This version of the form is not currently in use and is provided for reference only. Download this version of

Form T746

for the current year.

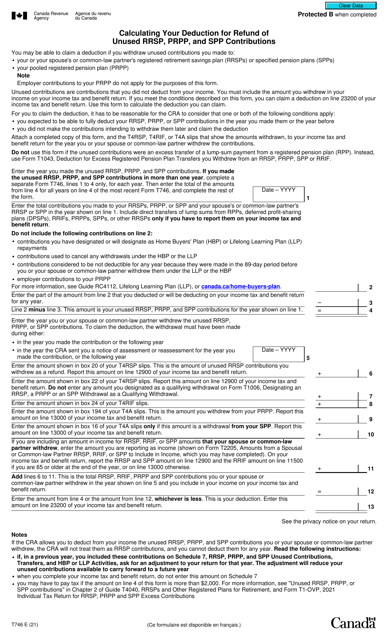

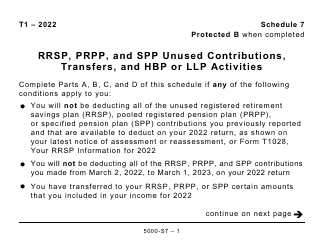

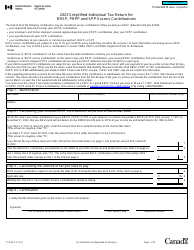

Form T746 Calculating Your Deduction for Refund of Unused Rrsp, Prpp, and Spp Contributions - Canada

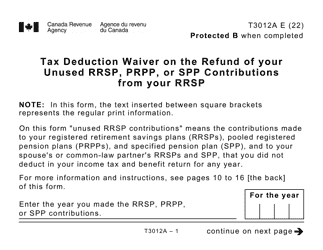

Form T746 "Calculating Your Deduction for Refund of Unused RRSP, PRPP, and SPP Contributions" in Canada is used to calculate the amount of deduction you can claim for the refund of unused contributions made to your Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP). This form helps you determine the maximum deduction you can claim on your tax return.

The individual taxpayer files the Form T746 to calculate their deduction for refund of unused RRSP, PRPP, and SPP contributions in Canada.

FAQ

Q: What is Form T746?

A: Form T746 is a tax form used in Canada to calculate the deduction for refund of unused RRSP, PRPP, and SPP contributions.

Q: What is RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a tax-advantaged savings account designed to help Canadians save for retirement.

Q: What is PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a retirement savings plan available to Canadians, particularly those who don't have access to a workplace pension plan.

Q: What is SPP?

A: SPP stands for Specified Pension Plan. It is a type of retirement savings plan available to certain Canadian employees.

Q: What does Form T746 help you calculate?

A: Form T746 helps you calculate the deduction you can claim for refund of unused RRSP, PRPP, and SPP contributions.

Q: Who should use Form T746?

A: Form T746 should be used by individuals who have made contributions to RRSPs, PRPPs, or SPPs and want to claim a deduction for unused contributions.

Q: How do I fill out Form T746?

A: To fill out Form T746, you need to provide information about your RRSP, PRPP, and SPP contributions, including the unused amounts from previous years.

Q: When should I file Form T746?

A: Form T746 should be filed with your tax return for the year in which you want to claim the deduction for unused contributions.

Q: Can I carry forward unused contributions?

A: Yes, unused contributions to RRSPs, PRPPs, and SPPs can be carried forward and claimed as deductions in future years.

Q: Can I claim a deduction for all my unused contributions?

A: No, there are certain limits and restrictions on the amount of unused contributions that can be claimed as a deduction.

Q: Is there a deadline for claiming the deduction for unused contributions?

A: Yes, the deadline for claiming the deduction is usually the same as the deadline for filing your tax return.

Q: Is Form T746 available for residents of the United States?

A: No, Form T746 is specific to Canadian tax filers and does not apply to residents of the United States.