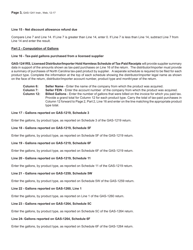

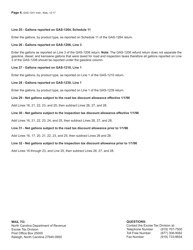

This version of the form is not currently in use and is provided for reference only. Download this version of

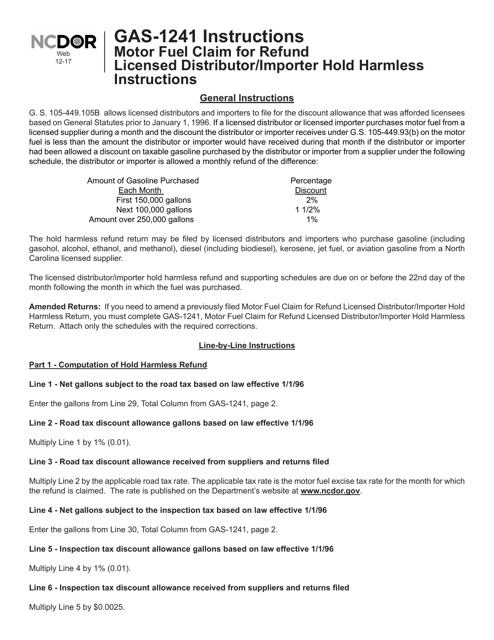

Instructions for Form GAS-1241

for the current year.

