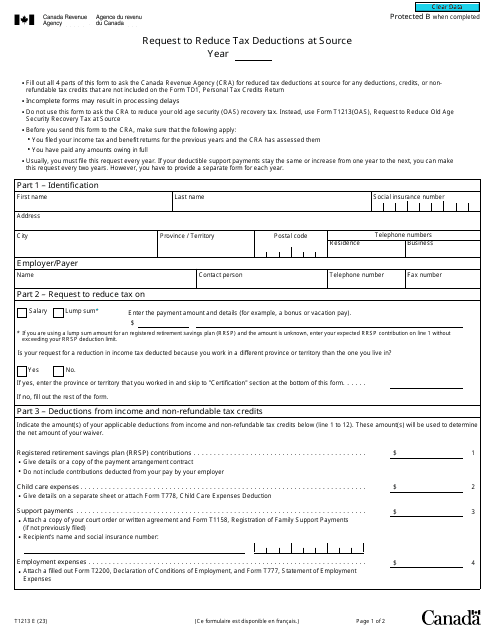

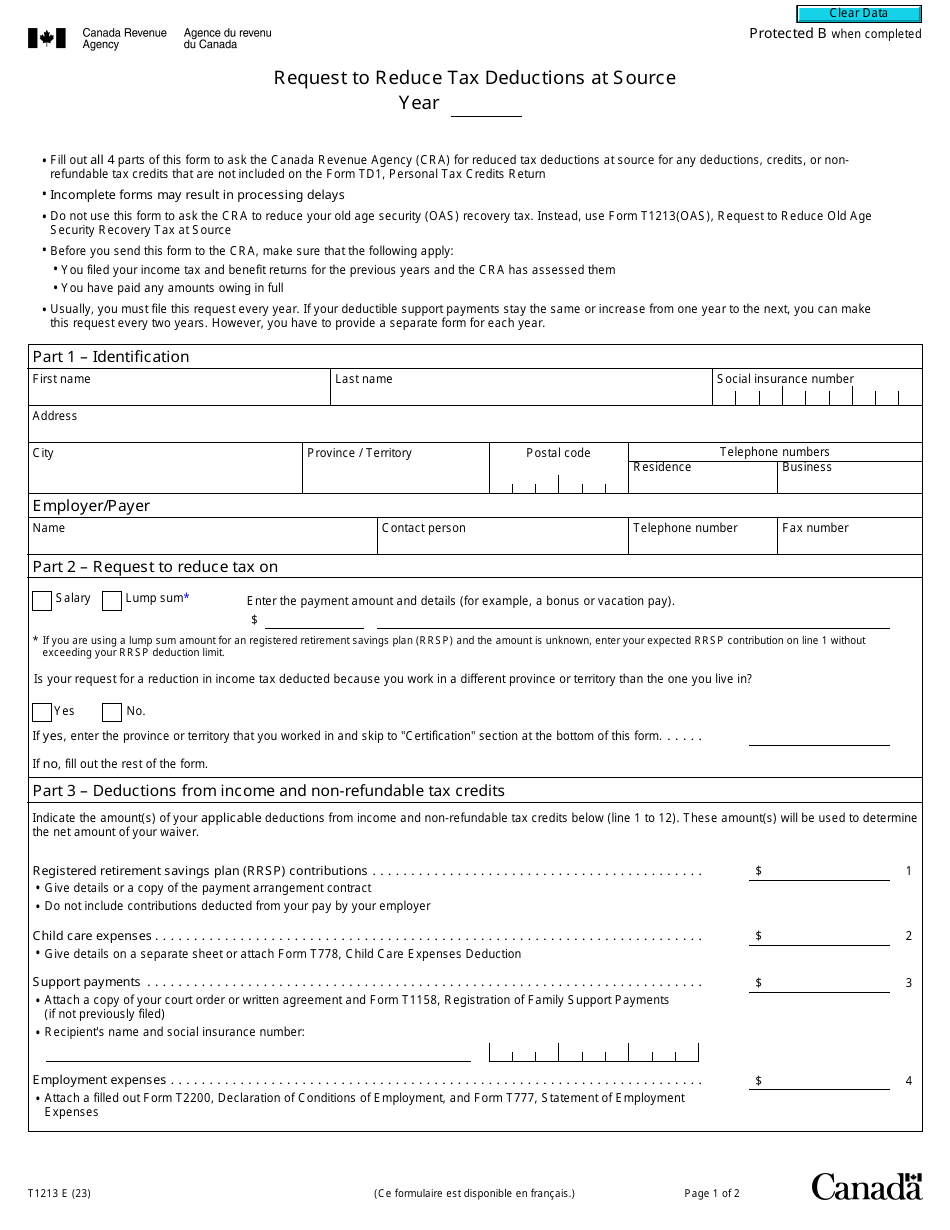

Form T1213 Request to Reduce Tax Deductions at Source - Canada

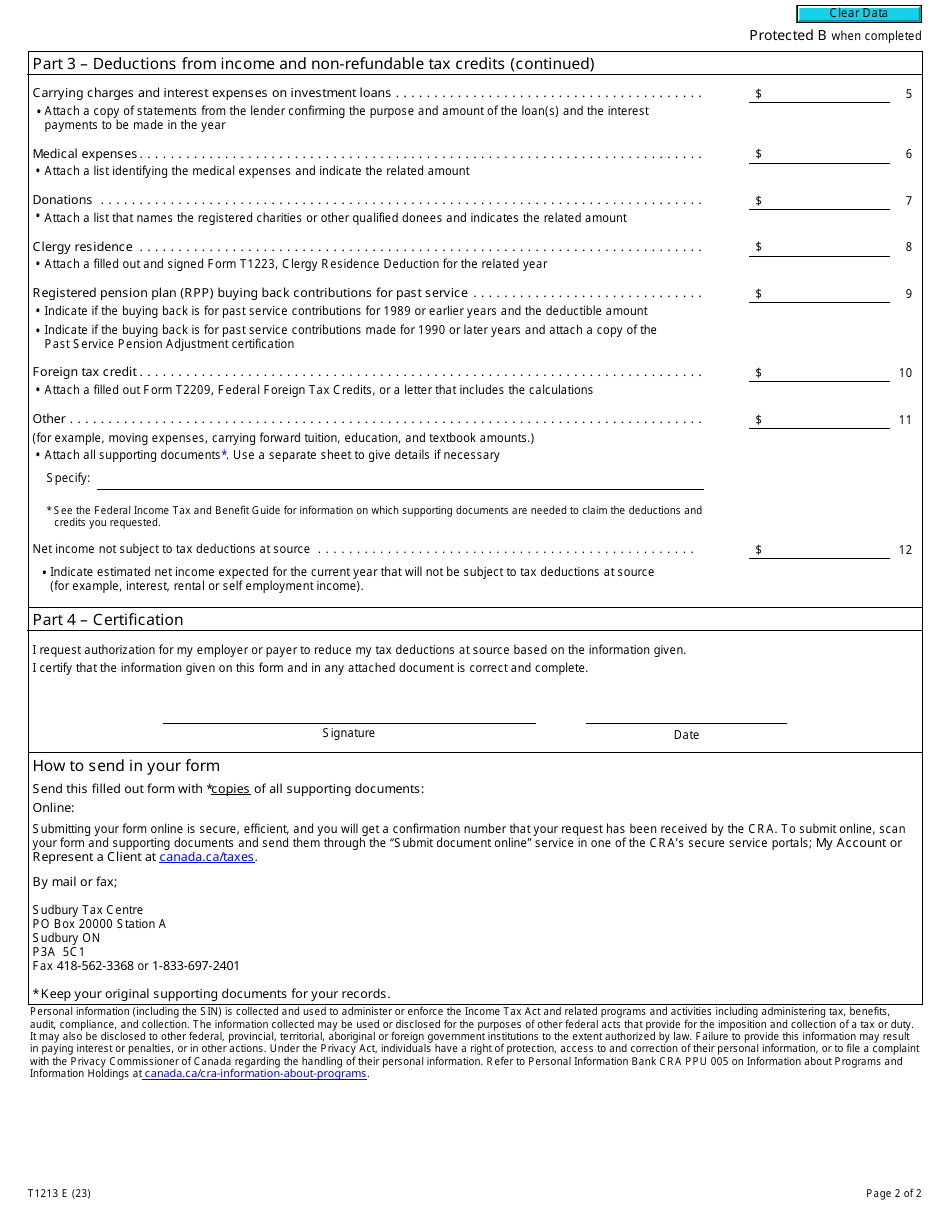

Form T1213, also known as the Request to Reduce Tax Deductions at Source, is used in Canada to apply for a reduction in the amount of income tax that is deducted from a person's income at source. This form is typically used by individuals who have eligible deductions and credits that are not already taken into account by their employer when calculating their tax withholdings. By completing and submitting Form T1213, individuals can request the Canada Revenue Agency (CRA) to authorize their employer to reduce the amount of tax withheld from their paychecks, allowing them to receive more income throughout the year instead of waiting for a tax refund at the end of the year.

The individual taxpayer files the Form T1213 Request to Reduce Tax Deductions at Source in Canada.

Form T1213 Request to Reduce Tax Deductions at Source - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1213?

A: Form T1213 is a request to reduce tax deductions at source in Canada.

Q: Why would I need to use Form T1213?

A: You would need to use Form T1213 if you want to reduce the amount of tax deducted from your income at source.

Q: What information do I need to provide on Form T1213?

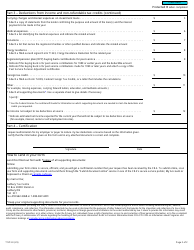

A: You will need to provide your personal information, details about your income and deductions, and any supporting documents.

Q: Are there any eligibility requirements for using Form T1213?

A: Yes, there are eligibility requirements. You must have a valid reason for requesting a reduction in tax deductions, such as eligible deductions or credits that will result in a significant reduction in taxes payable.

Q: Do I need to submit Form T1213 every year?

A: No, once your request is approved, it will generally be valid for the applicable tax year. However, you may need to reapply if your circumstances change.