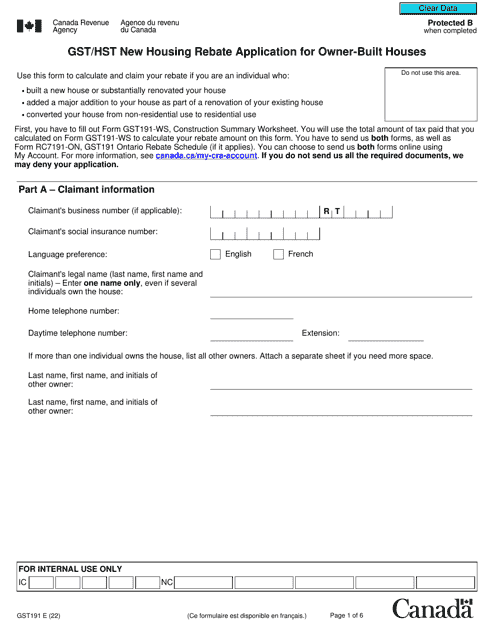

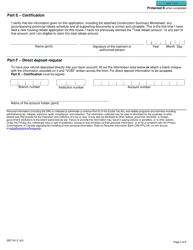

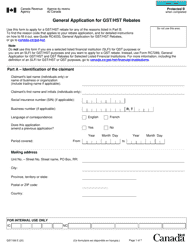

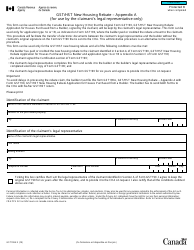

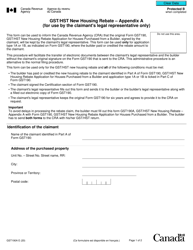

Form GST191 Gst / Hst New Housing Rebate Application for Owner-Built Houses - Canada

