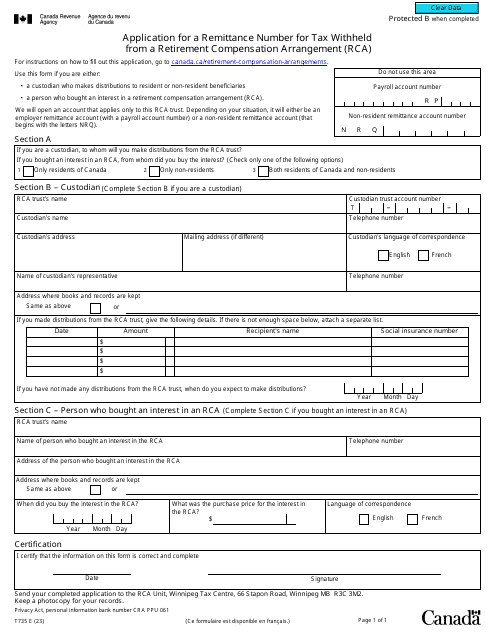

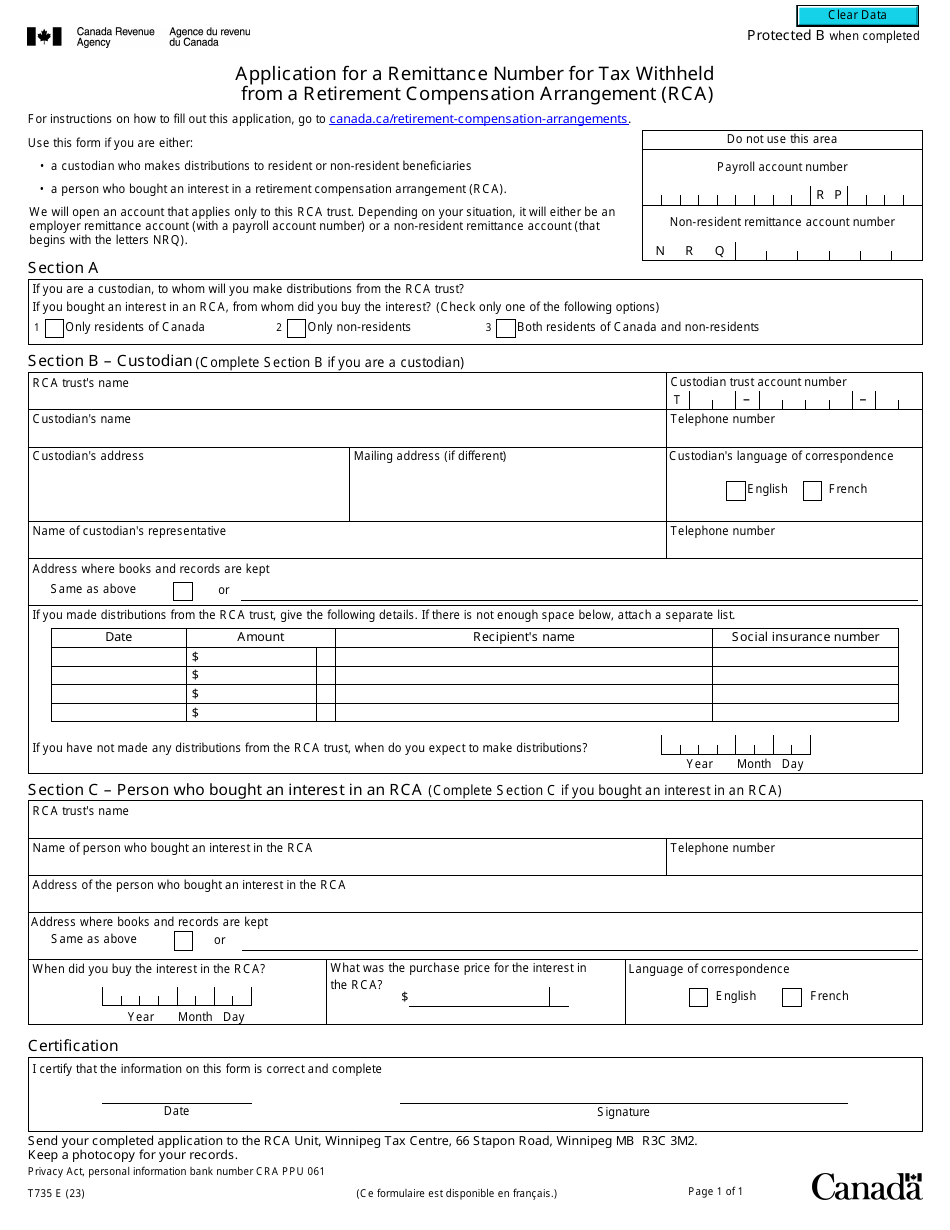

Form T735 Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (Rca) - Canada

Form T735 Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (RCA) in Canada is used to apply for a remittance number for tax withheld from a retirement compensation arrangement. It is a way for individuals or organizations to report and remit taxes withheld from a retirement compensation arrangement to the Canada Revenue Agency (CRA).

The Form T735 Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (RCA) in Canada is filed by the payer of the retirement income.

Form T735 Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (Rca) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T735?

A: Form T735 is an application form used in Canada to apply for a remittance number for tax withheld from a Retirement Compensation Arrangement (RCA).

Q: What is a Remittance Number?

A: A remittance number is a unique identifier assigned by the Canada Revenue Agency (CRA) to track tax payments.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of pension plan in Canada.

Q: Why do I need a Remittance Number for tax withheld from an RCA?

A: You need a Remittance Number to properly report and remit the tax withheld from an RCA to the CRA.

Q: Are there any fees associated with applying for a Remittance Number?

A: No, there are no fees associated with applying for a Remittance Number using Form T735.

Q: Are there any important deadlines for submitting Form T735?

A: The deadline for submitting Form T735 depends on the specific circumstances. It is best to consult the CRA or a tax professional for specific deadlines.

Q: What should I do after completing Form T735?

A: After completing Form T735, you should submit it to the CRA along with any required supporting documents.

Q: Who can I contact for more information about Form T735?

A: For more information about Form T735, you can contact the CRA or consult a tax professional.