This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1006

for the current year.

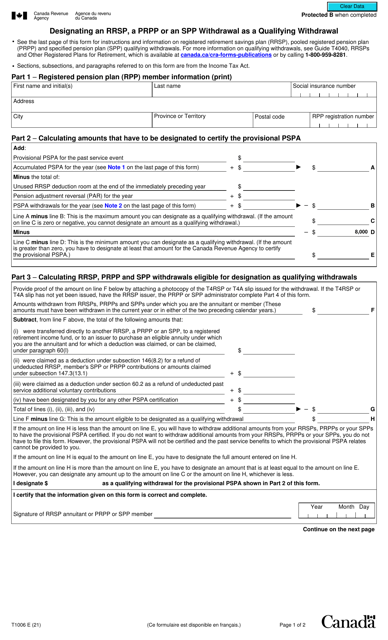

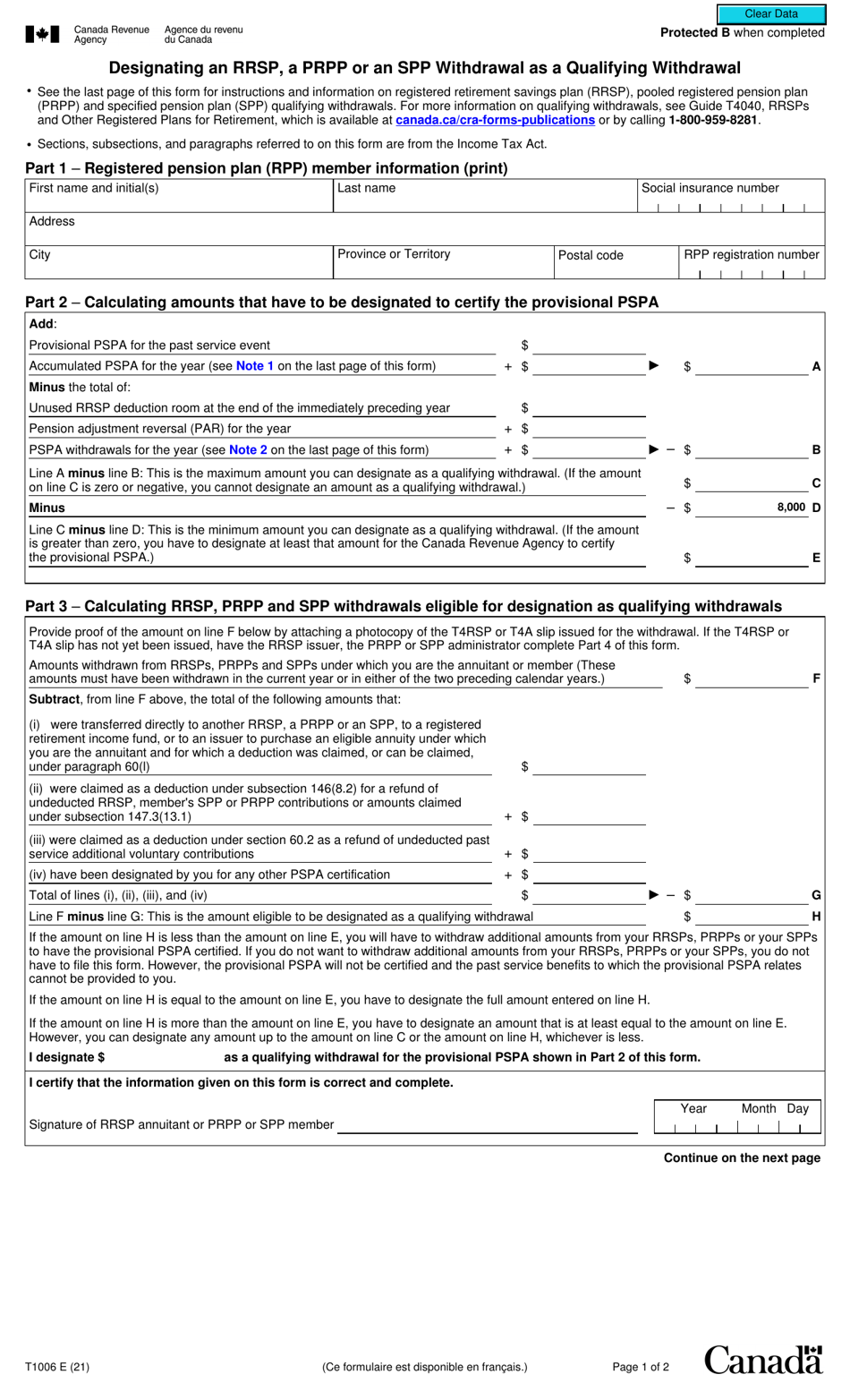

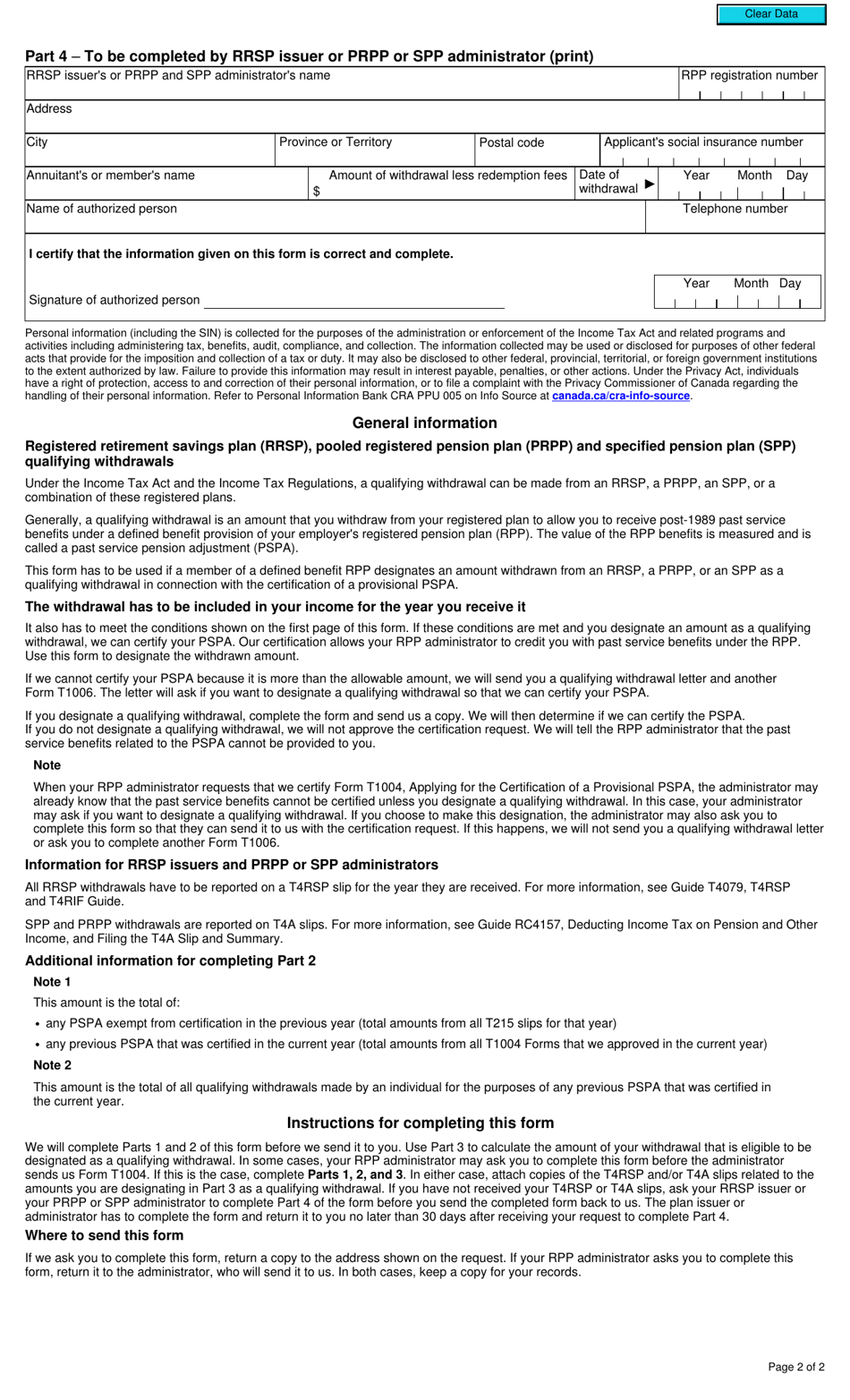

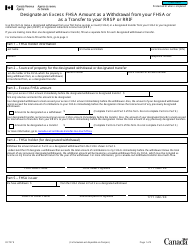

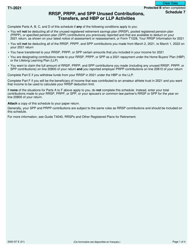

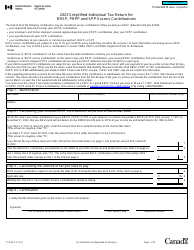

Form T1006 Designating an Rrsp, a Prpp or an Spp Withdrawal as a Qualifying Withdrawal - Canada

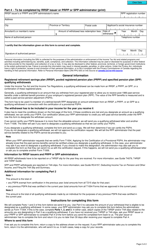

Form T1006 Designating an RRSP, a PRPP, or an SPP Withdrawal as a Qualifying Withdrawal in Canada is used to designate a withdrawal from an RRSP (Registered Retirement Savings Plan), a PRPP (Pooled Registered Pension Plan), or an SPP (Specified Pension Plan) as a qualifying withdrawal. This designation is important for tax purposes as it allows the withdrawal to be eligible for certain tax benefits or exemptions.

The individual making the RRSP, PRPP or SPP withdrawal files the Form T1006 to designate it as a qualifying withdrawal in Canada.

FAQ

Q: What is Form T1006?

A: Form T1006 is a form used in Canada for designating an RRSP, PRPP, or SPP withdrawal as a qualifying withdrawal.

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan, which is a tax-advantaged savings account for retirement in Canada.

Q: What is a PRPP?

A: PRPP stands for Pooled Registered Pension Plan, which is a pension plan option available in Canada.

Q: What is an SPP?

A: SPP stands for Specified Pension Plan, which is a type of pension plan in Canada. It is similar to an RRSP but has different rules.

Q: What is a qualifying withdrawal?

A: A qualifying withdrawal from an RRSP, PRPP, or SPP is a withdrawal that meets specific criteria, such as it being used towards the purchase or construction of a home, education expenses, or the payment of medical expenses.

Q: Why do I need to designate a withdrawal as a qualifying withdrawal?

A: Designating a withdrawal as a qualifying withdrawal allows you to potentially avoid taxes or penalties on the withdrawal amount.

Q: How do I use Form T1006?

A: To use Form T1006, you need to complete the form and submit it to the financial institution from which you are making the withdrawal. The financial institution will then process the withdrawal accordingly.

Q: Are there any fees associated with using Form T1006?

A: There are no fees associated with using Form T1006. However, there may be fees associated with the actual withdrawal from your RRSP, PRPP, or SPP.

Q: Are there any restrictions on qualifying withdrawals?

A: Yes, there are restrictions on qualifying withdrawals. The specific criteria for qualifying withdrawals can vary depending on the type of withdrawal and the purpose for which the funds are being used.