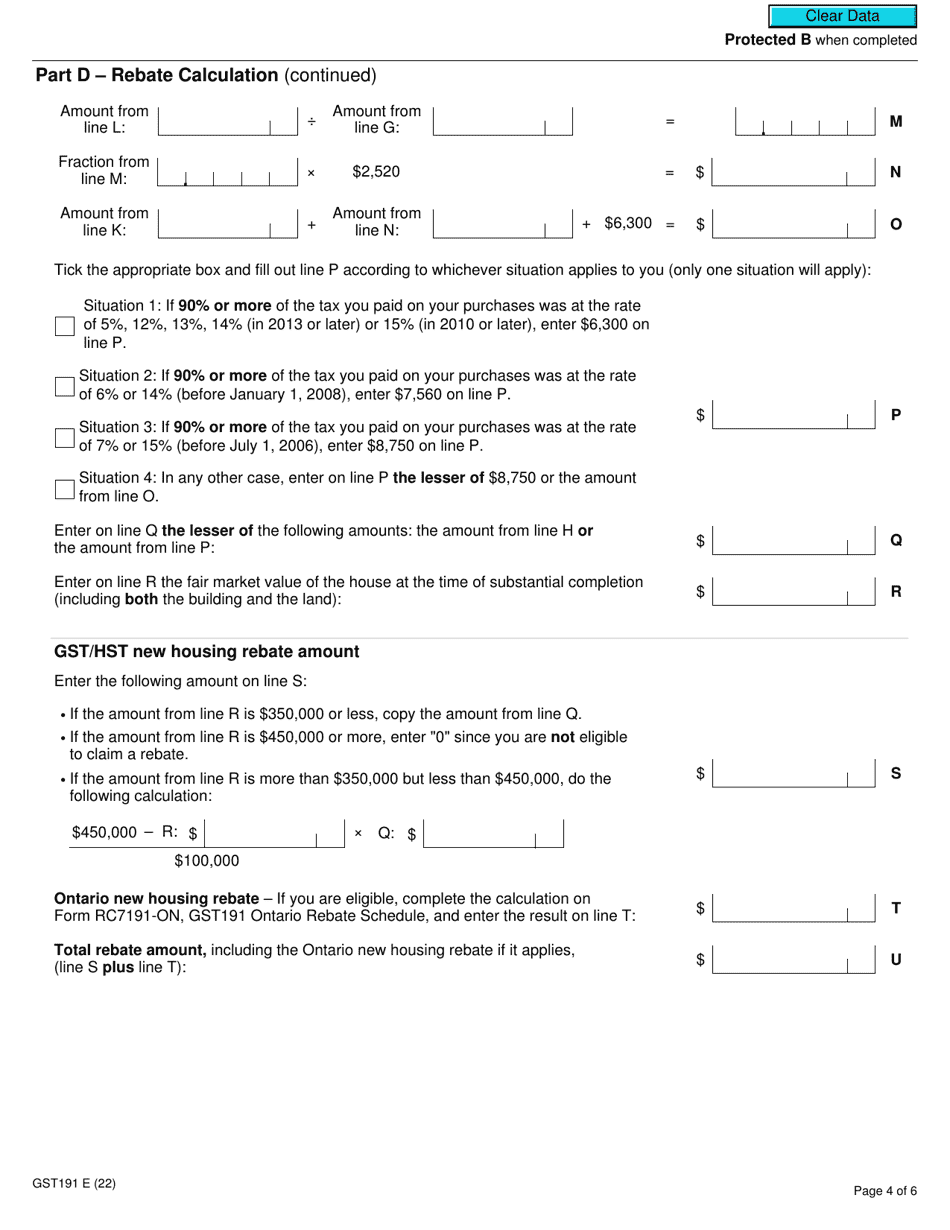

Form GST191 is an application form in Canada for individuals who have built a new house for themselves or a relative to claim a Goods and Services Tax/Harmonized Sales Tax (GST/HST) rebate.

