This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2205

for the current year.

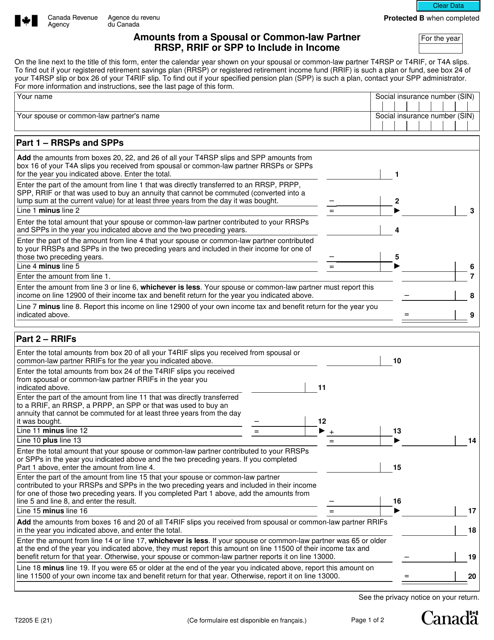

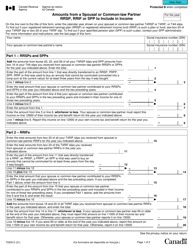

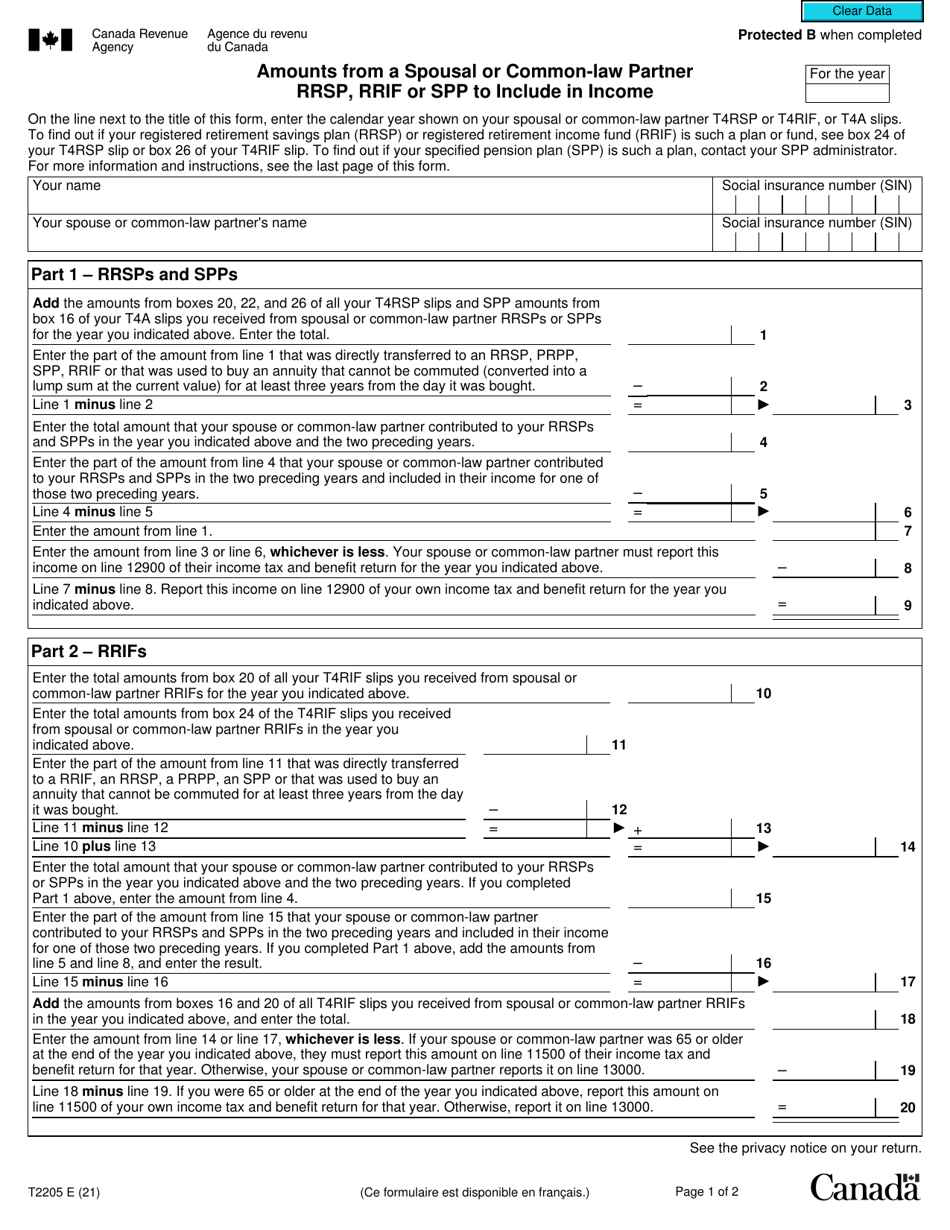

Form T2205 Amounts From a Spousal or Common-Law Partner Rrsp, Rrif or Spp to Include in Income - Canada

