This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST191

for the current year.

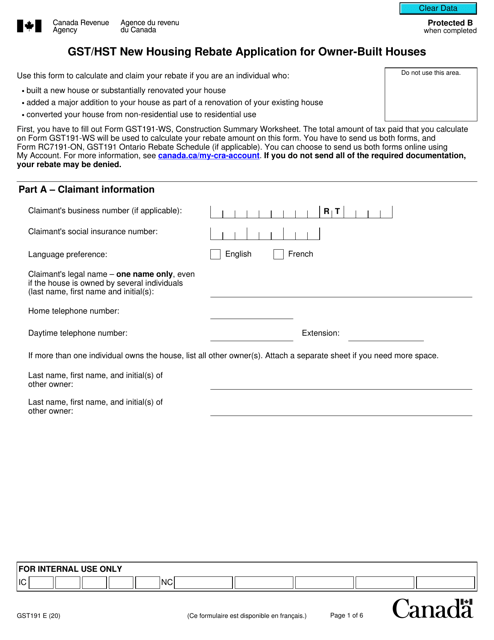

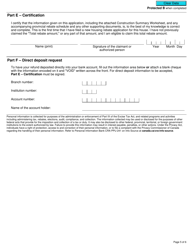

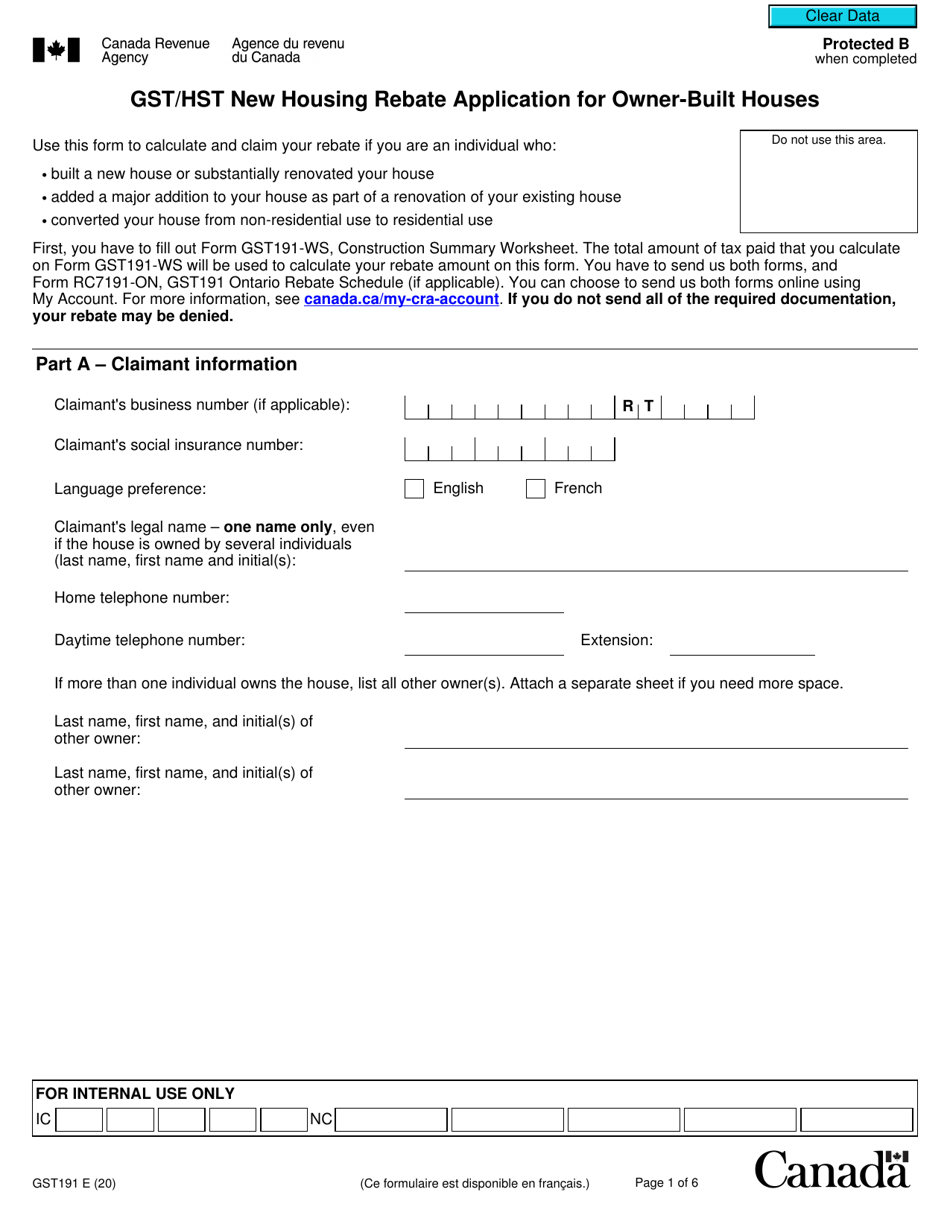

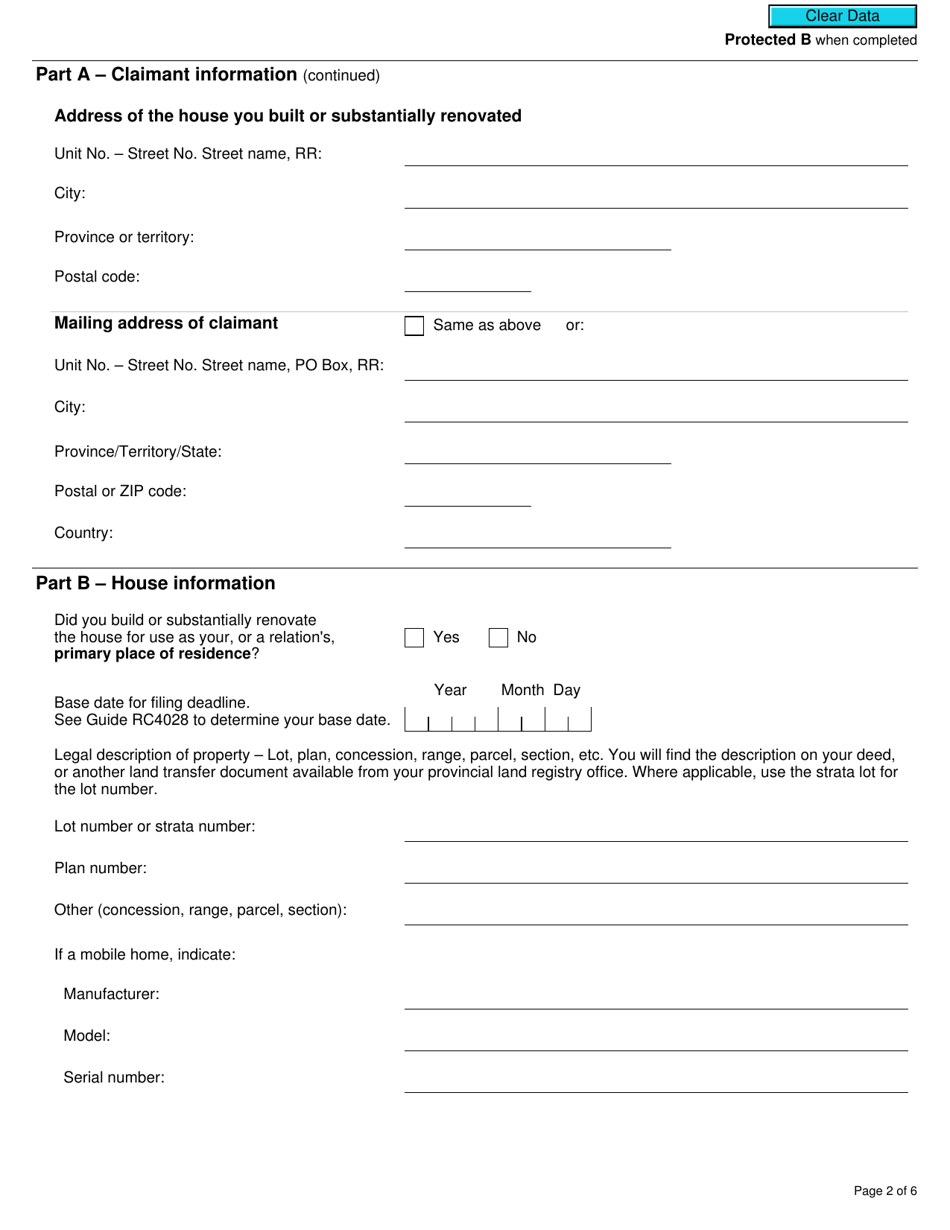

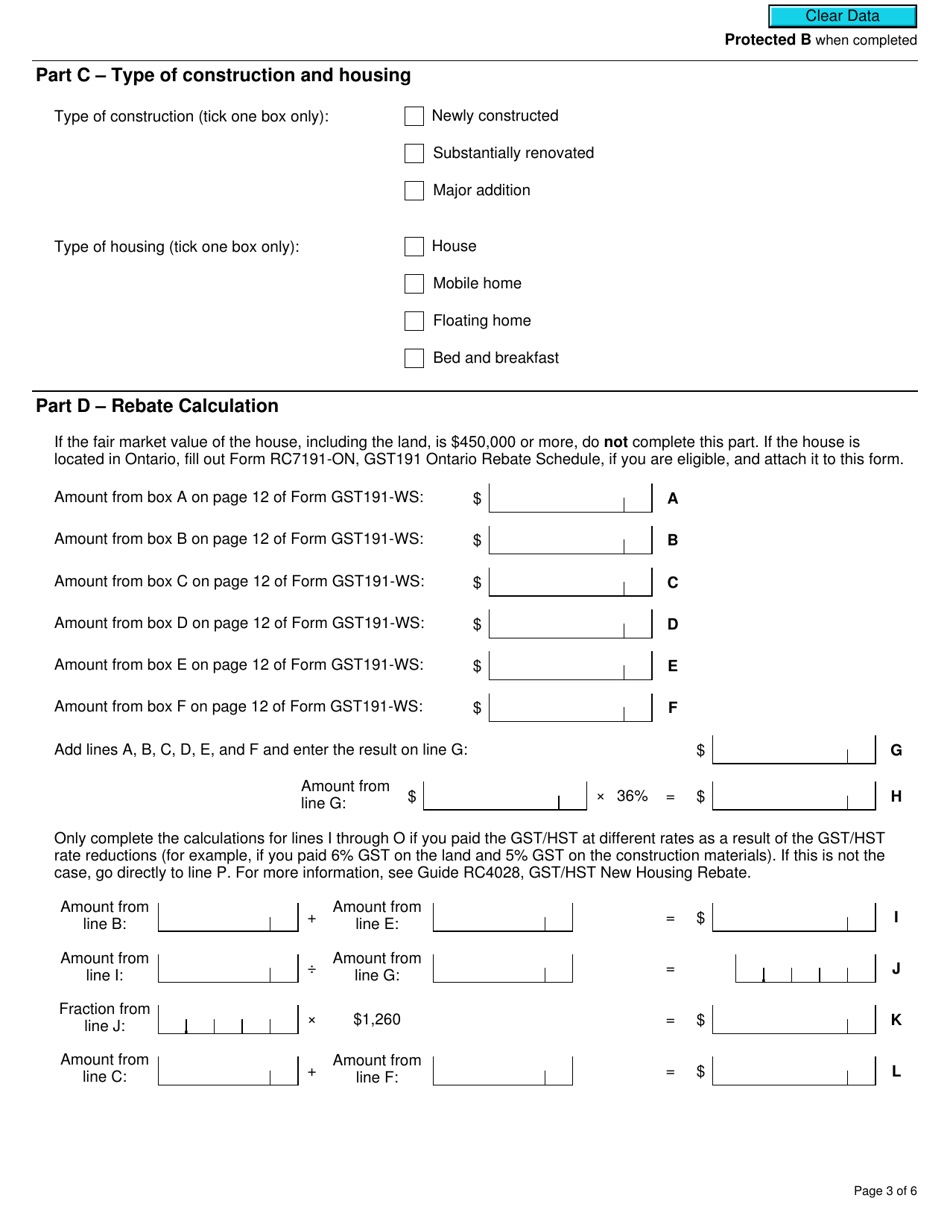

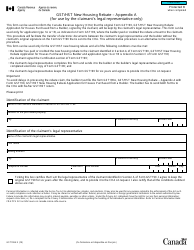

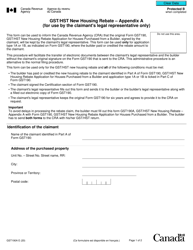

Form GST191 Gst / Hst New Housing Rebate Application for Owner-Built Houses - Canada

