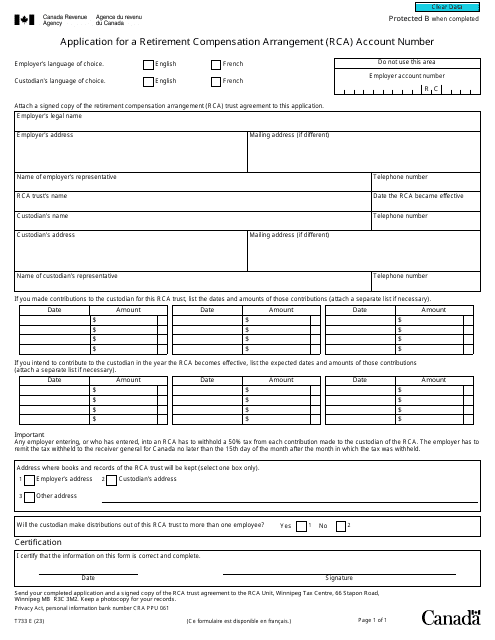

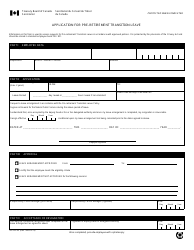

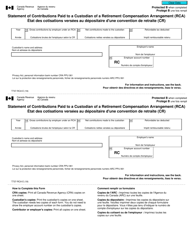

Form T733 Application for a Retirement Compensation Arrangement (Rca) Account Number - Canada

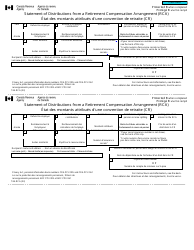

Form T733 Application for a Retirement Compensation Arrangement (RCA) Account Number in Canada is used to request an RCA account number from the Canada Revenue Agency (CRA). This form is required when establishing a Retirement Compensation Arrangement account, which is a type of registered pension plan for executives and highly paid individuals.

The Form T733 Application for a Retirement Compensation Arrangement (RCA) Account Number in Canada is filed by the employer.

Form T733 Application for a Retirement Compensation Arrangement (Rca) Account Number - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T733?

A: Form T733 is an application form for a Retirement Compensation Arrangement (RCA) account number in Canada.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of retirement savings plan for highly compensated employees.

Q: Why do I need an RCA account number?

A: You need an RCA account number to establish and manage your Retirement Compensation Arrangement (RCA) in Canada.

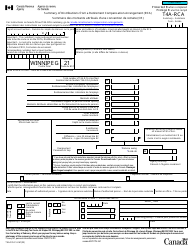

Q: How do I apply for a RCA account number?

A: You can apply for a RCA account number by completing and submitting Form T733 to the Canada Revenue Agency (CRA).

Q: Are there any fees for applying for a RCA account number?

A: There are no fees for applying for a RCA account number in Canada.

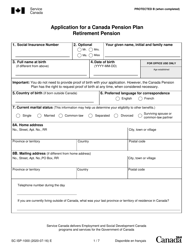

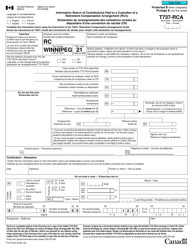

Q: What information do I need to provide on Form T733?

A: You will need to provide your personal information, details about the RCA, and other relevant information on Form T733.

Q: How long does it take to process the application for a RCA account number?

A: The processing time can vary, but it typically takes a few weeks for the Canada Revenue Agency (CRA) to process the application.