This version of the form is not currently in use and is provided for reference only. Download this version of

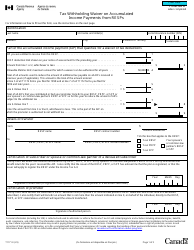

Form T1172

for the current year.

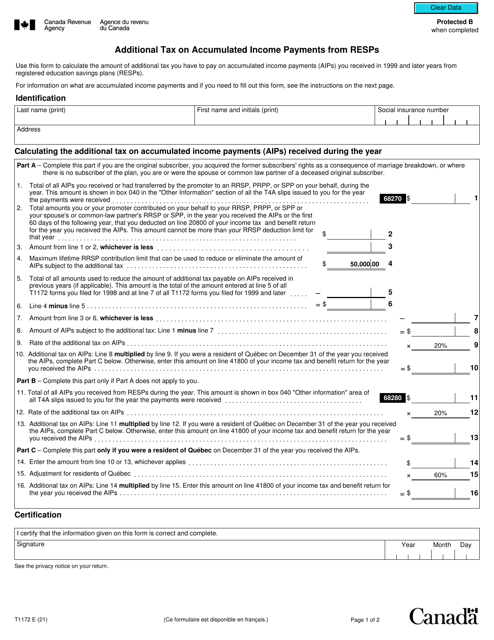

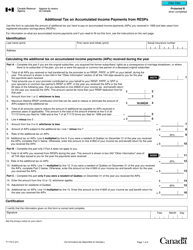

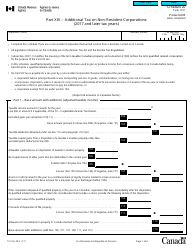

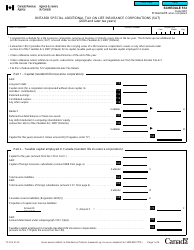

Form T1172 Additional Tax on Accumulated Income Payments From Resps - Canada

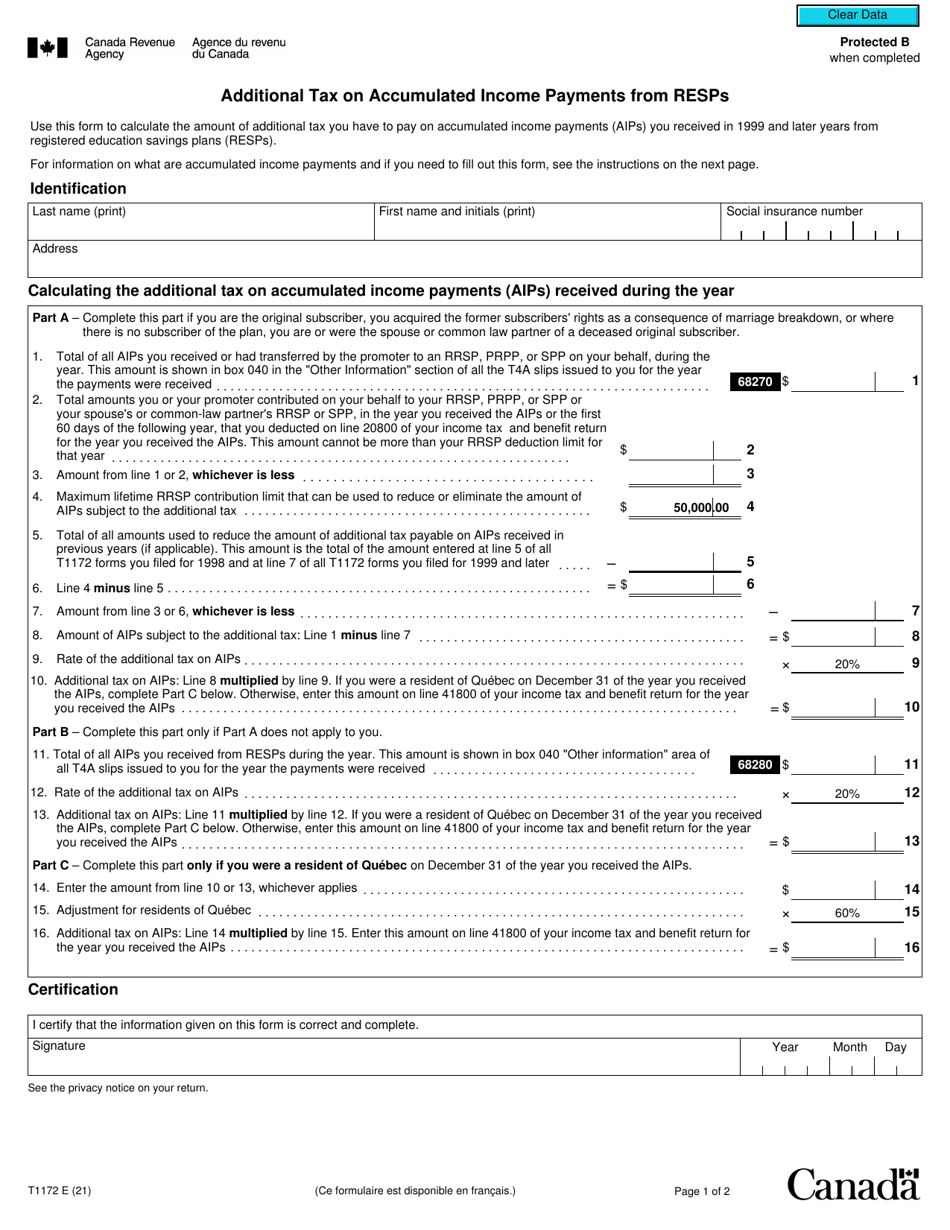

Form T1172 Additional Tax on Accumulated Income Payments From RESPs is a form used in Canada to calculate and report any additional tax owed on accumulated income payments from Registered Education Savings Plans (RESPs). This form helps determine if any additional tax is due on the income earned within an RESP when it is paid out to the beneficiary.

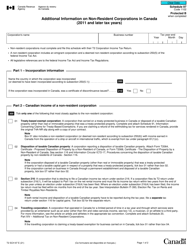

The subscriber or the specified family member files the Form T1172 Additional Tax on Accumulated Income Payments From RESPs in Canada.

FAQ

Q: What is Form T1172?

A: Form T1172 is a tax form used in Canada to calculate and report additional tax on accumulated income payments from Registered Education Savings Plans (RESPs).

Q: What are accumulated income payments from RESPs?

A: Accumulated income payments from RESPs are the earnings and growth that have accumulated in a Registered Education Savings Plan.