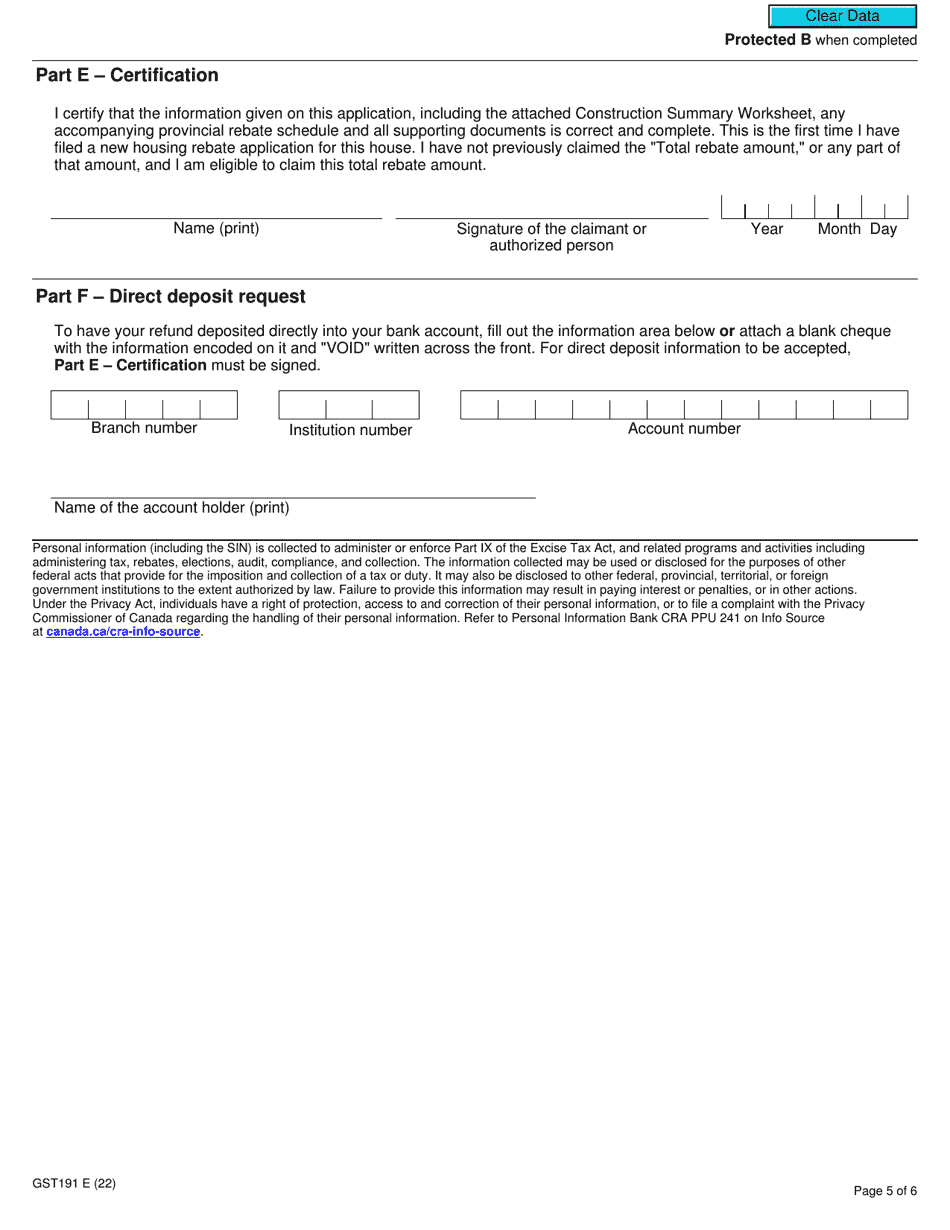

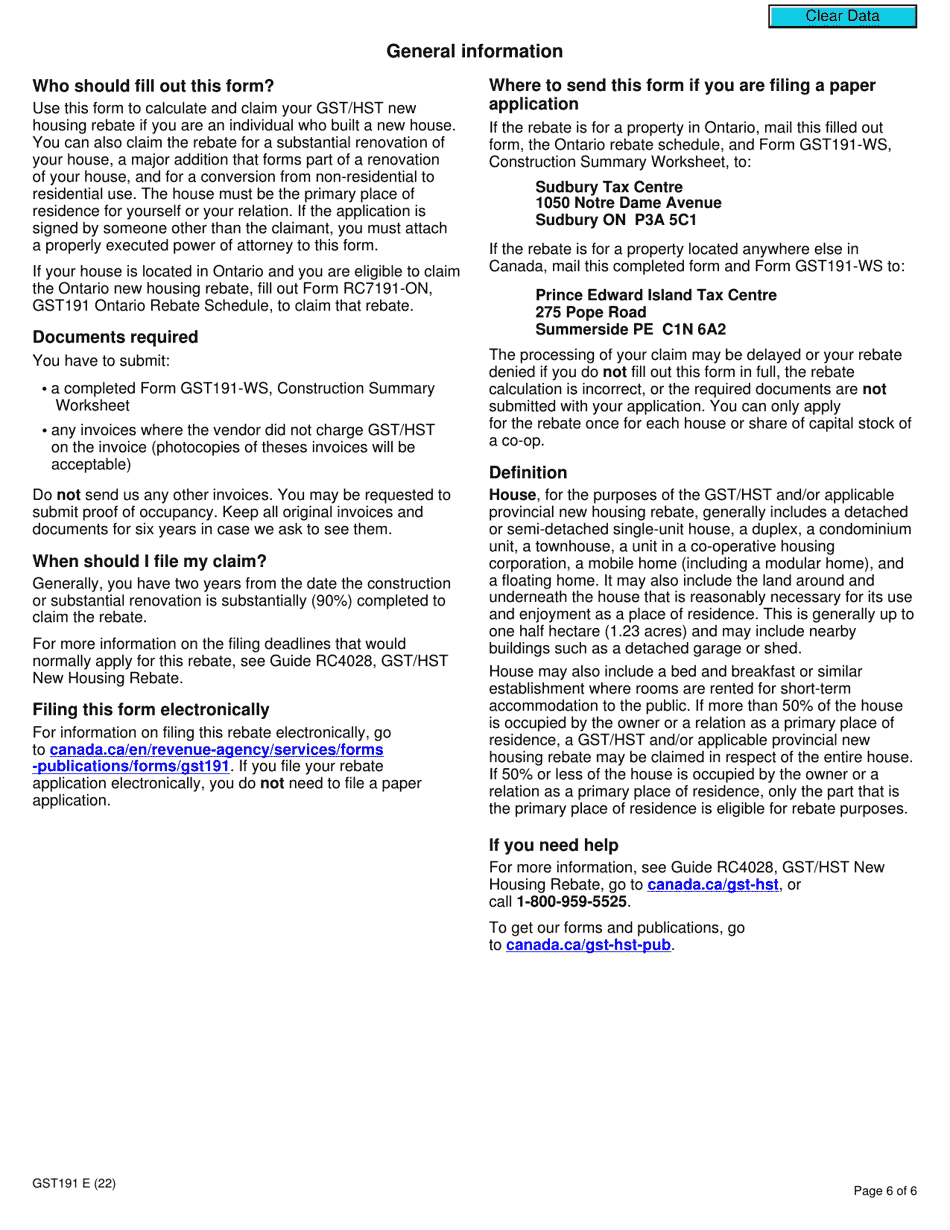

The owner of the owner-built house files the Form GST191 GST/HST New Housing Rebate Application for Owner-Built Houses in Canada.

