This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC520

for the current year.

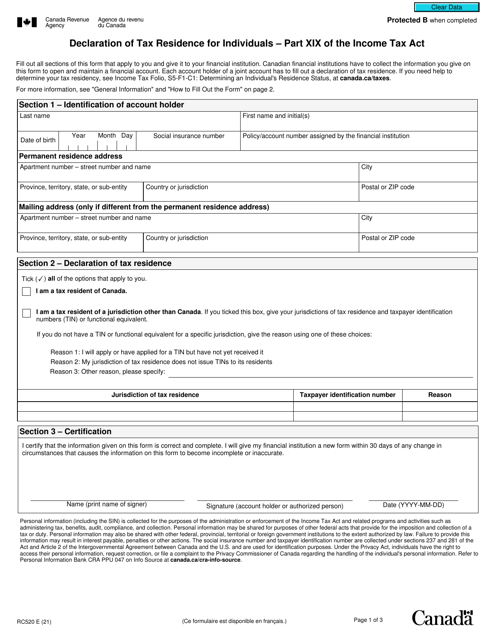

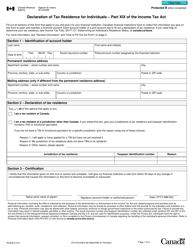

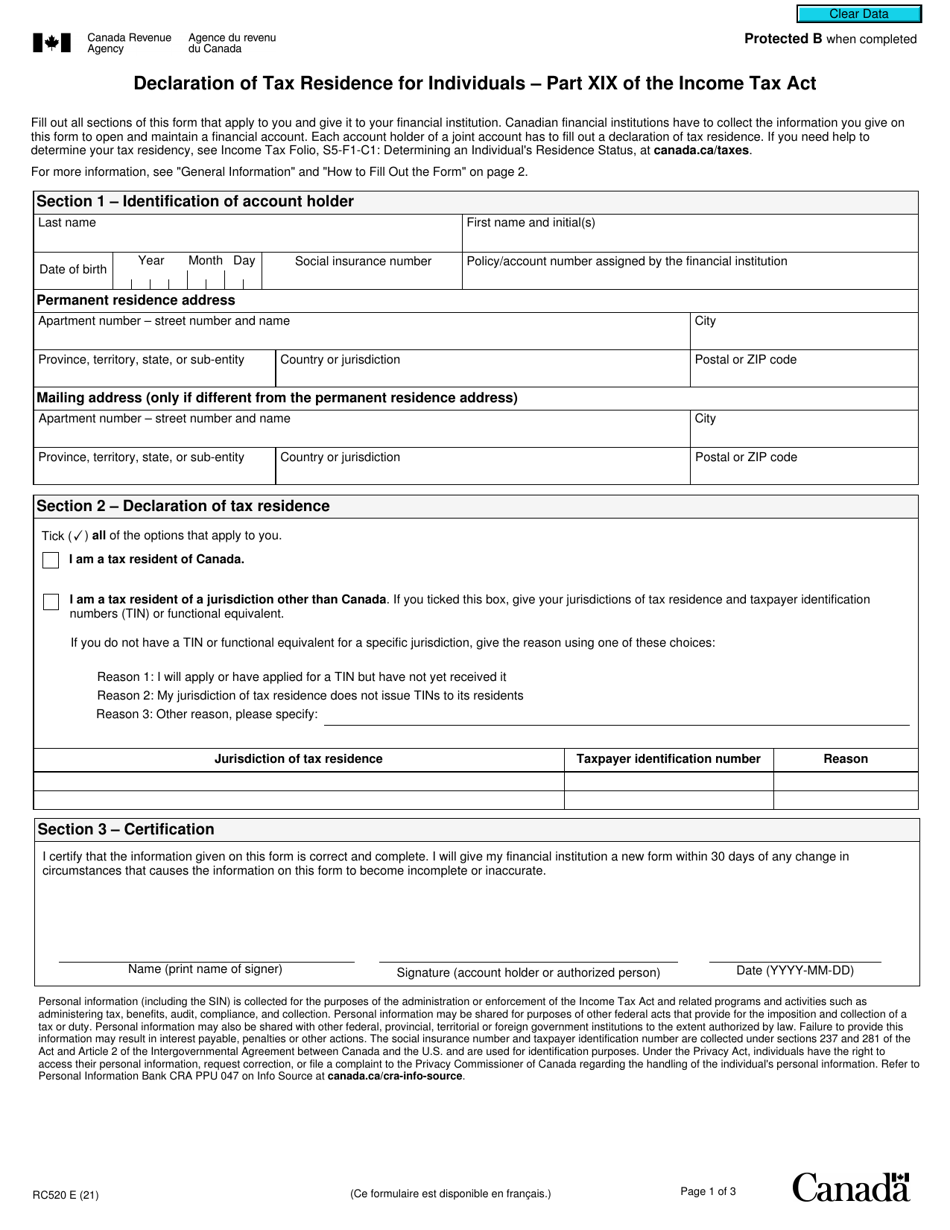

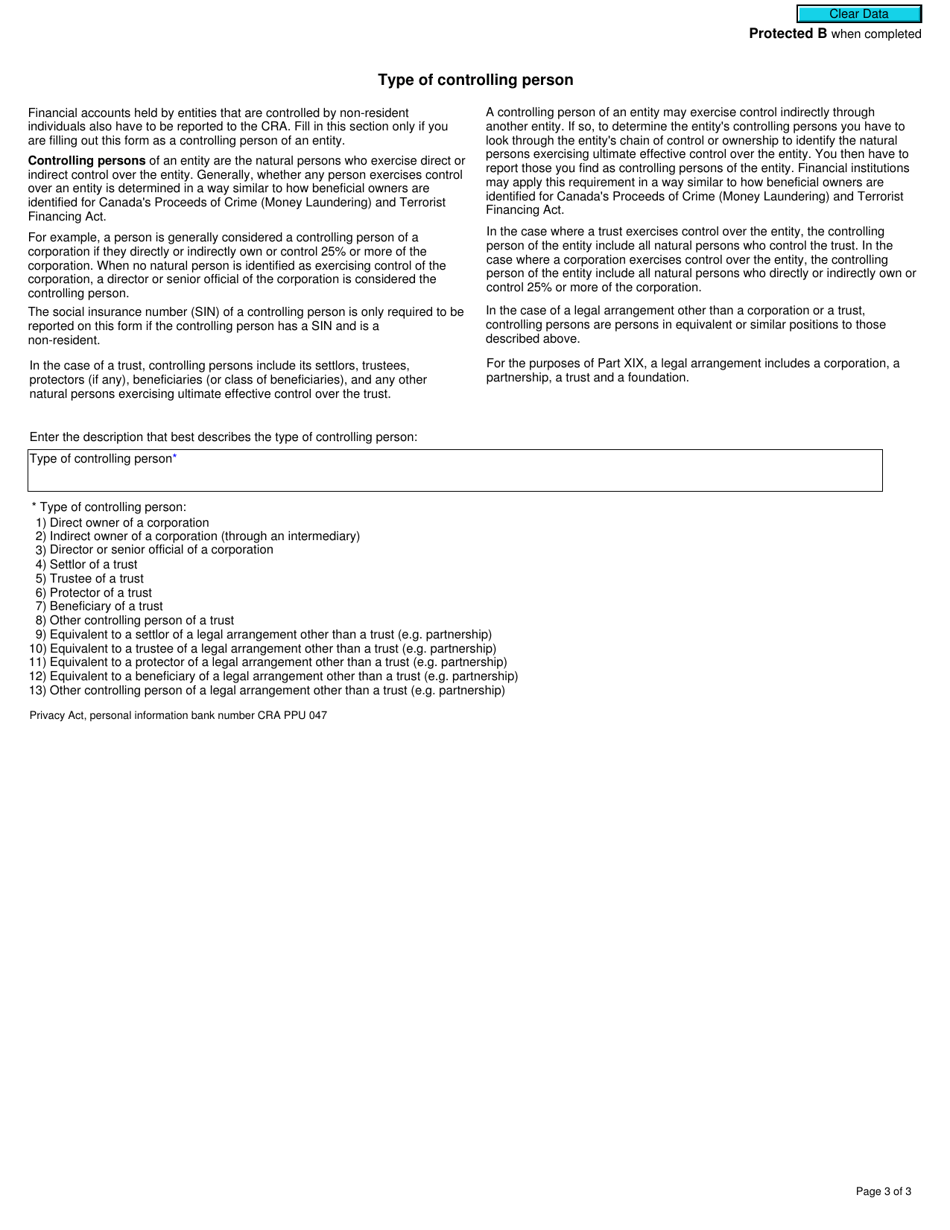

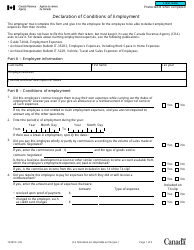

Form RC520 Declaration of Tax Residence for Individuals - Part Xix of the Income Tax Act - Canada

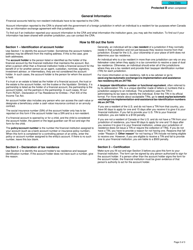

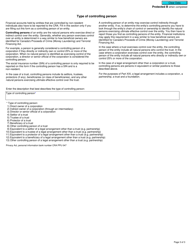

Form RC520 Declaration of Tax Residence for Individuals is a document used in Canada for individuals to declare their tax residence status. It is required to determine how an individual's income will be taxed in Canada.

The Form RC520 Declaration of Tax Residence for Individuals is filed by individuals who are residents of Canada for tax purposes.

FAQ

Q: What is Form RC520?

A: Form RC520 is the declaration of tax residence for individuals in Canada.

Q: What is the purpose of Form RC520?

A: The purpose of Form RC520 is to determine your tax residence status in Canada.

Q: Which part of the Income Tax Act in Canada does Form RC520 pertain to?

A: Form RC520 pertains to Part XIX of the Income Tax Act in Canada.

Q: Who needs to fill out Form RC520?

A: Individuals who want to declare their tax residence status in Canada need to fill out Form RC520.

Q: What information do I need to provide on Form RC520?

A: You will need to provide personal information, such as your name, address, social insurance number, and details about your residence and ties to Canada.

Q: When do I need to submit Form RC520?

A: You should submit Form RC520 as soon as possible if you are claiming to be a non-resident of Canada for tax purposes.

Q: Is Form RC520 mandatory?

A: Form RC520 is not mandatory, but it is recommended to declare your tax residence status in Canada.

Q: What are the consequences of not filling out Form RC520?

A: If you do not fill out Form RC520, the Canada Revenue Agency may consider you a resident of Canada for tax purposes.