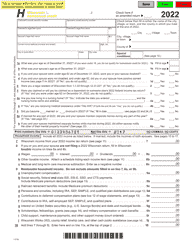

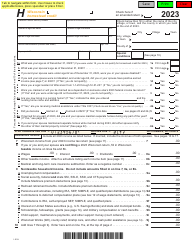

This version of the form is not currently in use and is provided for reference only. Download this version of

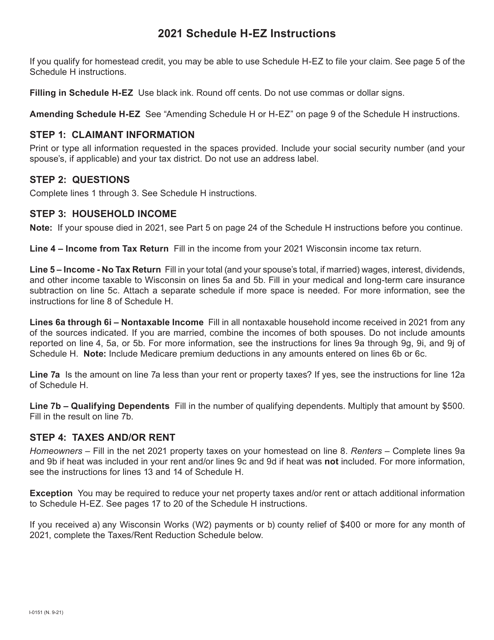

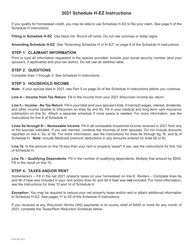

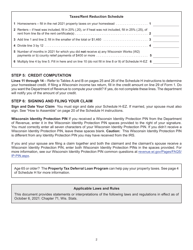

Instructions for Form I-015I Schedule H-EZ

for the current year.