Q: Who needs to file Form T1172?

A: Form T1172 needs to be filed by individuals who receive accumulated income payments from RESPs.

Q: What is the purpose of filing Form T1172?

A: The purpose of filing Form T1172 is to calculate and report any additional tax that may be owed on accumulated income payments from RESPs.

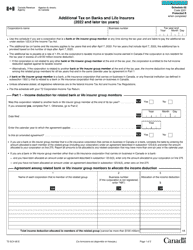

Q: How is the additional tax calculated?

A: The additional tax on accumulated income payments from RESPs is calculated based on a formula provided by the Canada Revenue Agency.

Q: Are there any exceptions or deductions available?

A: Yes, there are certain exceptions and deductions available that may reduce the amount of additional tax owed on accumulated income payments from RESPs.

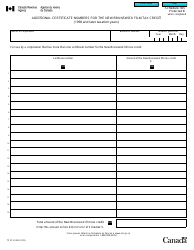

Q: When is the deadline for filing Form T1172?

A: The deadline for filing Form T1172 is generally the same as the deadline for filing your income tax return, which is April 30th of the following year.

Q: What happens if I don't file Form T1172?

A: If you don't file Form T1172 when required, you may be subject to penalties and interest charges on any additional tax owed.

Q: Can I get help with filling out Form T1172?

A: Yes, you can seek assistance from a tax professional or use tax software to help you fill out Form T1172 accurately.