This version of the form is not currently in use and is provided for reference only. Download this version of

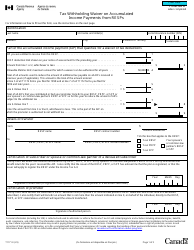

Form NR601

for the current year.

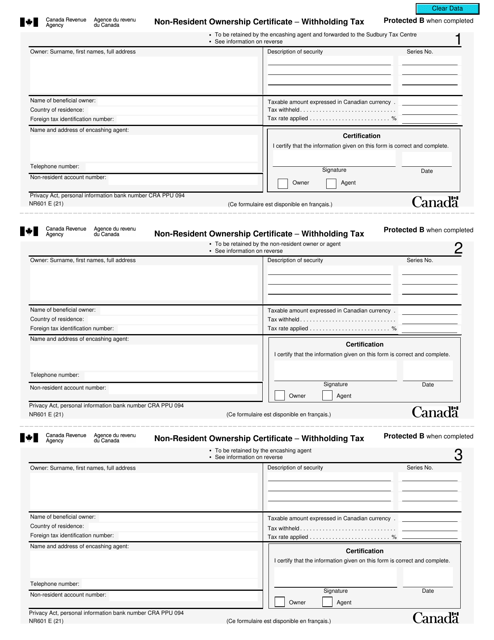

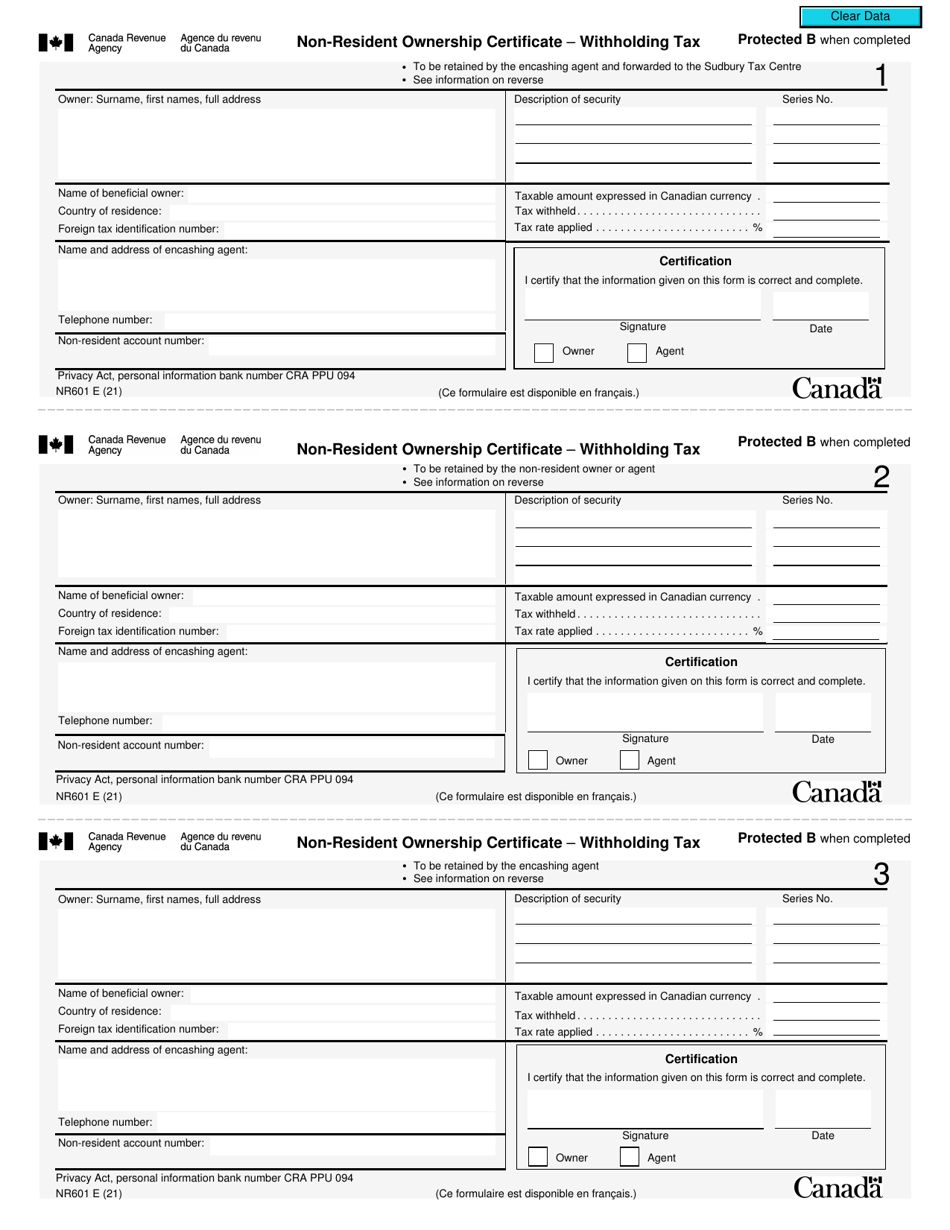

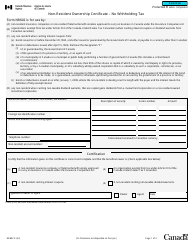

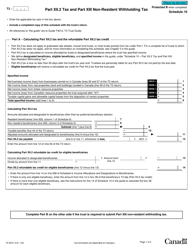

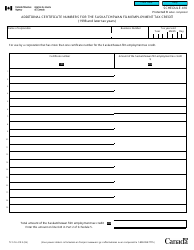

Form NR601 Non-resident Ownership Certificate - Withholding Tax - Canada

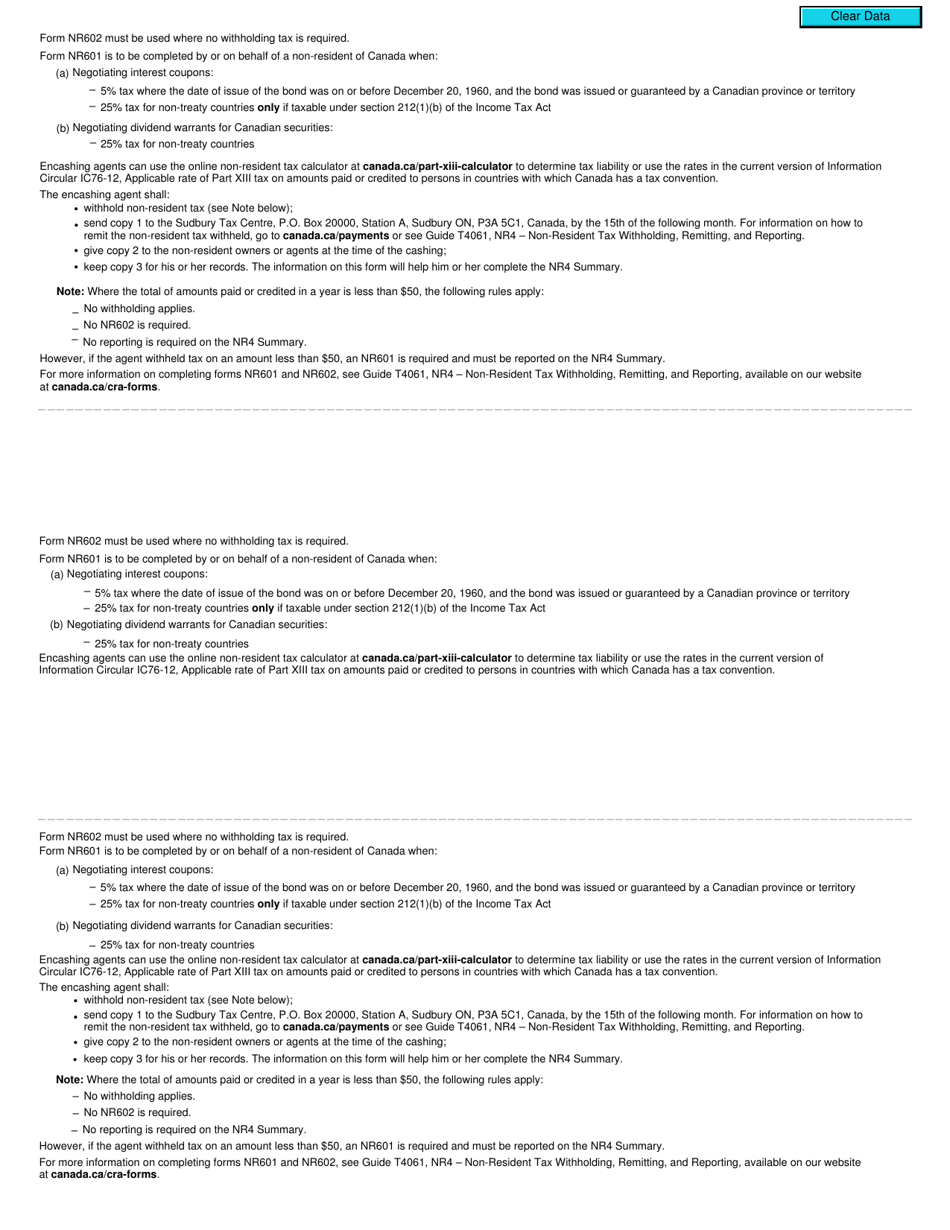

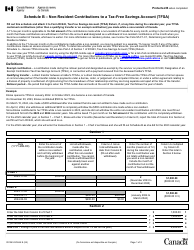

Form NR601 Non-resident Ownership Certificate - Withholding Tax - Canada is used by non-resident individuals or corporations to certify their ownership and claim benefits under a tax treaty with Canada. It helps to reduce or eliminate the amount of withholding tax on income derived from Canadian sources.

The Form NR601 Non-resident Ownership Certificate - Withholding Tax - Canada is filed by non-resident individuals or corporations who own taxable Canadian property.

FAQ

Q: What is Form NR601?

A: Form NR601 is the Non-resident Ownership Certificate that is used for withholding tax purposes in Canada.

