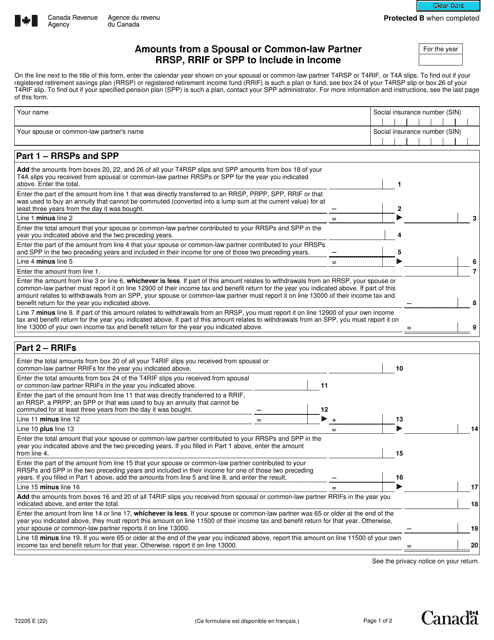

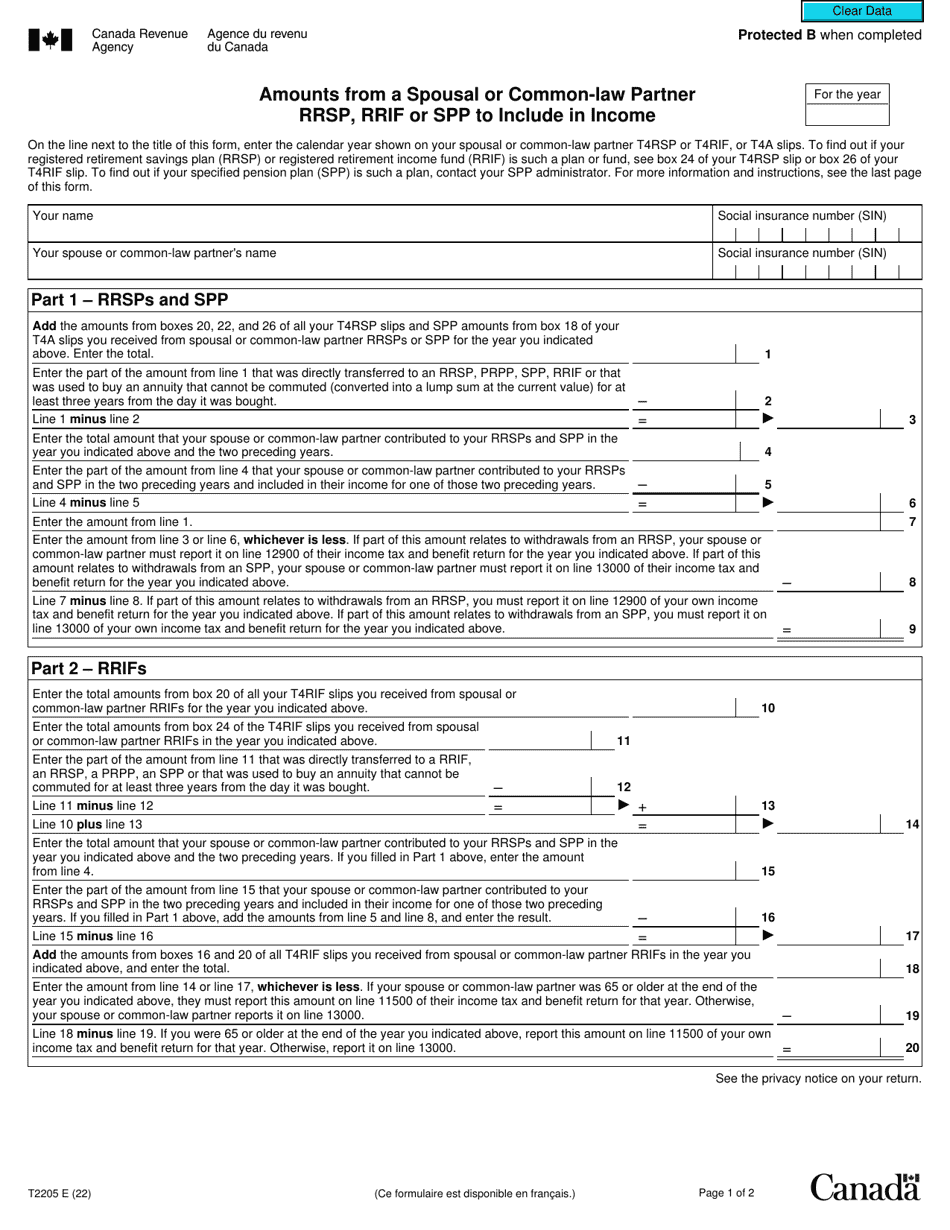

Form T2205 Amounts From a Spousal or Common-Law Partner Rrsp, Rrif or Spp to Include in Income - Canada

