This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2152 Schedule 1

for the current year.

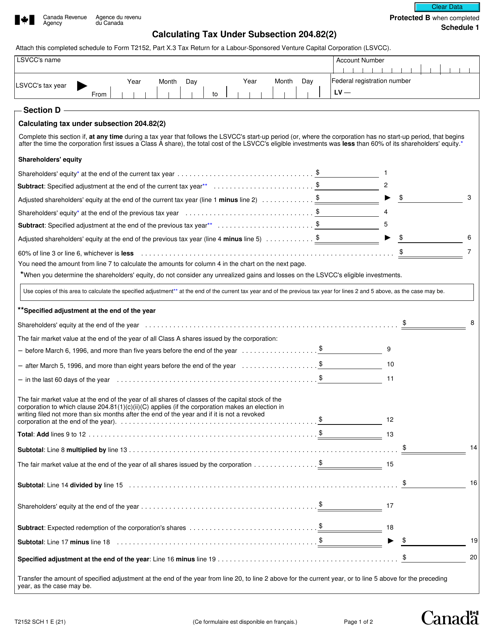

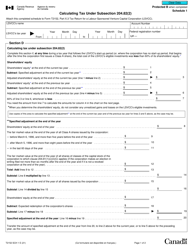

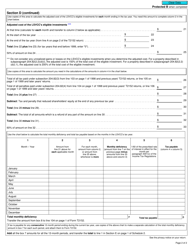

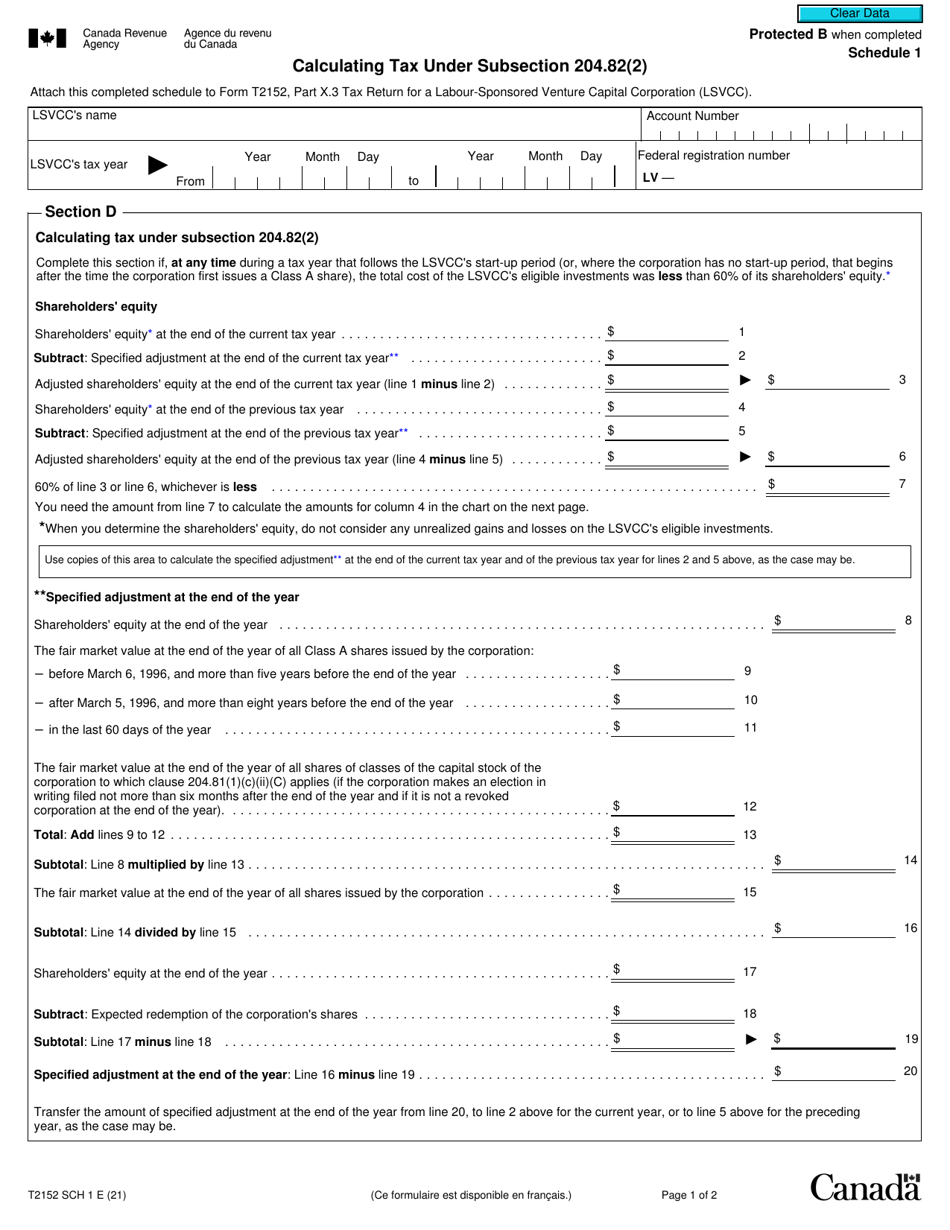

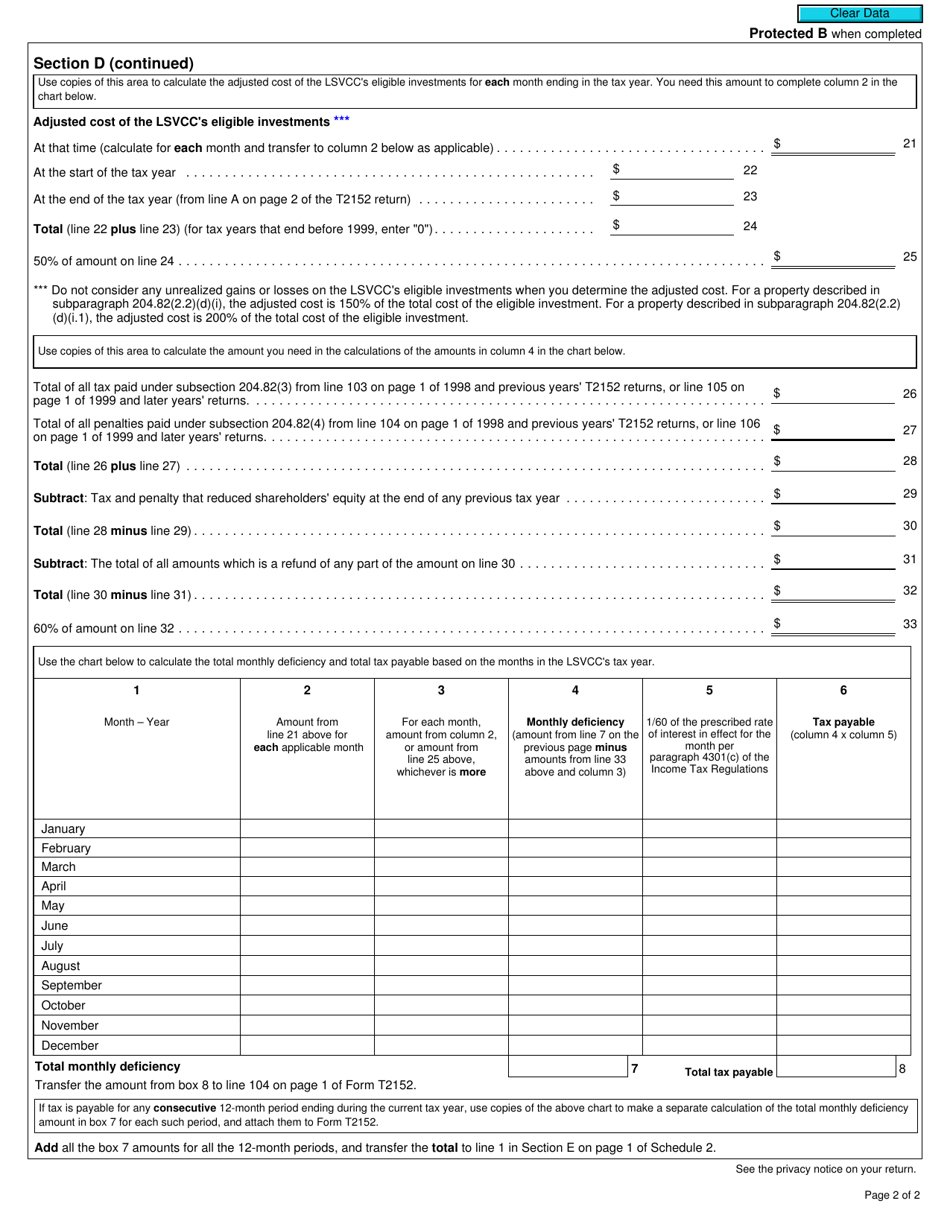

Form T2152 Schedule 1 Calculating Tax Under Subsection 204.82(2) - Canada

Form T2152 Schedule 1 is used in Canada to calculate the tax payable under subsection 204.82(2) of the Income Tax Act. This subsection relates to specific tax rules and calculations for certain types of income or deductions.

FAQ

Q: What is Form T2152?

A: Form T2152 is a schedule used in Canada to calculate tax under Subsection 204.82(2).

Q: What is Subsection 204.82(2)?

A: Subsection 204.82(2) refers to a specific section of the Canadian tax code.

Q: Why is Form T2152 used?

A: Form T2152 is used to calculate the tax owed under Subsection 204.82(2).

Q: How do I use Form T2152?

A: To use Form T2152, you need to follow the instructions provided on the form.