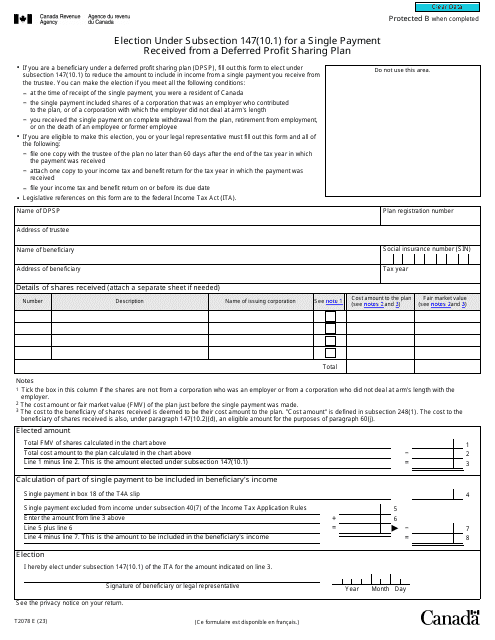

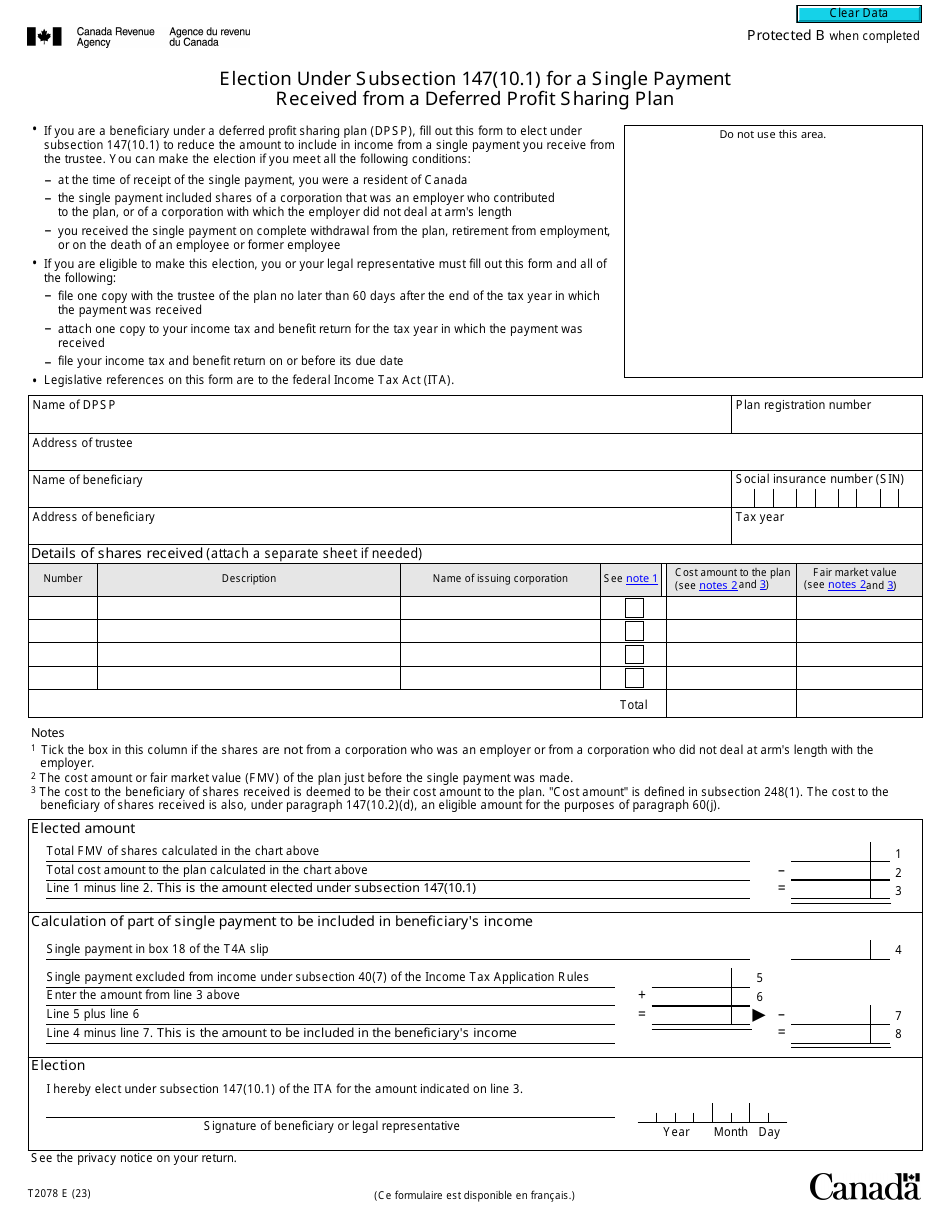

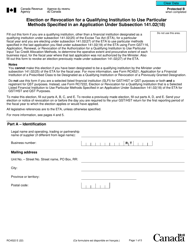

Form T2078 Election Under Subsection 147(10.1) for a Single Payment Received From a Deferred Profit Sharing Plan - Canada

Form T2078 Election Under Subsection 147(10.1) for a Single Payment Received From a Deferred Profit Sharing Plan in Canada is used to make an election on how to include a single payment received from a deferred profit sharing plan in your income for tax purposes. It allows taxpayers to choose how the payment will be taxed either as a lump sum or as a transfer to a Registered Retirement Savings Plan (RRSP).

In Canada, the individual who received a single payment from a Deferred Profit Sharing Plan (DPSP) would be responsible for filing the Form T2078 Election Under Subsection 147(10.1).

Form T2078 Election Under Subsection 147(10.1) for a Single Payment Received From a Deferred Profit Sharing Plan - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2078?

A: Form T2078 is a tax form in Canada used to elect under subsection 147(10.1) for a single payment received from a deferred profit sharing plan.

Q: What is subsection 147(10.1)?

A: Subsection 147(10.1) is a provision in the Canadian tax code that allows individuals to make an election regarding the tax treatment of a single payment received from a deferred profit sharing plan.

Q: What is a deferred profit sharing plan?

A: A deferred profit sharing plan is an arrangement in Canada where employers can contribute a portion of the company's profits to a plan for the benefit of its employees, which will be paid out at a later date.

Q: Why would I need to use Form T2078?

A: You would need to use Form T2078 if you received a single payment from a deferred profit sharing plan and you want to make an election under subsection 147(10.1) for the tax treatment of that payment.