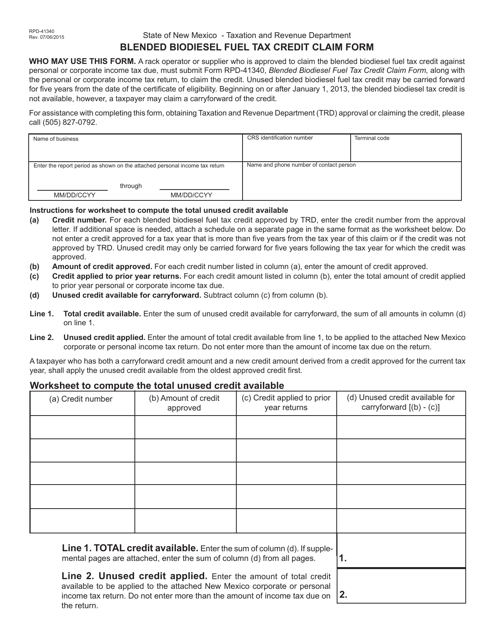

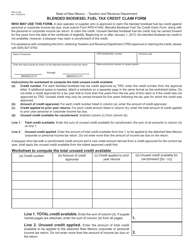

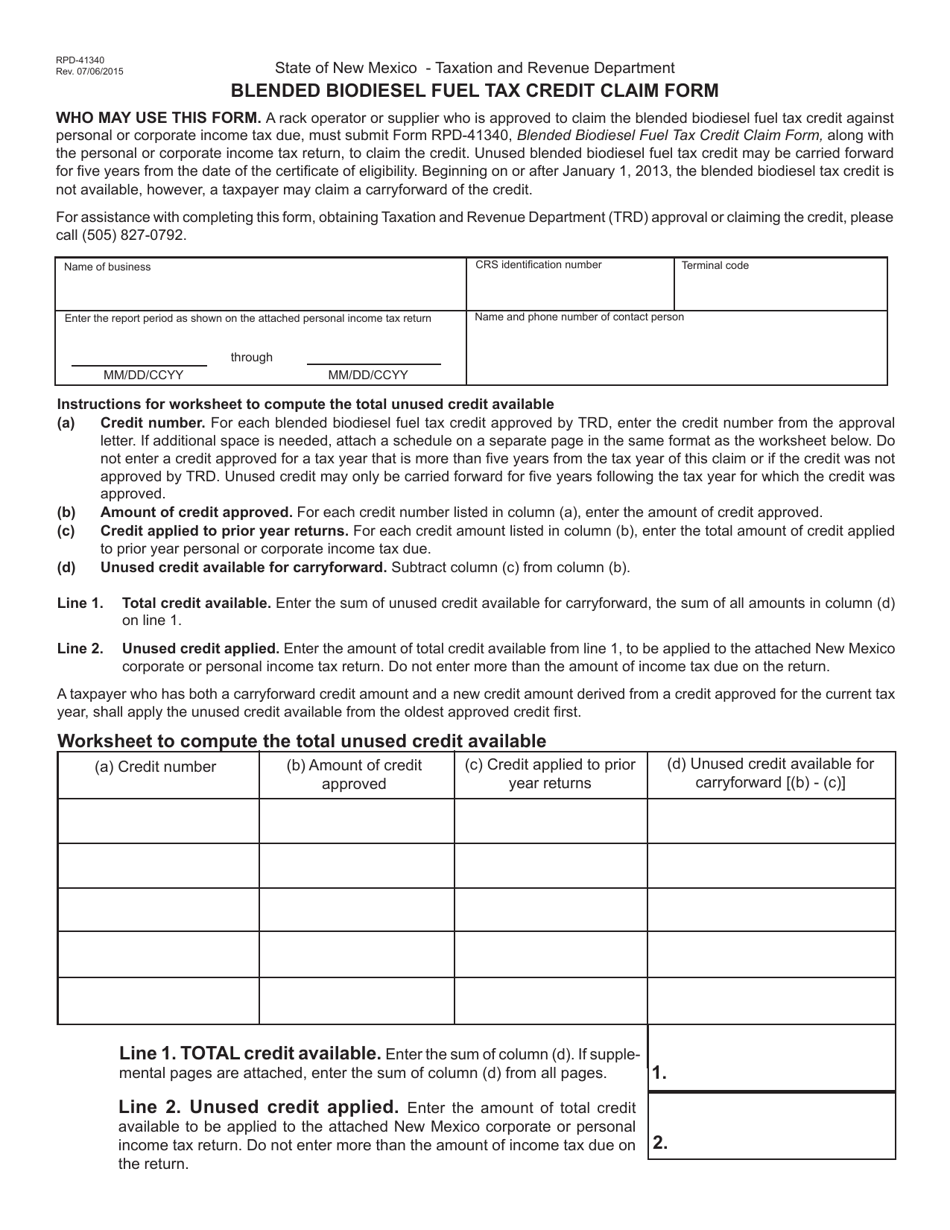

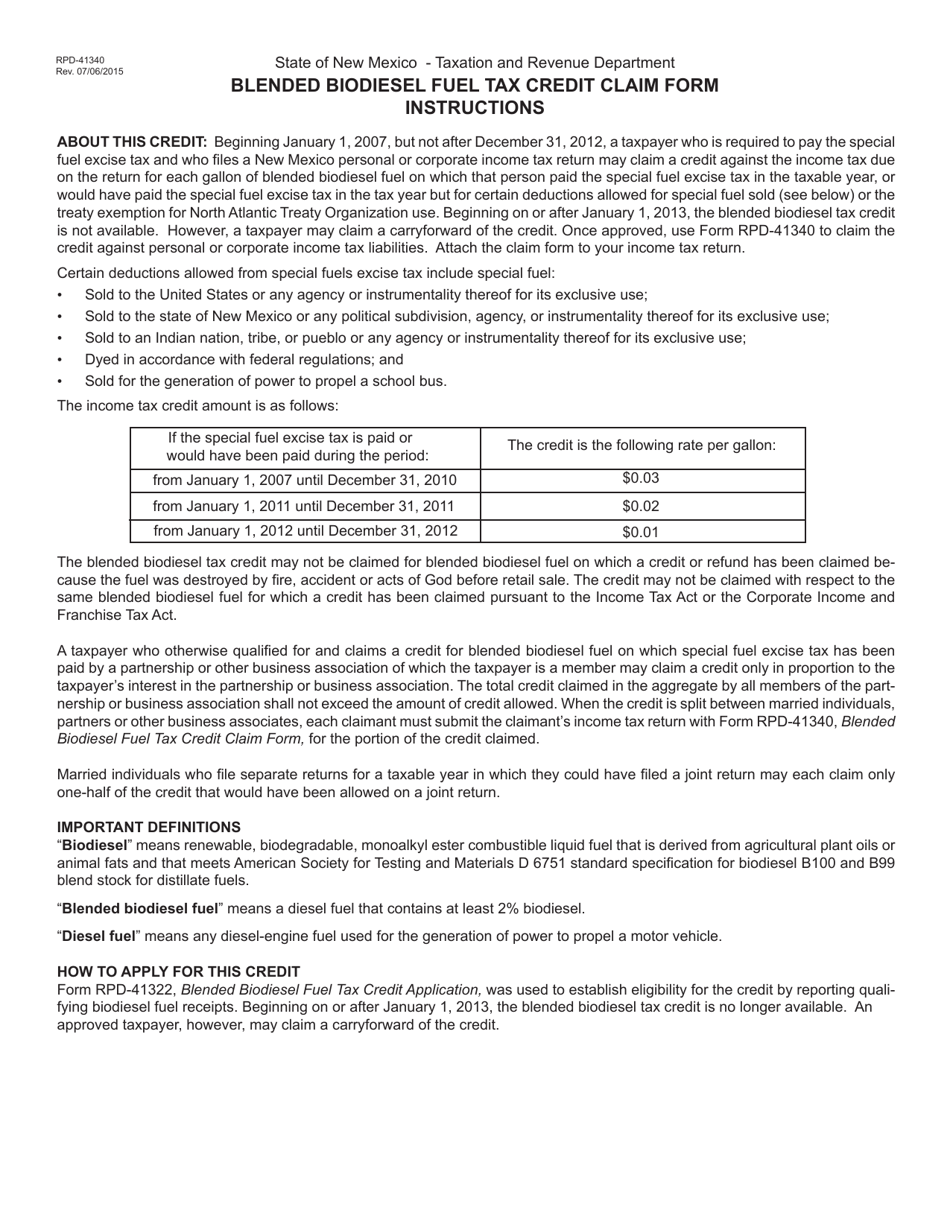

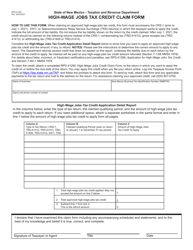

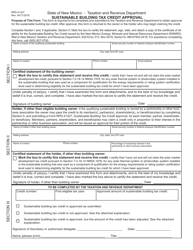

Form RPD-41340 Blended Biodiesel Fuel Tax Credit Claim Form - New Mexico

What Is Form RPD-41340?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RPD-41340?

A: Form RPD-41340 is the Blended Biodiesel Fuel Tax Credit Claim Form used in New Mexico.

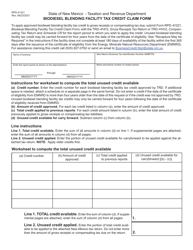

Q: What is the Blended Biodiesel Fuel Tax Credit?

A: The Blended Biodiesel Fuel Tax Credit is a tax credit offered in New Mexico for blending biodiesel fuel.

Q: Who can claim the Blended Biodiesel Fuel Tax Credit?

A: Any taxpayer who blends biodiesel fuel in New Mexico can claim the tax credit.

Q: What is the purpose of the Blended Biodiesel Fuel Tax Credit?

A: The purpose of the tax credit is to incentivize the use of biodiesel fuel in New Mexico.

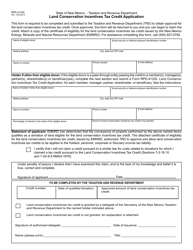

Form Details:

- Released on July 6, 2015;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41340 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.