Form GST191 Gst/Hst New Housing Rebate Application for Owner-Built Houses - Canada - Frequently Asked Questions (FAQ)

Q: What is GST191?

A: GST191 is the application form for the Gst/Hst New Housing Rebate for Owner-Built Houses in Canada.

Q: Who can apply for the Gst/Hst New Housing Rebate for Owner-Built Houses?

A: Individuals who have built a new house for their own use are eligible to apply for the rebate.

Q: What is the purpose of the rebate?

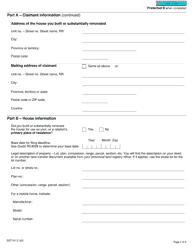

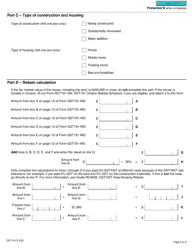

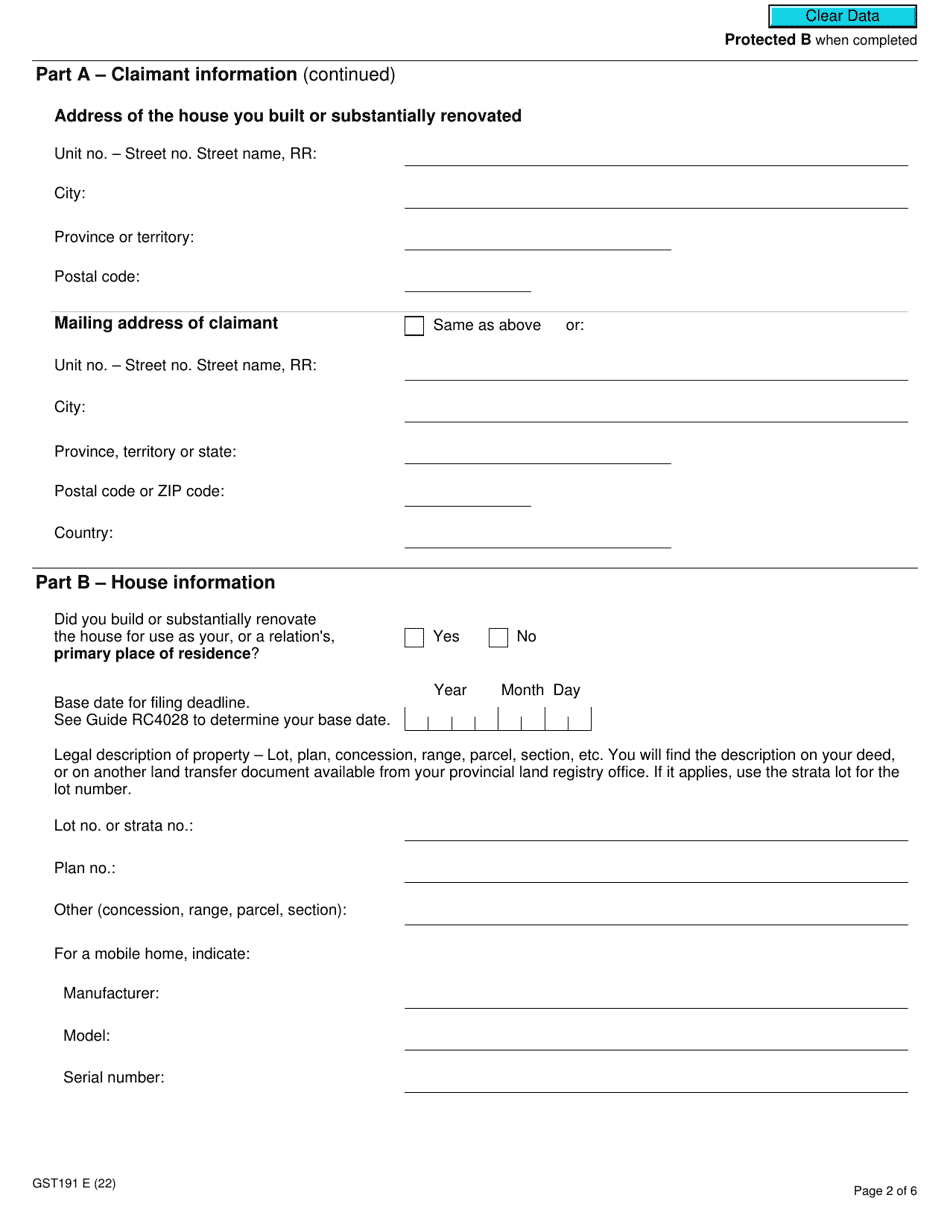

A: The rebate helps offset the goods and services tax/harmonized sales tax (GST/HST) paid on the construction costs or the fair market value of the house.

