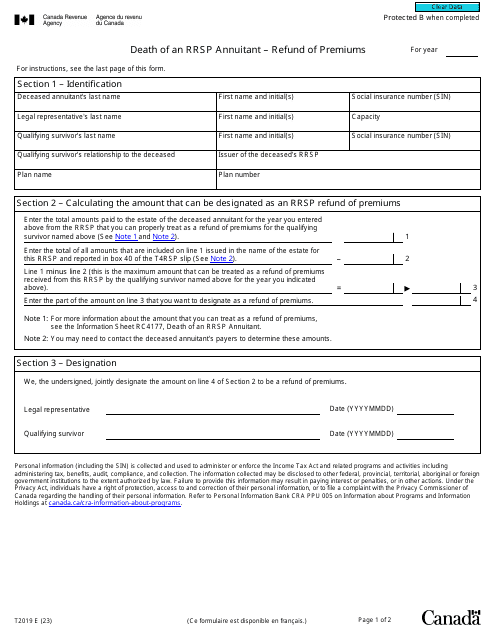

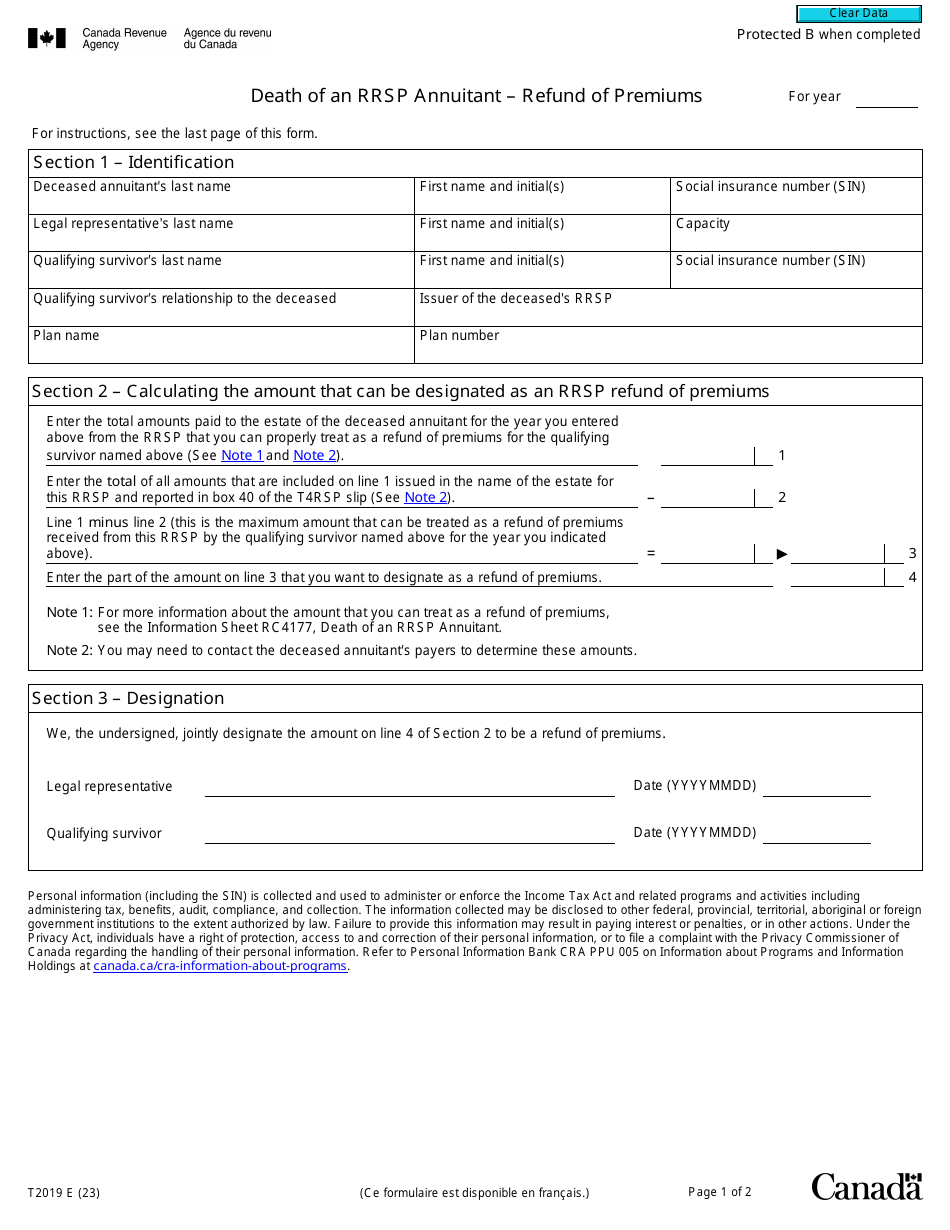

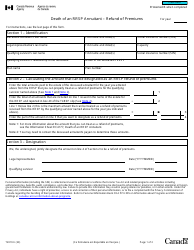

Form T2019 Death of an Rrsp Annuitant - Refund of Premiums - Canada

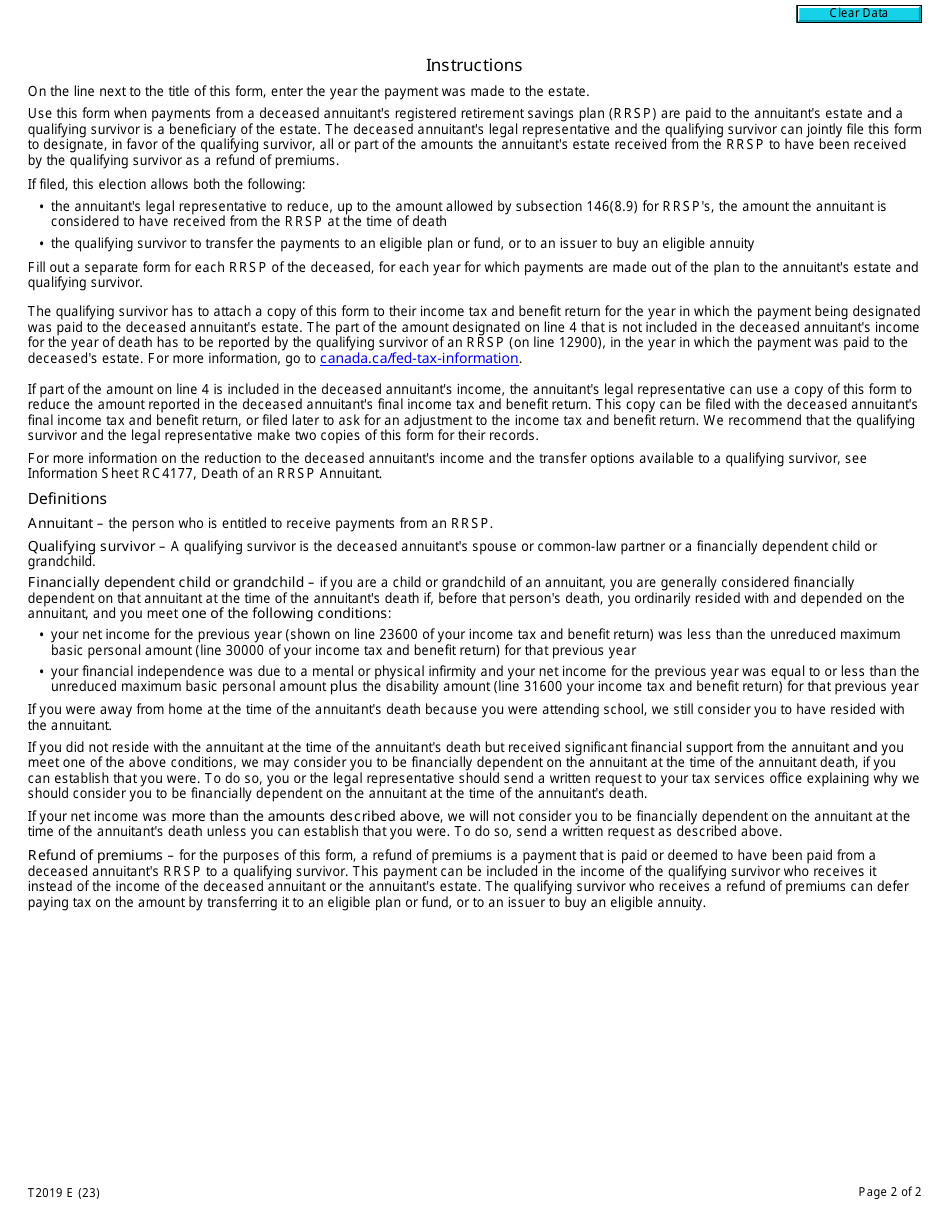

Form T2019 - Death of an RRSP Annuitant - Refund of Premiums is used in Canada when an individual who had a Registered Retirement Savings Plan (RRSP) passes away. This form is used to request a refund of the premiums paid into the RRSP.

The beneficiary or legal representative of the deceased RRSP annuitant in Canada files the Form T2019.

Form T2019 Death of an Rrsp Annuitant - Refund of Premiums - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2019?

A: Form T2019 is a form used in Canada to claim a refund of premiums for a Registered Retirement Savings Plan (RRSP) due to the death of an annuitant.

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a type of savings account registered with the Canadian government that offers tax benefits for retirement savings.

Q: Who can claim a refund of premiums using Form T2019?

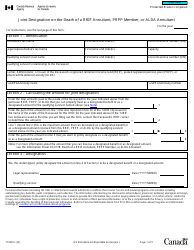

A: Form T2019 is used by the beneficiary or legal representative of the deceased annuitant to claim a refund of premiums from the RRSP.

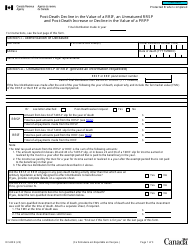

Q: What are premiums in relation to an RRSP?

A: Premiums refer to the contributions made to an RRSP by the annuitant.

Q: When can a refund of premiums be claimed?

A: A refund of premiums can be claimed when the annuitant of an RRSP passes away.

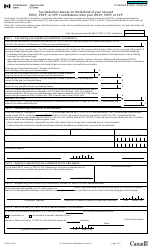

Q: How to complete Form T2019?

A: Form T2019 requires information about the deceased annuitant, the beneficiary or legal representative, and details about the RRSP.