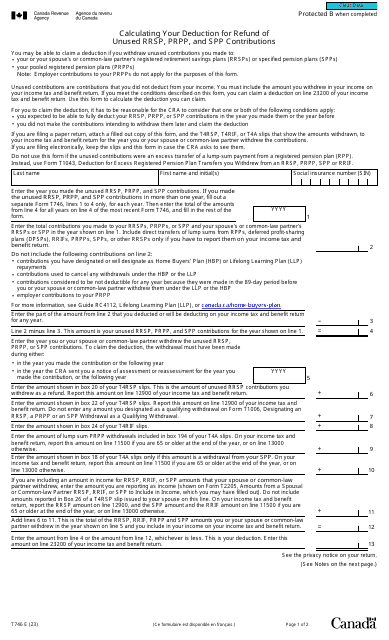

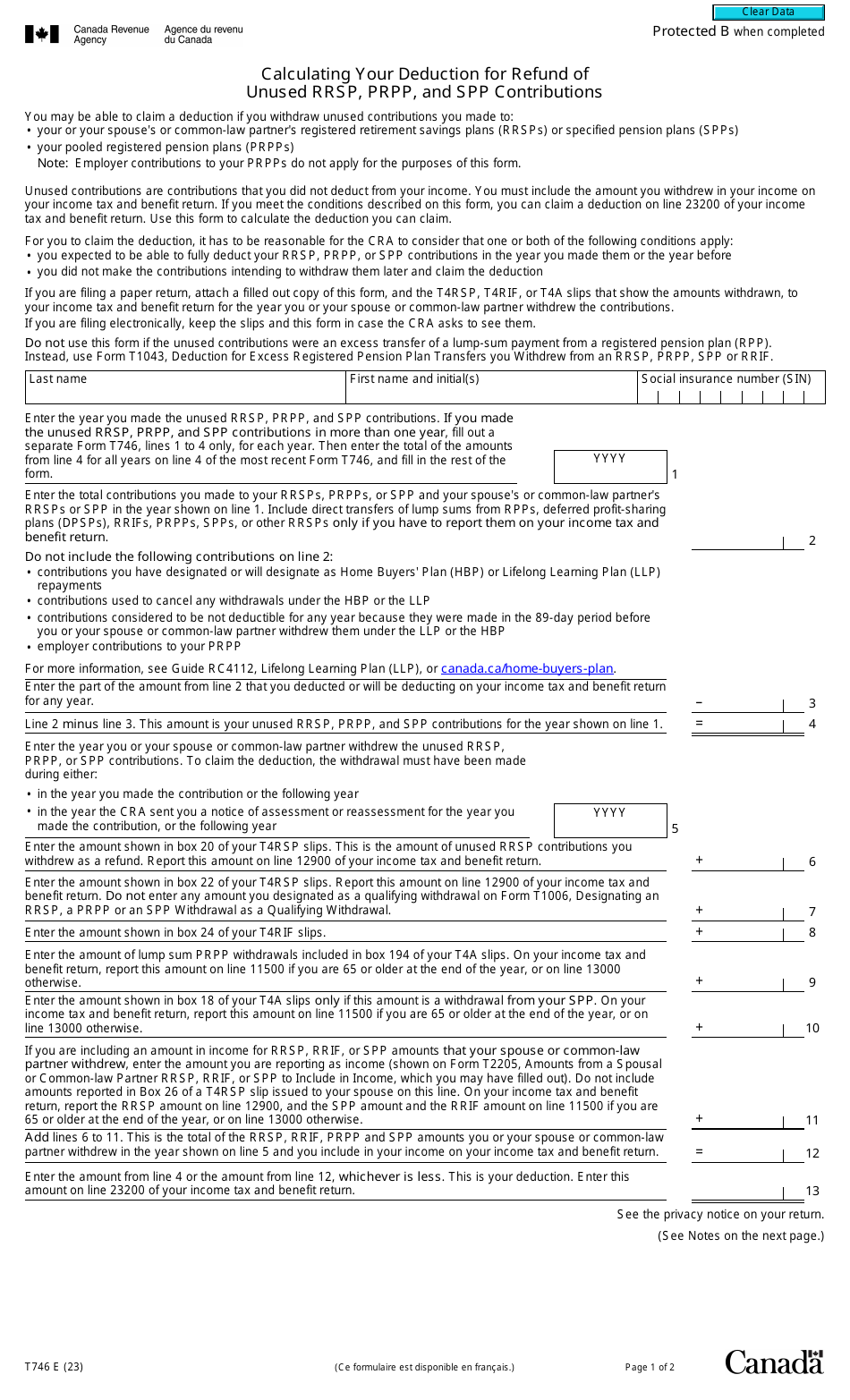

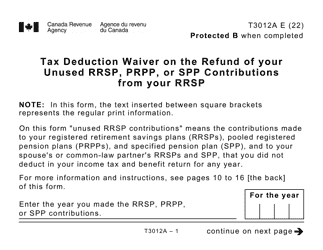

Form T746 Calculating Your Deduction for Refund of Unused Rrsp, Prpp, and Spp Contributions - Canada

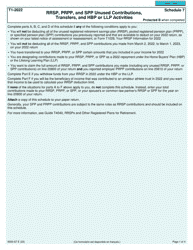

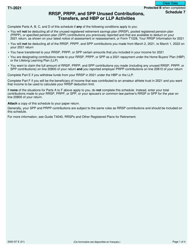

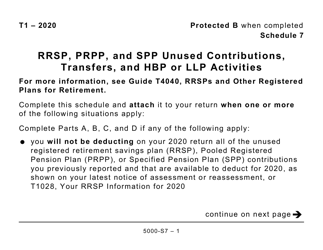

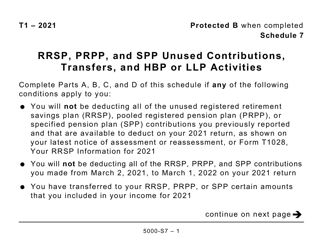

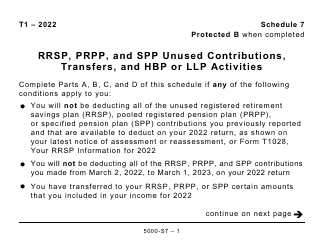

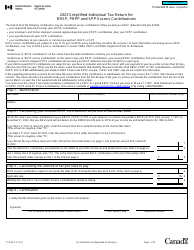

Form T746 "Calculating Your Deduction for Refund of Unused RRSP, PRPP, and SPP Contributions" is used in Canada to calculate the deduction amount for the refund of unused contributions made to Registered Retirement Savings Plans (RRSP), Pooled Registered Pension Plans (PRPP), and Saskatchewan Pension Plans (SPP). It helps individuals determine the amount they can claim as a deduction on their income tax return for these unused contributions.

The taxpayer files the Form T746 calculating their deduction for refund of unused RRSP, PRPP, and SPP contributions in Canada.

Form T746 Calculating Your Deduction for Refund of Unused Rrsp, Prpp, and Spp Contributions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T746?

A: Form T746 is used to calculate your deduction for refund of unused RRSP, PRPP, and SPP contributions in Canada.

Q: What does RRSP stand for?

A: RRSP stands for Registered Retirement Savings Plan.

Q: What does PRPP stand for?

A: PRPP stands for Pooled Registered Pension Plan.

Q: What does SPP stand for?

A: SPP stands for Specified Pension Plan.

Q: What can I deduct on Form T746?

A: You can deduct your unused RRSP, PRPP, and SPP contributions on Form T746.

Q: How do I calculate my deduction?

A: You can calculate your deduction by following the instructions on Form T746 provided by the Canada Revenue Agency.

Q: When should I file Form T746?

A: You should file Form T746 with your income tax return for the year in which you want to claim the deduction.

Q: Can I carry forward unused deduction amounts?

A: Yes, you can carry forward unused deduction amounts and claim them in future years.

Q: Do I need to include supporting documents with Form T746?

A: In most cases, you do not need to include supporting documents with Form T746. However, it is recommended to keep them for your records.