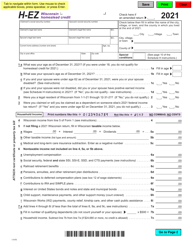

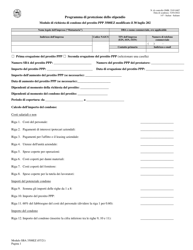

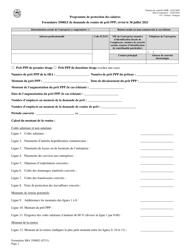

This version of the form is not currently in use and is provided for reference only. Download this version of

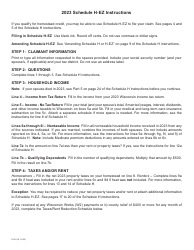

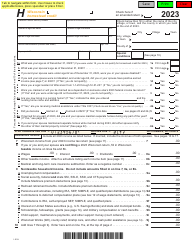

Form I-015I Schedule H-EZ

for the current year.

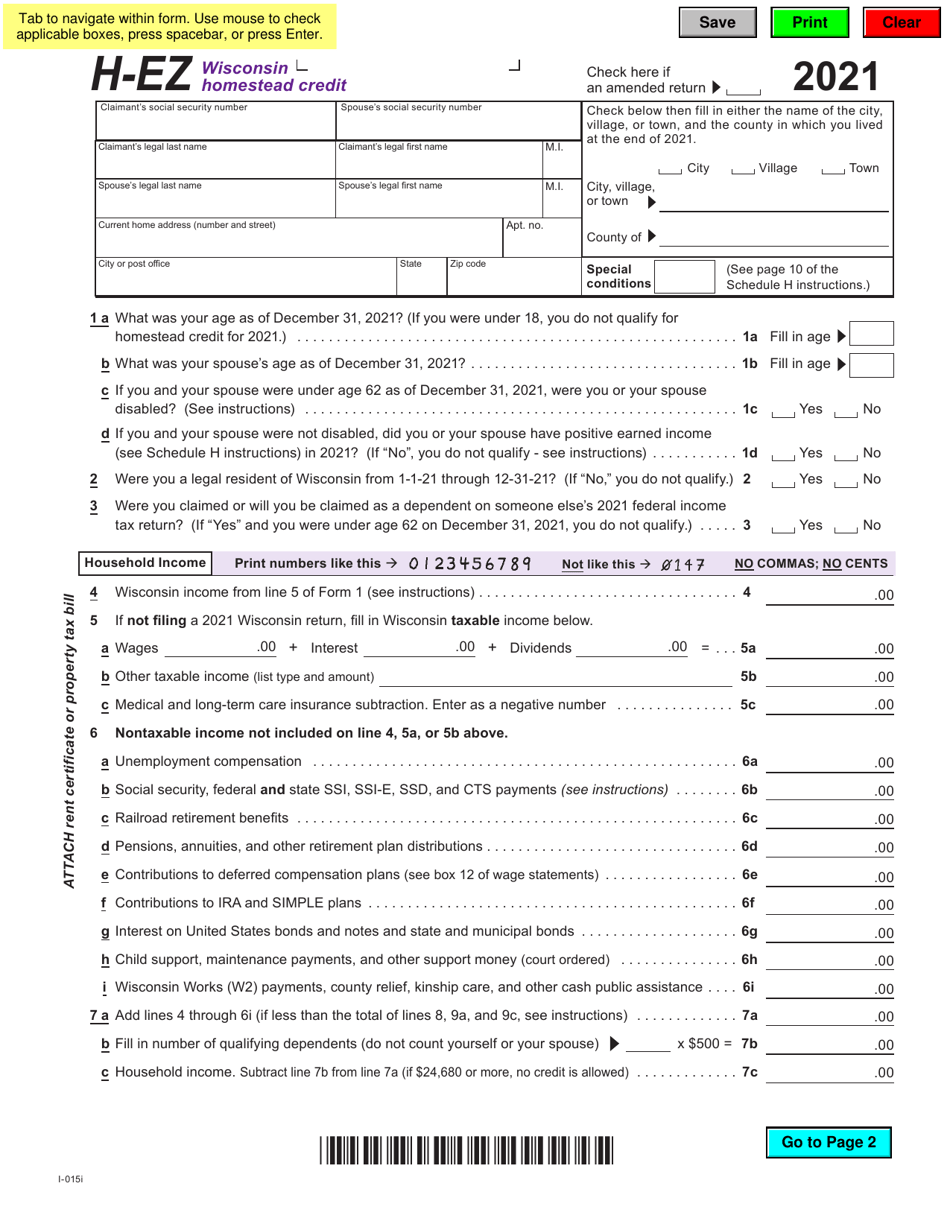

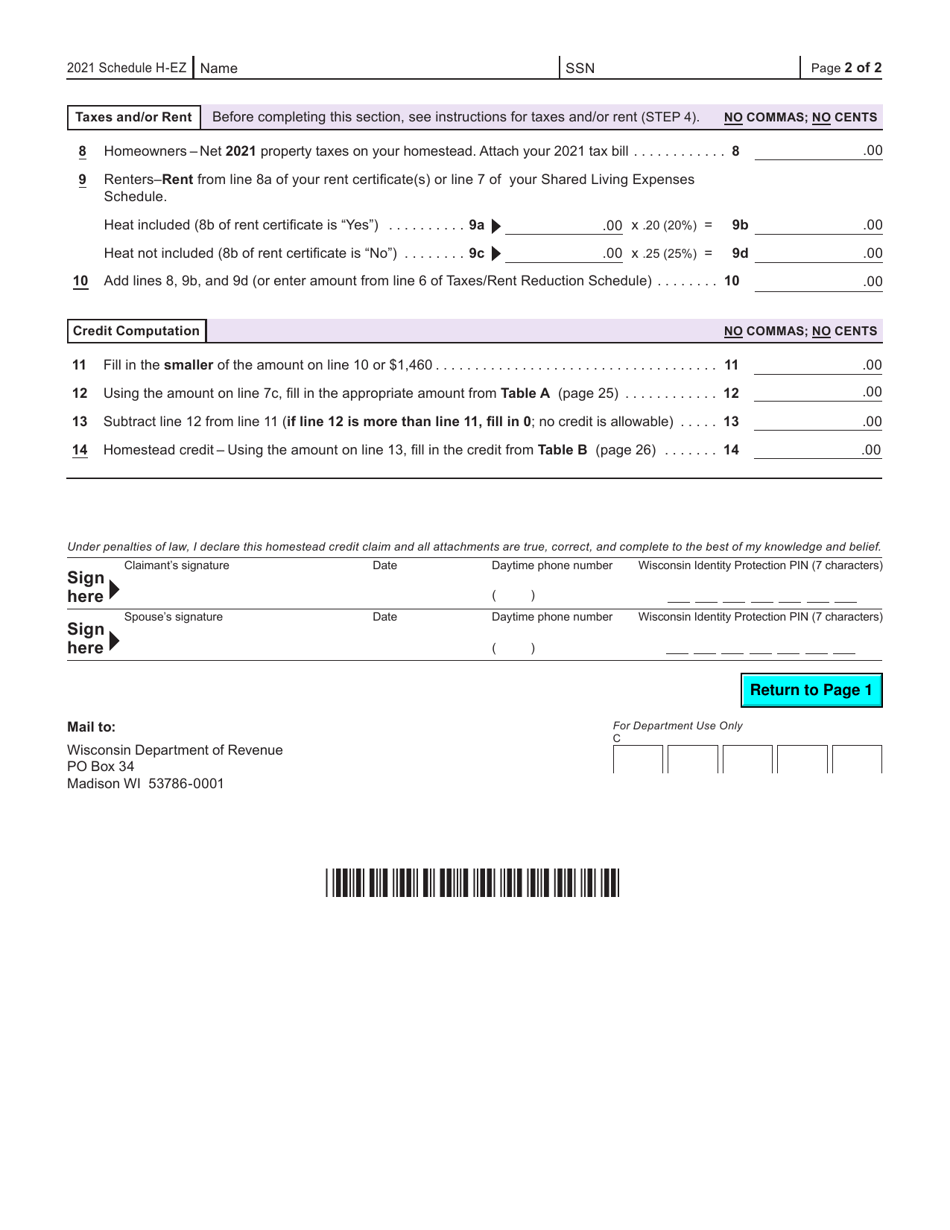

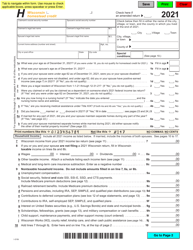

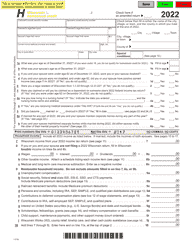

Form I-015I Schedule H-EZ Wisconsin Homestead Credit - Wisconsin

What Is Form I-015I Schedule H-EZ?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-015I Schedule H-EZ?

A: Form I-015I Schedule H-EZ is a tax form used in Wisconsin to claim the Wisconsin Homestead Credit.

Q: What is the Wisconsin Homestead Credit?

A: The Wisconsin Homestead Credit is a tax credit designed to provide property tax relief to eligible Wisconsin homeowners.

Q: Who is eligible to claim the Wisconsin Homestead Credit?

A: To be eligible for the Wisconsin Homestead Credit, you must meet certain requirements such as owning or renting a qualifying property, having a household income within the specified limits, and being a Wisconsin resident.

Q: What is the purpose of Schedule H-EZ?

A: Schedule H-EZ is used to calculate the amount of Wisconsin Homestead Credit you may be eligible for.

Q: How do I fill out Form I-015I Schedule H-EZ?

A: You need to provide information about your household, property, and income. Follow the instructions provided with the form to ensure accurate completion.

Q: When is the deadline to file Form I-015I Schedule H-EZ?

A: The deadline to file Form I-015I Schedule H-EZ is usually April 15th, but it can vary. Check the current year's tax instructions for the specific deadline.

Q: Can I e-file Form I-015I Schedule H-EZ?

A: Yes, you can e-file Form I-015I Schedule H-EZ if you meet the eligibility criteria and use an approved tax filing software.

Q: What should I do if I need help with Form I-015I Schedule H-EZ?

A: If you need help with Form I-015I Schedule H-EZ, you can contact the Wisconsin Department of Revenue or seek assistance from a tax professional.

Form Details:

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-015I Schedule H-EZ by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.