This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1213

for the current year.

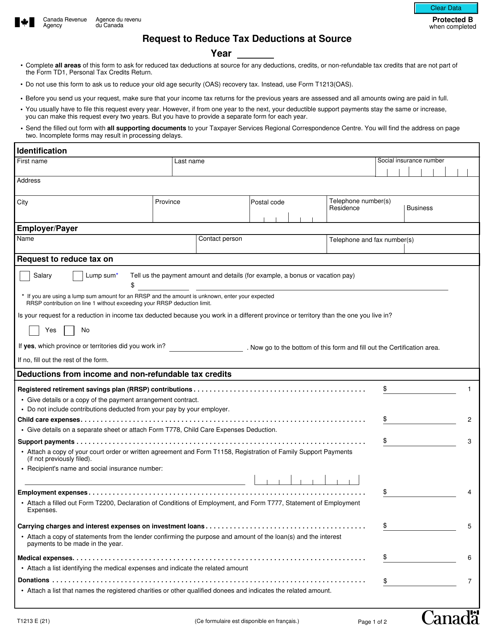

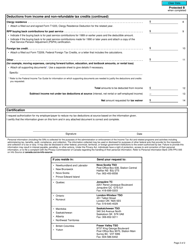

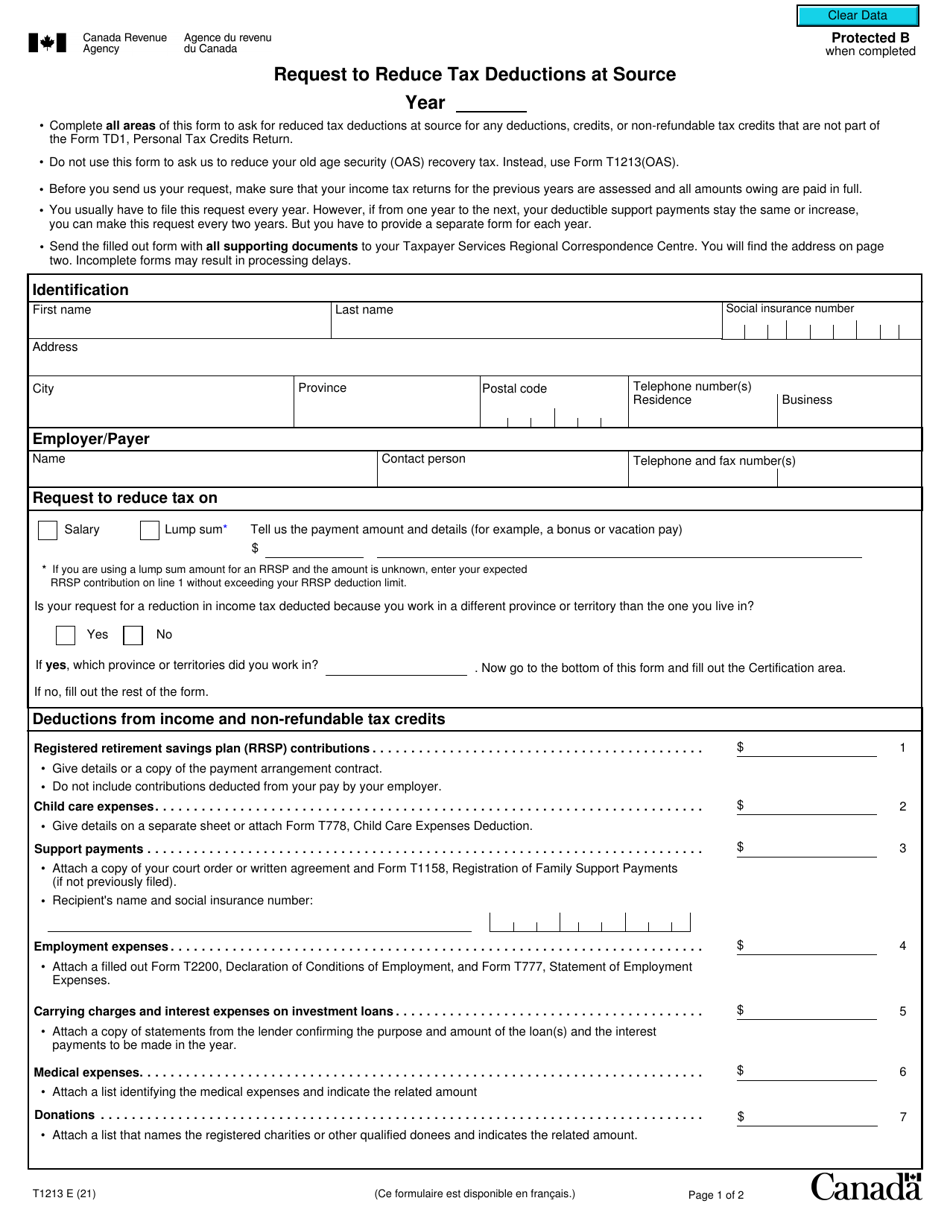

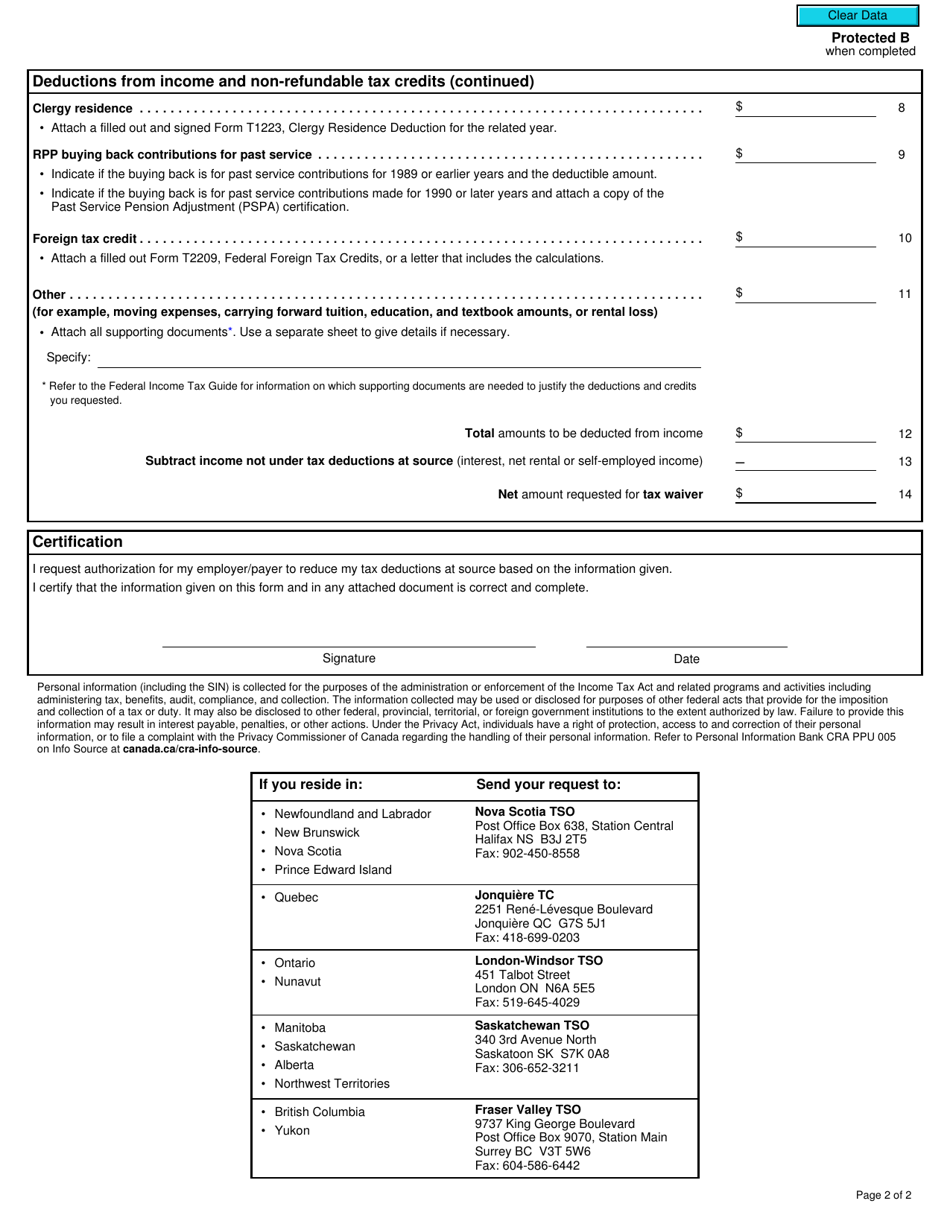

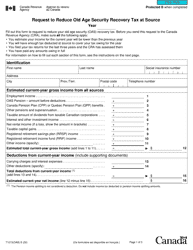

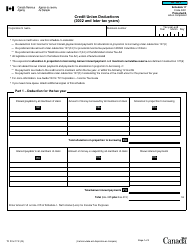

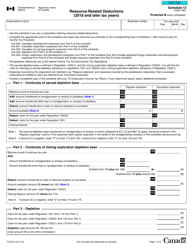

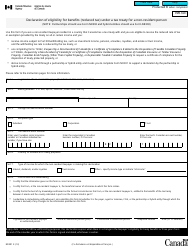

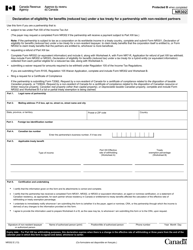

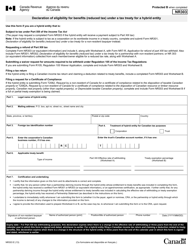

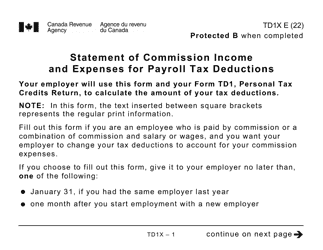

Form T1213 Request to Reduce Tax Deductions at Source - Canada

Form T1213, Request to Reduce Tax Deductions at Source, in Canada is used to request permission from the Canada Revenue Agency (CRA) to reduce the amount of tax that is deducted from your income at source. This form is typically used when you have certain deductible