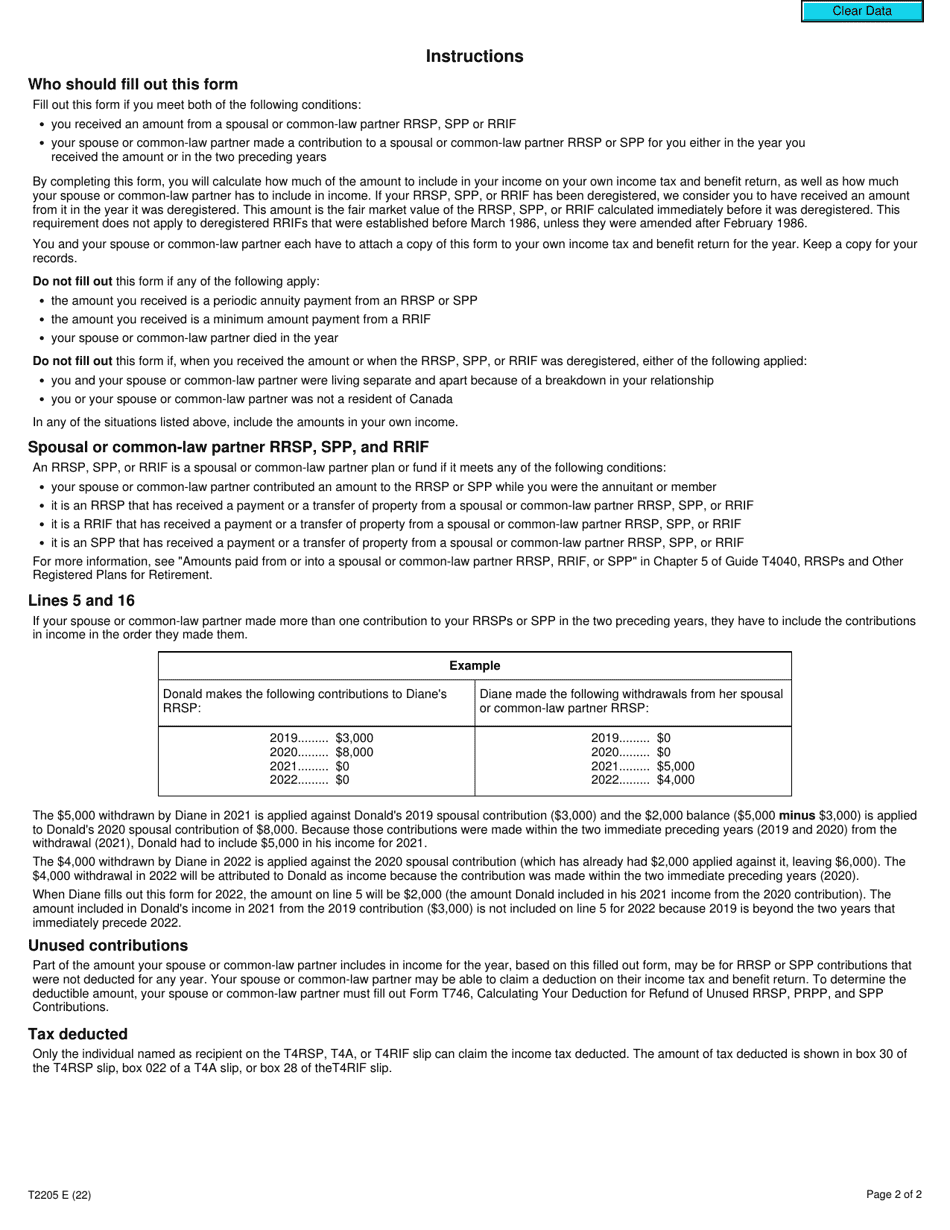

Form T2205 is used for reporting amounts received from a spousal or common-law partner's RRSP, RRIF, or SPP (Specified Pension Plan) that you need to include in your income. This form is specific to Canada.

The individual who received the spousal or common-law partner RRSP, RRIF, or SPP amounts should file the Form T2205 in Canada.

Form T2205 Amounts From a Spousal or Common-Law Partner Rrsp, Rrif or Spp to Include in Income - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2205?

A: Form T2205 is a tax form used in Canada to report amounts from a Spousal or Common-Law Partner RRSP, RRIF, or SPP to include in income.

Q: What does Form T2205 report?

A: Form T2205 reports amounts from a Spousal or Common-Law Partner RRSP, RRIF, or SPP that are included in income.

Q: Who needs to file Form T2205?

A: Individuals in Canada who have received amounts from a Spousal or Common-Law Partner RRSP, RRIF, or SPP that need to be included in income may need to file Form T2205.

Q: What is a Spousal RRSP?

A: A Spousal RRSP is a type of retirement savings plan in Canada where one spouse contributes to the RRSP of the other spouse.

Q: What is a Common-Law Partner RRSP?

A: A Common-Law Partner RRSP is a type of retirement savings plan in Canada where one common-law partner contributes to the RRSP of the other partner.

Q: What is an RRIF?

A: An RRIF (Registered Retirement Income Fund) is a type of investment account in Canada that is created from an RRSP (Registered Retirement Savings Plan) to provide income during retirement.

Q: What is an SPP?

A: An SPP (Specified Pension Plan) is a type of employer-sponsored pension plan in Canada.

Q: When is the deadline to file Form T2205?

A: The deadline to file Form T2205 is usually the same as the deadline to file your income tax return in Canada, which is April 30th.

Q: Is Form T2205 the only form needed to report RRSP, RRIF, or SPP amounts in income?

A: No, you may also need to complete other forms, such as Form T4RSP or Form T4RIF, depending on the specific circumstances.