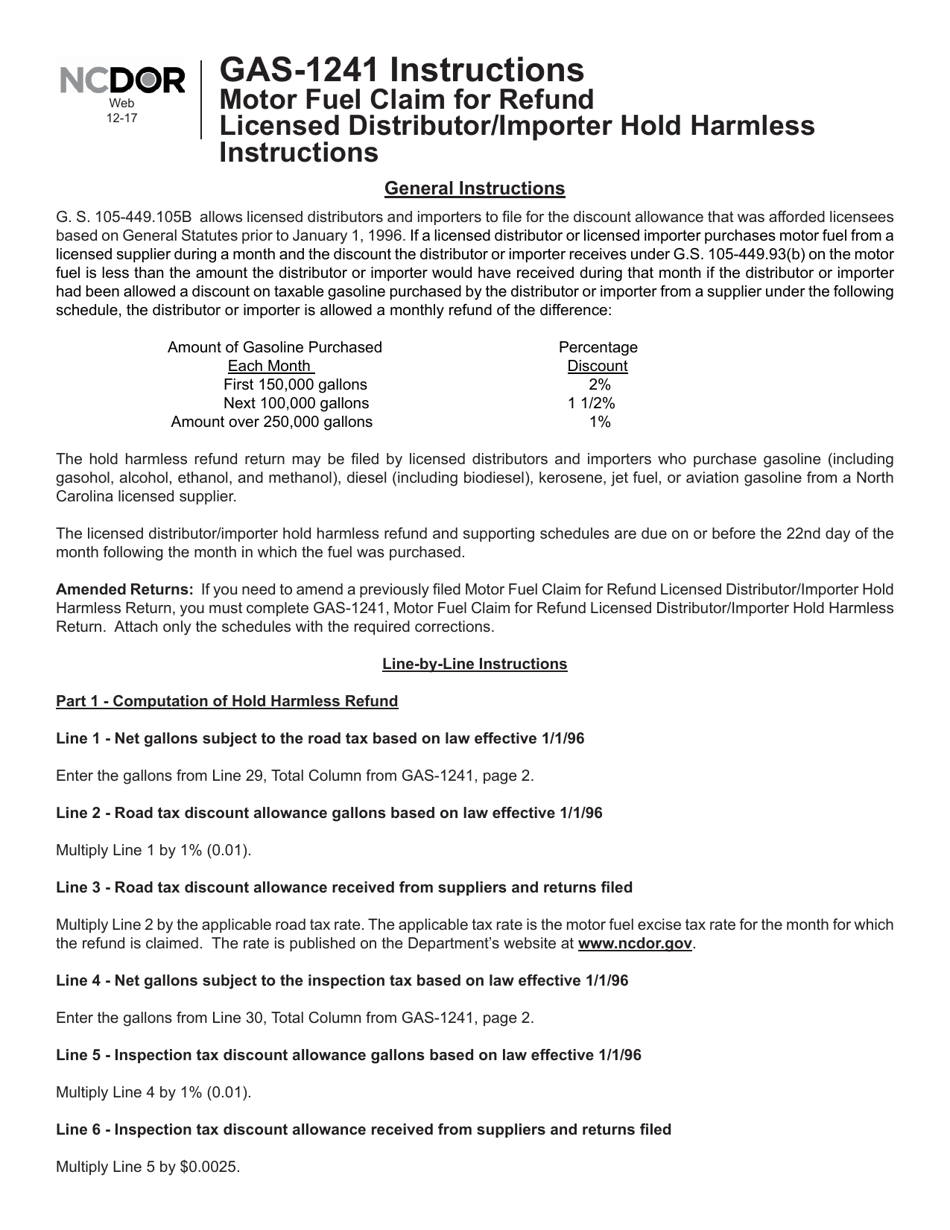

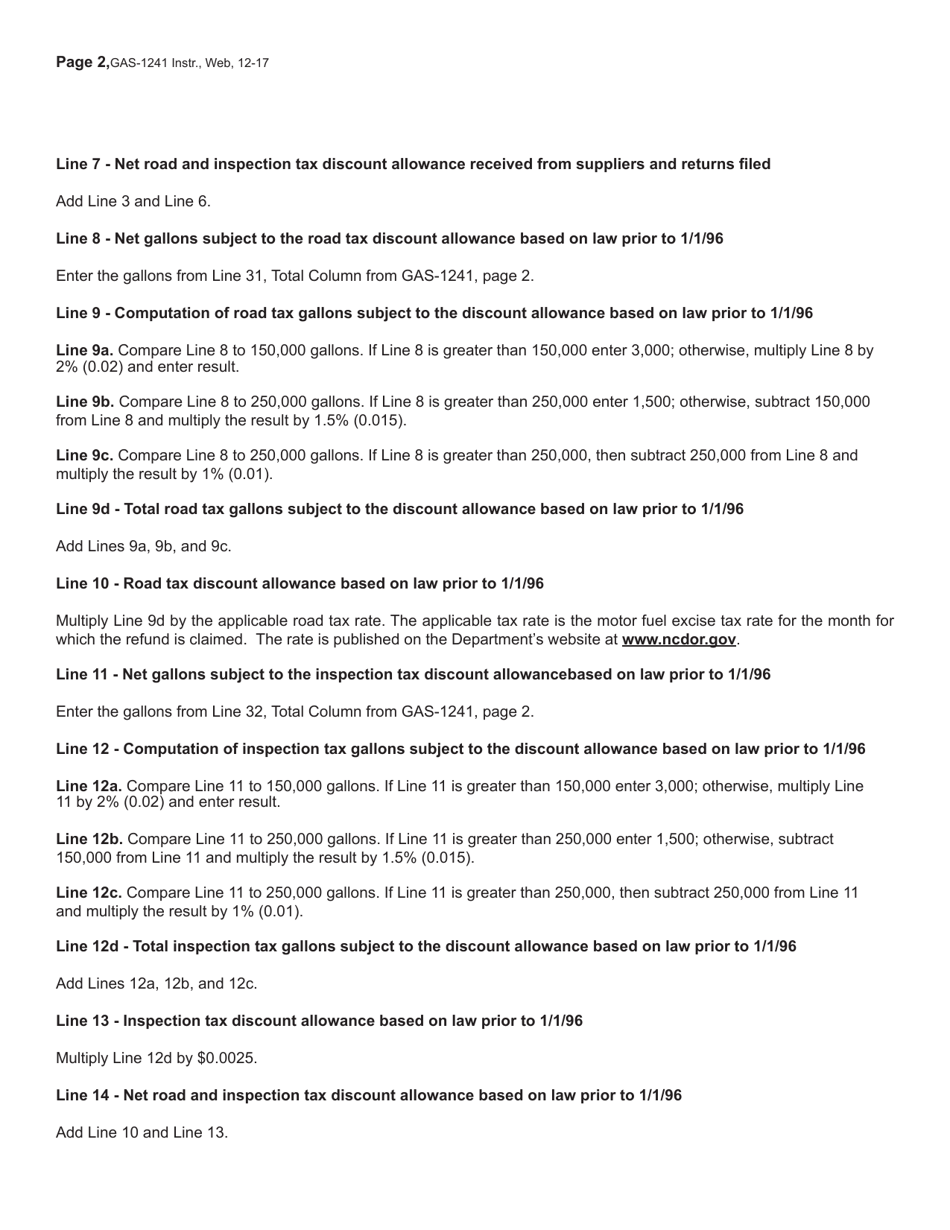

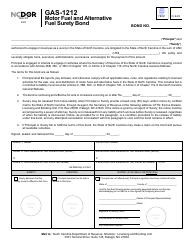

Instructions for Form GAS-1241 Motor Fuel Claim for Refund Licensed Distributor / Importer Hold Harmless - North Carolina

This document contains official instructions for Form GAS-1241 , Motor Fuel Claim for Refund Licensed Distributor/Importer Hold Harmless - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form GAS-1241 is available for download through this link.

FAQ

Q: What is Form GAS-1241?

A: Form GAS-1241 is a motor fuelclaim for refund form used by licensed distributors/importers in North Carolina.

Q: Who can use Form GAS-1241?

A: Only licensed distributors/importers of motor fuel in North Carolina can use Form GAS-1241.

Q: What is the purpose of Form GAS-1241?

A: The purpose of Form GAS-1241 is to claim a refund for the tax paid on motor fuel.

Q: What information is required on Form GAS-1241?

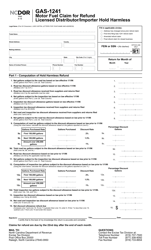

A: Form GAS-1241 requires information such as the distributor/importer's name, address, and license number, as well as details about the motor fuel and the amount of tax paid.

Q: Are there any specific instructions for completing Form GAS-1241?

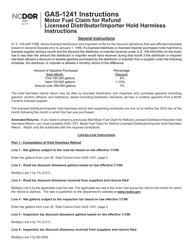

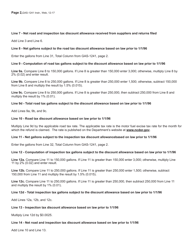

A: Yes, there are specific instructions provided with the form that explain how to complete each section accurately.

Q: Is there a deadline for submitting Form GAS-1241?

A: Yes, the form must be submitted within three years from the date of purchase of the motor fuel for which a refund is claimed.

Q: Can I claim a refund for motor fuel purchased in a previous year?

A: Yes, as long as the motor fuel was purchased within the three-year deadline, you can claim a refund for it.

Q: Is there a fee associated with submitting Form GAS-1241?

A: No, there is no fee for submitting Form GAS-1241.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.