expenses or tax credits that you want to apply throughout the year, rather than waiting to claim them when you file your tax return. By submitting this form, you can potentially have more money in your pocket every pay period, rather than waiting for a tax refund at the end of the year.

The Form T1213 Request to Reduce Tax Deductions at Source in Canada is filed by individual taxpayers.

FAQ

Q: What is Form T1213?

A: Form T1213 is a Request to Reduce Tax Deductions at Source form in Canada.

Q: Why would I need to fill out Form T1213?

A: You would need to fill out Form T1213 if you want to reduce the amount of taxes deducted from your income at source.

Q: What information do I need to provide on Form T1213?

A: You need to provide information about your income, deductions, and credits, as well as supporting documents.

Q: How long does it take for the CRA to process Form T1213?

A: It can take several weeks for the CRA to process Form T1213, so it's important to submit it well in advance.

Q: Can I use Form T1213 to reduce taxes in the United States?

A: No, Form T1213 is specific to tax deductions in Canada and cannot be used to reduce taxes in the United States.

Q: Is there a fee to submit Form T1213?

A: No, there is no fee to submit Form T1213.

Q: Can I submit Form T1213 electronically?

A: No, currently Form T1213 cannot be submitted electronically and must be mailed or faxed to the CRA.

Q: How often do I need to submit Form T1213?

A: You need to submit Form T1213 each year if you want to continue reducing tax deductions at source.

Q: Can I make changes to my Form T1213 once it has been submitted?

A: Yes, you can make changes to your Form T1213 by submitting a new form with the updated information.