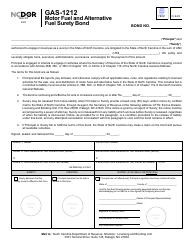

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GAS-1241

for the current year.

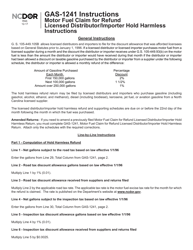

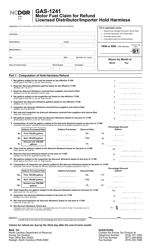

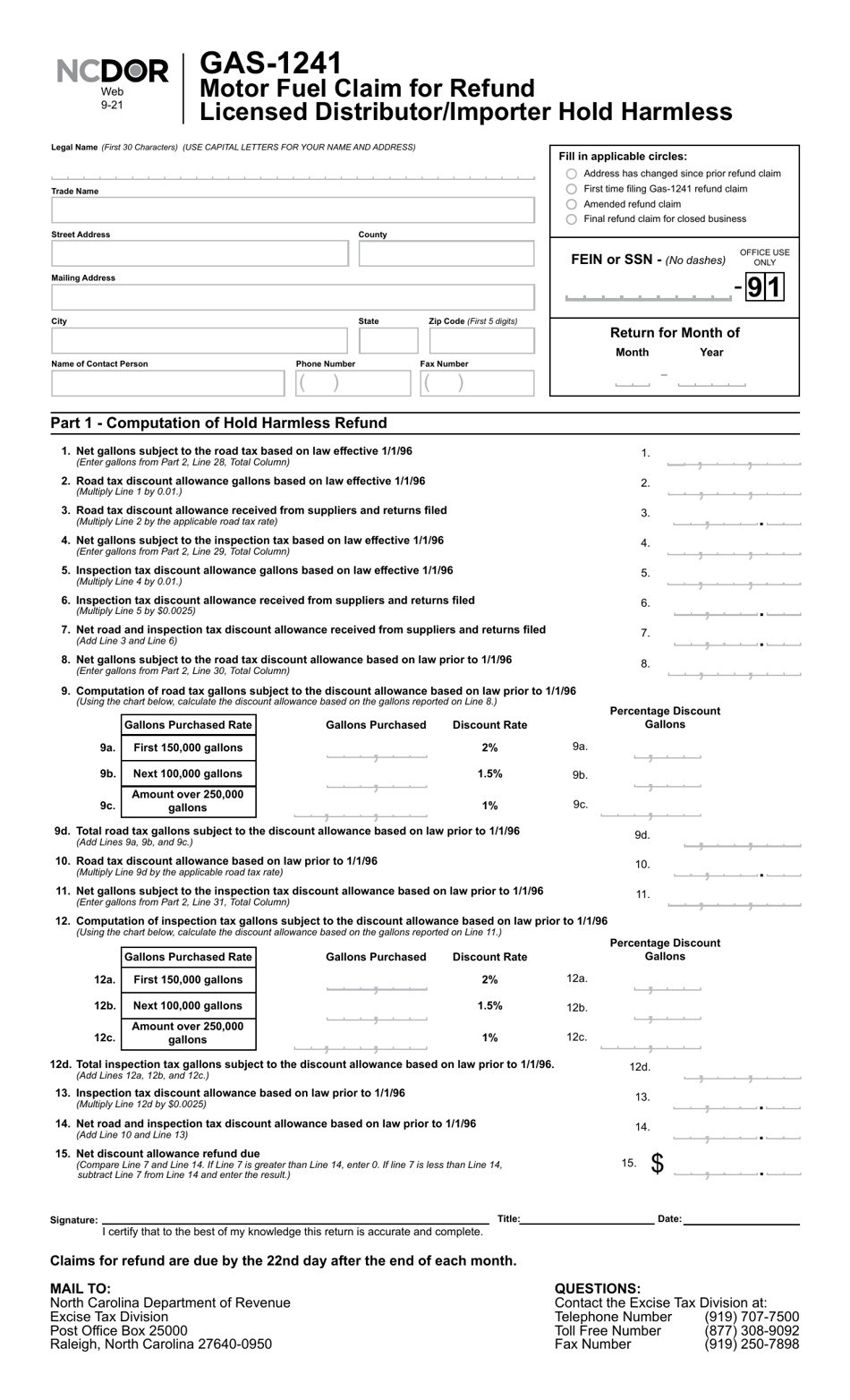

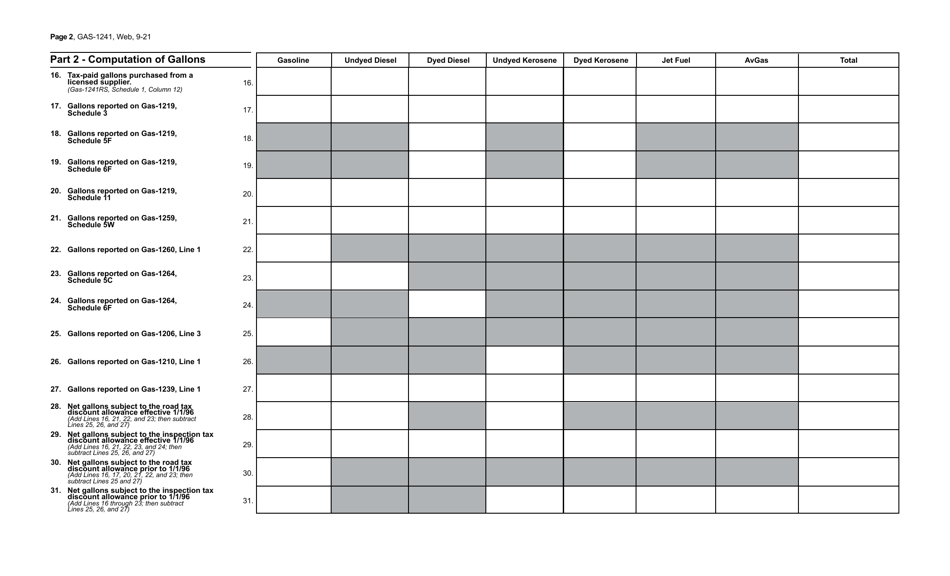

Form GAS-1241 Motor Fuel Claim for Refund Licensed Distributor / Importer Hold Harmless - North Carolina

What Is Form GAS-1241?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is GAS-1241?

A: GAS-1241 is a form used to claim a refund for motor fuel as a licensed distributor/importer in North Carolina.

Q: Who can use GAS-1241?

A: Licensed distributors and importers of motor fuel in North Carolina can use GAS-1241.

Q: What is the purpose of GAS-1241?

A: GAS-1241 is used to claim a refund of motor fuel taxes paid by licensed distributors/importers in North Carolina.

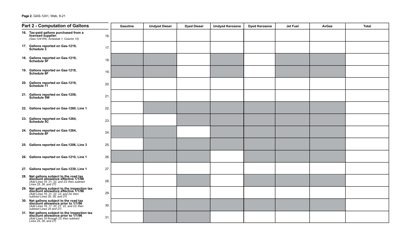

Q: What do I need to include in GAS-1241?

A: You need to provide details of the motor fuel purchases, sales, and the amount of tax paid in the claim form.

Q: Is there a deadline for submitting GAS-1241?

A: Yes, GAS-1241 must be submitted on a monthly basis, and there is a deadline for each month's claim.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

