Instructions for Form RPD-41282 Land Conservation Incentives Tax Credit - New Mexico

This document contains official instructions for Form RPD-41282 , Land Conservation Incentives Tax Credit - a form released and collected by the New Mexico Taxation and Revenue Department.

FAQ

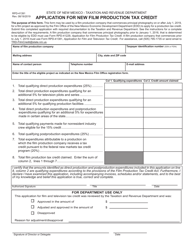

Q: What is Form RPD-41282?

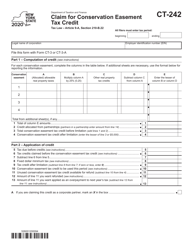

A: Form RPD-41282 is the application form for claiming the Land Conservation Incentives Tax Credit in New Mexico.

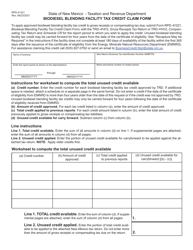

Q: What does the Land Conservation Incentives Tax Credit do?

A: The Land Conservation Incentives Tax Credit provides a tax credit to individuals or businesses who donate land for conservation purposes in New Mexico.

Q: Who can claim the Land Conservation Incentives Tax Credit?

A: Individuals or businesses who donate land for conservation purposes in New Mexico can claim the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is designed to promote land conservation by providing an incentive for individuals and businesses to donate land for that purpose.

Q: How do I apply for the Land Conservation Incentives Tax Credit?

A: You can apply for the tax credit by completing and submitting Form RPD-41282 to the New Mexico Taxation and Revenue Department.

Q: What information is required on Form RPD-41282?

A: Form RPD-41282 requires information about the donated land, including its location, size, and purpose for conservation.

Q: Is there a deadline for applying for the tax credit?

A: Yes, the application for the Land Conservation Incentives Tax Credit must be submitted by April 15th of the year following the donation of the land.

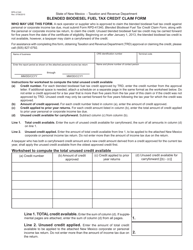

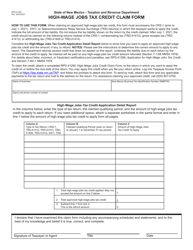

Q: How much is the tax credit?

A: The amount of the tax credit is based on the appraised value of the donated land and can range from 50% to 100% of the value.

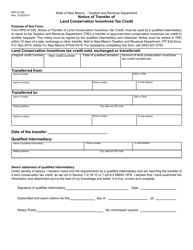

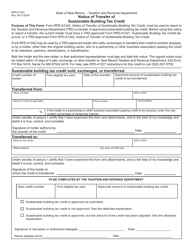

Q: Can the tax credit be carried forward or transferred?

A: Yes, unused portions of the tax credit can be carried forward for up to five years, and the credit can be transferred to other eligible taxpayers.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are certain limitations and restrictions, such as a maximum annual credit of $250,000 per taxpayer and a maximum lifetime credit of $4 million per taxpayer.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Mexico Taxation and Revenue Department.