This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1171

for the current year.

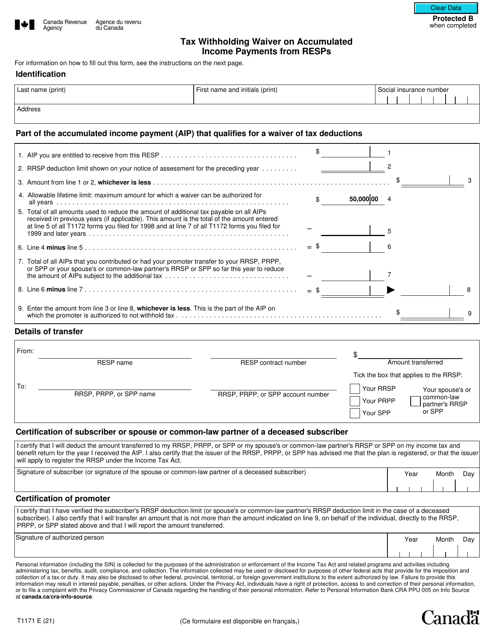

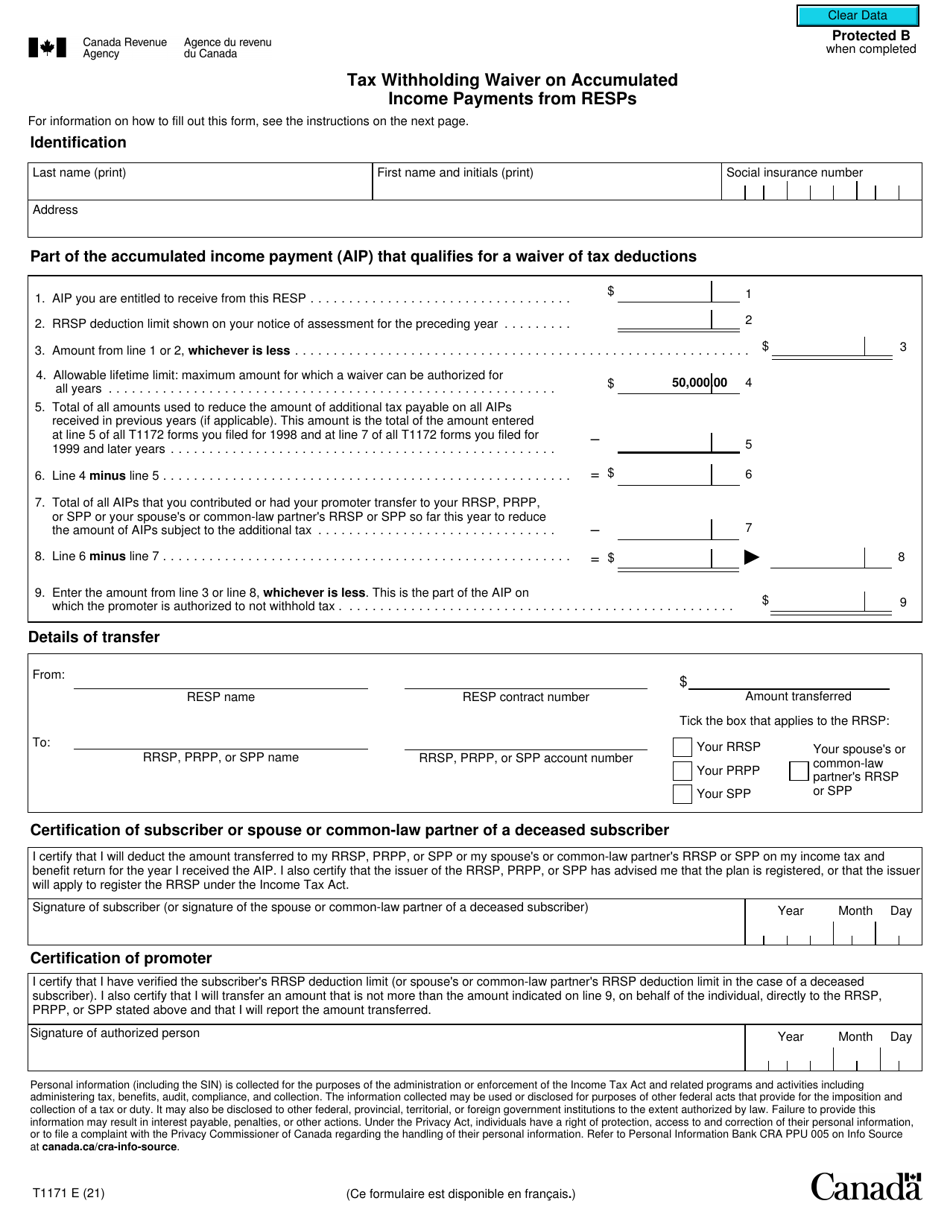

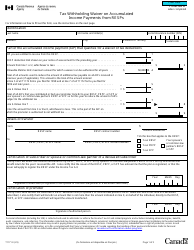

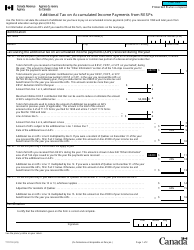

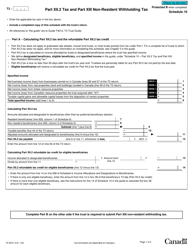

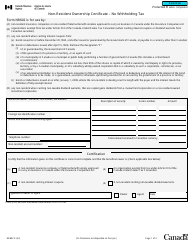

Form T1171 Tax Withholding Waiver on Accumulated Income Payments From Resps - Canada

