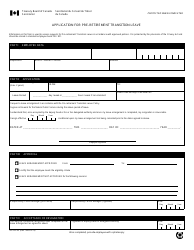

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T733

for the current year.

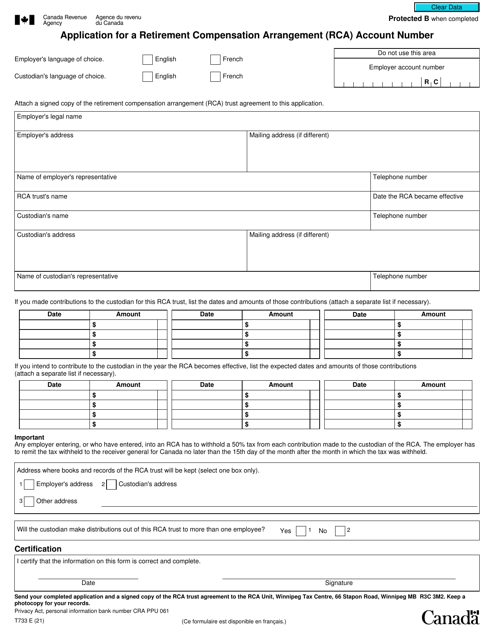

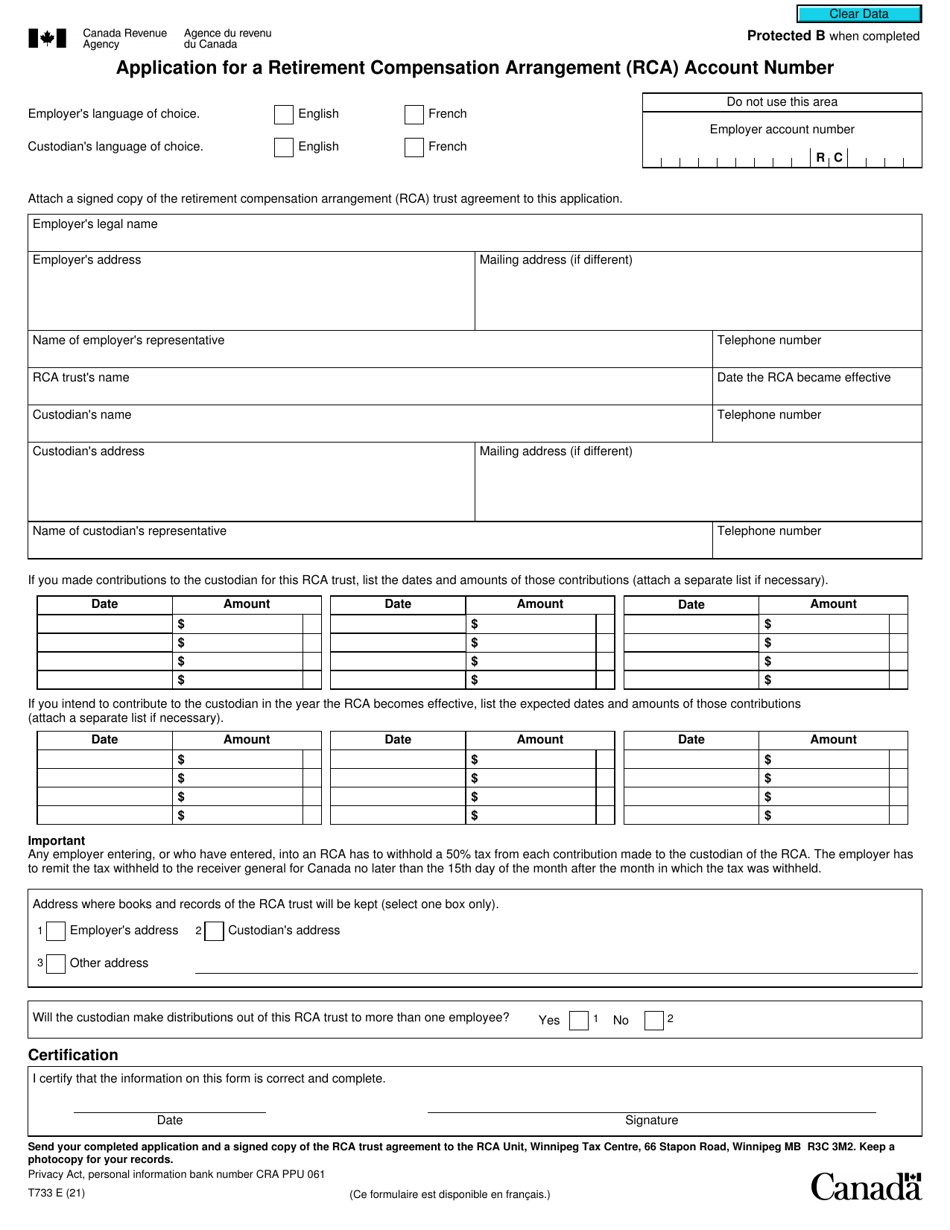

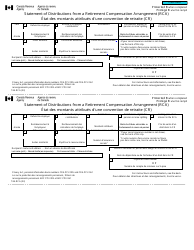

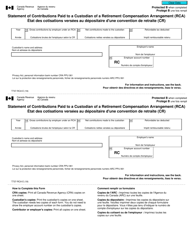

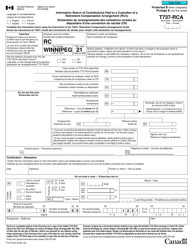

Form T733 Application for a Retirement Compensation Arrangement (Rca) Account Number - Canada

Form T733 - Application for a Retirement Compensation Arrangement (RCA) Account Number in Canada is used to apply for an RCA account number. RCA is a type of retirement plan used by employers to provide retirement benefits to their employees. This form is used by individuals or businesses who want to establish an RCA account in Canada.

The employer or plan administrator files the Form T733 Application for a Retirement Compensation Arrangement (RCA) account number in Canada.

FAQ

Q: What is Form T733?

A: Form T733 is an application form used to request an account number for a Retirement Compensation Arrangement (RCA) in Canada.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of registered pension plan that provides retirement benefits for individuals.

Q: Who needs to use Form T733?

A: Individuals or plan administrators who want to establish a Retirement Compensation Arrangement (RCA) account in Canada need to use Form T733.

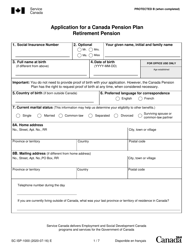

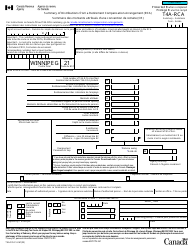

Q: What information is required on Form T733?

A: Form T733 requires information such as the applicant's name, address, social insurance number (SIN), and details about the proposed Retirement Compensation Arrangement (RCA).

Q: Is there a fee to submit Form T733?

A: No, there is no fee required to submit Form T733.

Q: Is Form T733 required for every RCA account?

A: Yes, Form T733 is required for the establishment of every Retirement Compensation Arrangement (RCA) account in Canada.

Q: What is the purpose of an RCA account?

A: The purpose of an RCA account is to provide retirement benefits for individuals in a tax-efficient manner.

Q: Are there any specific eligibility criteria for RCA accounts?

A: Yes, there are specific eligibility criteria outlined by the Canada Revenue Agency (CRA) for establishing an RCA account.