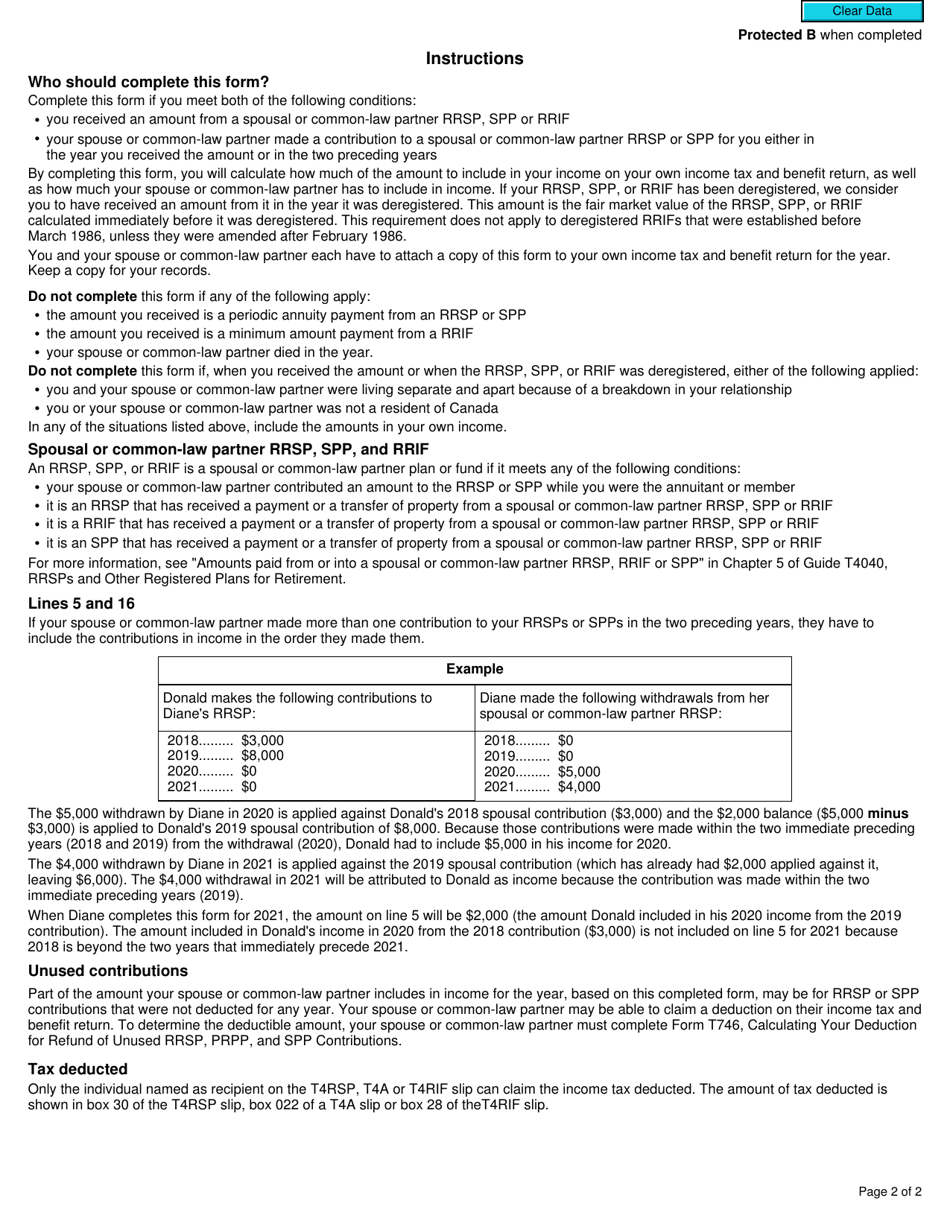

Form T2205 - Amounts From a Spousal or Common-Law Partner RRSP, RRIF, or SPP to Include in Income in Canada is used to report any withdrawals made from your spouse's or common-law partner's Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), or Specified Pension Plan (SPP). The amounts withdrawn from these accounts may need to be included as income on your personal tax return.

In Canada, the person who receives the spousal or common-law partner's RRSP, RRIF, or SPP amounts must file the Form T2205 to include those amounts in their income.

FAQ

Q: What is Form T2205?

A: Form T2205 is a form used in Canada to report amounts received from a spousal or common-law partner's RRSP, RRIF or SPP that need to be included in income.

Q: What types of amounts are reported on Form T2205?

A: Form T2205 is used to report amounts received from a spouse or common-law partner's Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), or Specified Pension Plan (SPP).

Q: Why do I need to report these amounts on Form T2205?

A: You need to report these amounts on Form T2205 in order to include them in your taxable income for the year.

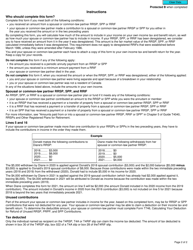

Q: Who needs to fill out Form T2205?

A: You need to fill out Form T2205 if you have received amounts from your spouse or common-law partner's RRSP, RRIF or SPP that need to be included in your income.

Q: When do I need to file Form T2205?

A: You need to file Form T2205 along with your income tax return for the year in which you received the amounts from your spouse or common-law partner's RRSP, RRIF or SPP.

Q: Is there a deadline for filing Form T2205?

A: The deadline for filing Form T2205 is the same as the deadline for filing your income tax return, which is usually April 30th of the following year.