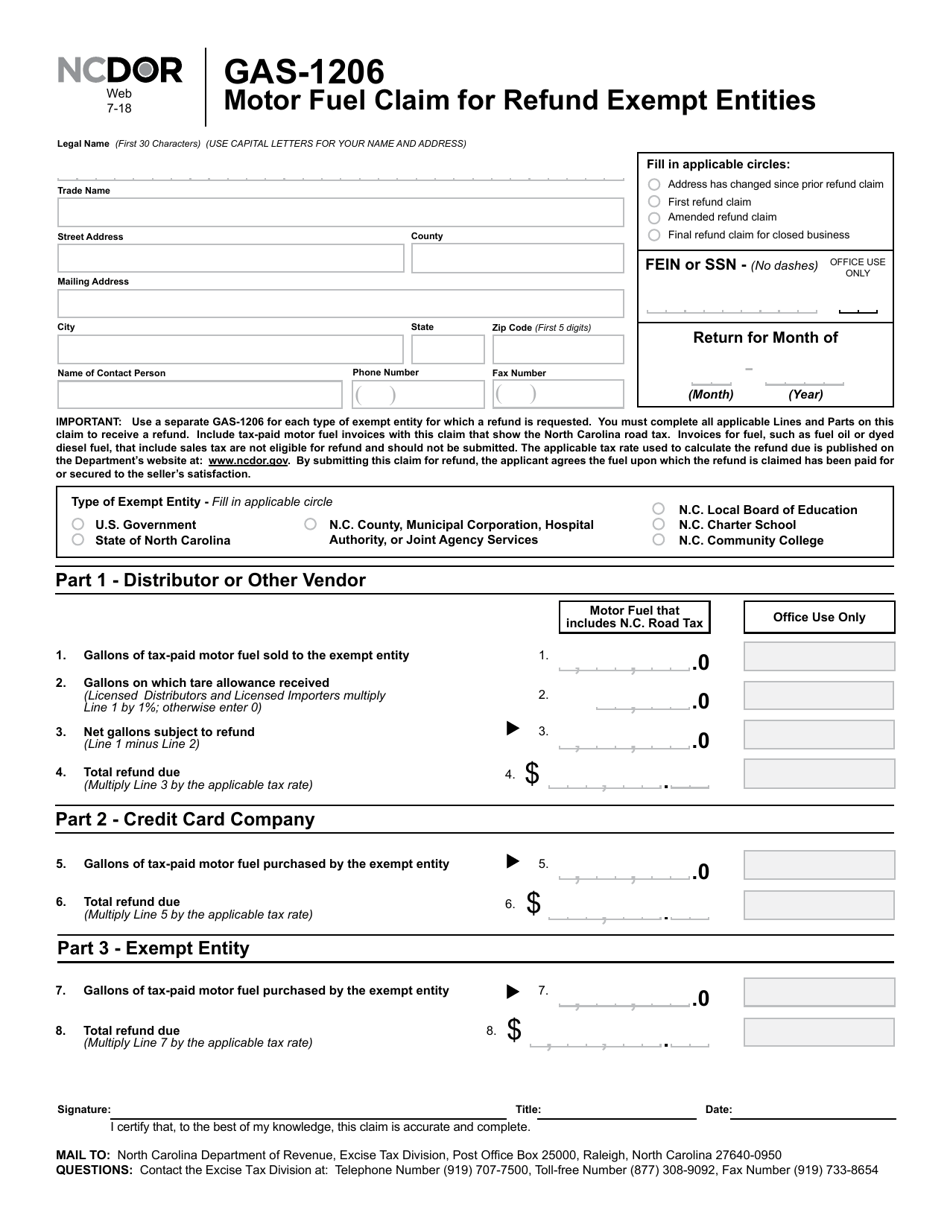

Form GAS-1206

for the current year.

Form GAS-1206 Motor Fuel Claim for Refund Exempt Entities - North Carolina

What Is Form GAS-1206?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GAS-1206?

A: Form GAS-1206 is a form used to claim a refund of motor fuel tax for exempt entities in North Carolina.

Q: Who can use Form GAS-1206?

A: Exempt entities in North Carolina can use Form GAS-1206 to claim a refund of motor fuel tax.

Q: What is a motor fuel tax refund?

A: A motor fuel tax refund is a reimbursement for the taxes paid on motor fuel by exempt entities.

Q: What is an exempt entity?

A: An exempt entity refers to an organization or entity that is exempt from paying certain taxes, such as motor fuel tax.

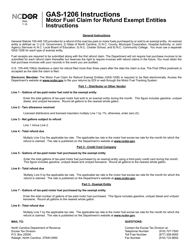

Q: Are there any specific requirements to claim a motor fuel tax refund?

A: Yes, there are specific requirements that must be met in order to claim a motor fuel tax refund. These requirements are outlined in the instructions accompanying Form GAS-1206.

Q: How do I submit Form GAS-1206?

A: Form GAS-1206 can be submitted by mail to the North Carolina Department of Revenue. The mailing address is provided on the form.

Q: Is there a deadline to submit Form GAS-1206?

A: Yes, there is a deadline to submit Form GAS-1206. The specific deadline is mentioned in the instructions accompanying the form.

Q: Can I submit Form GAS-1206 electronically?

A: No, Form GAS-1206 cannot be submitted electronically. It must be submitted by mail.

Q: What should I do if I need assistance with Form GAS-1206?

A: If you need assistance with Form GAS-1206, you can contact the North Carolina Department of Revenue for further guidance.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1206 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.