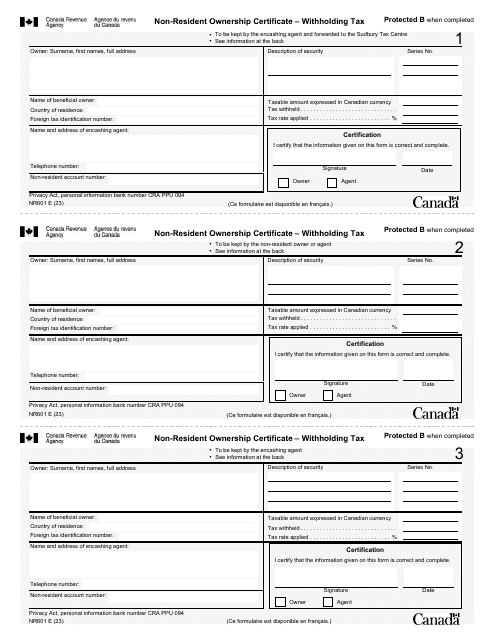

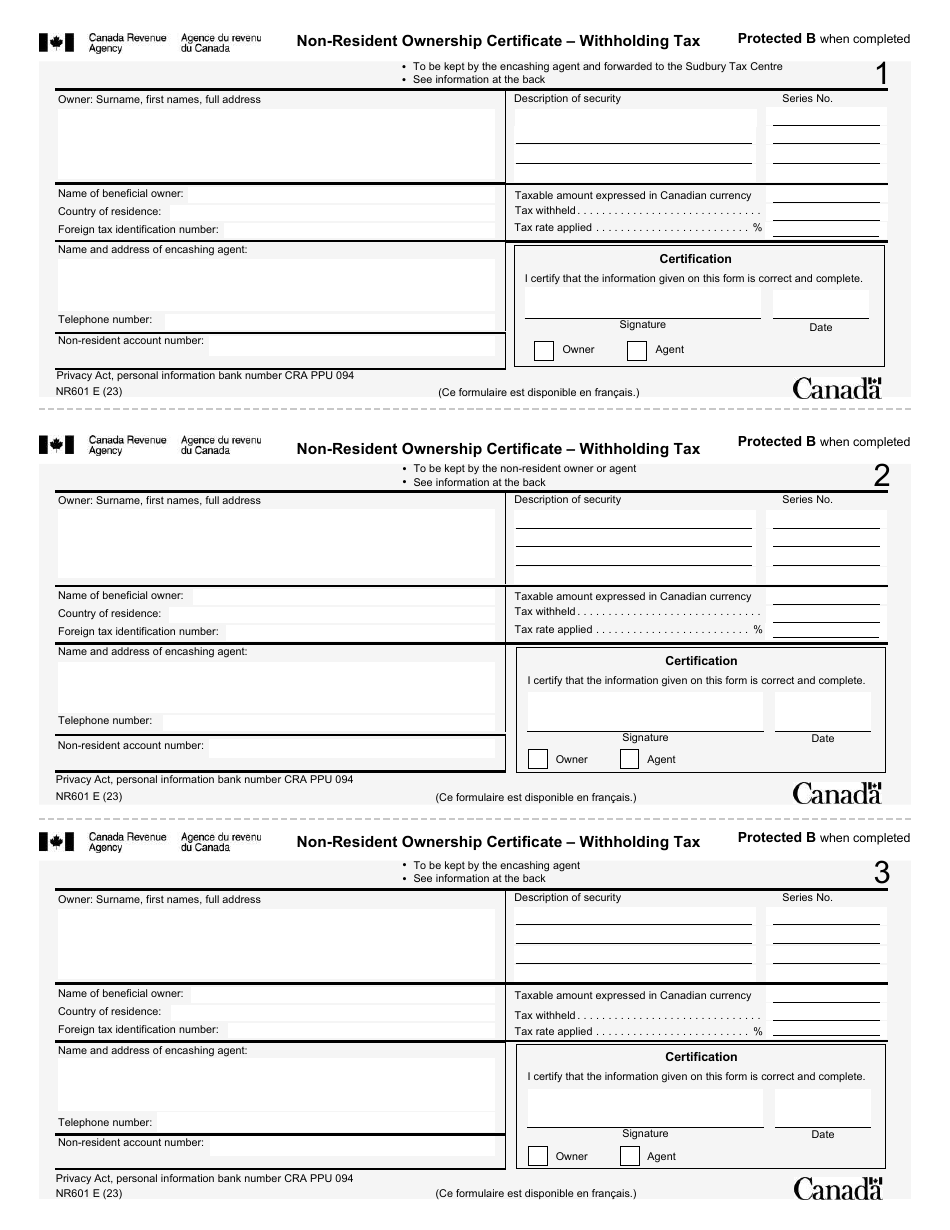

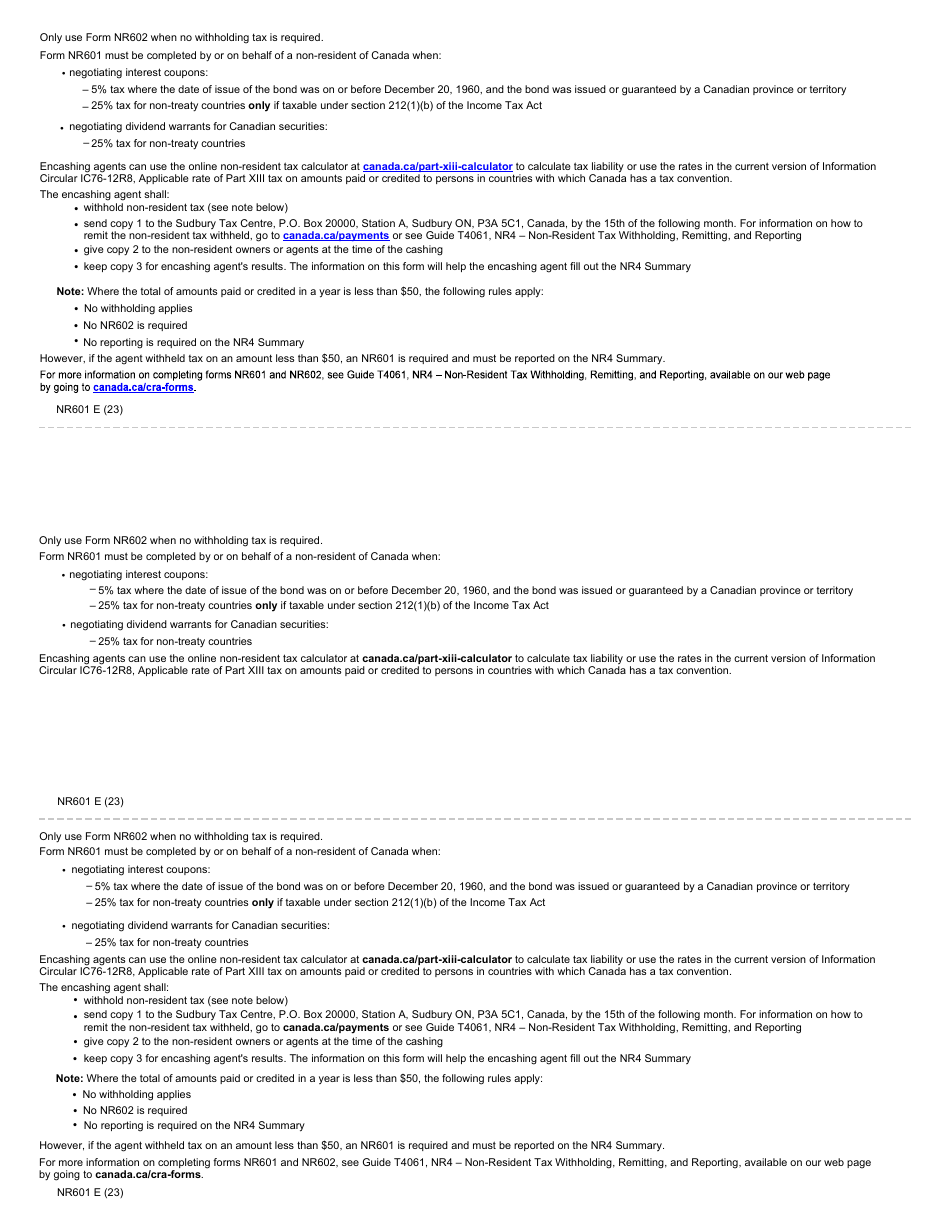

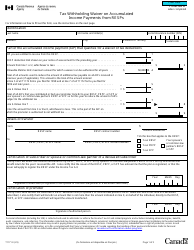

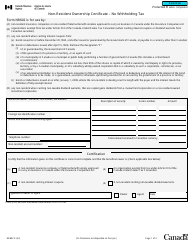

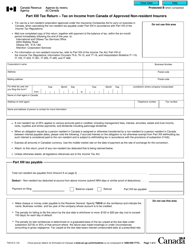

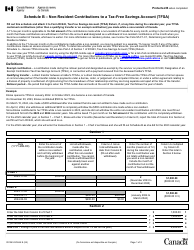

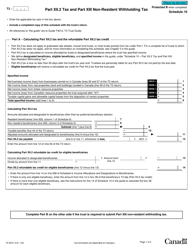

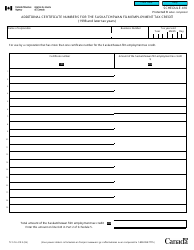

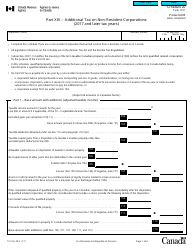

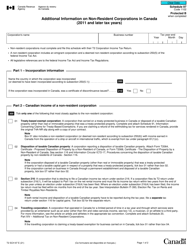

Form NR601 Non-resident Ownership Certificate - Withholding Tax - Canada

Fill PDF Online

Fill out online for free

without registration or credit card