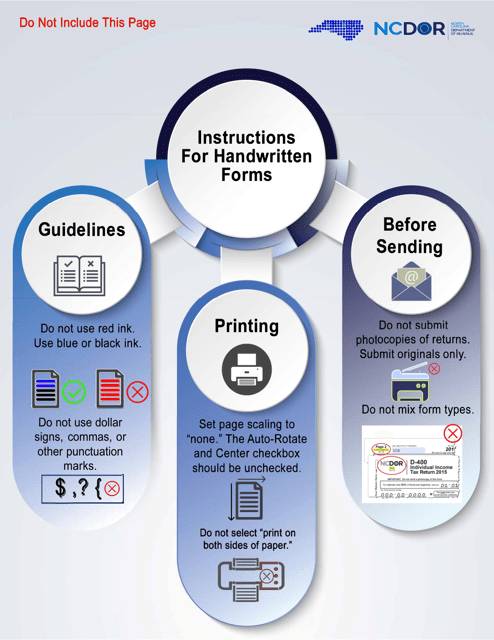

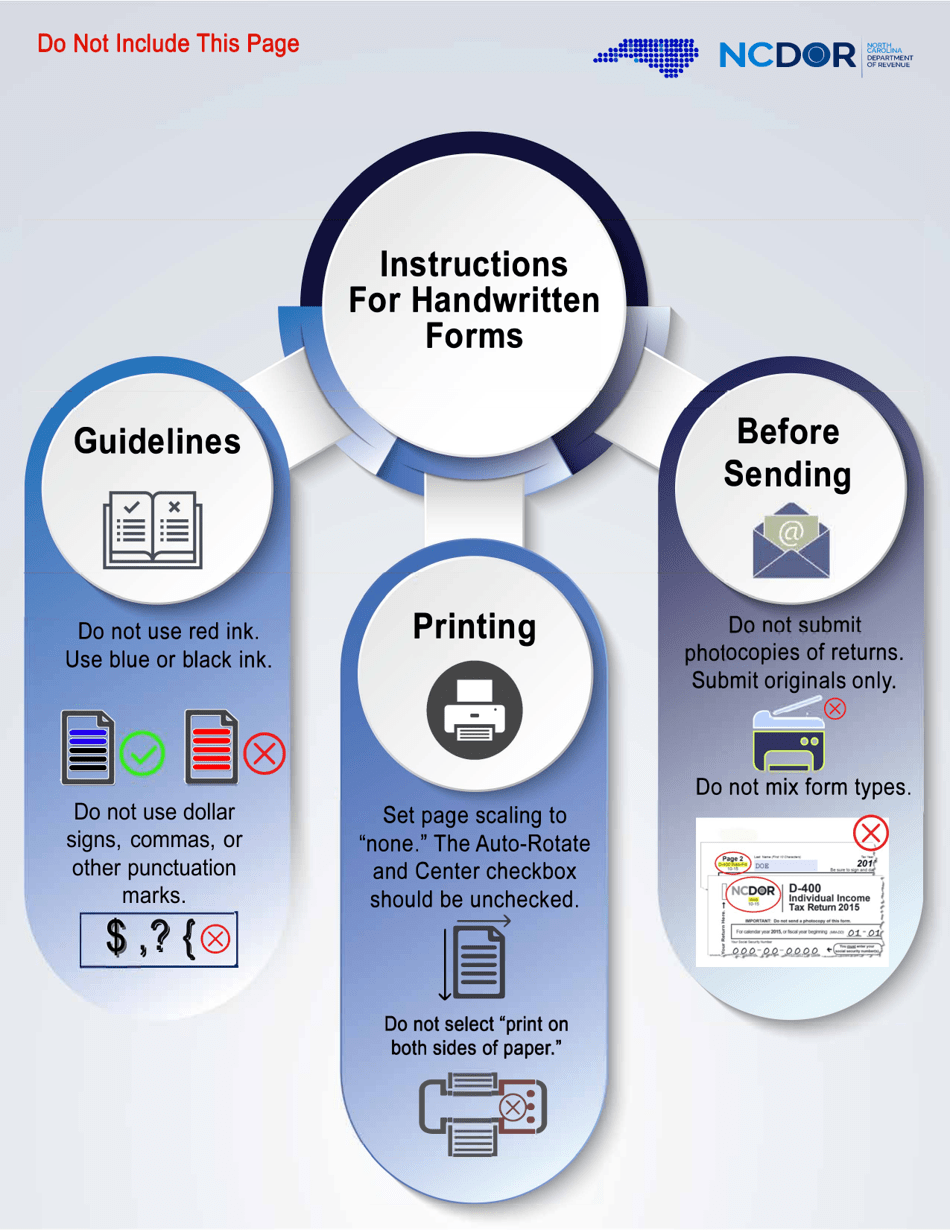

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1241 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.