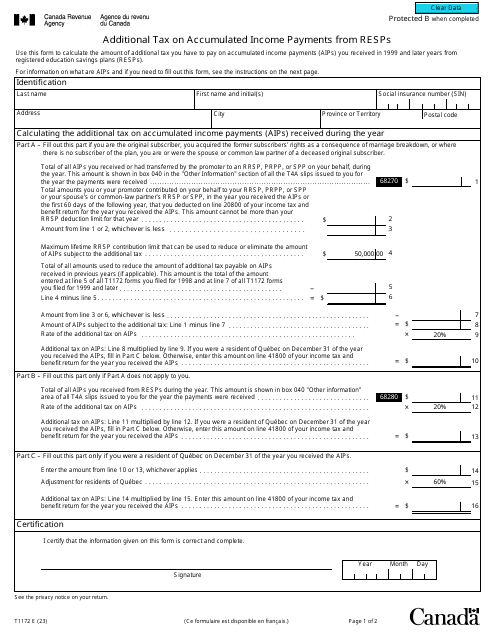

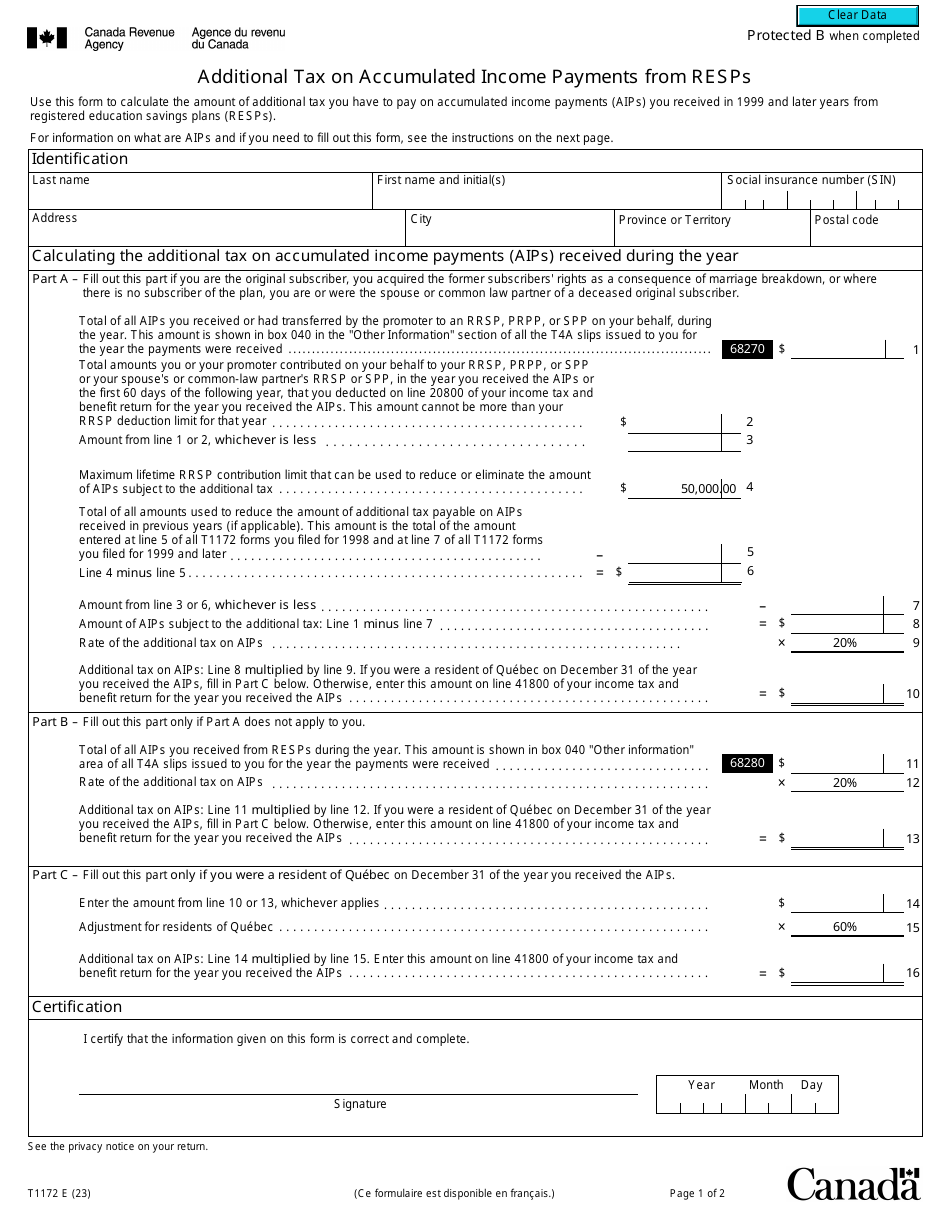

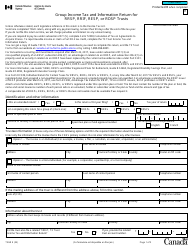

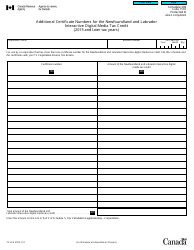

Form T1172 Additional Tax on Accumulated Income Payments From Resps - Canada

Form T1172 is used in Canada to calculate and report any additional tax that may be applicable on accumulated income payments received from Registered Education Savings Plans (RESPs). The form ensures that the correct amount of tax is paid on these types of payments.

In Canada, the individual who receives the accumulated income payments from RESPs is responsible for filing the Form T1172 - Additional Tax on Accumulated Income Payments from RESPs.

Form T1172 Additional Tax on Accumulated Income Payments From Resps - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1172?

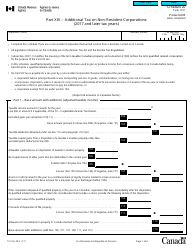

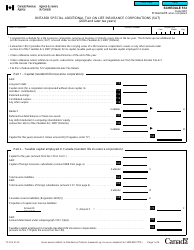

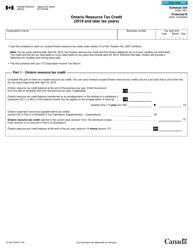

A: Form T1172 is a tax form used in Canada to report additional tax on accumulated income payments from Registered Education Savings Plans (RESPs).

Q: What are accumulated income payments from RESPs?

A: Accumulated income payments from RESPs are payments that include both the income earned and government grants within the RESP.

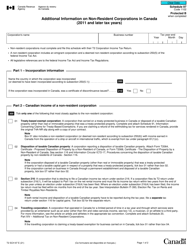

Q: Who needs to file Form T1172?

A: Individuals who receive accumulated income payments from RESPs need to file Form T1172 to report and pay any additional tax owed.

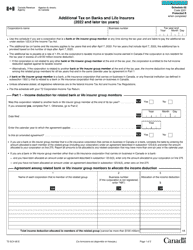

Q: How much is the additional tax on accumulated income payments?

A: The additional tax on accumulated income payments is generally 20%.

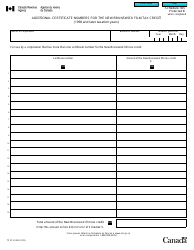

Q: When is Form T1172 due?

A: Form T1172 is typically due on or before the individual's income tax filing deadline, which is usually April 30 of the following year.