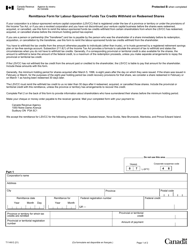

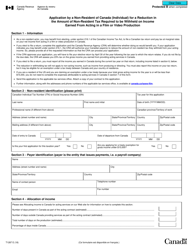

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T735

for the current year.

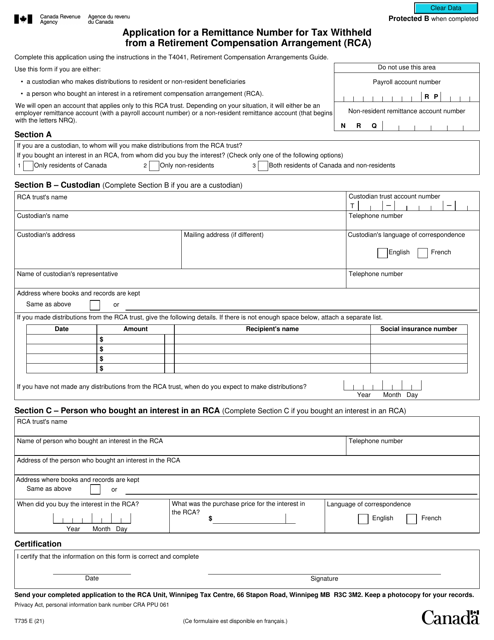

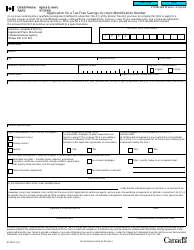

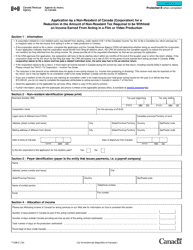

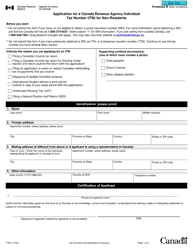

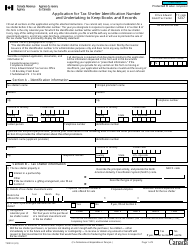

Form T735 Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (Rca) - Canada

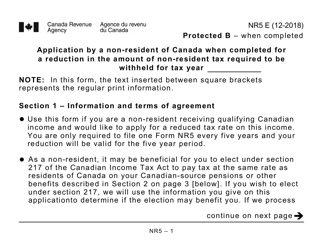

Form T735, Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (RCA), is used in Canada to apply for a remittance number for tax withheld from a Retirement Compensation Arrangement. This form helps individuals who have retired compensation arrangements to comply with their tax obligations.

The Form T735 Application for a Remittance Number for Tax Withheld from a Retirement Compensation Arrangement (RCA) in Canada is typically filed by the payer or administrator of the RCA.

FAQ

Q: What is the Form T735?

A: Form T735 is used to apply for a remittance number for tax withheld from a Retirement Compensation Arrangement (RCA) in Canada.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of retirement plan for high-income individuals in Canada.

Q: Why do I need a remittance number?

A: A remittance number is required to report and pay taxes withheld from a Retirement Compensation Arrangement (RCA) to the Canada Revenue Agency (CRA).

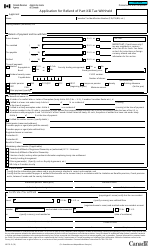

Q: How do I apply for a remittance number?

A: You can apply for a remittance number by completing and submitting Form T735 to the Canada Revenue Agency (CRA).

Q: Are there any fees associated with applying for a remittance number?

A: There are no fees associated with applying for a remittance number.

Q: How long does it take to process an application for a remittance number?

A: The processing time for an application for a remittance number can vary, but it typically takes several weeks.

Q: What should I do if I need help with my application?

A: If you need help with your application for a remittance number, you can contact the Canada Revenue Agency (CRA) for assistance.