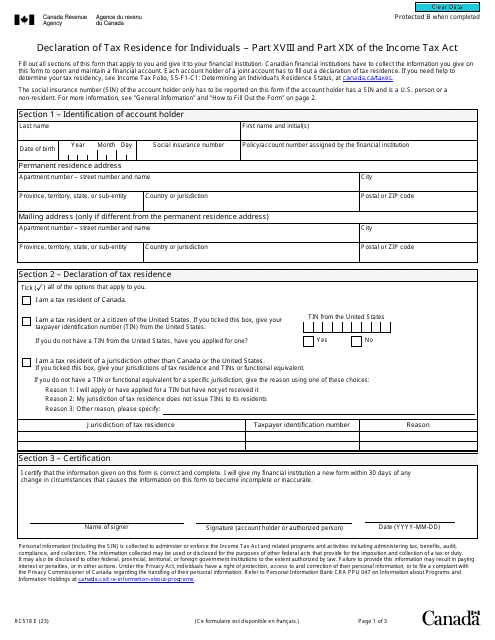

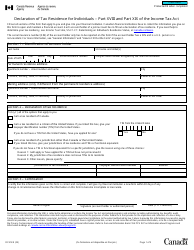

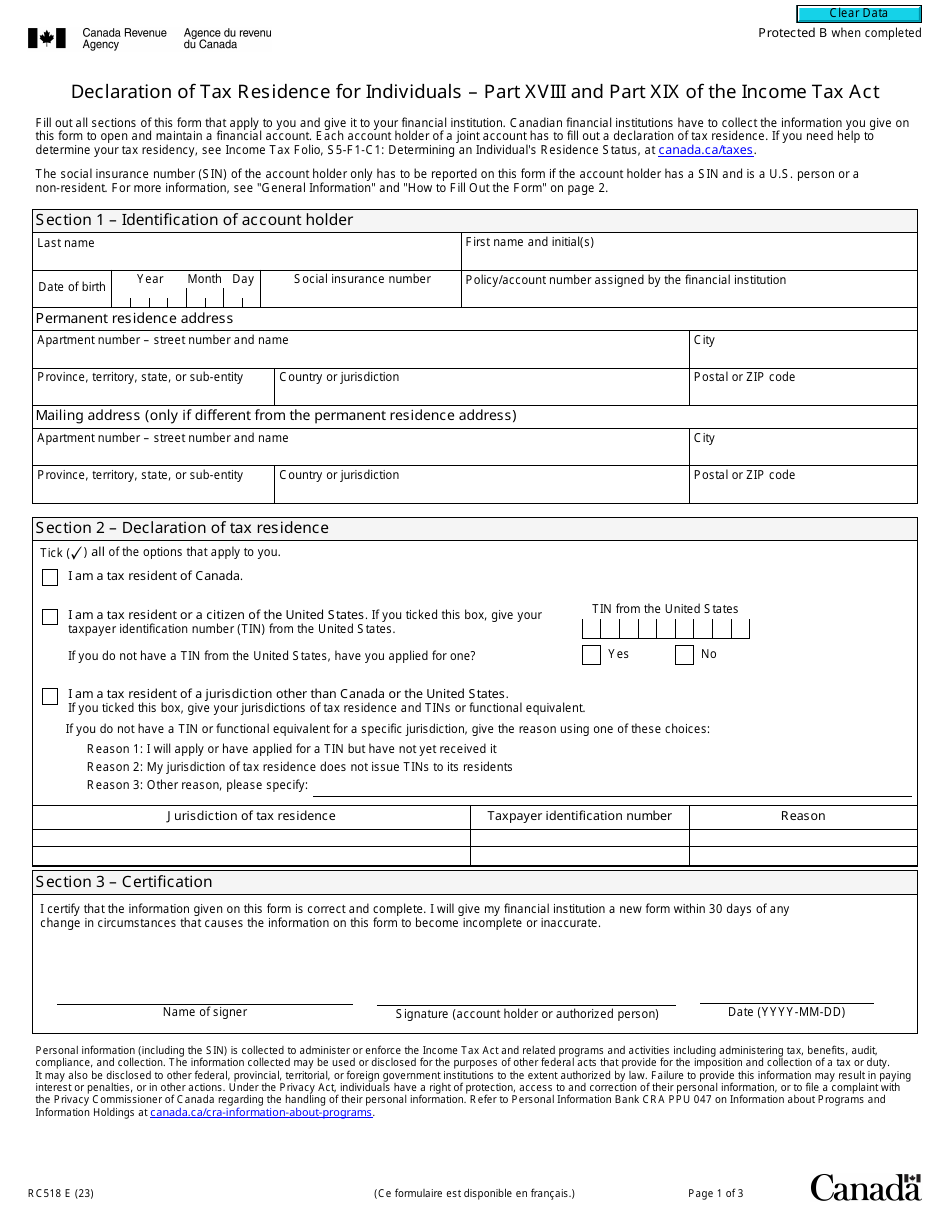

Form RC518 Declaration of Tax Residence for Individuals - Part Xviii and Part Xix of the Income Tax Act - Canada

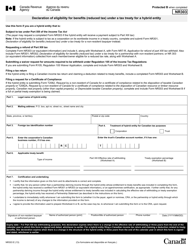

Form RC518 Declaration of Tax Residence for Individuals - Part XVIII and Part XIX of the Income Tax Act - Canada is used for declaring your tax residence and providing important information to the Canada Revenue Agency (CRA). This form helps determine your eligibility for certain tax benefits and ensures that you are correctly assessed for income tax purposes. It is required to be filled out by individuals who are non-residents of Canada for tax purposes.

The Form RC518 Declaration of Tax Residence for Individuals - Part XVIII and Part XIX of the Income Tax Act - Canada is filed by individuals who need to declare their tax residence status in Canada.

Form RC518 Declaration of Tax Residence for Individuals - Part Xviii and Part Xix of the Income Tax Act - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC518?

A: Form RC518 is the Declaration of Tax Residence for Individuals in Canada.

Q: What is Part XVIII of the Income Tax Act in Canada?

A: Part XVIII of the Income Tax Act in Canada deals with the taxation of non-residents' income from Canadian sources.

Q: What is Part XIX of the Income Tax Act in Canada?

A: Part XIX of the Income Tax Act in Canada covers the taxation of individuals' income from Canadian sources.

Q: Who needs to fill out Form RC518?

A: Individuals who want to declare their tax residence status in Canada should fill out this form.

Q: What are the purposes of Form RC518?

A: The main purposes of Form RC518 are determining an individual's tax residency status and complying with Canadian tax laws.

Q: How do I determine my tax residency in Canada?

A: Your tax residency is determined based on factors such as the number of days you spend in Canada, residential ties, and the location of your permanent home.

Q: Can I be a tax resident of both the U.S. and Canada?

A: Yes, it is possible to be a tax resident of both the U.S. and Canada, but you may be eligible for tax benefits under the U.S.-Canada tax treaty to avoid double taxation.

Q: Do I need to attach any documents with Form RC518?

A: Depending on your circumstances, you may need to provide supporting documents such as copies of passports, immigration records, or lease agreements.

Q: How often do I need to fill out Form RC518?

A: You need to fill out this form every time there is a change in your tax residence status or as requested by the CRA.