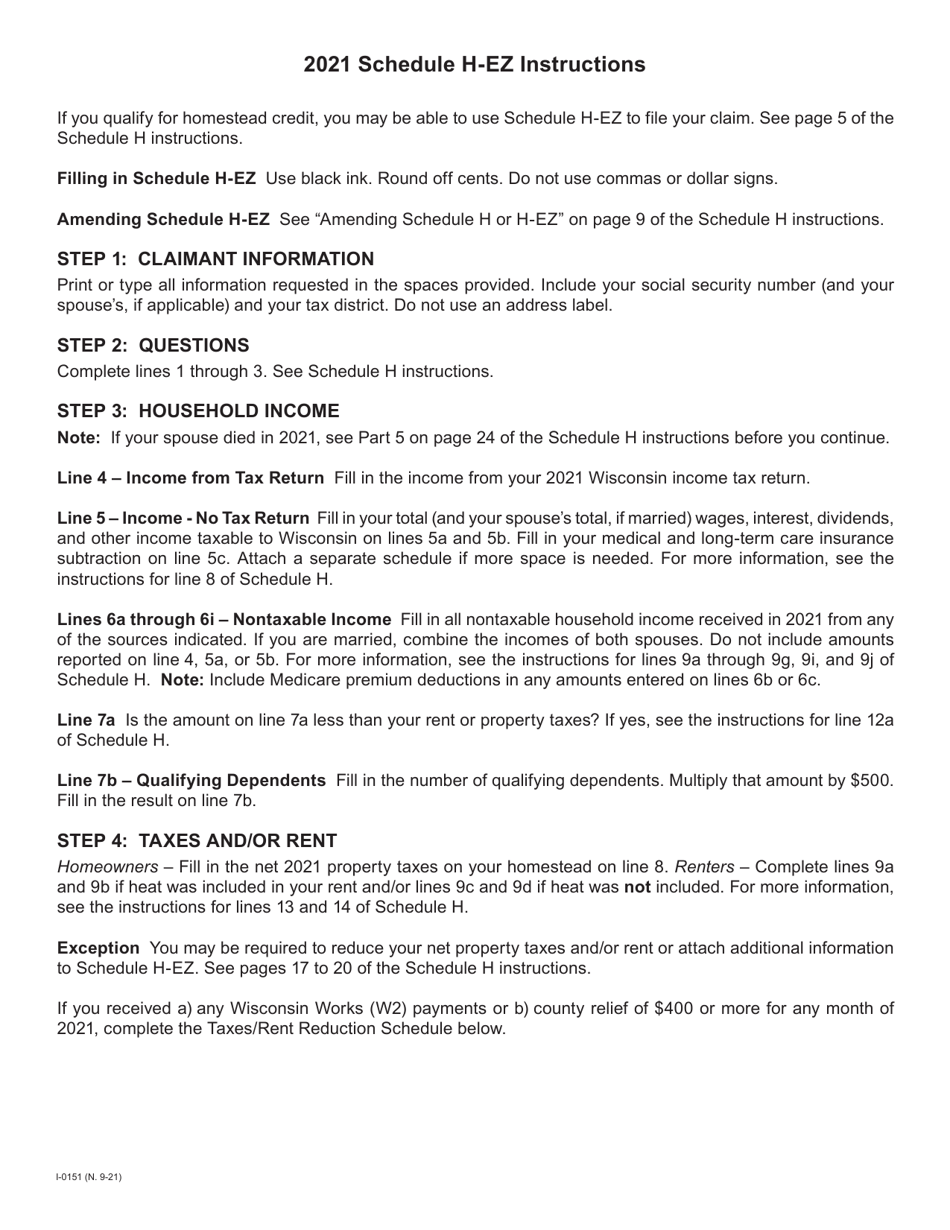

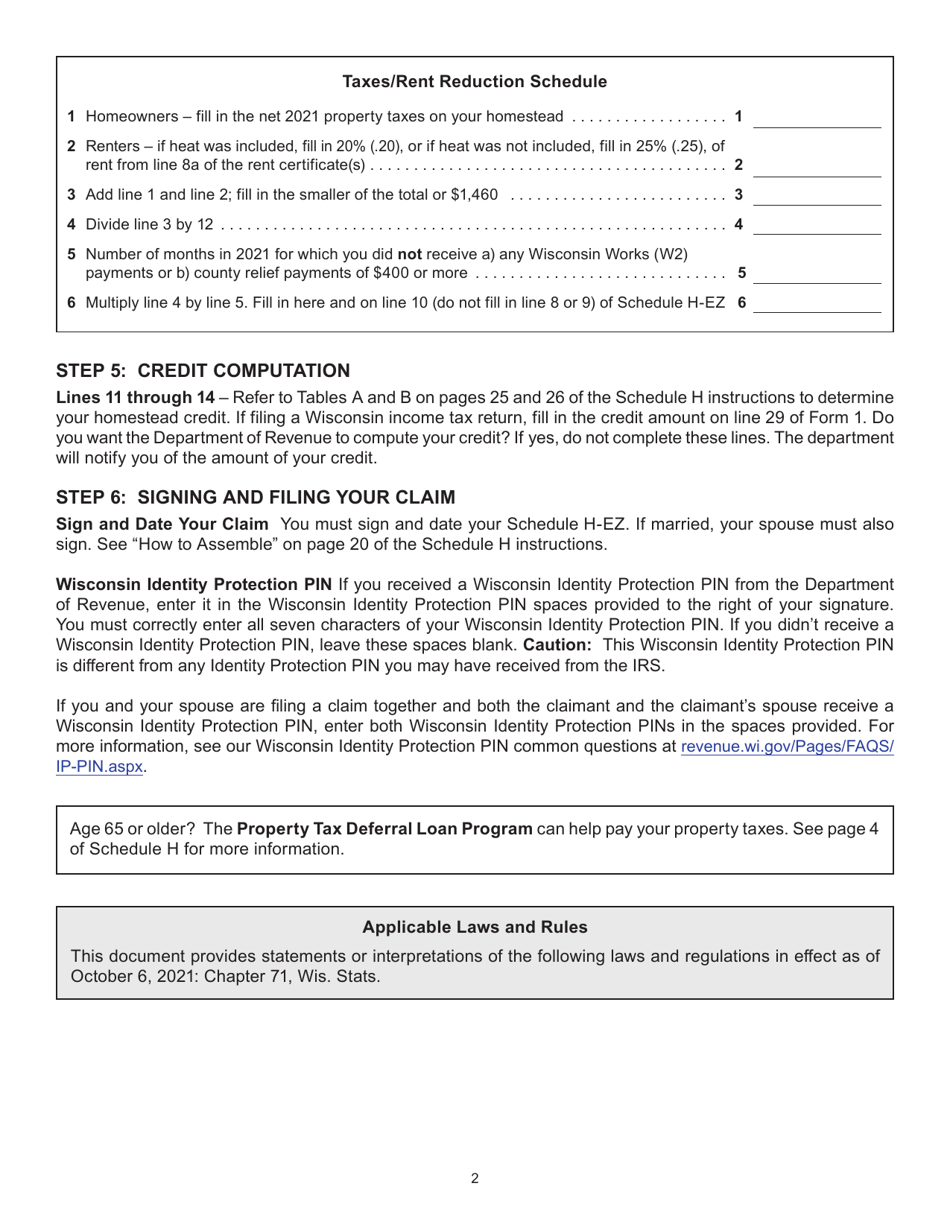

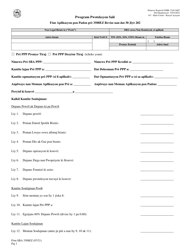

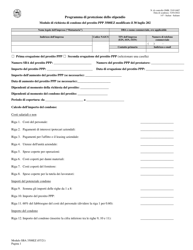

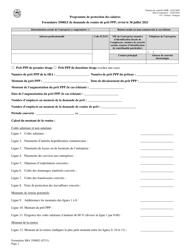

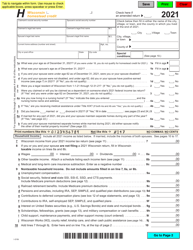

Instructions for Form I-015I Schedule H-EZ Homestead Credit Claim (Easy Form) - Wisconsin

This document contains official instructions for Form I-015I Schedule H-EZ, Homestead Credit Claim (Easy Form) - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form I-015I Schedule H-EZ is available for download through this link.

FAQ

Q: What is Form I-015I Schedule H-EZ?

A: Form I-015I Schedule H-EZ is a simplified version of Schedule H, which is used to claim the Homestead Credit in Wisconsin.

Q: What is the Homestead Credit?

A: The Homestead Credit is a tax credit provided to eligible Wisconsin residents to help offset property tax or rent costs.

Q: Who can use Form I-015I Schedule H-EZ?

A: Form I-015I Schedule H-EZ is designed for individuals who meet certain criteria, such as having a household income below a certain threshold.

Q: How is Form I-015I Schedule H-EZ different from Schedule H?

A: Form I-015I Schedule H-EZ is a simpler version of Schedule H and has fewer requirements and calculations. It is intended for individuals with basic tax situations.

Q: What documents do I need to complete Form I-015I Schedule H-EZ?

A: You will need your property tax bill or rent certificate, as well as information about your household income and expenses.

Q: How do I file Form I-015I Schedule H-EZ?

A: You can file Form I-015I Schedule H-EZ by mail or electronically using appropriate tax software.

Q: When is the deadline to file Form I-015I Schedule H-EZ?

A: The deadline for filing Form I-015I Schedule H-EZ is generally April 15th, but it may vary in certain situations.

Q: Can I claim the Homestead Credit if I rent a property?

A: Yes, you can still claim the Homestead Credit if you are a renter and meet the eligibility requirements.

Q: What is the benefit of claiming the Homestead Credit?

A: Claiming the Homestead Credit can help reduce your property tax or rent expenses, providing financial assistance to eligible Wisconsin residents.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.