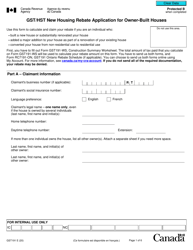

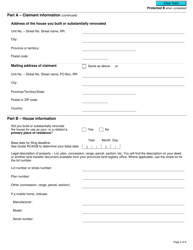

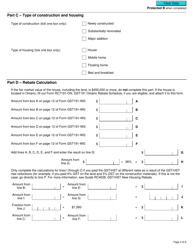

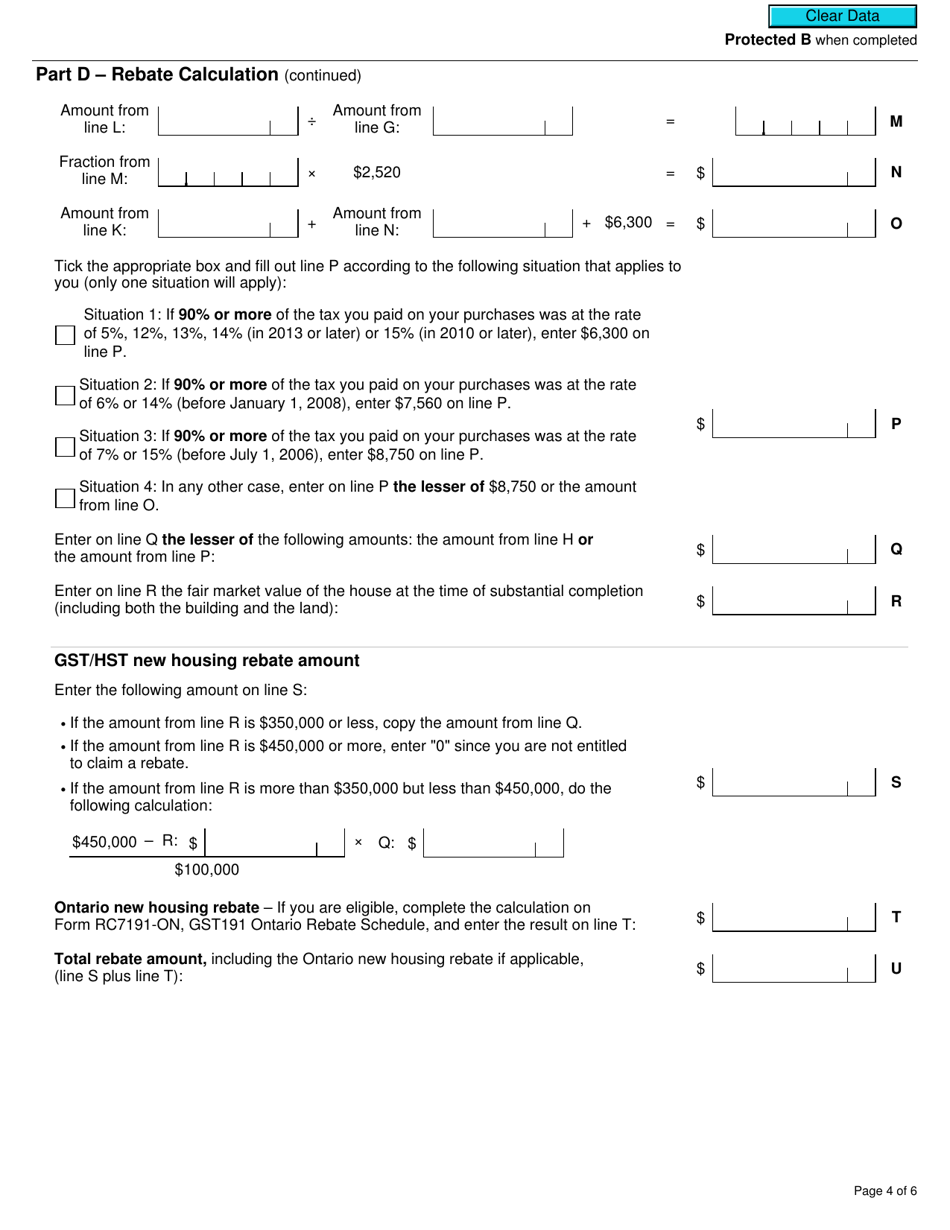

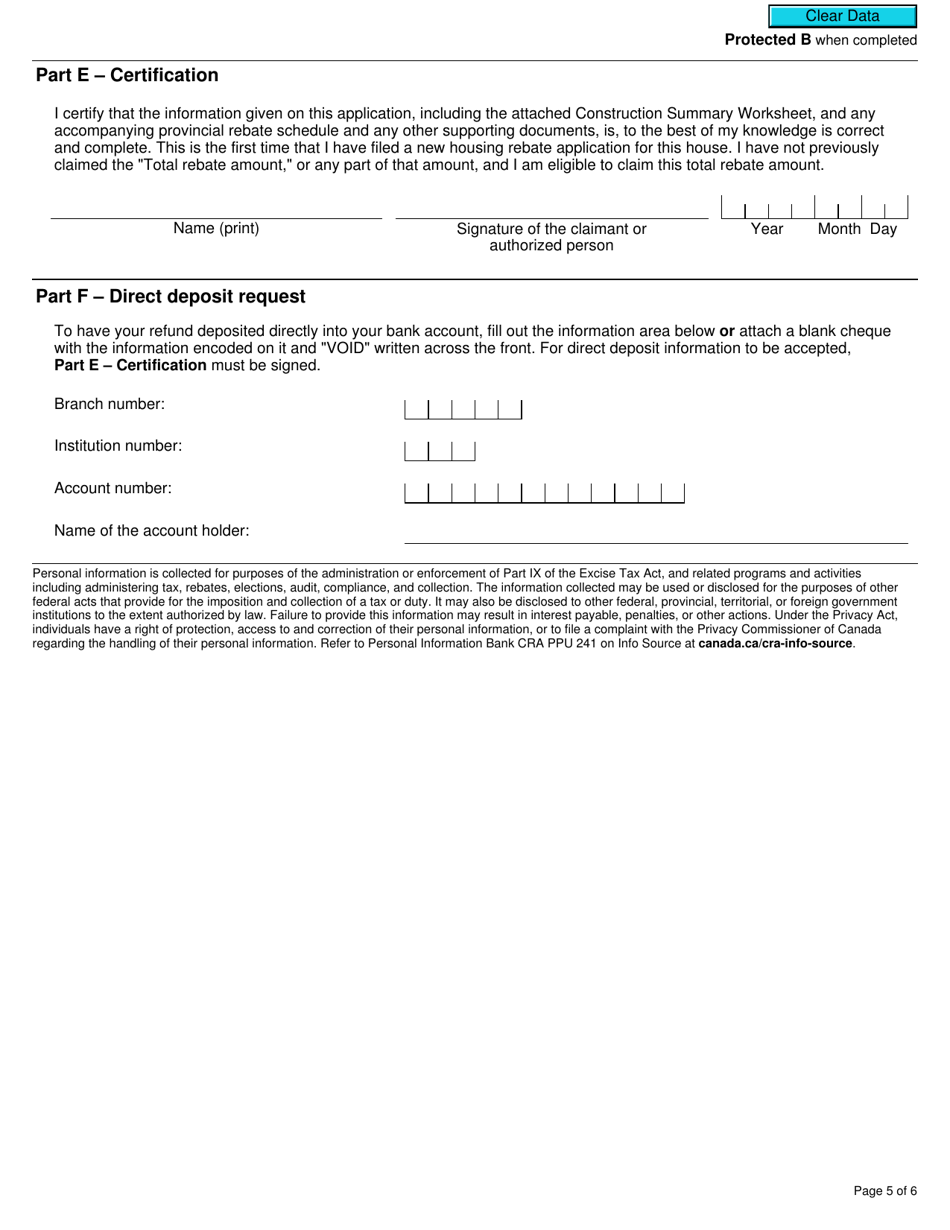

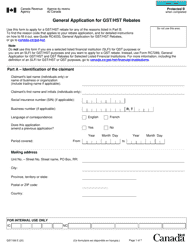

Form GST191 is the application form used by Canadian residents to claim a Goods and Services Tax (GST)/Harmonized Sales Tax (HST) rebate for newly constructed or substantially renovated houses that are owner-built. The rebate helps offset the taxes paid on the construction or renovation costs.

The owner of the self-built house files the Form GST191 GST/HST New Housing Rebate Application for Owner-Built Houses in Canada.

FAQ

Q: What is Form GST191?

A: Form GST191 is the GST/HST New Housing Rebate Application for Owner-Built Houses in Canada.

Q: Who can use Form GST191?

A: Form GST191 can be used by individuals who have built their own house in Canada and are applying for the GST/HST New Housing Rebate.

Q: What is the GST/HST New Housing Rebate?

A: The GST/HST New Housing Rebate is a rebate provided by the Canadian government to help homeowners recover some of the GST or HST paid on a newly built home or a substantial renovation.

Q: What is an owner-built house?

A: An owner-built house is a house that has been constructed or substantially renovated by the owner, rather than by a builder or contractor.

Q: How can I apply for the GST/HST New Housing Rebate?