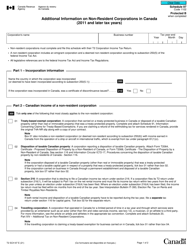

Q: Who needs to fill out Form NR601?

A: Non-residents who own property in Canada and are subject to withholding tax need to fill out Form NR601.

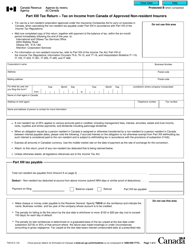

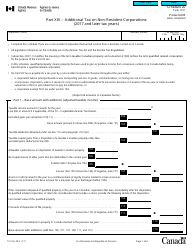

Q: What is withholding tax?

A: Withholding tax is a tax deducted at source on certain types of income, such as rental income, paid to non-residents.

Q: What information is required on Form NR601?

A: Form NR601 requires information such as the non-resident's name, address, and taxpayer identification number.

Q: When should Form NR601 be filed?

A: Form NR601 should be filed at least 30 days before the first payment subject to withholding tax is made.

Q: Will filling out Form NR601 exempt me from withholding tax?

A: Filling out Form NR601 does not automatically exempt you from withholding tax. It is used to determine the correct amount of tax to withhold.

Q: Can I file Form NR601 electronically?

A: No, Form NR601 cannot be filed electronically. It must be submitted in paper format by mail or in person.