This version of the form is not currently in use and is provided for reference only. Download this version of

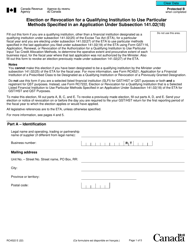

Form T2078

for the current year.

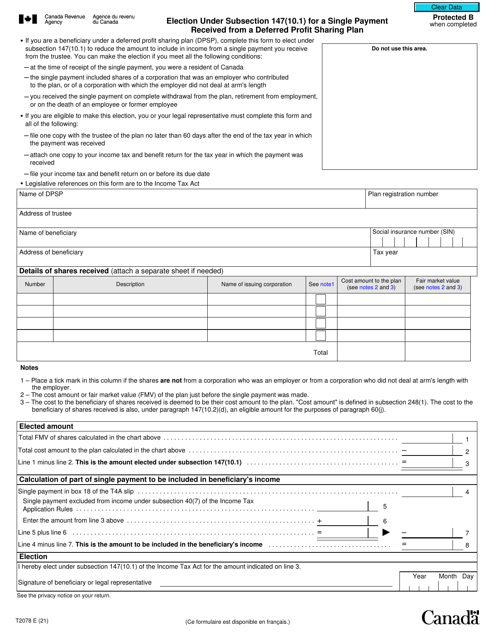

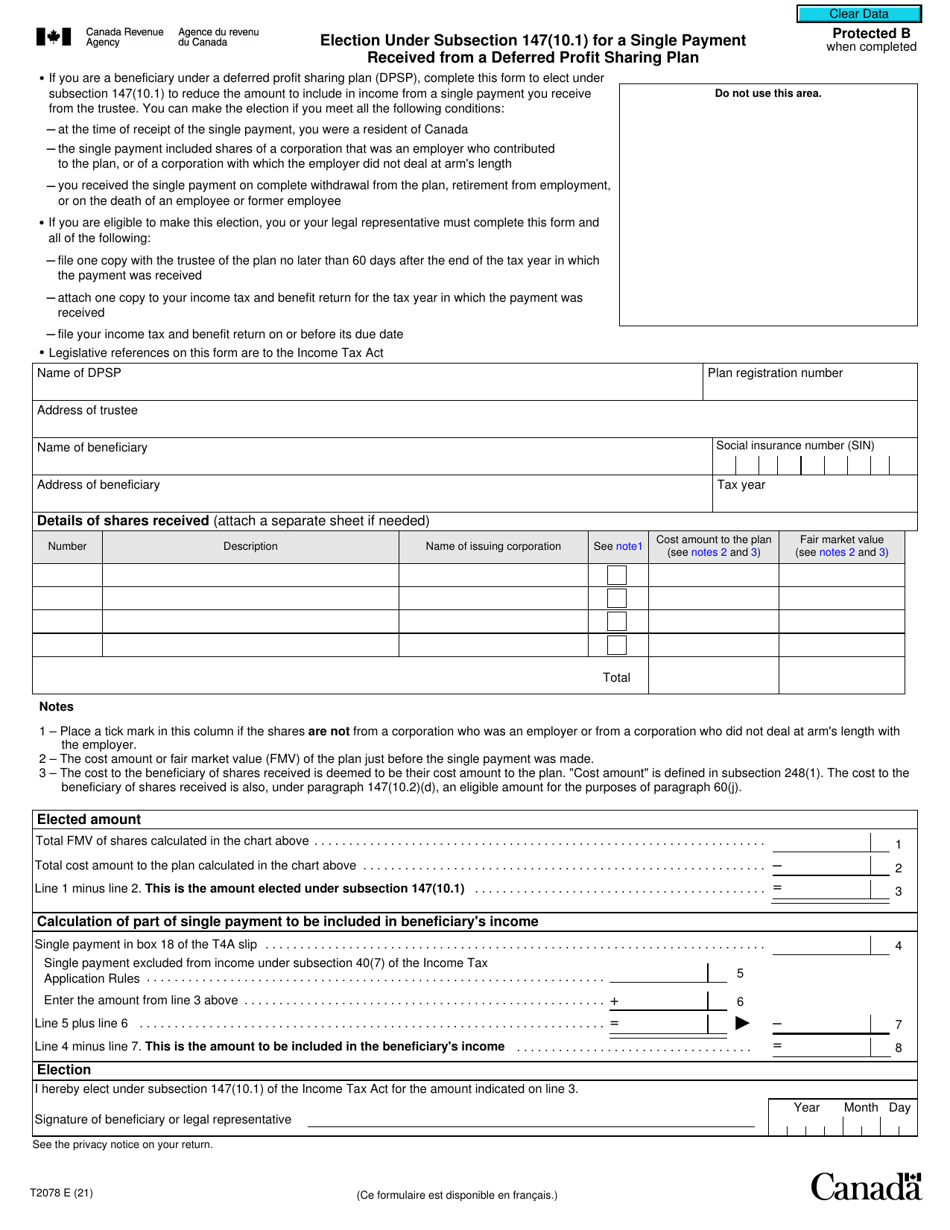

Form T2078 Election Under Subsection 147(10.1) for a Single Payment Received From a Deferred Profit Sharing Plan - Canada

Form T2078 Election Under Subsection 147(10.1) is used in Canada for a single payment received from a Deferred Profit Sharing Plan (DPSP). This form allows individuals to elect to include the payment in their income for that year or defer the inclusion until a later year.

The employer who made the single payment from the deferred profit sharing plan files the Form T2078 election under subsection 147(10.1) in Canada.

FAQ

Q: What is Form T2078?

A: Form T2078 is a tax form used in Canada to elect under subsection 147(10.1) for a single payment received from a Deferred Profit Sharing Plan (DPSP).

Q: What does subsection 147(10.1) refer to?

A: Subsection 147(10.1) is a provision of the Canadian Income Tax Act that allows individuals to elect to include a single payment received from a DPSP in their income for tax purposes.

Q: What is a Deferred Profit Sharing Plan (DPSP)?

A: A Deferred Profit Sharing Plan (DPSP) is a type of retirement savings plan offered by some employers in Canada. It allows employees to share in the profits of the company and defer income tax on their contributions and the company's contributions until they withdraw the funds.

Q: When should Form T2078 be used?

A: Form T2078 should be used when an individual wants to elect under subsection 147(10.1) to include a single payment received from a DPSP in their income for tax purposes.

Q: How do I fill out Form T2078?

A: The instructions for filling out Form T2078 can be found on the form itself. It requires providing information about the DPSP, the amount of the single payment, and making the election under subsection 147(10.1).

Q: Can I elect to include multiple payments from a DPSP on Form T2078?

A: No, Form T2078 is specifically for electing to include a single payment received from a DPSP. If you have multiple payments, you may need to file multiple forms or consult with a tax professional.

Q: What are the tax implications of electing under subsection 147(10.1) for a single payment from a DPSP?

A: By electing under subsection 147(10.1), the amount of the single payment from the DPSP will be included in your income for tax purposes in the year it is received. This may result in additional income tax owing.

Q: Do I need to submit Form T2078 with my tax return?

A: Yes, if you have elected to include a single payment from a DPSP under subsection 147(10.1), you need to include Form T2078 with your tax return to report the election and the income included.