This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC518

for the current year.

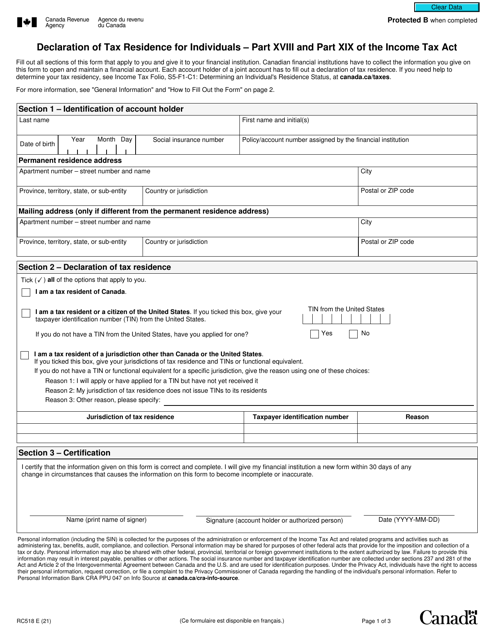

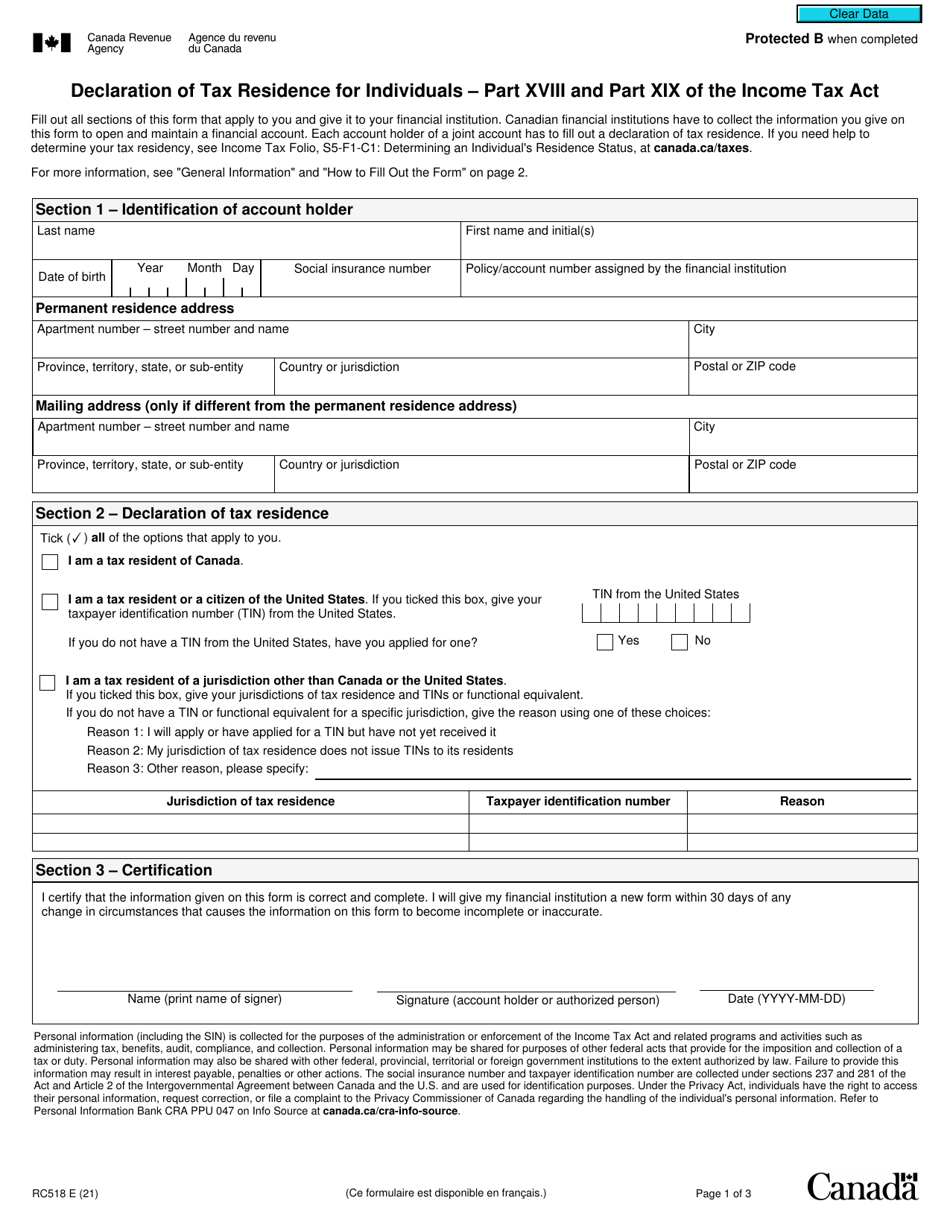

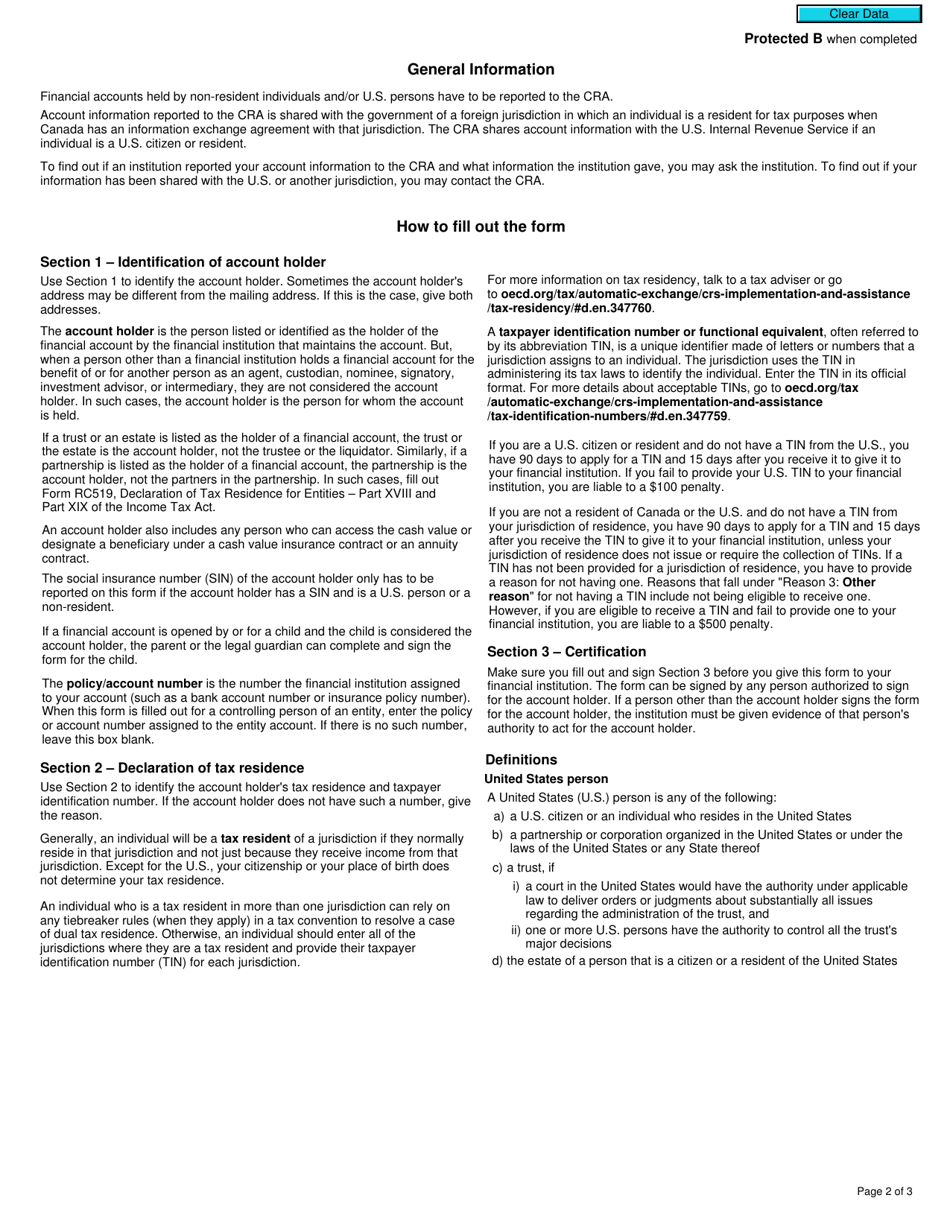

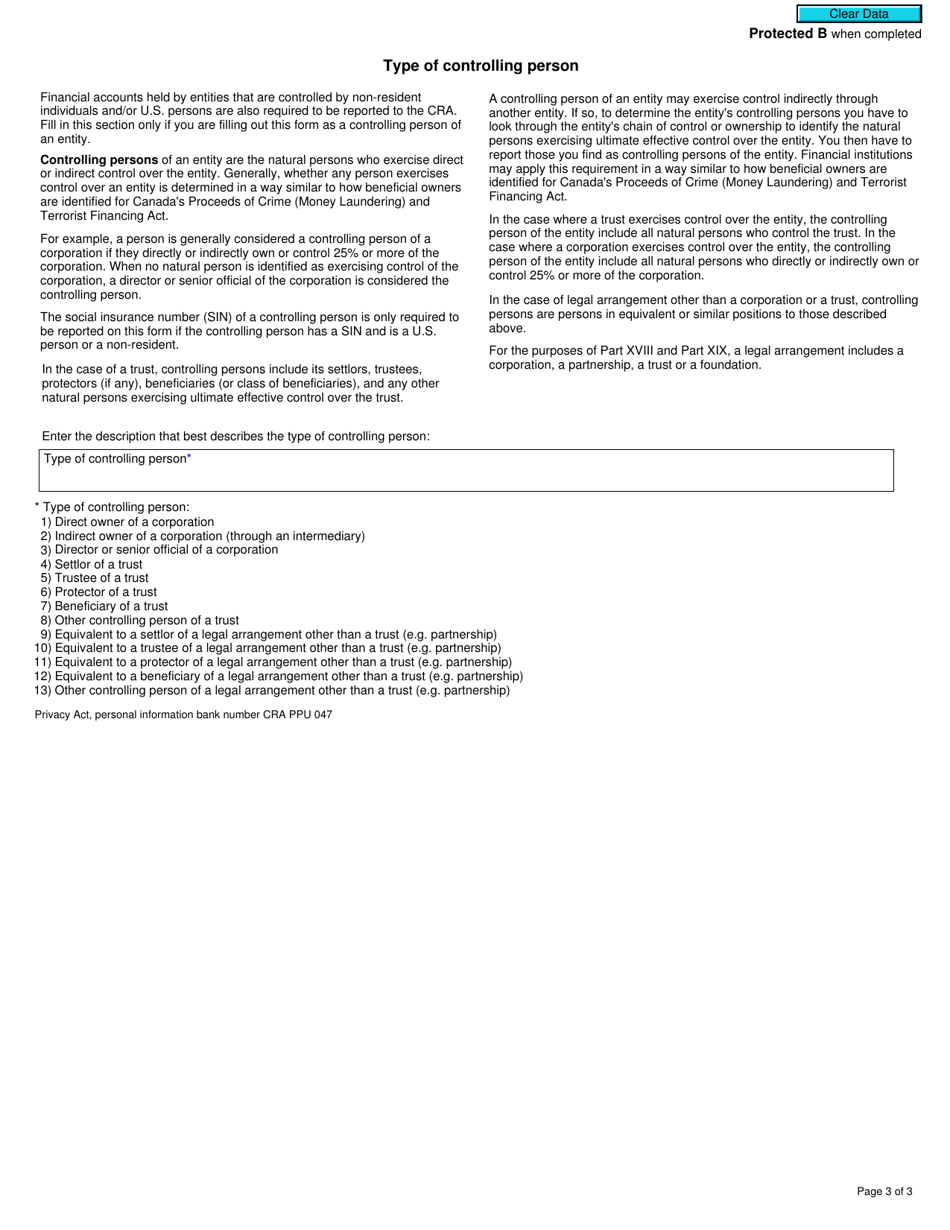

Form RC518 Declaration of Tax Residence for Individuals - Part Xviii and Part Xix of the Income Tax Act - Canada

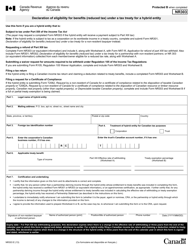

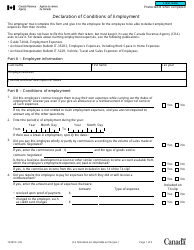

Form RC518 Declaration of Tax Residence for Individuals - Part XVIII and Part XIX of the Income Tax Act - Canada is used to declare your tax residency status in Canada. Part XVIII is for individuals who are residents of countries that have a tax treaty with Canada, and Part XIX is for individuals who are not residents of a tax treaty