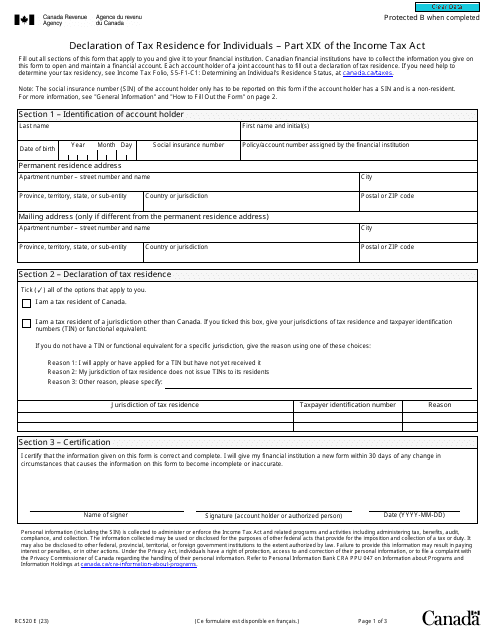

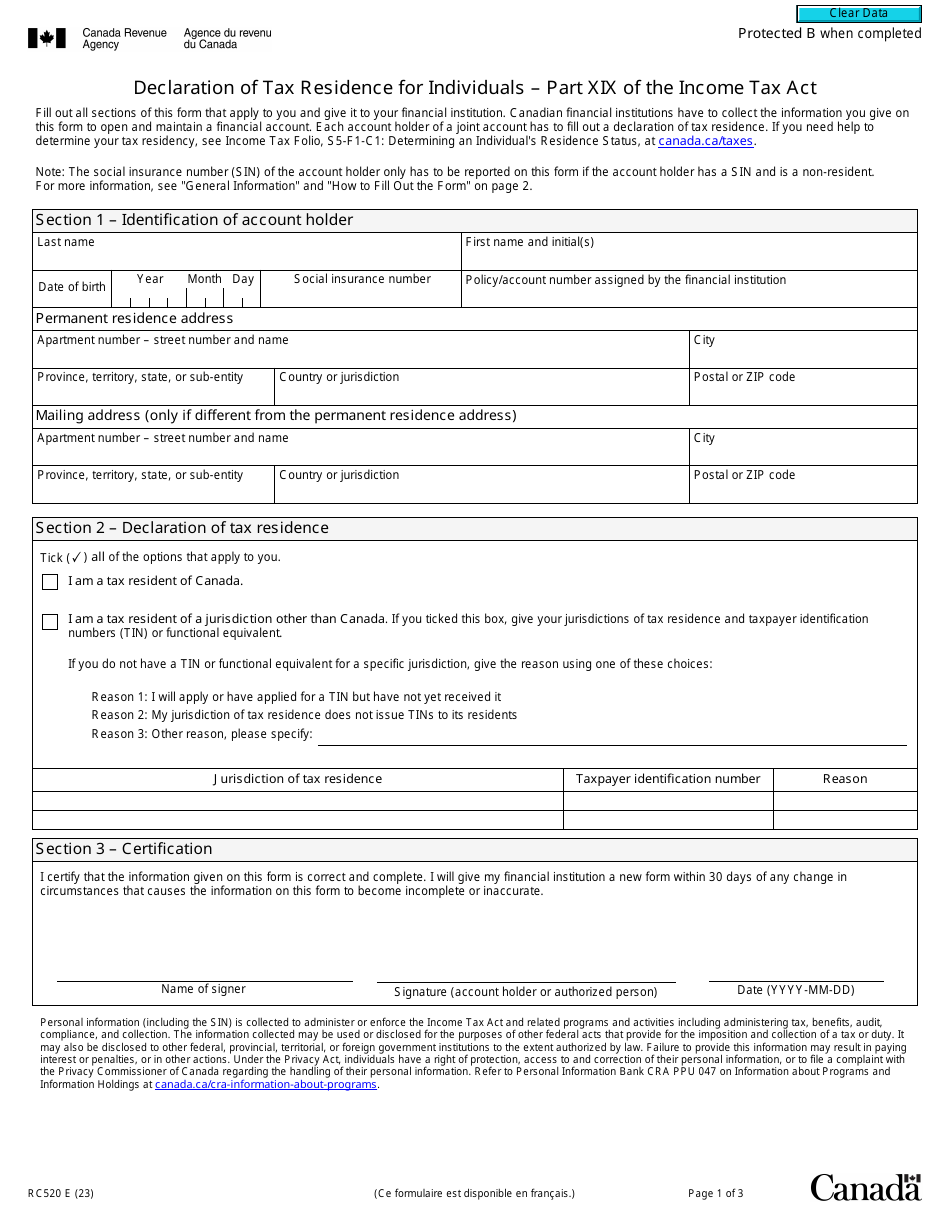

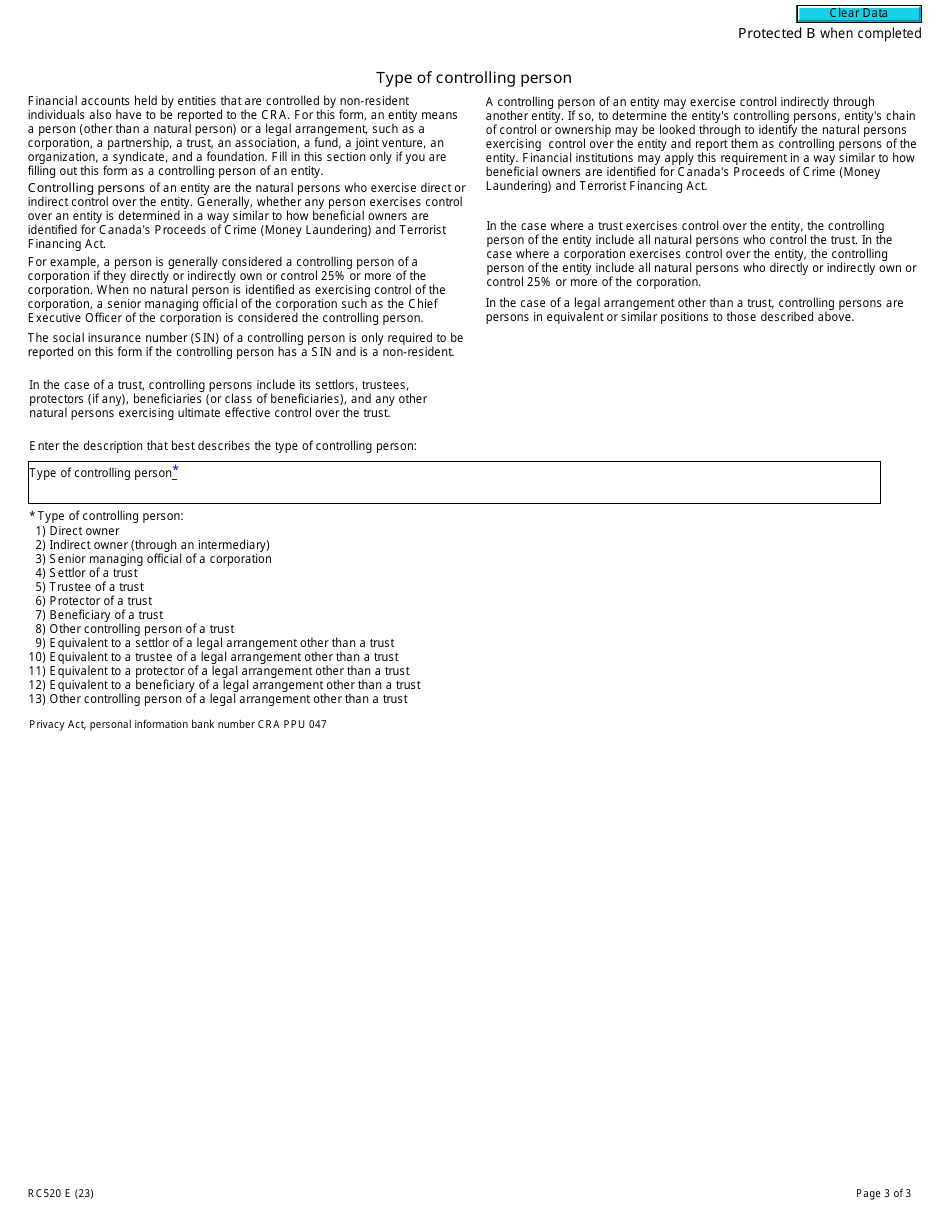

Form RC520 Declaration of Tax Residence for Individuals - Part Xix of the Income Tax Act - Canada

Form RC520 Declaration of Tax Residence for Individuals is used by individuals to declare their tax residence status in Canada. This form is required for non-resident individuals who want to claim benefits under a tax treaty between Canada and another country, such as reduced withholding tax rates on income earned in Canada.

The Form RC520 Declaration of Tax Residence for Individuals - Part XIX of the Income Tax Act in Canada is filed by individuals who want to declare their tax residence for income tax purposes.

Form RC520 Declaration of Tax Residence for Individuals - Part Xix of the Income Tax Act - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC520?

A: Form RC520 is the Declaration of Tax Residence for Individuals.

Q: What is the purpose of Form RC520?

A: The purpose of Form RC520 is to determine your tax residence status in Canada.

Q: Who needs to complete Form RC520?