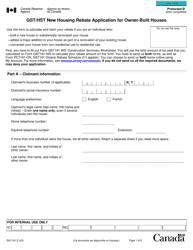

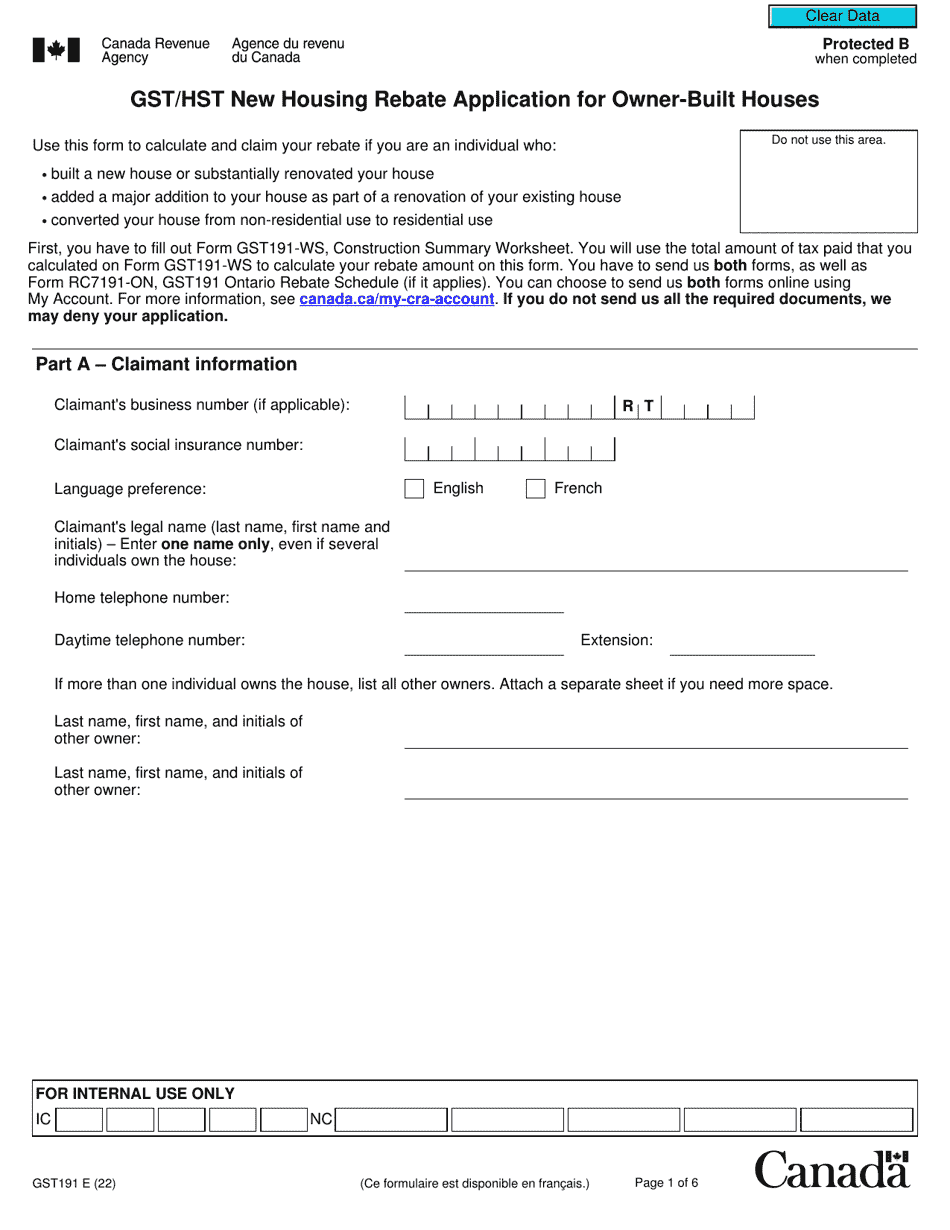

Q: What are the requirements to qualify for the rebate?

A: To qualify, the house must be built or substantially renovated by the applicant, the applicant must own the land, and the applicant must intend to live in the house as their primary residence.

Q: How much is the rebate?