country. The purpose of this form is to determine your eligibility for certain tax exemptions or benefits based on your tax residency status.

The Form RC518 Declaration of Tax Residence for Individuals in Canada is filed by individuals who want to claim treaty benefits for tax purposes.

FAQ

Q: What is Form RC518?

A: Form RC518 is the Declaration of Tax Residence for Individuals.

Q: What are Part XVIII and Part XIX of the Income Tax Act in Canada?

A: Part XVIII of the Income Tax Act in Canada deals with international tax rules, while Part XIX deals with various administrative provisions.

Q: Do I need to fill out Form RC518?

A: You need to fill out Form RC518 if you are an individual and you want to declare your tax residence status in Canada.

Q: What information is required in Form RC518?

A: Form RC518 requires information such as your personal details, your tax residence status, and details about your foreign income and assets.

Q: What is the purpose of Part XVIII of the Income Tax Act?

A: Part XVIII of the Income Tax Act is designed to prevent tax evasion and ensure that individuals are properly reporting their international income and assets.

Q: What is the purpose of Part XIX of the Income Tax Act?

A: Part XIX of the Income Tax Act contains various administrative provisions that govern the application and interpretation of the tax law in Canada.

Q: When is the deadline to submit Form RC518?

A: The deadline to submit Form RC518 is generally April 30th of the following year, or June 15th if you or your spouse or common-law partner is self-employed.