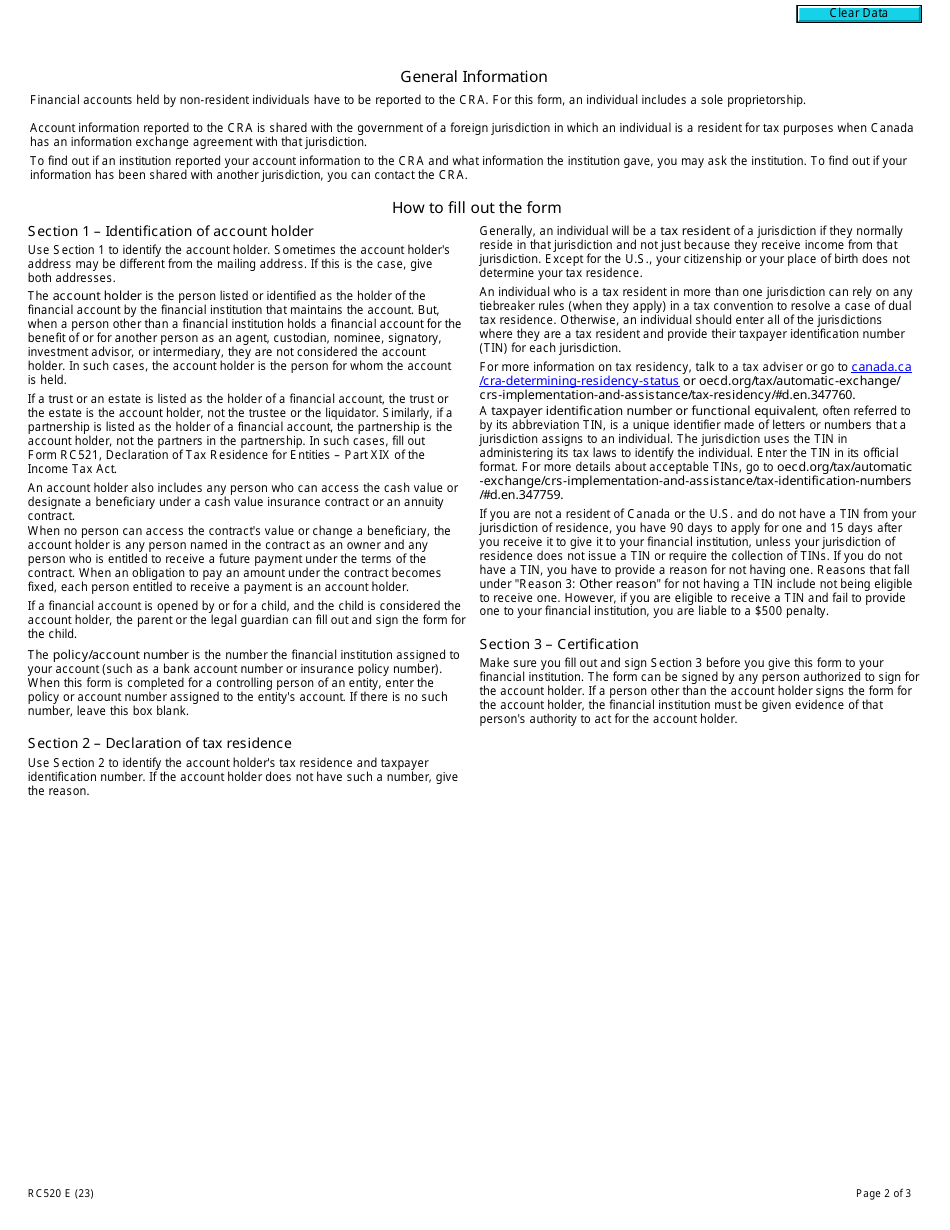

A: Individuals who are or will be resident in Canada for tax purposes need to complete Form RC520.

Q: What is considered tax residence in Canada?

A: You are considered a tax resident in Canada if you have significant residential ties and you stay in Canada for 183 days or more in a given tax year.

Q: What information do I need to provide on Form RC520?

A: You will need to provide personal information, details about your residency status, and supporting documentation to determine your tax residence.

Q: When do I need to submit Form RC520?

A: You should submit Form RC520 when requested by the CRA or when you need to establish your tax residence status in Canada.

Q: Are there any penalties for not submitting Form RC520?

A: Failure to submit Form RC520 when required may result in penalties or consequences under the Income Tax Act.

Q: Can I submit Form RC520 electronically?

A: Yes, you can submit Form RC520 electronically using NETFILE or EFILE, if you meet the eligibility criteria.

Q: Can I get help with completing Form RC520?

A: Yes, you can seek assistance from tax professionals or contact the CRA for guidance on completing Form RC520.