A: The rebate amount depends on the amount of GST/HST paid on the construction or fair market value of the house. It can be up to a maximum of $30,000.

Q: When should I submit the GST191 form?

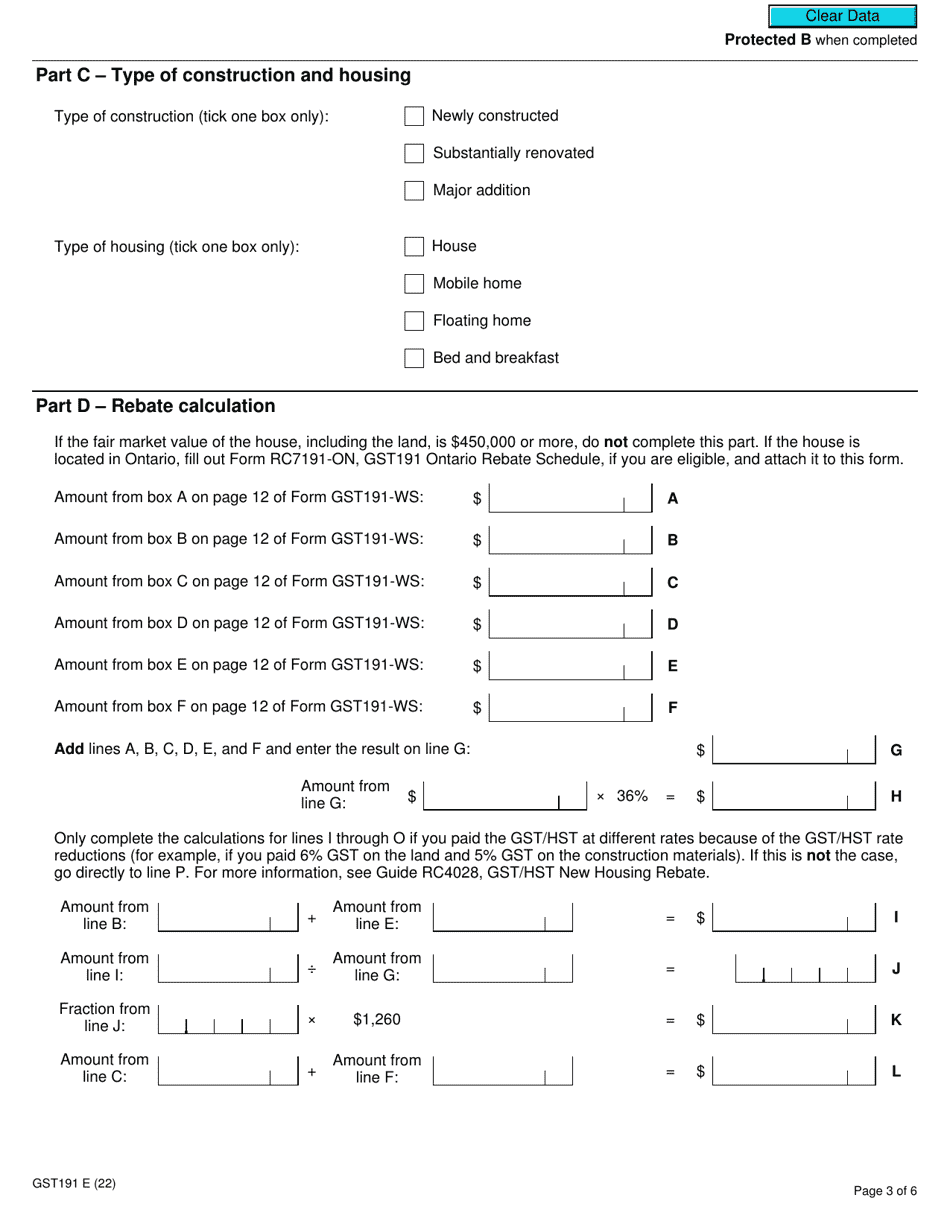

A: The GST191 form should be submitted within two years of completing construction or substantial renovation of the house.

Q: What documents do I need to submit with the GST191 form?

A: You will need to provide supporting documents such as invoices, receipts, and proof of ownership to support your claim.

Q: How long does it take to receive the rebate?

A: The processing time for the rebate can vary, but it typically takes several weeks to months to receive the rebate.

Q: What should I do if my application is rejected?

A: If your application is rejected, you can request a review of the decision or appeal to the Tax Court of Canada if necessary.