This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2019

for the current year.

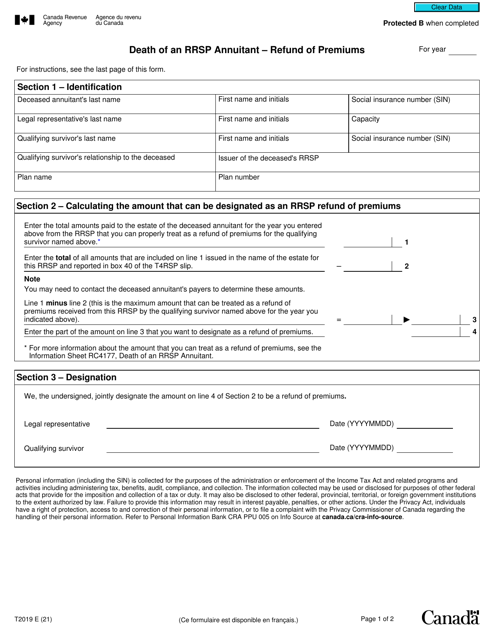

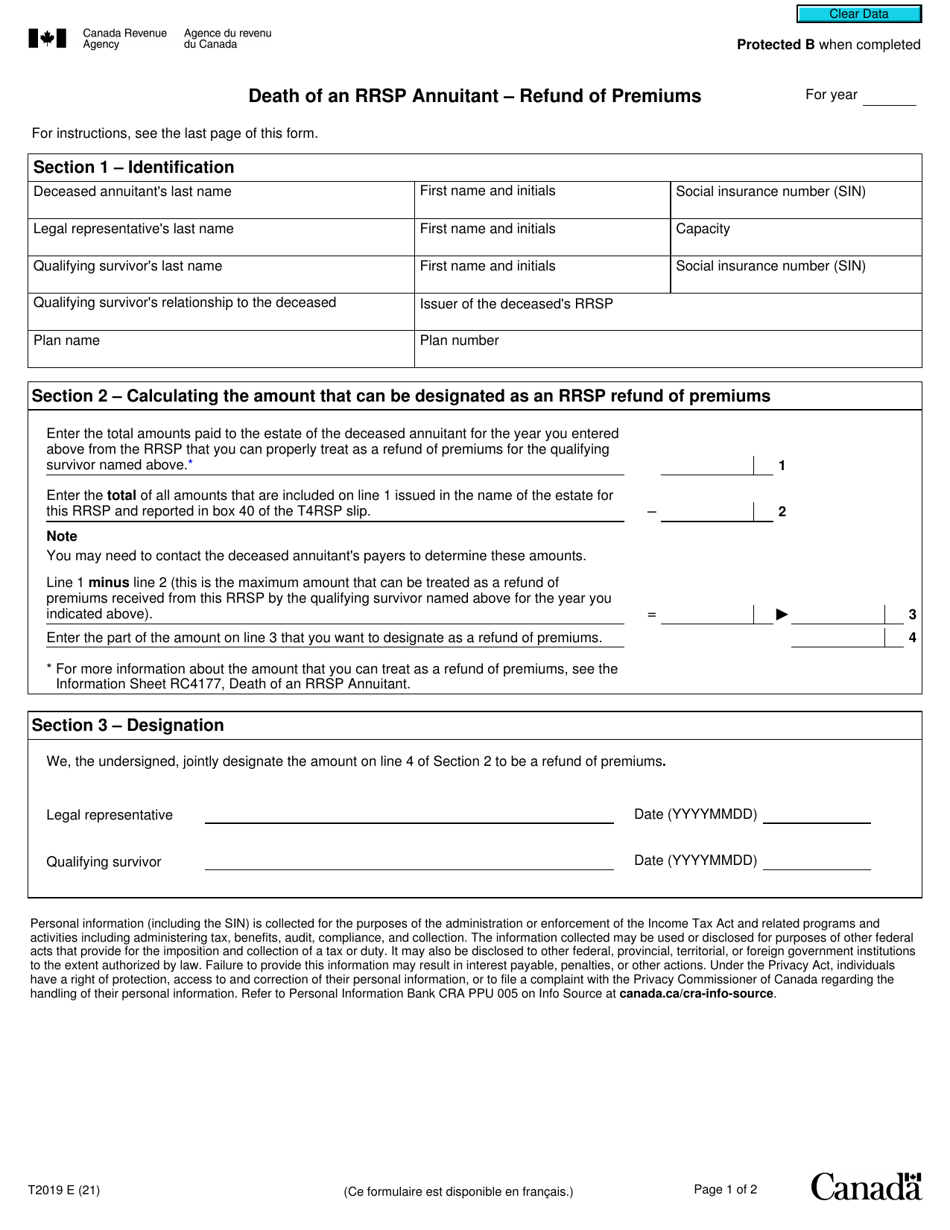

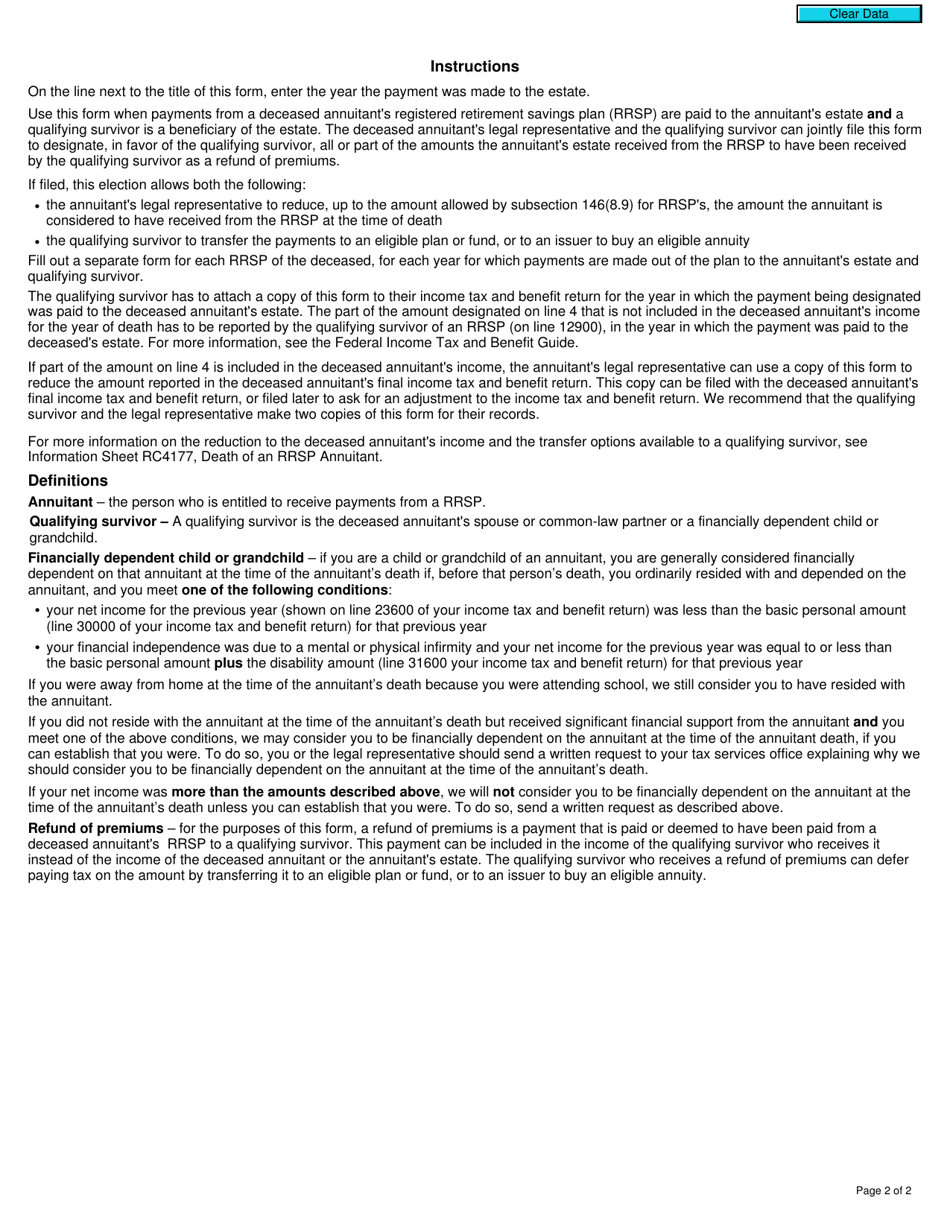

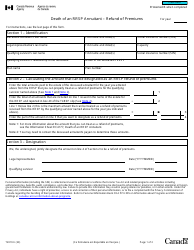

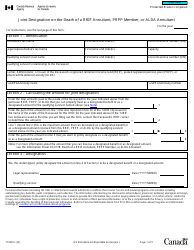

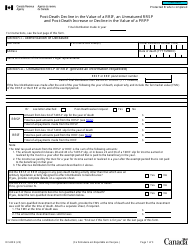

Form T2019 Death of an Rrsp Annuitant - Refund of Premium - Canada

Form T2019, Death of an RRSP Annuitant - Refund of Premium, is used in Canada to claim a refund of premiums paid for a Registered Retirement Savings Plan (RRSP) upon the death of the annuitant. This form allows beneficiaries or estate representatives to request a return of the unused premiums from the deceased annuitant's RRSP.

The beneficiary or estate of the deceased RRSP annuitant in Canada files the Form T2019 for the death of an RRSP annuitant.

FAQ

Q: What is Form T2019?

A: Form T2019 is a tax form used in Canada for claiming a refund of premiums paid into an RRSP (Registered Retirement Savings Plan) after the death of the annuitant.

Q: What is an RRSP?

A: An RRSP is a Registered Retirement Savings Plan, which is a type of account that allows Canadians to save for retirement and enjoy tax benefits.

Q: Who can use Form T2019?

A: Form T2019 is used by the legal representative of the deceased annuitant's estate to claim a refund of premiums paid into the RRSP.

Q: What does 'refund of premium' mean?

A: 'Refund of premium' refers to the return of the premiums, or contributions, made to an RRSP after the death of the annuitant.

Q: How do I fill out Form T2019?

A: To fill out Form T2019, you will need to provide information about the deceased annuitant, the RRSP account, and the premiums paid. It is advised to consult with a tax professional or refer to the instructions provided with the form for specific guidance.