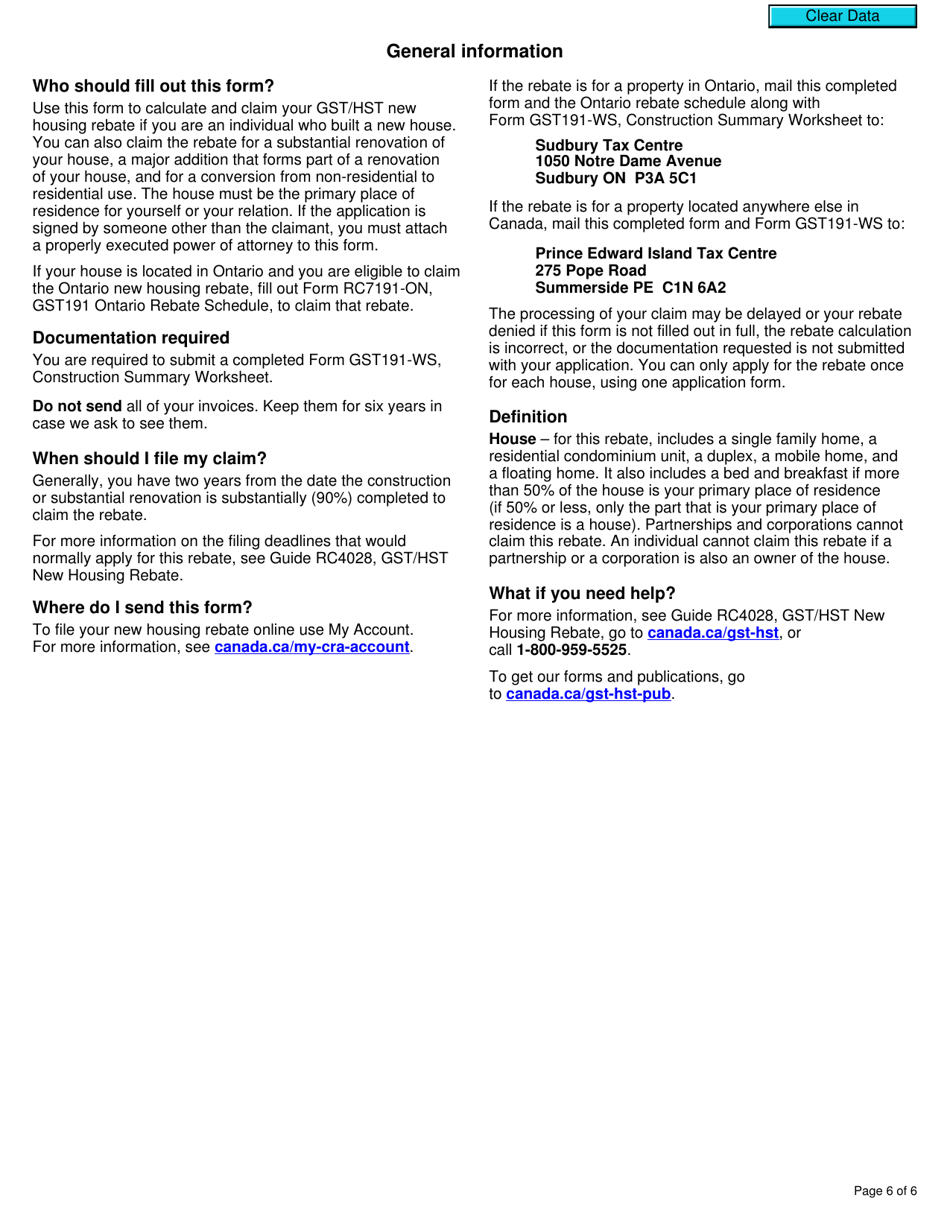

A: You can apply for the GST/HST New Housing Rebate by completing Form GST191 and submitting it to the Canada Revenue Agency (CRA) along with any required supporting documents.

Q: What documents do I need to include with my GST/HST New Housing Rebate application?

A: You may need to include documents such as a copy of your purchase agreement, invoices for materials and services, and proof of occupancy.

Q: Are there any deadlines for submitting the GST/HST New Housing Rebate application?

A: Yes, you must submit your GST/HST New Housing Rebate application within two years of the substantial completion of your house or renovation.

Q: How long does it take to process the GST/HST New Housing Rebate application?

A: Processing times can vary, but it typically takes the Canada Revenue Agency (CRA) about two to eight weeks to process the application.

Q: How will I receive the GST/HST New Housing Rebate?

A: If your application is approved, you will receive the rebate as a direct deposit or a check in the mail.

Q: Can I claim the GST/HST New Housing Rebate if I am not the owner-builder?

A: No, the GST/HST New Housing Rebate is specifically for individuals who have built their own house in Canada.

Q: Can I apply for the GST/HST New Housing Rebate if I have hired a contractor to build or renovate my house?

A: No, the GST/HST New Housing Rebate is not available for houses that have been built or substantially renovated by a contractor.