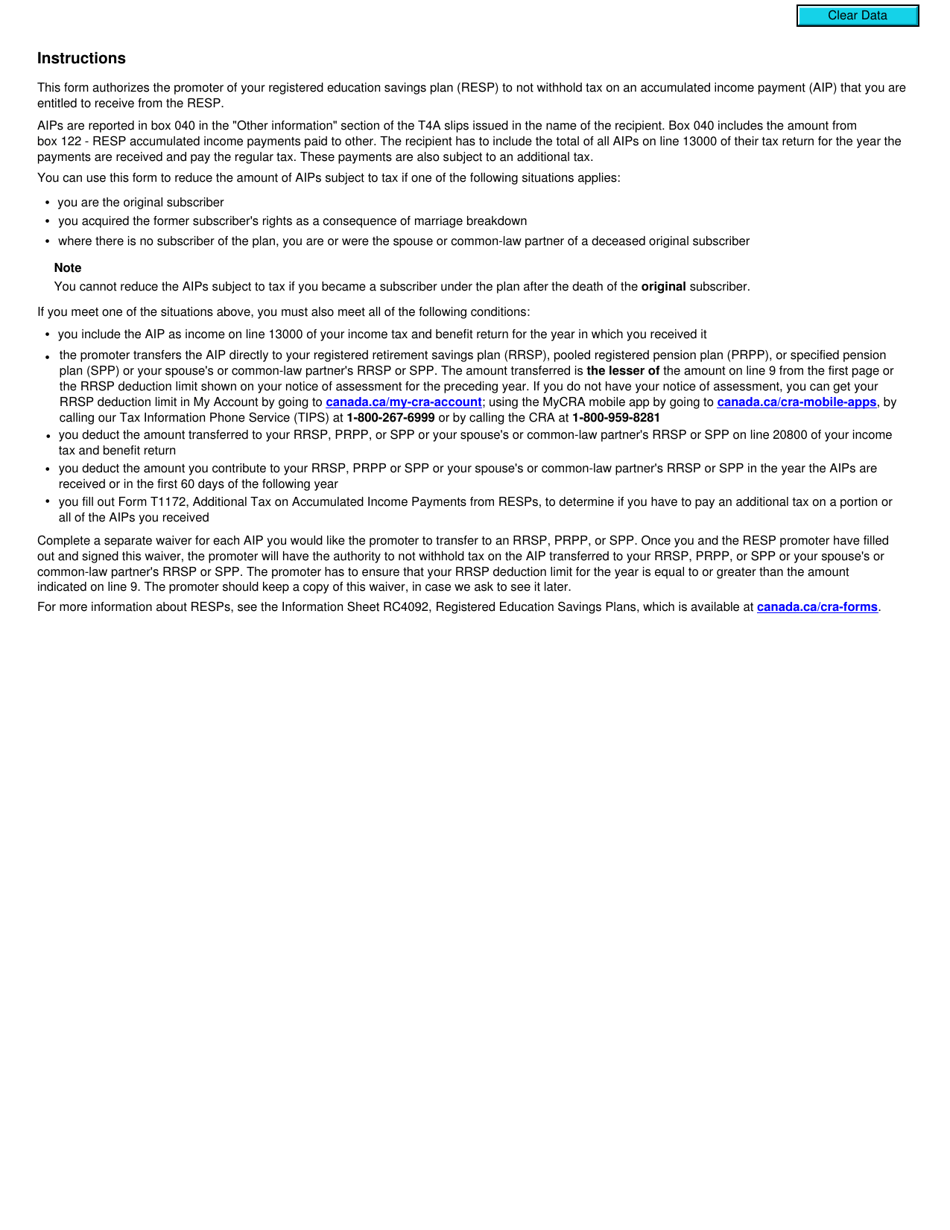

Form T1171 Tax Withholding Waiver on Accumulated Income Payments From RESPs is used in Canada to request a waiver of tax withholding on accumulated income payments from Registered Education Savings Plans (RESPs). This form ensures that you do not have income tax withheld when you withdraw funds from your RESP.

The subscriber or annuitant of the RESP (Registered Education Savings Plan) files the Form T1171 for tax withholding waiver on accumulated income payments from RESPs in Canada.

FAQ

Q: What is Form T1171?

A: Form T1171 is a tax withholding waiver form in Canada.

Q: What is a tax withholding waiver?

A: A tax withholding waiver is a request to waive the requirement of withholding taxes on certain payments.

Q: What are accumulated income payments from RESPs?

A: Accumulated income payments from RESPs (Registered Education Savings Plans) are payments received from the RESP that include the income earned on contributions.

Q: Why would I need to complete Form T1171?

A: You would need to complete Form T1171 to request a waiver of tax withholding on accumulated income payments from RESPs.

Q: Who can request a tax withholding waiver?

A: The subscriber or the beneficiary of an RESP can request a tax withholding waiver.

Q: Are there any conditions for obtaining a tax withholding waiver?

A: Yes, there are specific conditions that need to be met in order to obtain a tax withholding waiver. These conditions are outlined on Form T1171.

Q: Is there a deadline for submitting Form T1171?

A: Yes, Form T1171 must be submitted to the CRA before the payment of accumulated income from the RESP.

Q: What happens if I don't submit Form T1171?

A: If you don't submit Form T1171, taxes will be withheld from the accumulated income payment from the RESP at the regular rate.